Building Capital Market Assumptions for Sukuks

Key Takeaways

- Sukuks, a key component of Islamic finance, continue to gain popularity as Shariah compliant investors seek opportunities within the global fixed income market.

- Sukuks share the same fundamental attributes as conventional bonds. This allows us to directly apply certain aspects of the building block methodology used in our Long-Term Capital Market Assumptions (LTCMAs) to this asset class.

In this paper we explain how we transform and apply our CMA framework to investment grade (IG) and high yield (HY) sukuks1. Our results can provide investors with guidance on deciding the level of portfolio exposure they may want to consider to this asset class and how to incorporate sukuks into their asset allocation processes, both within and outside of the Shariah-compliant investor universe.

Introduction

There has been a substantial growth in sukuk issuance (Islamic fixed income securities) in Gulf Cooperation Council (GCC) countries and certain Southeast Asian markets over the past decade 2. Historically accounting for approximately 90% of Islamic fixed income, the sukuk market serves as high potential alternative funding source for both corporations and governments (Al-Sayed, 2014). A sukuk is a Shariah-compliant Islamic fixed income instrument. It differs from a conventional bond as the holder has technical ownership of the underlying asset. Shariah law prohibits traditional interest payments and investments in specific industries such as tobacco, alcohol, and certain food products.

Growth within the sukuk market can primarily be attributed to two variables (Al Ansari, 2021). First, governments of Islamic-majority nations require substantial funding to support economic development. Additionally, many GCC countries have shown strong historical growth in GDP per capita which has in turn led to the growth of their capital markets. Hence, as we move into a post-pandemic cycle, we believe investors have reasonable evidence to classify sukuk instruments as an attractive investment option.

- Historically strong risk-adjusted returns: One of the many drivers of the growing demand for sukuks is the historically strong risk-adjusted returns of these instruments compared to conventional bonds. The return/risk ratio of FTSE IdealRatings Broad USD Sukuk Index from 2012 to 2019 is 1.64, which is much higher than that of the FTSE Emerging Markets Broad Bond Index at 0.91 (Hamil, 2021). The sukuk market continues to provide a compelling risk-return profile across the market cycle.

- Growth: Over the last ten years, the market value of the FTSE IdealRatings Broad US Dollar Sukuk Index has grown from US $15 billion to $126 billion (Hamil, 2021). The sukuk market is expected to continue to grow substantially in the near term.

- Diversification: Both Shariah-compliant and traditional global investors that are looking to develop a diversified multi-asset portfolio could consider sukuks. A recent study has examined the volatilities and correlations of bond indices of emerging markets such as South Korea, Singapore, China, India, Indonesia, and Malaysia with a sukuk index 3. It concludes that the sukuk market offers effective portfolio diversification opportunities for fixed income investors (Bhuiyan, Rahman, Saiti and Ghani, 2018).

In this piece, we discuss how to formulate and apply our long-term CMA methodology towards investment grade and high yield sukuks. Sukuks can offer attractive investment opportunities for investors who might be interested in delving deeper into a new asset class. These CMAs can assist investors with insights on how to appropriately implement a sukuk allocation within their portfolios.

Investment grade and high yield sukuks as individual asset classes

The sukuk market has grown significantly over the past decade, attracting the attention of both Shariah-compliant and traditional global investors. Sukuks form the largest fixed income asset class in Islamic finance and sukuk issuance is projected to grow at an estimated compound annual growth rate of 6.8% over the next several years, reaching US $257 billion in 2027, according to Refinitiv’s Sukuk Supply and Demand Model. Total sukuk outstanding is projected to reach US $1.1 trillion by 2027.

Source: Refinitiv, Sukuk Perceptions and Forecast Study 2022.

For investment grade sukuks we use the FTSE IdealRatings Sukuk Index to develop our CMA. Originally launched in September 2005, the index provides a suitable benchmark to measure the performance of investment grade sukuks globally. It contains sukuks from markets such as Saudi Arabia, United Arab Emirates, Indonesia, Qatar, Bahrain, and Kuwait. In terms of credit rating, the majority of assets are split almost evenly between BBB and A as of March 2023.

Source: FTSE Russell, Data as of March 31, 2023.

We use the FTSE IdealRatings Broad USD Sukuk High Yield Index as our benchmark for high yield sukuks. Part of the FTSE IdealRatings Broad Sukuk index, the high yield portion was launched in December 2010. Issuers from Bahrain, Turkey, Oman, Saudi Arabia, United Arab Emirates, Pakistan, and Maldives are included in the index. Just over 95% of the assets in the index have a credit rating of B or BB as of March 2023.

