What’s next for gold after $4000?

Gold has surged past the historic $4,000 an ounce mark, a watershed moment placing the metal as one of the best performing major assets in 2025. Yet, some market participants view this as cautionary, underscoring market’s unease with dollar stability amidst the current macro and policy backdrop.

Hedge fund titans Ray Dalio and Ken Griffin have both pointed to the erosion of confidence in the dollar as a key driver, with Dalio framing gold as a superior safe haven in times of monetary debasement, while Griffin warns that the metal’s ascent signals growing anxiety over the greenback’s long-term role in the global system.

How right are they? It is true that gold has traditionally served some signaling quality, a “canary in the coal mine” for risks on the horizon. That dynamic appears alive today. The gold surge is not only a reflection of its strong performance but may also be a warning light flashing against the backdrop of US policy turbulence.

With the White House pursuing unconventional reforms, growth momentum slowing, and the administration openly challenging the independence of the Federal Reserve and other institutions, investors may be right to read gold’s ascent as a barometer of rising systemic risk.

Gold’s ascent has been particularly striking because the traditional macro drivers (as a real, non-yielding asset) of falling USD and falling long yields aren’t present. The USD against a basket of currencies as represented by the US Dollar Index (DXY) has been moving sideways since mid-year, as has the 30-year U.S. Treasury (UST) yield.1

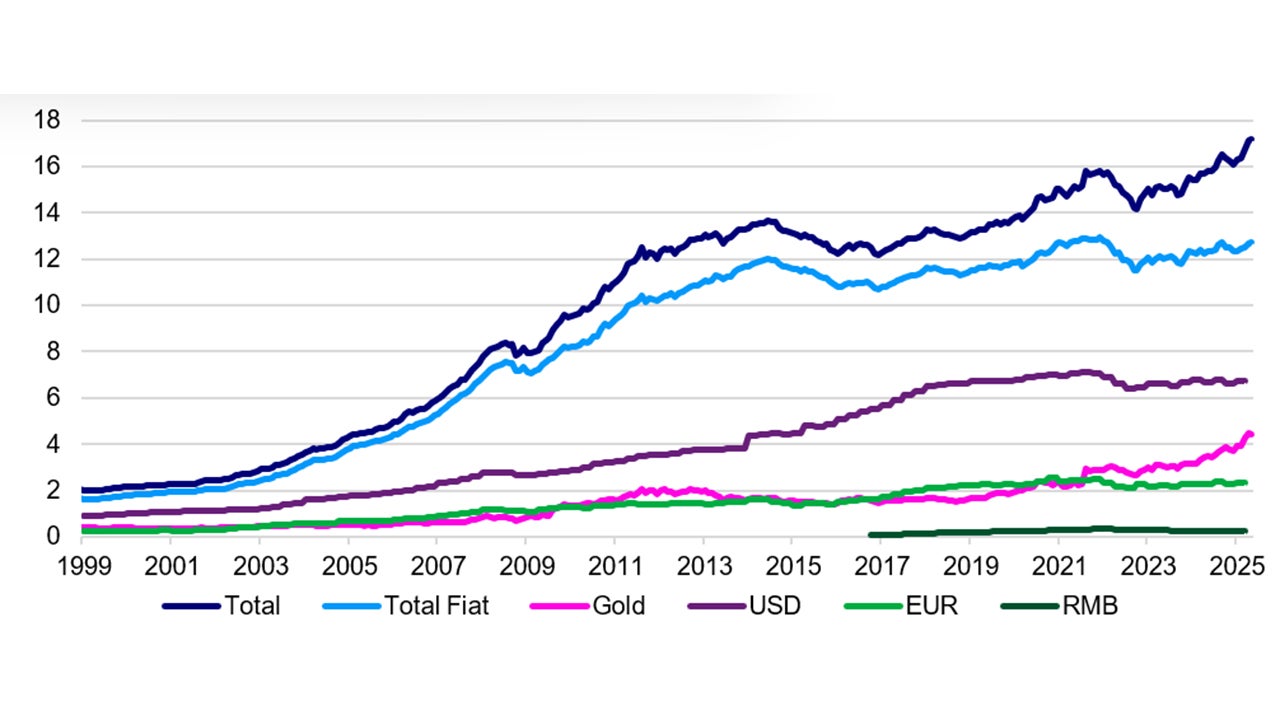

A major driver of demand has been from central banks accumulating gold as a form of official reserves. Counting gold shows the reserve shift is not from USD into EUR or RMB, but from fiat currencies into gold. In fact, gold has overtaken the EUR in reserves. In our view, it’s possible that central banks may be buying gold because they see no fiat alternative to the dollar.

