Insurance Insights Q3 2025: Fed policy signals and yield curve dynamics

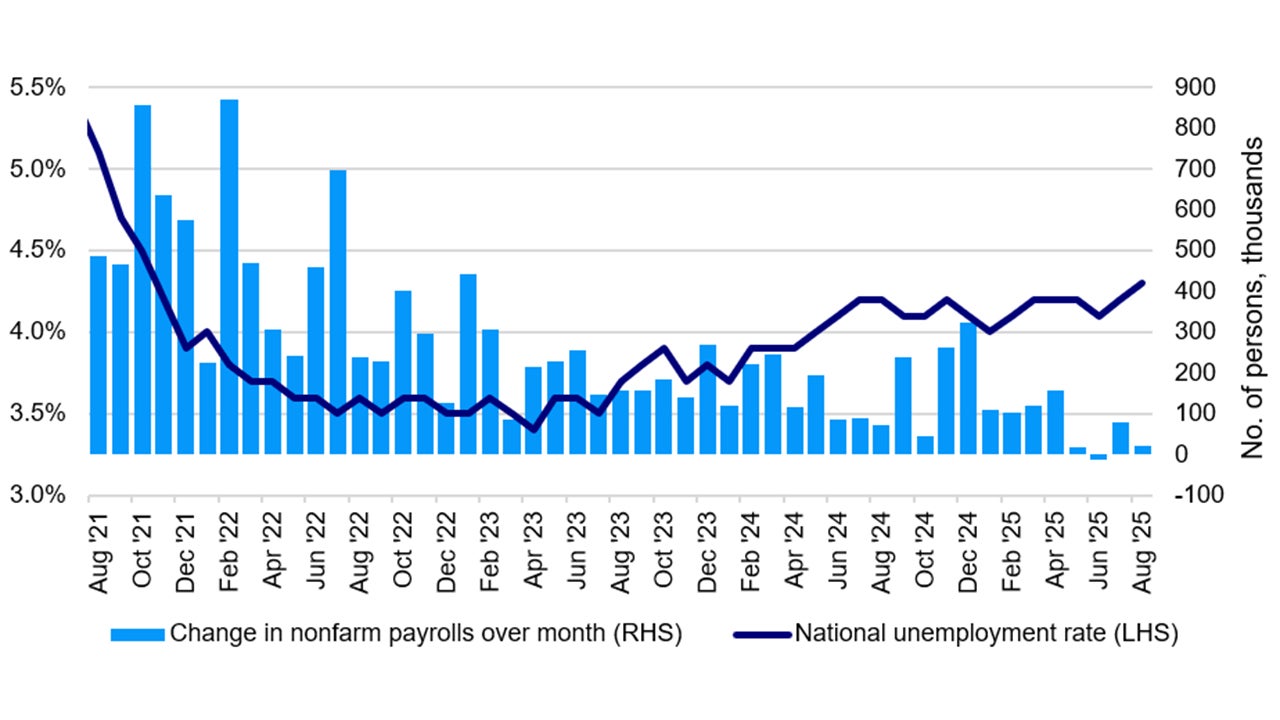

As the quarter unfolds, markets are navigating September’s reputation for seasonal weakness, though history shows such patterns are far from deterministic. While signs point to a slowing US economy, the broader macro backdrop remains constructive, with recession risks appearing limited. The US labor market is clearly cooling as hiring demand eases and payroll figures are revised lower. At the same time, labor market participation remains constrained by factors such as retirements and reduced immigration. This gradual softening is giving the Federal Reserve cover to shift its focus toward the employment side of its dual mandate.

Against this backdrop, central bank policy signals point to a narrower path ahead. The Fed appears poised to cut rates even as inflation remains above target and financial conditions stay accommodative, supported by elevated equity markets and compressed credit spreads. US tariff policy is also beginning to take clearer shape: most developed markets now face duties in the 10–15% range, even as negotiations continue to reduce non‑tariff barriers to US exports. Emerging market measures are more targeted, with Taiwan facing tariffs aimed at encouraging semiconductor fabrication on US soil and Vietnam subject to transshipment duties to curb re‑routed exports.

Tariff‑related price pressures are expected to lift inflation in the near term, but these pressures seem to be more transitory in nature rather than the start of a sustained trend. With inflation expectations still anchored and the labor market showing signs of strain, the balance of risks has tilted toward accommodation. Political noise, including calls for Fed Governor Lisa Cook’s resignation, has so far done little to undermine perceptions of the central bank’s independence, but any erosion of that credibility over time could push borrowing costs higher and weigh on the dollar.

For investors, volatility in the weeks and months ahead is more likely to present selective entry points than to mark a turn in the cycle. We think markets are right to be more composed than during April’s “tariff tantrum”, primarily because the current macro backdrop is more supportive. More importantly, the risk of a full‑blown trade war appears low. Countries facing the steepest duties, such as India and Brazil, account for only a small share of US overall imports.

Yield curve steepening is likely to persist, as incremental Fed rate cuts bring down the short end, while concerns over the US budget deficit and Fed governance may keep the long end relatively range-bound. In credit markets, spreads remain historically tight across both investment grade and high yield. While supported by solid fundamentals and earnings resilience, the current environment calls for a selective approach. According to our observation, demand for credit remains robust, providing strong support for the market backdrop, likely reflecting that all-in yields remain attractive on both a real and nominal basis, particularly income-focused investors.1

Source: U.S. Bureau of Labor Statistics (BLS) and Invesco. Monthly data as of August 2025.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.