Source : FTSE Russell, Data as of March 31, 2023.

Methodology

Using our traditional CMA framework, we separate the process into a few main components to estimate each driver of asset class returns. Through a “bottom-up” approach, we divide our estimates into income and capital appreciation components. For fixed income assets, the income component is represented by yield and capital appreciation is made up of roll return, valuation change, and credit loss. These building blocks are estimated as follows.

- Establish income component with the level of yield;

- Estimate capital appreciation via:

- Roll return which captures the effect of a bond moving closer to maturity as time passes;

- Valuation change estimates based on how expensive or cheap the fixed income index currently is, and;

- Capital loss estimates by accounting for the impact of potential rating migration or default through appreciation/depreciation in price.

It is important to understand if and how our global CMA framework could be applied to sukuks. Sukuk instruments and conventional bonds have many structural similarities, namely in areas such as yield to maturity, price behavior till maturity, spread, and credit ratings. In addition, sufficient data is available for sukuks for yield, duration, and spread, which allows us to build each of the four building block components.

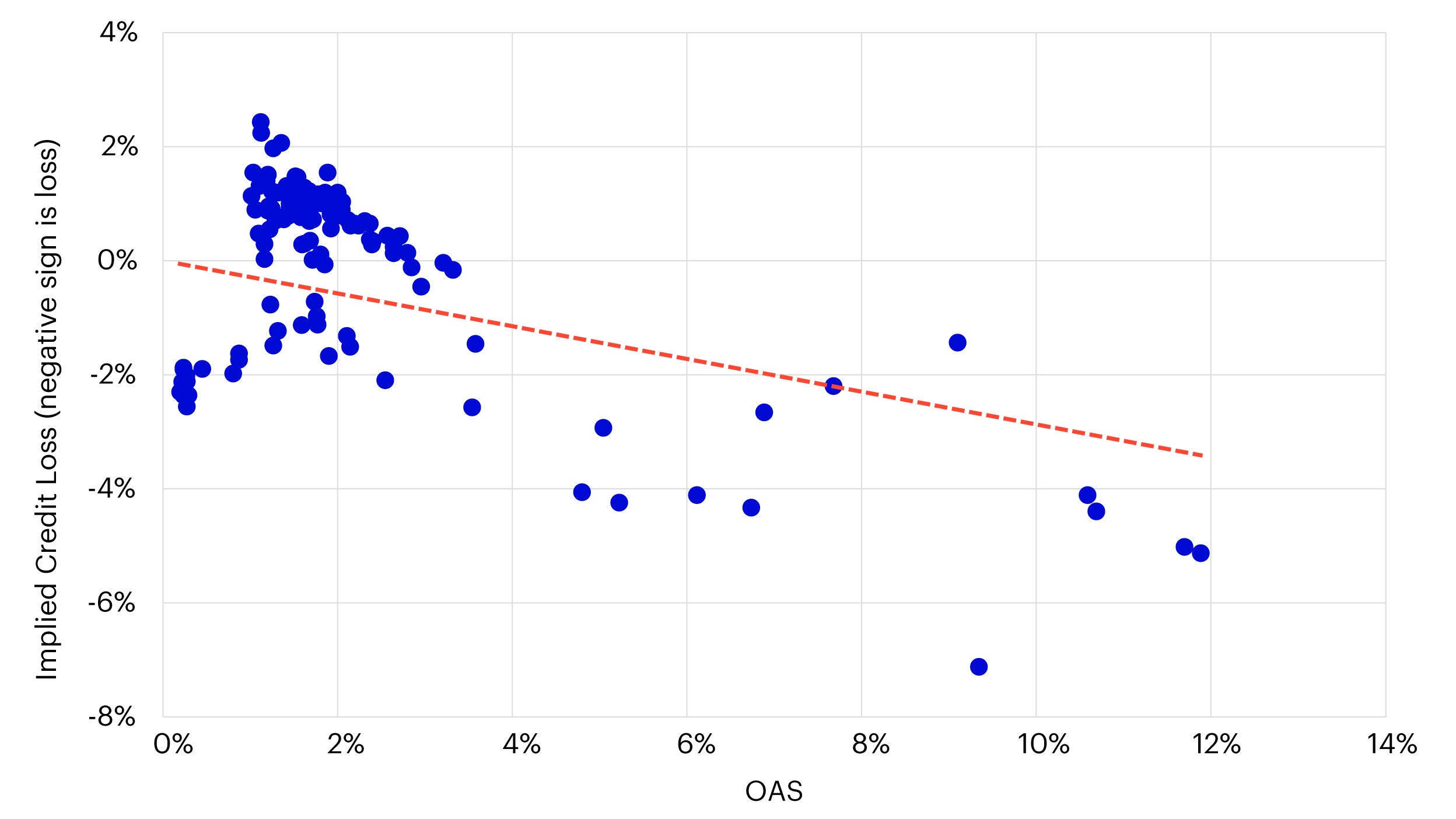

Due to the unique properties of sukuks, a few changes needed to be made to the CMA building blocks used for traditional bonds. For example, given the limited default data for high yield sukuks, estimating credit loss proved challenging. As of March 2023, only one high yield sukuk has ever defaulted within the index universe. Because of this, we use a percentage of option-adjusted spread (OAS) as an estimate of credit loss for both high yield and investment grade sukuks.

We start off by calculating CMA excess return which is CMA return leaving out the building block that represents credit loss. Next, we calculate actual excess return by taking realized 5Y average returns for each of the FTSE IdealRatings indices and subtracting realized 5Y average US treasury returns with similar duration.

Finally, we calculate implied credit loss by taking the difference between actual excess return and CMA excess return. To find the percentage, we regress implied credit loss versus OAS and use the coefficient as the estimated percentage of OAS for expected credit loss.

Through this process, we find the appropriate estimate of credit loss is 30% of the OAS for investment grade and 40% for high yield sukuks.

Sources: Bloomberg, FTSE Russell, and Invesco Estimates

Sources: Bloomberg, FTSE Russell, and Invesco Estimates

Sources: FTSE Russell, Bloomberg, Invesco. Data as of March 2023. Capital market assumptions contain forward-looking information that is not purely historical in nature. They should not be construed as guarantees of future returns.

Yield

