What are the investment implications of Trump’s latest tariffs?

Just before sweeping tariffs on Mexico and Canada were due to come into force, Trump halted them at the eleventh hour announcing a 30-day delay following bilateral calls with Mexican President Sheinbaum and Canadian Prime Minister Trudeau.

The reversal on Mexico and Canada tariffs was welcomed by markets, as they would have delivered an immediate shock to the North American and world economies. Canada, Mexico and US trade flows are so large we think that growth losses could reach 0.5-1.5% of GDP. The Canadian Dollar and Mexican Peso reversed earlier losses, and equities stabilized somewhat.

Concessions were extracted on non-trade issues, demonstrating Trump’s willingness to compromise and furthering his reputation as a negotiator. Mutual dependence and efforts to address fentanyl and immigration grievances may also help avert all-out trade war. That said, uncertainty will prevail, and Trump has conditioned the halts on a “final economic deal”. It’s possible the fiasco has upped the stakes and softened Mexico and Canada up for the coming United States-Mexico-Canada Agreement (USMCA) negotiation.

The Trump administration will hold talks with China in the coming days, and even without a delay it is possible that the US will be slow to implement the tariffs.

From a US macro perspective, the overall inflation impact of tariffs should be somewhat mitigated by the impact of “relative price shifts” – tariffed goods might go up in price, but the currency effect would offset this to a significant degree. The growth hit may well dominate as real incomes get squeezed and lowers demand.

Tariffs may not have an immediate impact, but they would lead to a chipping away of relationships and a reorganization of supply chains. It impacts small businesses more significantly than larger ones, so we may not see the brunt of the impact on listed companies, which tend to be large. Asset-light businesses may also have an advantage, especially over those that have extensive international supply-chains. Further, the way this policy is conducted leads to more uncertainty that reduces investment further.

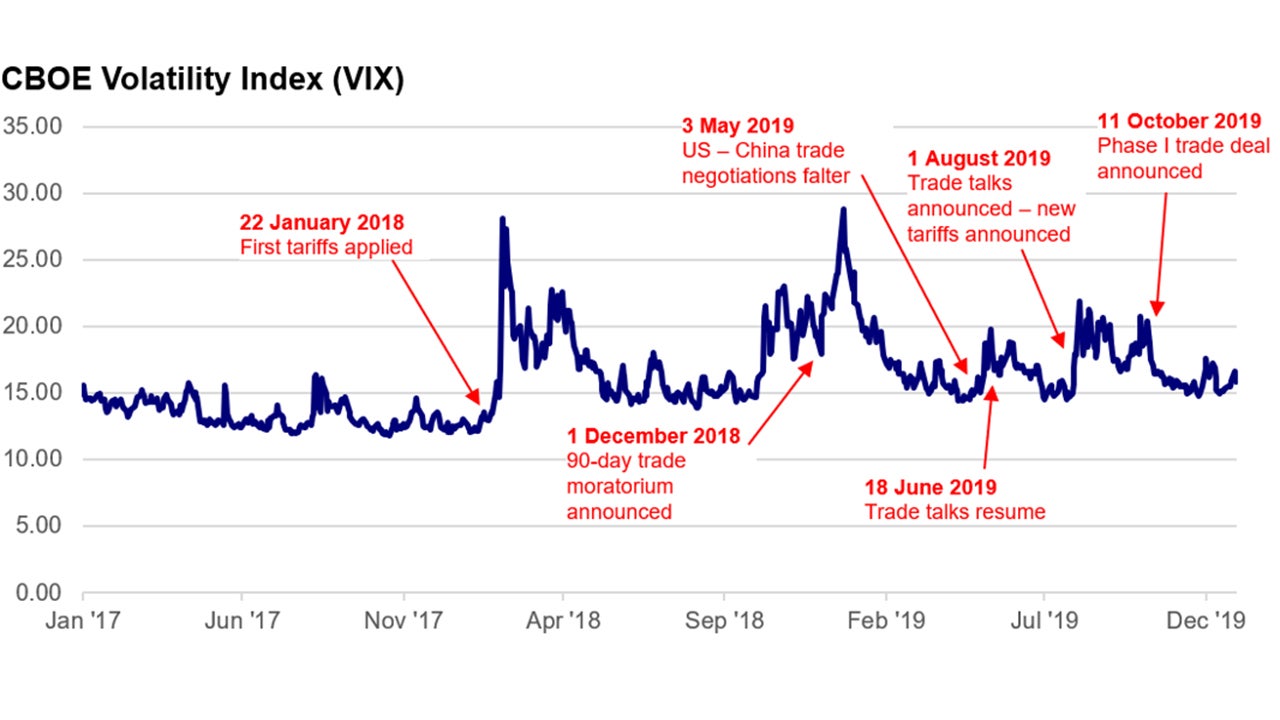

The 2018-2019 trade tensions between the US and China caused disruptions, stalled US business investment and led to a flight to quality in markets globally. It also caused periods of significant volatility. Once a resolution was reached as the Phase I trade deal between the US and China was announced, volatility eased, and financial markets reaccelerated. We could see a similar scenario unfold this time as well.

Sources: Bloomberg, Chicago Board Options Exchange (CBOE), and Invesco Global Market Strategy Office, as of 2 February 2025.

To the extent that an all-out trade war breaks out, the USD and US markets generally might well outperform the smaller, more open economies.

Asia is particularly vulnerable to rising trade tensions, as many Asian economies are heavily dependent on trade. Among the 10 largest bilateral trade deficits the US has, 7 are with Asian countries. It is important to note that global trade patterns have shifted since the last trade war, and companies are now better prepared for potential trade barriers.

Moving forward, domestic factors are likely to play a more significant role in determining the region's economic prospects. For instance, India and Japan have robust domestic demand that can help cushion the impact of weaker international trade. China’s outlook will depend on the policy stimulus rollout this year as well as tolerance for a weaker FX fixing. These internal dynamics can help offset the negative effects of reduced trade, making these countries more resilient to external shocks.

For now, a strong US dollar will likely persist tactically on the back of elevated trade uncertainty. This could challenge emerging market flows because a stronger dollar causes liquidity drain as capital is drawn to the US.

With contributions from Arnab Das, Andras Vig and Kristina Hooper

Investment Risks:

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations), and investors may not get back the full amount invested.