What are the investment implications of the recent US dollar selloff?

The recent USD selloff has been historic.

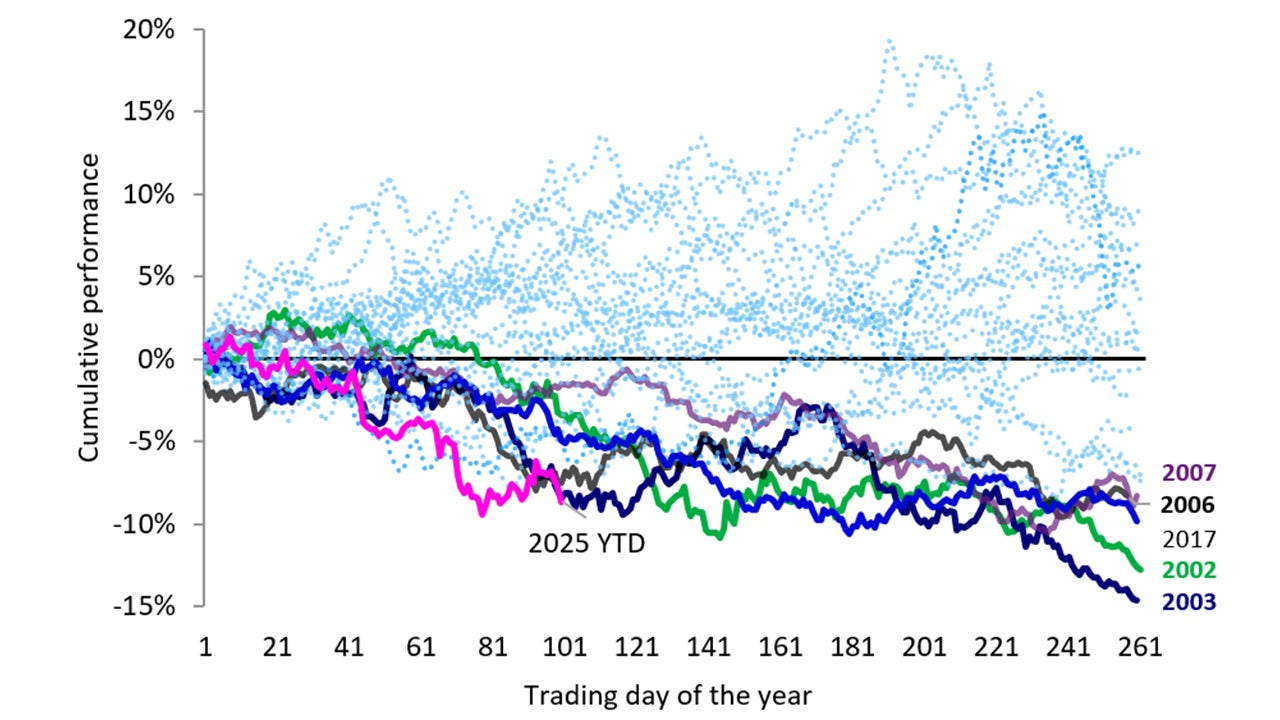

To put in perspective, the USD is off to its worst start to a year since 1974 and has weakened around 9.27% since the beginning of 2025.1

Despite the year-to-date selloff, the value of the dollar remains well above its long-term average and further weakness may be imminent.

However, we believe that this doesn’t necessarily reflect a structural shift away from the USD.

Source: Bloomberg, daily US Dollar Index data from 31 December 1999 through 23 May 2025, as of 23 May 2025. United States (US). Year-to-date (YTD).

The recent driving force of USD

The relative strength of the dollar is no longer being driven by global interest rate differentials.

Instead, a marginal reallocation away from dollar-denominated assets by foreign investors, along with a diminished perceived “safe haven” appeal, appear to be driving recent declines.