To calculate the income component or yield, we take an estimate of the average income to be received by holding a fixed income security throughout its life. For our CMA, we calculate yield using the average of the current (starting) and estimated (ending) yield levels.

Ye= Ys + ΔYdiff

Ys=starting yield

Ye=ending yield

ΔYdiff=difference between spot and forecasted rate+ ΔOAS

Since the indices we focus on consist of USD-denominated sukuks, we use proxy spot and forward curves constructed based on the US spot and forward rates and calculate the difference in yield between current and estimated future yield curves based on various durations. We then take the sum of the difference and current yield to maturity of each index to calculate our final ending yield value. For changes in credit spreads or OAS, we assume reversion to the mean (Prigent, Renault and Scaillet, 2001).

Source: FTSE Russell, Bloomberg, Invesco. Data as of March 2023. Capital market assumptions contain forward-looking information that is not purely historical in nature. They should not be construed as guarantees of future returns.

Source: FTSE Russell, Bloomberg, Invesco. Data as of March 2023. Capital market assumptions contain forward-looking information that is not purely historical in nature. They should not be construed as guarantees of future returns.

Capital appreciation component:

The capital appreciation component is estimated using three factors: roll return, valuation change, and credit loss.

Roll Return

Roll return comes from the change in price of a fixed income security due to movement along the yield curve. In other words, we treat the yield curve as fixed and calculate the impact on price as the bond moves toward maturity. We then take the average of the current and expected roll return to obtain our final CMA roll return values.

Roll Return = - ( t - 1 )*∆Y

t = maturity

∆Y=interest rate differential between t and t-1

As the spot yield curve has been slightly inverted since mid-2022, we get a negative current roll return from then on.

Source: Bloomberg, Invesco. Data as of March 2023. Capital market assumptions contain forward-looking information that is not purely historical in nature. They should not be construed as guarantees of future returns.

Source: Bloomberg, Invesco. Data as of March 2023. Capital market assumptions contain forward-looking information that is not purely historical in nature. They should not be construed as guarantees of future returns.

Valuation Change

Valuation change represents the capital appreciation or depreciation when the yield curve moves. In normal market conditions, when the forward curve is above the spot curve and is upward sloping, we can expect valuation changes to be negative.

Valuation Change=1 - [ 1 - t * ( Ye - Ys ) ] 1/10 – 1

t = maturity

Ye=ending yield

Ys=starting yield

Source: Bloomberg, Invesco. Data as of March 2023. Capital market assumptions contain forward-looking information that is not purely historical in nature. They should not be construed as guarantees of future returns.