Note: Most metrics for global reserves exclude monetary gold because it used to be a sideshow in international reserves. Until the Global Financial Crisis, developed market central banks were selling gold in a dollar-dominated, fiat-currency world where their currencies floated. Emerging market central banks tended to buy dollar reserves given their exposure to dollarized commodity and financial markets, and dollar pegs. Since then, DMs stopped selling, and EMs have been buying. Source: IMF IFS, COFER; Macrobond; Invesco. Quarterly and monthly data, latest available, as at 05 September 2025.

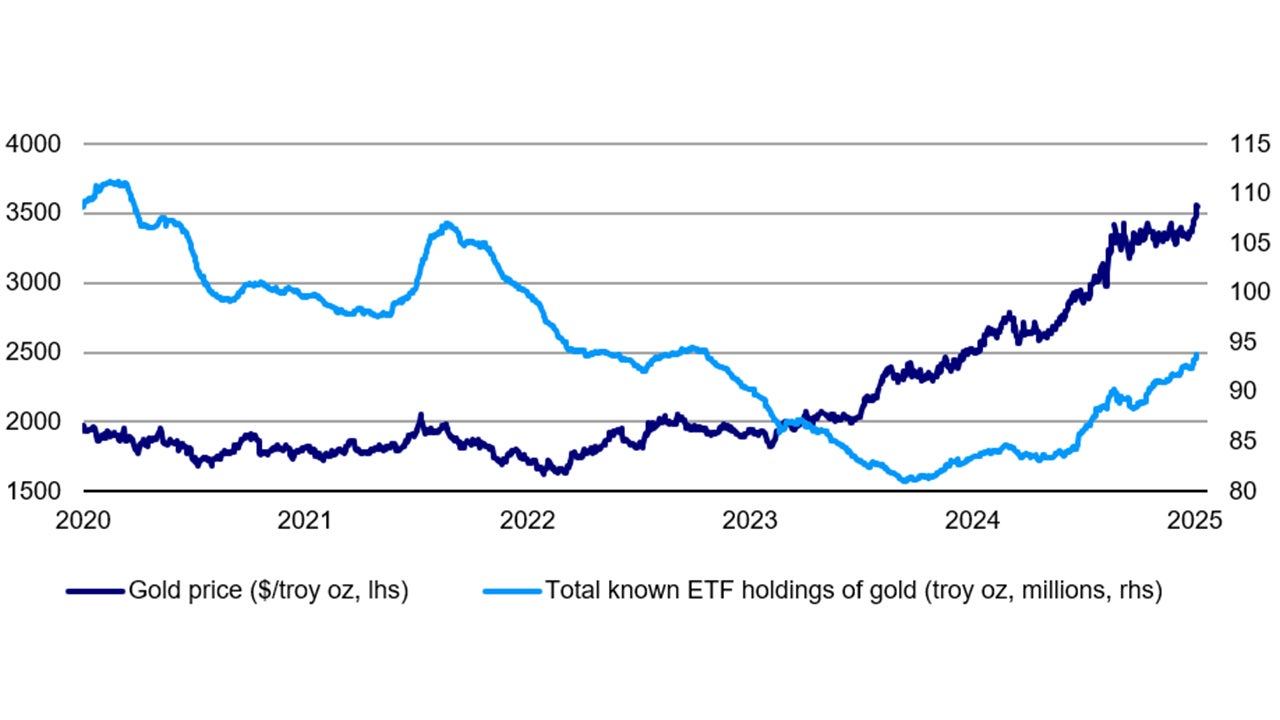

Despite double-digit gold returns in both 2023 and 2024, investor participation through ETFs remained muted, with holdings actually declining over that period. In contrast, the strong performance so far in 2025 appears to be drawing investors back into the market, with ETF inflows finally turning positive. If sustained, this renewed participation could act as a powerful tailwind to gold prices.

Source: Bloomberg, daily data from 31 August 2020 through 5 September 2025, as of 5 September 2025. Price of gold based on the gold spot US dollar price. Left hand side (lhs) and right hand side (rhs). An investment cannot be made directly into an index. Past performance does not guarantee future returns.

