Tactical Asset Allocation - January 2024

Synopsis

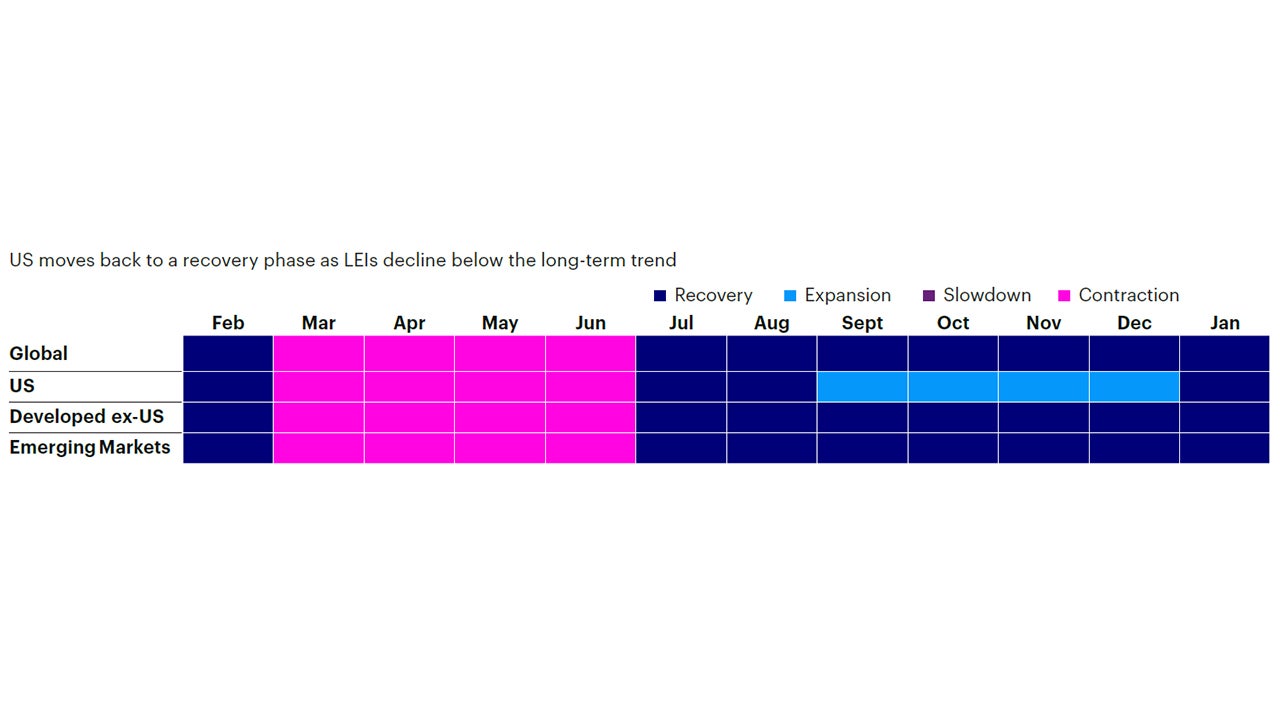

We remain positioned for a recovery in the global cycle, while the United States has moved back from an expansion to a recovery phase due to decline in leading indicators back to below-trend levels. Growth outside the US continues to improve while inflation declines.