Credit Loss

As mentioned earlier, with limited information on previous defaults, we model potential credit loss as a percentage of OAS for both investment grade and high yield sukuks.

Credit Loss = OAS Haircut (%) * OAS

OAS Haircut=30% for IG, 40% for HY

OAS=Option Adjusted Spread

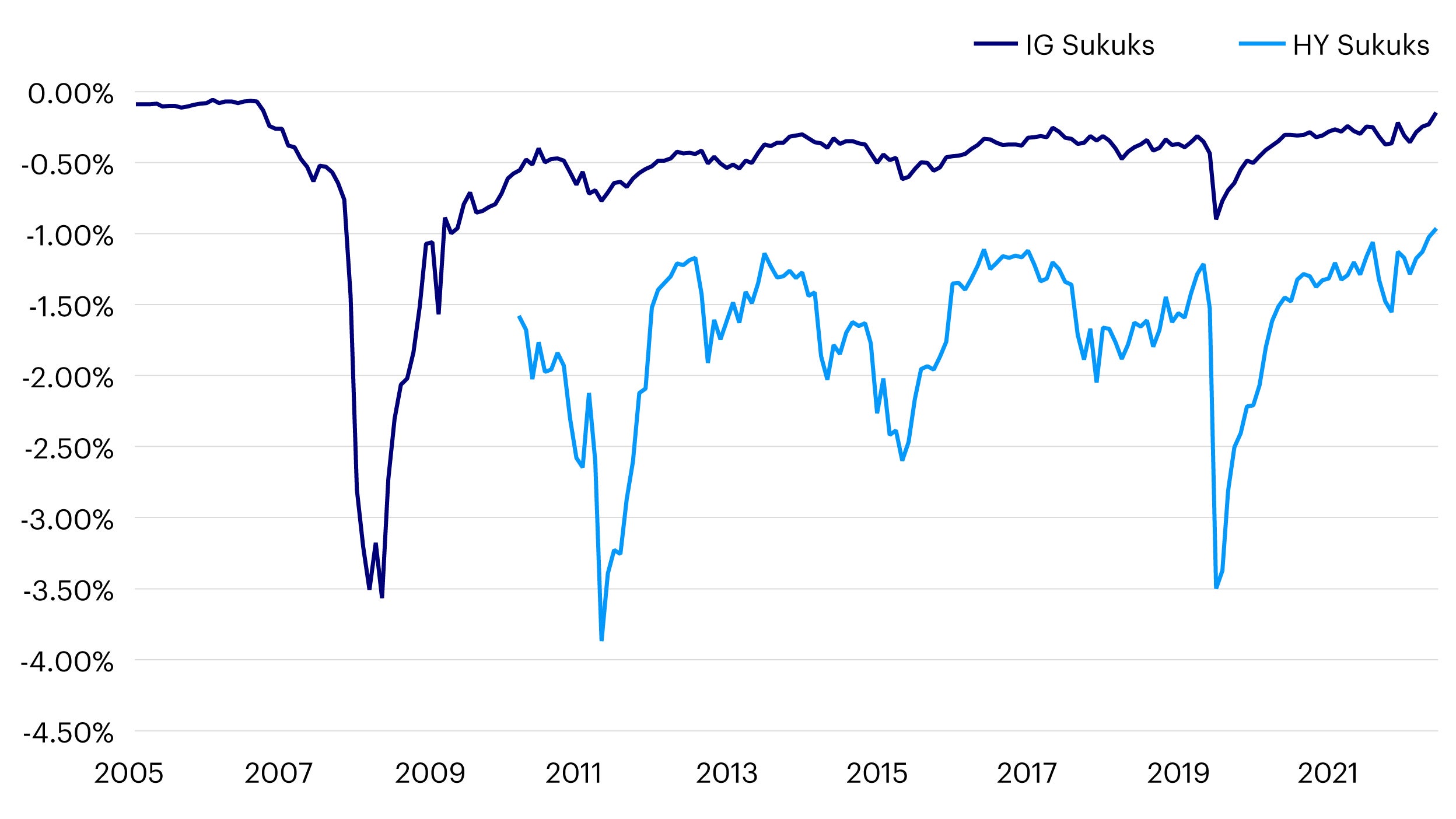

Comparing expected returns from our CMAs and realized returns

From the two graphs below, we can see that our long-term return estimates appear to be reasonable. Due to the short history of the indices, having only been incepted just over 10 years ago, we compare CMA returns with 5-year realized returns.

