Insight

Dynamic Multifactor Strategies: A Macro Regime Approach

Executive Summary

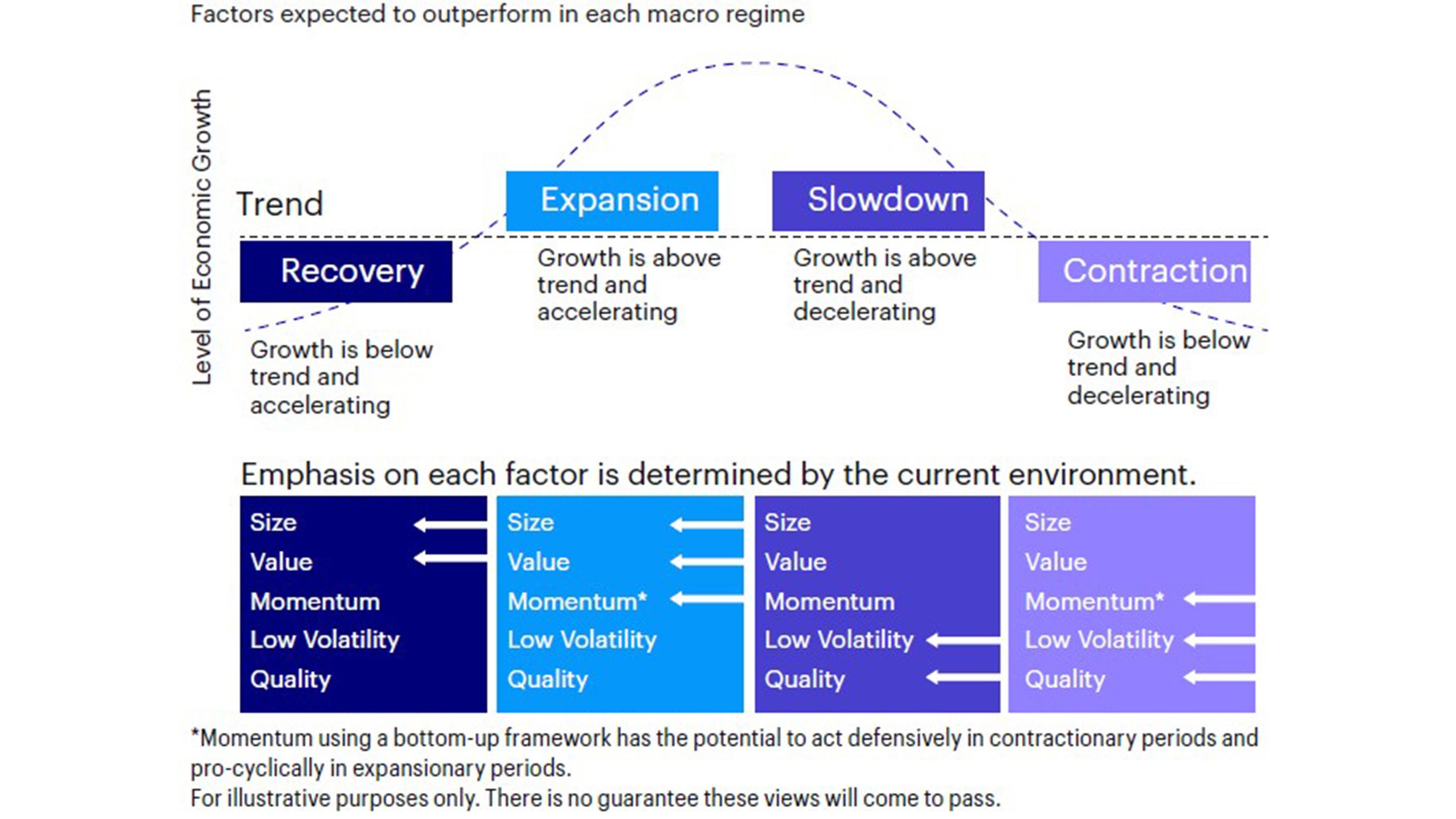

- Factor portfolios based on quantitative characteristics such as value, momentum, quality, size and low volatility have historically generated attractive excess returns, outperforming market cap weight (MCW) benchmarks on a risk-adjusted basis. While single factors have outperformed over the long-term, they have also experienced strong cyclicality, occasionally leading to extended periods of underperformance driven by changing market environments.

- Factor cyclicality can be understood in the context of factor fundamentals and their sensitivity to macroeconomic risks. While size and value tend to be pro-cyclical factors, low volatility and quality tend to be defensive factors. Momentum, a more transient factor, tends to outperform during late cyclical stages.

- We believe investors can exploit these distinct macro sensitivities among factors, developing dynamic multifactor rotation strategies driven by forwardlooking macro regime frameworks, with the potential to outperform equalweight multifactor strategies (EWMF) while maintaining diversification to multiple factors.

- These dynamic multifactor strategies (DMF) have generated attractive excess returns while reducing portfolio risk in terms market beta and drawdowns. Our results are consistent and robust across market cap segments and regions (US, Developed Markets ex-US and Emerging Markets).

- In part two of this two part series, we provide additional insights into the time-varying exposures and risk characteristics of these strategies, analyzing their downside risks, and which market conditions may provide challenges to performance.

Exhibit 1: Macro regimes and factor cyclicality