Why Japanese bond yields are rising and the yen is falling

The trigger to the rapid rise in Japanese Government Bond (JGB) yields could be pointed to growing expectations that the economic stimulus package being formulated under the new Takaichi administration may turn out to be much bigger than previously expected.

This could be financed by the issuance of additional government bonds. Markets have become increasingly concerned about risks to the sustainability of Japan’s long-term fiscal position.

Another factor to explain the surge in Japan’s long-term interest rates is the shifting supply-demand dynamics in the government bond market, which has made yields more susceptible to upward pressure.

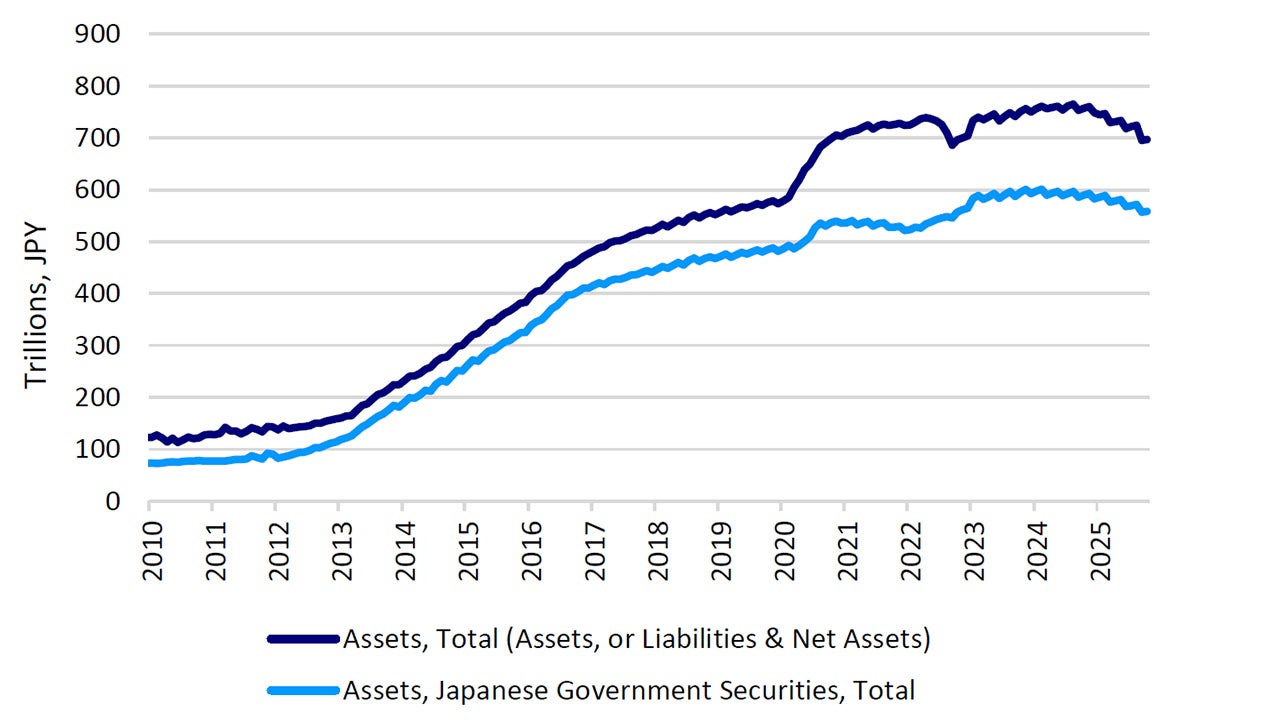

The Bank of Japan (BOJ) abolished its yield curve control (YCC) framework in March 2024. YCC acted as a major buyer of JGBs helping to stabilize long-term rates. In August 2024, the BOJ initiated a quantitative tightening (QT) policy aimed at reducing its JGB holdings.

Since then, domestic banks and foreign investors have stepped in as primary buyers of JGBs – though in Q2 2025, domestic banks’ purchases dropped significantly, thus increasing the reliance on foreign investors.

Foreign investors tend to be more sensitive than domestic investors to risks associated with eroding fiscal discipline.

Thus, amid growing dependence on foreign investors and rising concerns over fiscal deterioration linked to new stimulus measures, expectations have increased that foreign investors may adopt a more cautious stance toward JGB holdings.

If long-term interest rates continue to trudge upwards, this raises the possibility for the BOJ to increase its JGB purchase operations or end quantitative tightening (QT) earlier than planned.

Source: Macrobond. Monthly data as of October 2025, as at November 24, 2025.

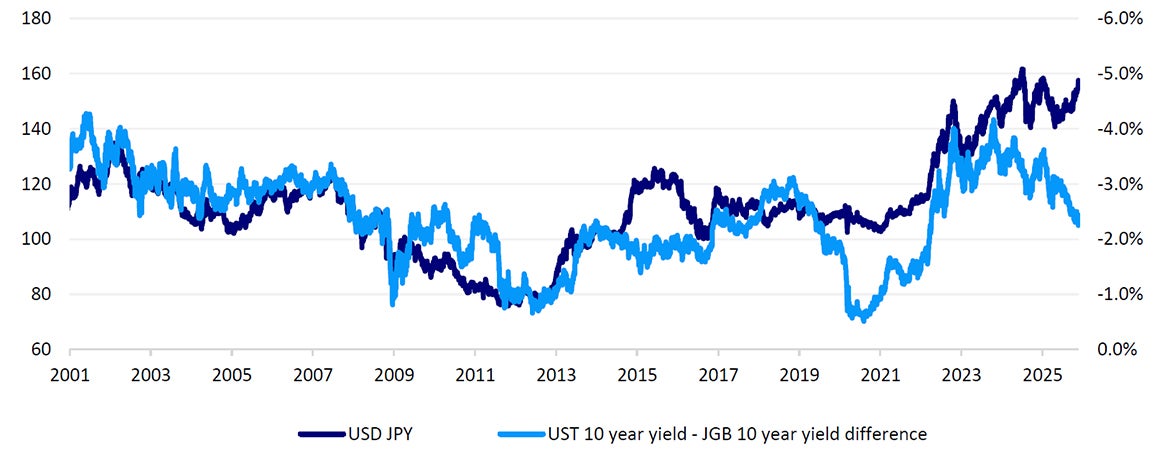

The recent JPY weakness

From a currency perspective, the JPY has weakened since Takaichi’s election, reflecting expectations of her cautious stance on monetary tightening and concerns over fiscal deterioration tied to large-scale stimulus plans.

The government has grown concerned about JPY weakness and if the currency approaches ¥160 per dollar, foreign exchange intervention is likely. That said, the yen’s decline is expected to stabilize once the size and details of the stimulus package become clearer.

Investment Implications

The combination of yen weakness and expectations for large-scale economic stimulus provides a tailwind for a BOJ rate hike.

While Japan’s Q3 GDP contracted by –1.8% annualized, marking the first decline since Q1 2024, this was largely driven by temporary export weakness. Domestic demand has remained resilient due to strong wage growth and improving household optimism.

Growth is expected to return to the positive territory in Q4, supported by stimulus measures and moderating inflation.

I believe that the likelihood of a rate hike at the December 18–19 meeting has increased.

My view is that the JPY is currently very much undervalued and is likely to strengthen ahead of next month’s BOJ meeting, where I expect a rate hike.

And while I’m not a buyer of JGB’s even after the recent sell-off, I believe that Japanese equities present a compelling story, driven by reasonable valuations and a reflationary economic story in the coming year.

With contribution from Tomo Kinoshita.

Source: Macrobond. Monthly data as of October 2025, as at November 24, 2025.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.