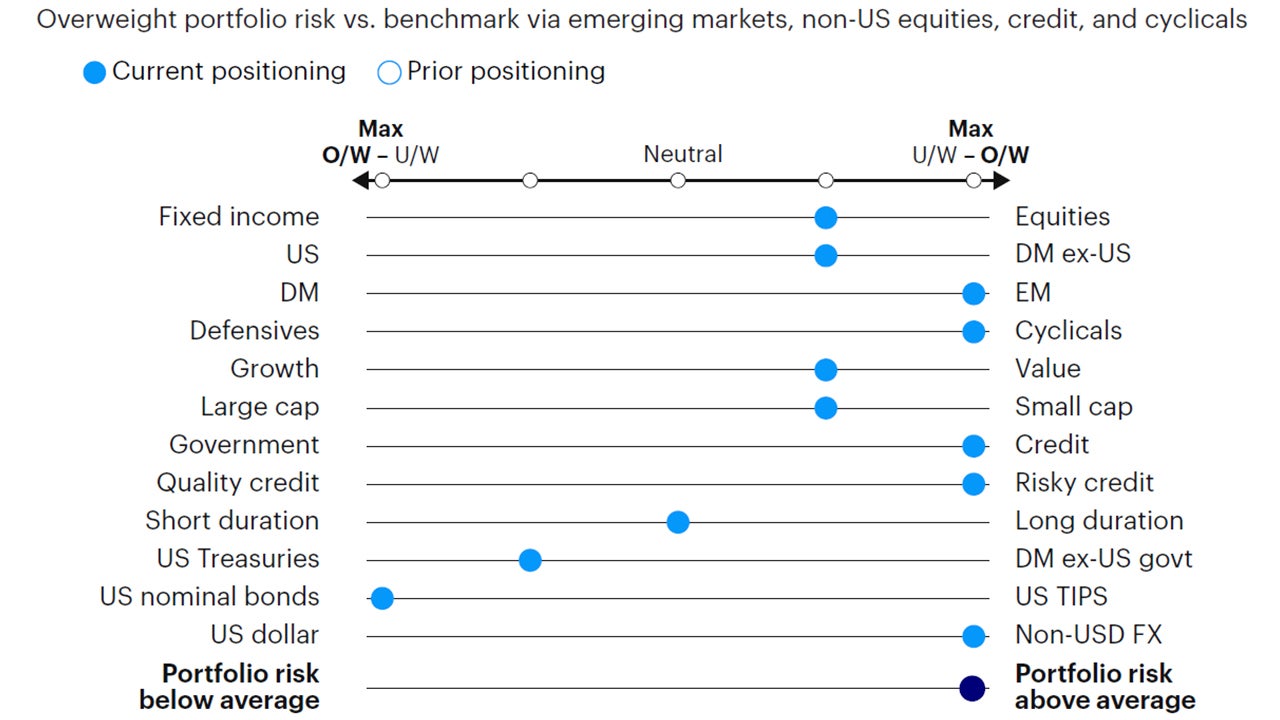

We remain overweight portfolio risk in the Global Tactical Asset Allocation model,1 favoring equities relative to fixed income, non-US equity markets, value, and smaller capitalizations. In fixed income, we are overweight risky credit, neutral on duration, and underweight the US dollar.

Overweight risk assets, with a preference for non-US equities on early signs of cyclical divergence in favor of Europe and emerging markets

Our macro process drives tactical asset allocation decisions over a time horizon between six months and three years, on average, seeking to harvest relative value and return opportunities between asset classes (e.g., equity, credit, government bonds, and alternatives), regions, factors, and risk premia.