Source: FTSE Russell, Invesco. Data as of March 2023. Capital market assumptions contain forward-looking information that is not purely historical in nature. They should not be construed as guarantees of future returns.

Source: FTSE Russell, Invesco. Data as of March 2023. Capital market assumptions contain forward-looking information that is not purely historical in nature. They should not be construed as guarantees of future returns.

Source: Invesco, as of March 2023. These estimates are forward-looking, are not guarantees, and they involve risks, uncertainties, and assumptions. These estimates reflect the views of the authors, the views of other investment teams at Invesco may differ from those presented here. “IG sukuks ” is based on the FTSE IdealRatings Sukuk Index. “HY sukuks” is based on the FTSE IdealRatings Broad USD Sukuk High Yield Index. Capital market assumptions contain forward-looking information that is not purely historical in nature. They should not be construed as guarantees of future returns.

Source: FTSE Russell, Invesco. Data as of March 2023. Capital market assumptions contain forward-looking information that is not purely historical in nature. They should not be construed as guarantees of future returns.

Historical and current CMAs for investment grade and high yield sukuks can be seen in the chart above. Additionally, we leveraged Invesco Vision, a proprietary asset allocation decision support platform, to analyze the impact of adding sukuks to a traditional global fixed income opportunity set. Invesco Vision utilizes our long-term CMAs and additional inputs to calculate forward-looking return, risk, and covariance estimates, creating a tool for constructing optimized portfolios.

Source: Invesco Vision, data as of 28 February 2023. Global bonds portfolio has investment universe of US treasuries (represented by Bloomberg US Treasury Index), global IG corporate bonds (represented by Bloomberg Global Aggregate Corporate Index) and global high yield bonds (represented by Bloomberg Global High Yield Index). Investment universe for Global bonds + sukuks portfolio includes IG sukuks (represented by FTSE IdealRatings Sukuk Index) and HY sukuks (represented by FTSE IdealRatings Broad USD Sukuk High Yield Index) in addition to that of Global bonds portfolio. Return estimates are based on the Q1 2023 Long-Term Capital Market Assumptions. These estimates are forward-looking, are not guarantees, and they involve risks, uncertainties, and assumptions.

As shown in the chart above, the efficient frontier undergoes significant expansion by adding investment grade and high yield sukuks to a universe containing traditional bonds – identified as US treasuries, global corporate bonds, and global high yield bonds. We view this expansion as meaningful for portfolio constructionists, making a strong case for the inclusion of sukuks in a diversified portfolio. The return and risk trade-offs of sukuks are particularly compelling, and warrant consideration by global investors, regardless of investors’ preference for Shariah compliance.

As an example, a portfolio of 80% IG sukuks and 20% HY sukuks, as compared to an allocation of 50% US treasuries, 30% global investment grade corporate bonds, and 20% global high yield bonds 4 , has a slightly lower return expectation (4.6% vs. 4.9%), but much lower risk (3.1% vs. 4.5%). This is primarily due to the lower duration of sukuks. Also, it is worth noting that these two allocations have nearly identical sensitivity to credit, implying both are very high quality, defensive portfolios suitable to diversify exposure to growth assets. While we know traditional investors will not to be turning over their bond portfolios in favor of an all-sukuk allocation any time soon, our objective here is to demonstrate the efficacy of sukuks to address the core investment outcomes desired by fixed income assets.

Source: Invesco Vision, data as of 28 February 2023. Return estimates are based on the Q1 2023 Long-Term Capital Market Assumptions. These estimates are forward-looking, are not guarantees, and they involve risks, uncertainties, and assumptions.

Also for Shariah-compliant investors, utilizing a balance of investment grade and high yield sukuks can adequately provide income and diversification to a portfolio of Shariah equities.

Conclusion

In this paper, we formulate long-term return expectations for investment grade and high yield sukuks using Invesco’s Capital Market Assumptions building blocks. By developing a credit loss model customized for sukuks, we can forecast sound, research-based return expectations for these asset classes. Specifically, we create a model which focuses on tying together current market conditions with historical information to better predict what may happen to these asset classes. The results of this analysis suggest that investing in investment grade and high yield sukuks may enable investors to achieve higher risk-adjusted returns through diversification, and give access to a fast-growing market.