What are the investment implications of the latest US-China trade agreement?

Over the weekend, the US and China agreed to a 90-day rollback in tariffs on China from 145% to 30% and tariffs on US imports from 125% to 10% by 14th May1.

We believe that the recent tariff policy reprieve and road towards normalizing trade policies plus the focus now on cutting taxes in the US, could pivot us back to a pre-2025 state.

The two sides also established a consultation mechanism to address the remaining issues and touched on non-tariff barriers such as export controls on rare earth minerals and some consensus on the fentanyl issue.

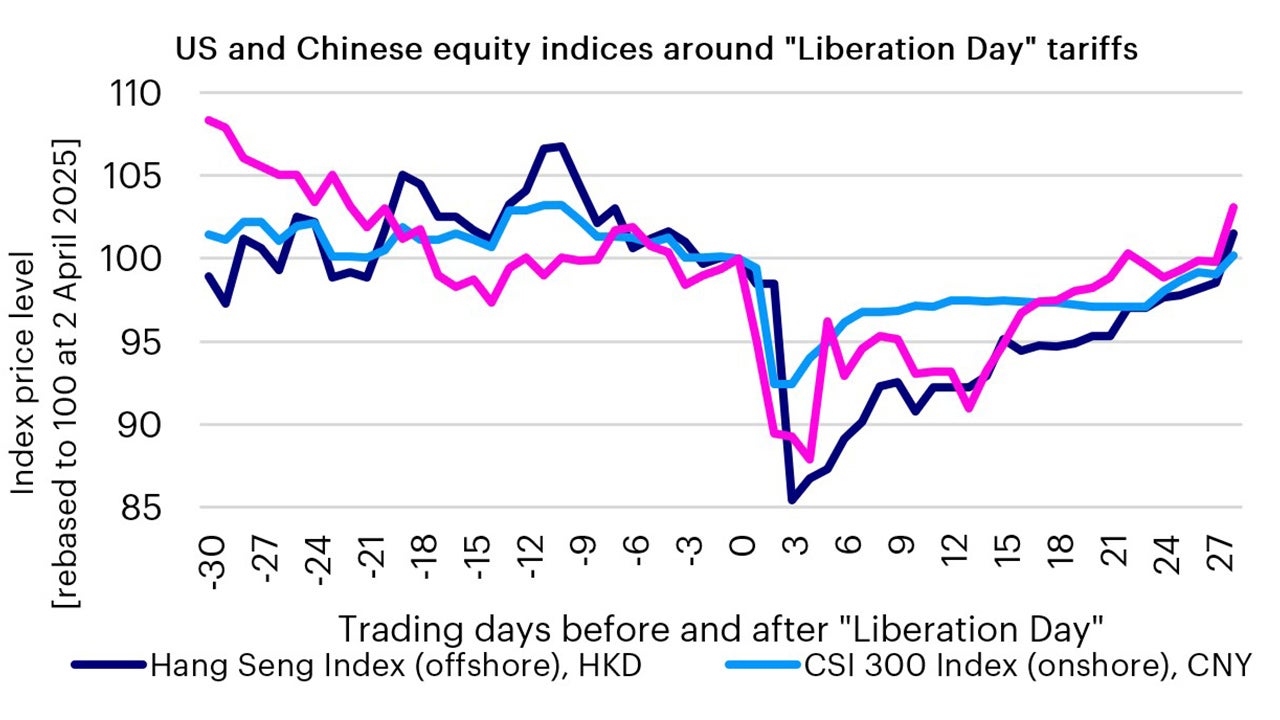

The swiftness of the US-China trade deal surprised markets, with the Hang Seng Index (HSI) closing up 3% following the announcement2. MSCI China index is now up +18% since the lows on 7th April following “Liberation Day” and has largely recovered its losses.

Source: Macrobond. Data as at 13 May 2025.

The White house is keen on de-escalating trade tensions

Coupled with the US-UK trade deal last week, it’s become clear that the White house is keen on de-escalating trade tensions at a much faster pace than previously expected.

It’s no surprise that equity markets in the US, India and Japan have all rallied over the past few weeks as investors start to shrug off tariff concerns.

