What are the investment implications of the latest US-Venezuela geopolitical developments?

US President Trump announced that Venezuela was being placed under temporary US control after Maduro’s capture, with US oil companies expected to move in and rebuild the country’s severely deteriorated energy infrastructure - a process that could take a while.

Market reaction

The weekend’s developments are unlikely to have significant near‑term global macro or market consequences, given Venezuela’s relatively small role in today’s energy landscape.

This is why there hasn’t been any significant move for oil, US equity futures nor major shifts in other macro assets.

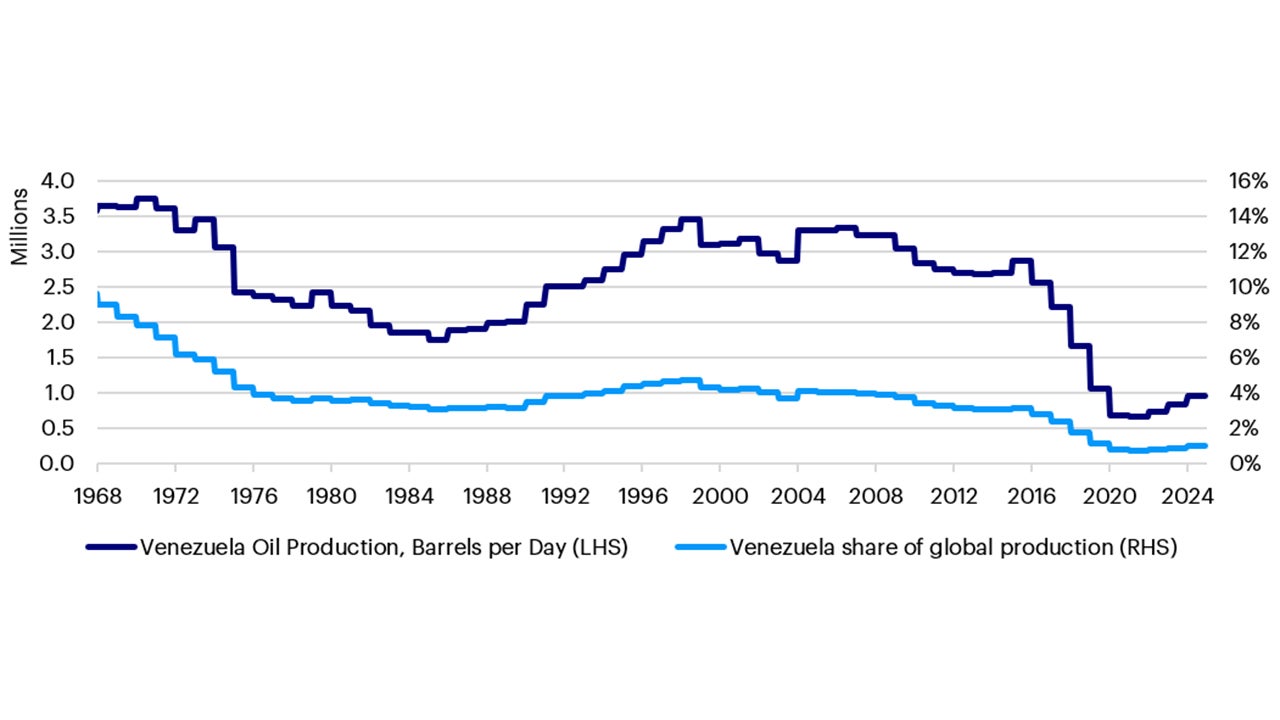

Venezuela, which holds roughly 17% of global oil reserves, once produced 3.5 million barrels per day in the 1970s but saw output fall to about 1.1 million barrels per day last year (chart).1

Experts caution that production is unlikely to rise significantly in the near term, even with major US investment.

Investment Implication

The broader message is that geopolitical uncertainty is now part of the macro environment, and this could continue to underpin demand for precious metals amid elevated volatility.

Despite silver outperforming gold at the end of 2025, I believe that gold is likely to reassert its position as the preeminent geopolitical hedge and experience a rebound relative to silver.

More so, expectations of increased US defense spending under the Trump administration point to further steepening pressure on the long end of the Treasury curve.

Source: Energy Institute, BP Statistical Review of World Energy. Annual data as of 2024 as at 5 Jan 2026.

Long‑duration bonds are also exposed to the inflationary impulse from larger fiscal spending even though the Fed continues to guide for more rate cuts. For these reasons, my preference remains tilted toward equities over fixed income.

Asia’s immediate market reaction has been muted, with investors largely brushing off the weekend’s developments.

In North Asia, the focus remains firmly on the structural tailwind from rising AI investment, outweighing geopolitical concerns.

In addition, the APAC region is a significant net importer of oil. Trump’s renewed push for increased oil production out of Venezuela could also hold down crude oil prices and restrain inflation in the region.

These variables could open the door again for more Asian central bank easing, which has historically been positively correlated with rising share prices.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.