Macro update

Growth

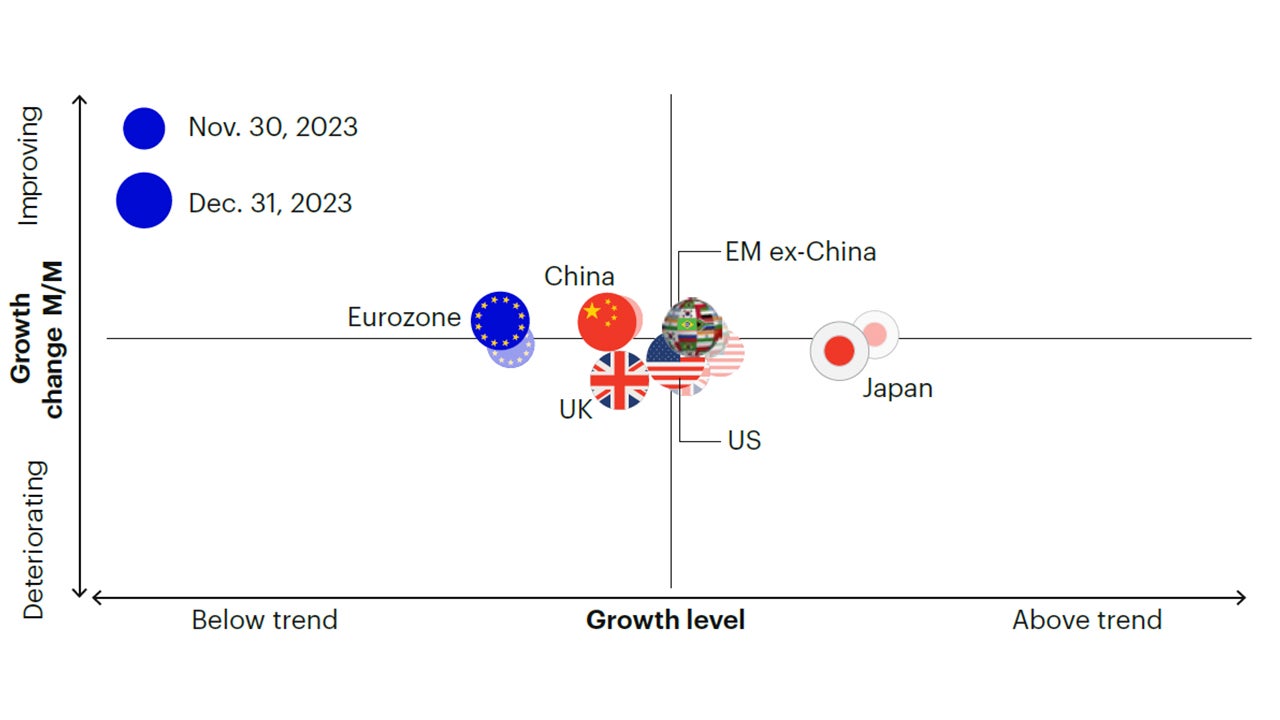

Our leading indicators suggest global growth in aggregate remains stable, while confirming the emergence of cyclical divergence in favor of developed markets outside the US and emerging markets; the United States continues to decelerate and has now returned to below-trend growth. In the US, consumer sentiment and business survey results stabilized but remain below their long-term trend. Manufacturing activity improved and remains above its long-term trend, while housing indicators deteriorated marginally and remain around their historical average. On the other hand, manufacturing business survey results demonstrate improving momentum in Europe, where the inventory cycle is pointing to rising production expectations and improving demand. Similarly, incoming data from China and the rest of Asia is showing positive cyclical momentum, with improvements in business survey data and industrial production, while property markets have stabilized, albeit at weak levels (Figures 1a, 1b, and 1c).

From a medium-term perspective, based on our modeling research of the business cycle, we expect lagged effects from past monetary tightening to contribute negatively over the next few quarters on a global basis, given the extent and duration of global yield curve inversion in the past two years. In other words, we attribute a high probability to a scenario where our leading indicators remain below their long-term trend for the foreseeable future.