This is evidenced by the numerous instances of US stocks, Treasury prices and the USD falling simultaneously on days of heightened policy uncertainty and market volatility.

Sustained periods of dollar depreciation have historically benefited non-US stocks, both developed and emerging.

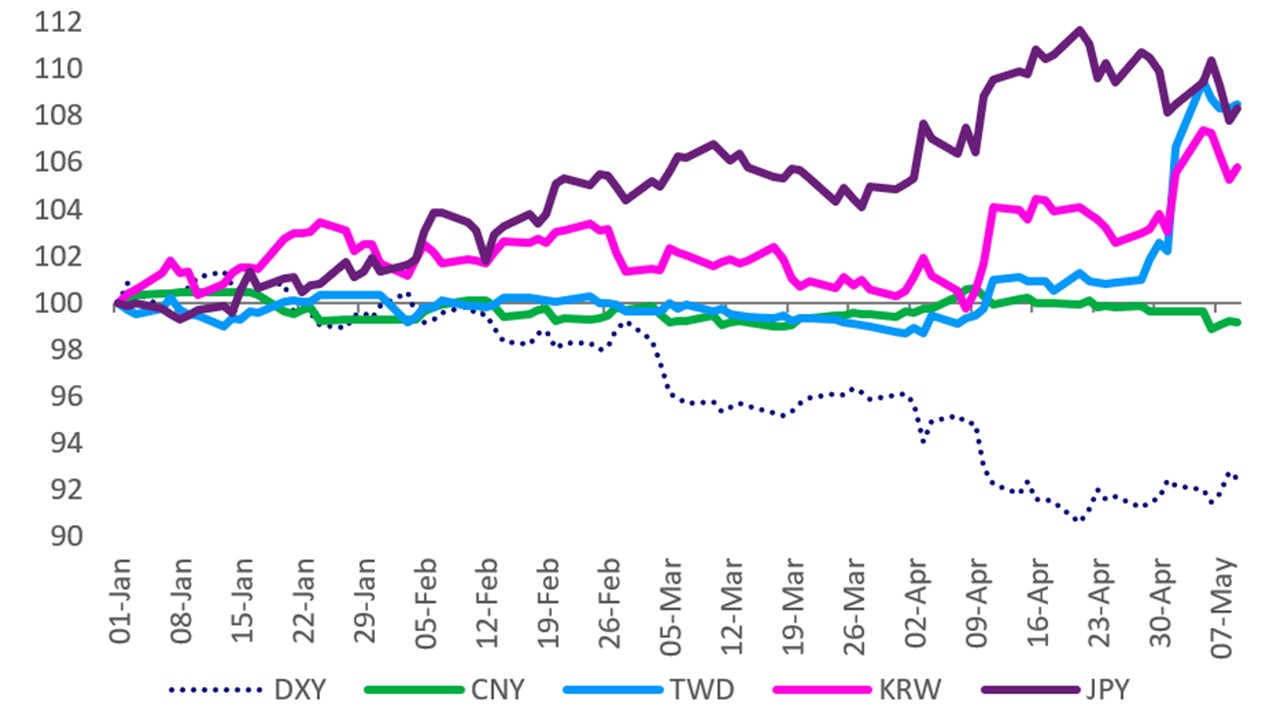

That said, the recent USD-Asia foreign exchange turbulence appears to have been due more so to portfolio rebalancing. TWD and KRW have surged though JPY nor CNY have not.

Longer-term, will the USD remain as a dominant currency?

Questions have recently arisen over whether this shift is a milestone in the USD’s demise as a dominant currency. I’m not so sure. For example, Taiwanese insurers are estimated to own around $700bn in US assets of which only about half are FX hedged.2

If investors begin to unwind or hedge their positions involving the USD, it could trigger "avalanche risk", leading to sudden and significant exchange rate fluctuations. This could result in increased volatility in the FX market or potentially signal a shift in the dollar's role in the global economy.