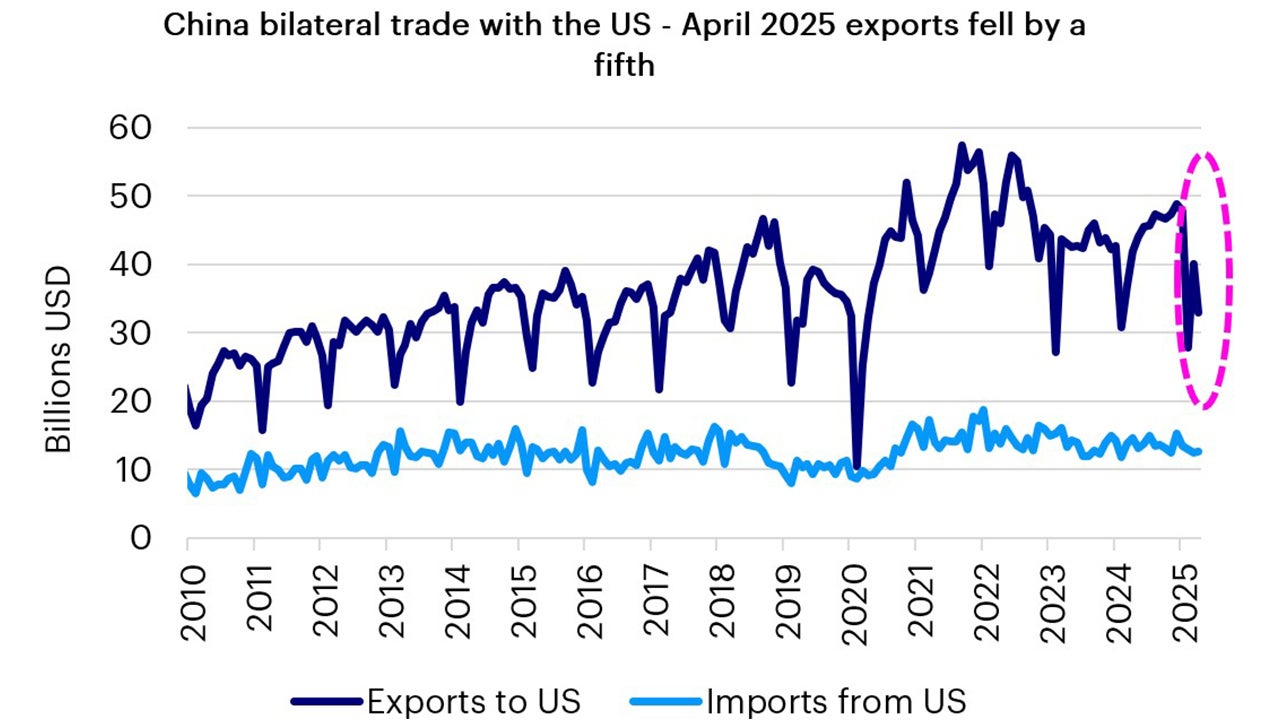

From a Chinese economy angle, this significant de-escalation could lead to a burst in pent-up exports in the coming months as many domestic manufacturers and exporters may have held up their shipments to the US in April.

Still, the 30% additional tariffs on Chinese imports to the US is likely to be felt – which means all eyes will be on the impact of these tariffs on economic activity in China and the US over the next 90 days to guide negotiations during this period.

Plus, tariff uncertainty on sectors such as electronics and semiconductors remain. While markets are apt to cheer this weekend’s trade deal as a win-win for both sides, I don’t believe that the risks from President Trump’s tariffs have completely gone away.

Source: China General Administration of Customs (GAC). Data as at 13 May 2025.

Investment implications

Until recently, market jitters about US domestic policy volatility leading to recession fears led to a mark-down of US assets. We may now see a reversal of those flows.

While the average tariff that the US charges for imports is very likely to be higher when compared to last year, it certainly is going to be much lower than what was announced on Liberation Day.

Reduced tariff uncertainties also reduce the chances of a recession. And so, while the US economy may still slow from here as the “hard” economic data catches up with the weakening “soft” data, it’s possible that investors may see through the soft patch and start to price a recovery in the US economy and assets.

The US administration appears to be engaging in a policy pivot, tempering tariff policies while focusing on more pro-growth policies, such as cutting income taxes. We could soon enter an environment that’s similar to pre-2025, and have warmed up to US equities, especially small and mid-cap stocks.

We also favour European and US investment grade debt given the attractive yields and improving macro backdrop.

Chinese markets are largely back to pre-early April levels, when Liberation Day tariffs were first announced.

Despite the recent run, Chinese stocks are still priced at a regional discount. From a valuation basis, MSCI China trade currently around 11.5x P/E, which is relatively attractive when compared to MSCI Taiwan at 15x, Nikkei 225 at 19x and BSE Sensex (India) at 21x.3

Trade related sectors in China such as EV/battery, construction machinery, home appliance and pet food companies are likely to see upside from here.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.