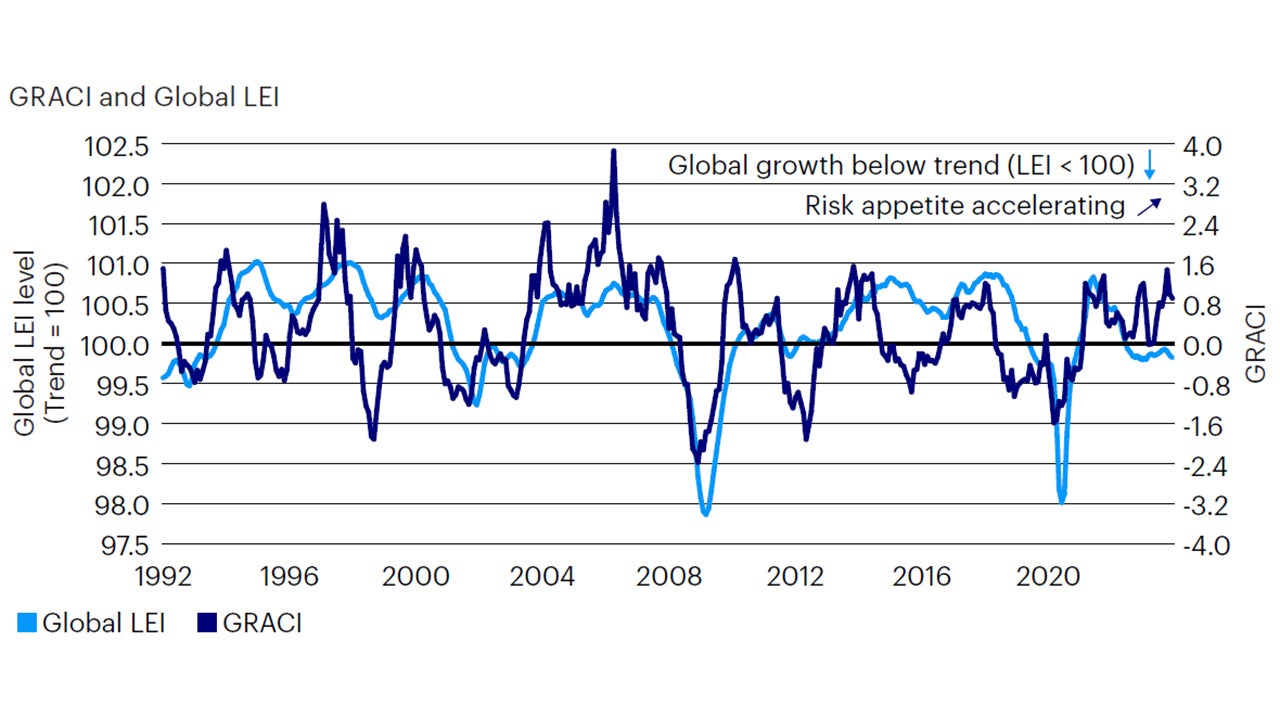

The last quarter of 2023 ended with a powerful recovery in asset prices, driven by a goldilocks backdrop of weak-but-stable growth, rapidly falling inflation, and central banks not only signaling the end of the tightening cycle but, importantly, acknowledging the potential for rate cuts over the course of 2024. The decline in global bond yields by approximately 100 basis points (bps) in Q4 2023 led to positive repricing across asset classes via lower discount rates. It also ignited expectations for improving growth and risk appetite, as indicated by the meaningful compression in credit spreads across all sectors, both corporate and sovereign, now hovering well below their historical long-term averages.

Sources: Bloomberg L.P., Macrobond. Invesco Solutions research and calculations. Proprietary leading economic indicators of Invesco Solutions. Macro regime data as of December 31, 2023. The Leading Economic Indicators (LEIs) are proprietary, forward-looking measures of the level of economic growth. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment. Developed markets ex-USA include the eurozone, UK, Japan, Switzerland, Canada, Sweden, Australia. Emerging markets include Brazil, Mexico, Russia, South Africa, Taiwan, China, South Korea, India.

Source: Invesco Solutions as of December 31, 2023.

Sources: Bloomberg L.P., Macrobond. Invesco Solutions research and calculations. Proprietary leading economic indicators of Invesco Solutions. Macro regime data as of December 31, 2023. The Leading Economic Indicators (LEIs) are proprietary, forward-looking measures of the level of economic growth. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment.

Our barometer of global risk appetite has stabilized over the past two months after peaking at levels consistent with similar peaks in the post-GFC period. Unless global growth begins to accelerate meaningfully in the near term, validating market expectations and fueling additional momentum in risky assets, we believe markets have otherwise largely priced in a normalized inflation environment and more accommodating policy backdrop, with some risk of profit taking in case of negative surprises. Overall, our framework suggests the global economy remains in a recovery regime, while the United States has moved from an expansion back to a recovery phase due to a decline in leading economic indicators back to below-trend levels (Figure 2).

Sources: Bloomberg L.P., MSCI, FTSE, Barclays, JPMorgan, Invesco Solutions research and calculations, from January 1, 1992 to December 31, 2023. The Global Leading Economic Indicator (LEI) is a proprietary, forward-looking measure of the growth level in the economy. A reading above (below) 100 on the Global LEI signals growth above (below) a long-term average. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment. A reading above (below) zero signals a positive (negative) compensation for risk-taking in global capital markets in the recent past. Past performance does not guarantee future results.