Note: Chart shows currency performance, reindexed to 01 Jan 2025=100. DXY is a nominal index of the dollar against liquid major currencies – EUR, JPY, GBP, CAD, SEK. Higher (lower) index numbers represent a stronger (weaker) currency against the USD; chart uses reciprocal values for currencies for which the quoting convention is a lower number for a stronger currency (JPY, TWK, KRW). Source: Bloomberg, Macrobond, Invesco. Daily data as at 09 May 2025.

Yet DXY’s current stability contrasts with big legs down after “Liberation Day” and the recent sharp dollar-Asia moves.

I believe that early April saw G7 portfolio rebalancing out of the US which has rotated to Asia. But this doesn’t necessarily reflect a structural shift away from the USD.

Longer term, the case for the USD’s demise as the dominant global currency is driven by deteriorating confidence in US credibility, as disruptive policy changes undermine institutions and raise worries about returns on US capital.

We should monitor these developments carefully, but also avoid over-interpreting the situation.

The UK experience

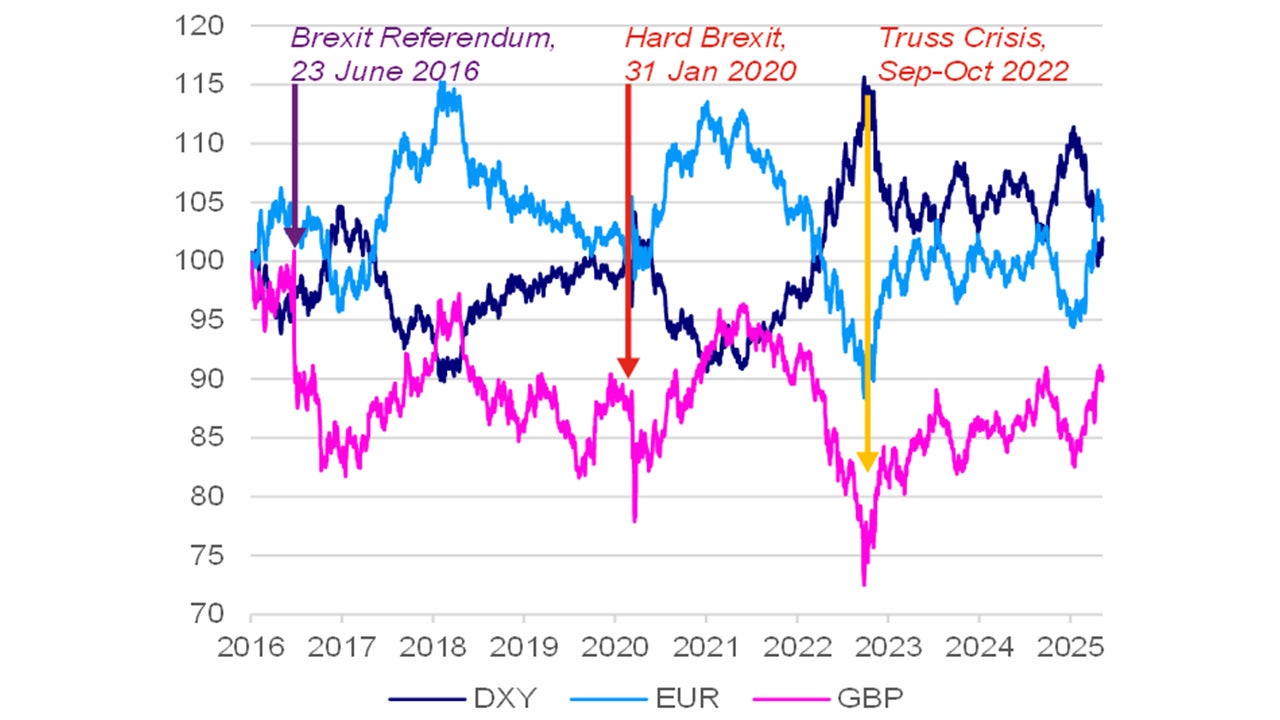

The recent big USD moves recall what happened to GBP during Brexit and the Truss Crisis.