We think the gold rally has legs even from record highs, even though it has broken from normal valuation drivers – the dollar, real rates – and looks expensive. We see no true alternative to gold as a hedge against US risks and expect central banks to keep buying gold.

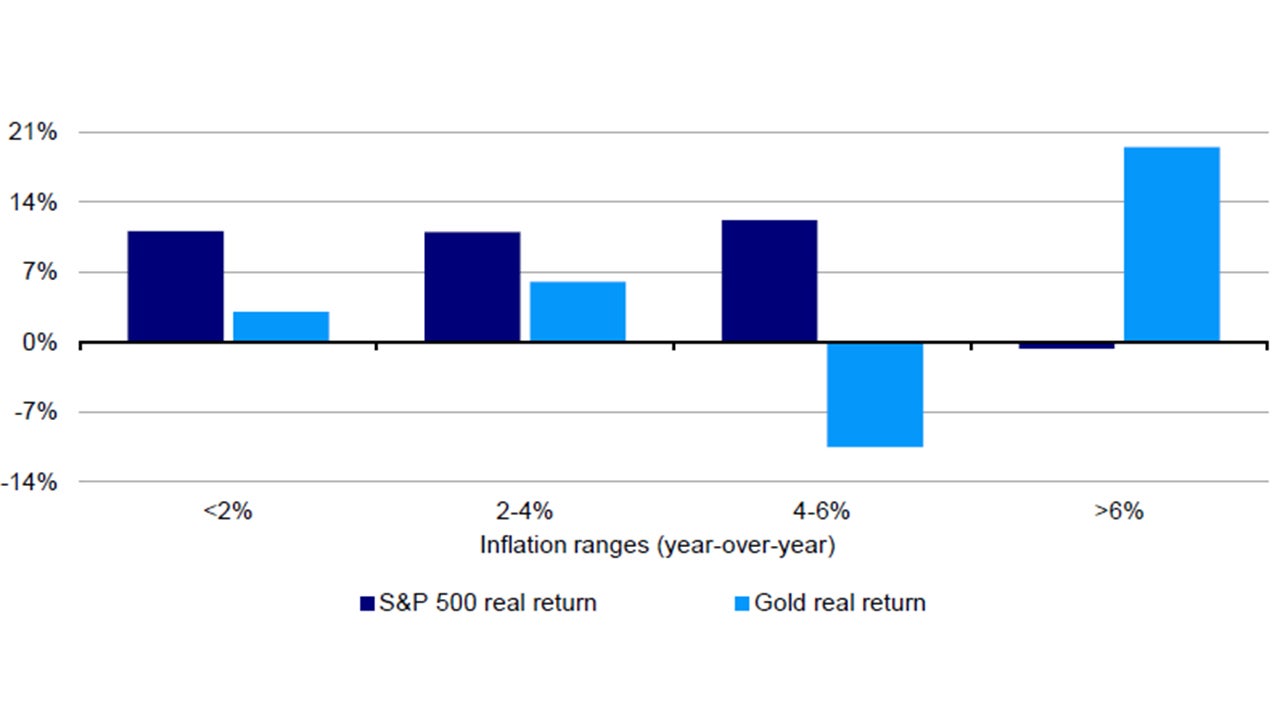

From an inflation hedging angle, contrary to common perception, gold has not been a consistent winner during ordinary inflationary periods. Historical data show that when inflation has remained below roughly 6%, equities have typically delivered stronger real returns. Gold’s relative outperformance has been concentrated in episodes of elevated or extreme inflation, which are comparatively rare.

Given that the precious metal has not historically provided the real return potential of stocks (or downside risk mitigation of bonds), investors should be mindful to size any allocation appropriately.

Sources: Bloomberg L.P., and Federal Reserve Economic Database, as of 22 September 2025. Gold returns based on gold spot US dollar price. S&P 500 returns based on the S&P 500 Index. Both are adjusted by headline personal consumption expenditures inflation, calculated on a rolling year-over-year basis using monthly data from 30 September 1973–31 July 2025. Personal consumption expenditures (PCE), or the PCE Index, measures price changes in consumer goods and services. An investment cannot be made directly into an index. Past performance does not guarantee future returns.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. Instruments providing exposure to commodities are generally considered to be high risk which means there is a greater risk of large fluctuations in the value of the instrument.