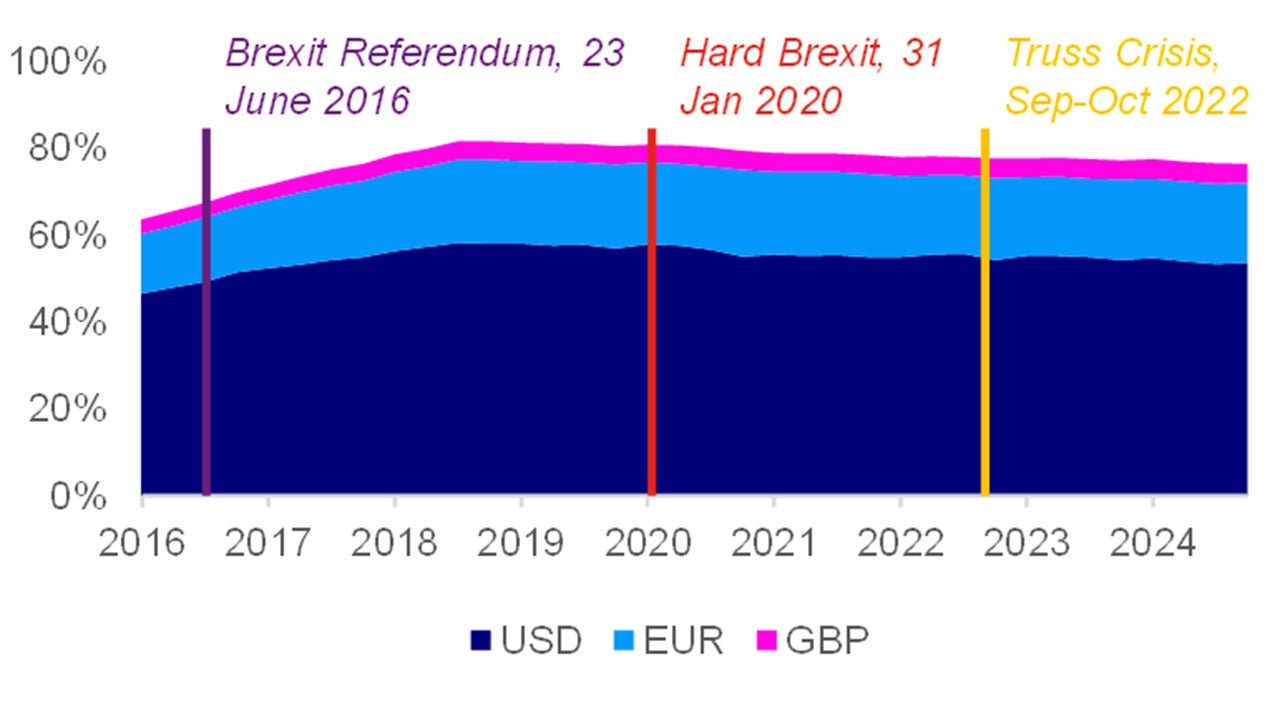

The GBP fell in value, yet its role in FX reserves held up over the past decade despite crises that cost the UK credibility.

The US, if anything, is in a stronger position given its market depth as well as the scale and diversity of its economy.

Note: Chart shows currency composition market share of gross official foreign exchange reserves of the US dollar, euro and sterling; the rise of their FX reserve shares in the mid-2010s is usually attributed to a reallocation by currency of “unallocated” reserves. Sources: IMF, Bloomberg, Macrobond, Invesco. Monthly data left to October 2024

Sources: IMF, Bloomberg, Macrobond, Invesco. as at 9 May 2025.

With contributions from James Anania & Arnab Das.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.