Inflation

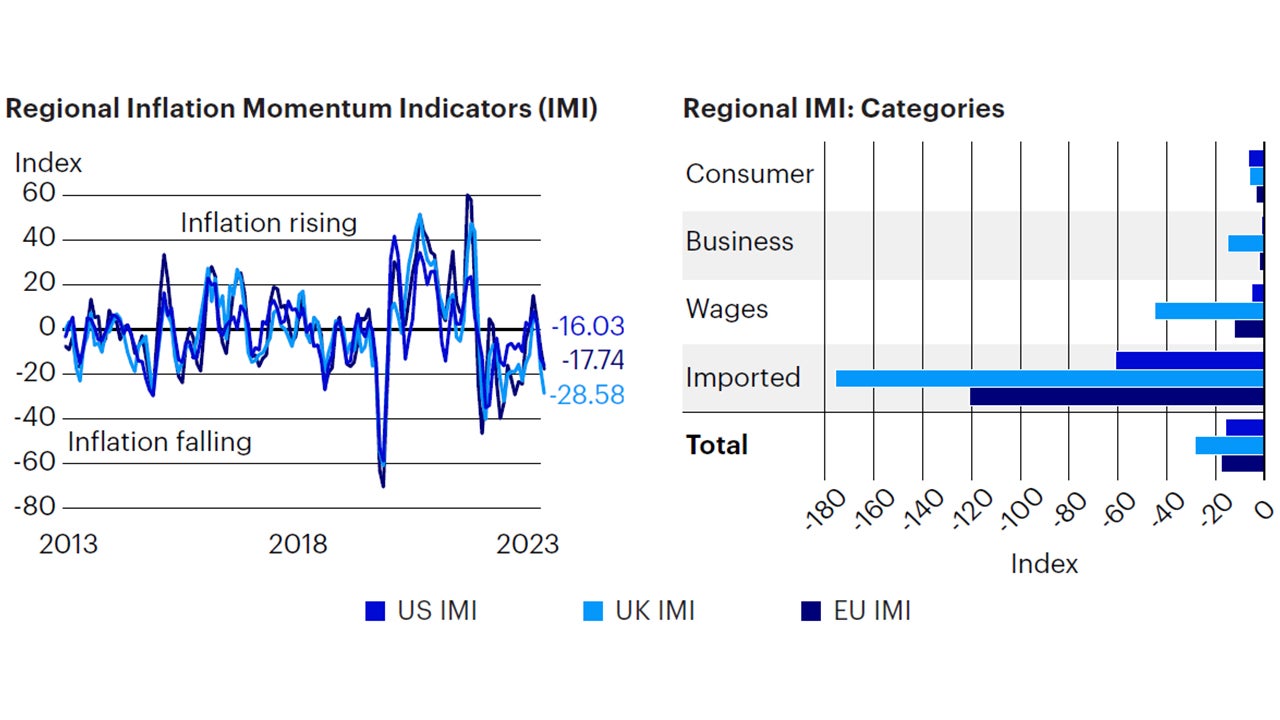

Inflation continues to decline across regions and economic sectors, led by falling commodity prices resulting in lower production costs and consumer prices. Incoming data across sectors suggest this trend is likely to continue over the next few months (Figure 3).

Overall, the evolution of growth, inflation, and monetary policy expectations continues to support our positioning for a favorable backdrop in risk assets in the near term while we remain ready to adjust exposures in case of changes in economic and market conditions.

Sources: Bloomberg L.P. data as of December 31, 2023, Invesco Solutions calculations. The US Inflation Momentum Indicator (IMI) measures the change in inflation statistics on a trailing three-month basis, covering indicators across consumer and producer prices, inflation expectation surveys, import prices, wages, and energy prices. A positive (negative) reading indicates inflation has been rising (falling) on average over the past three months.

Investment positioning

We remain overweight risk relative to the benchmark in the Global Tactical Allocation Model, overweight equities over fixed income, favoring developed ex-US equities and emerging markets at the expense of US equities, and remain underweight the US dollar. We overweight cyclical sectors, value, and smaller capitalizations. In fixed income, we remain overweight credit risk via lower quality sectors, maintaining a neutral duration posture (Figures 4-7). In particular:

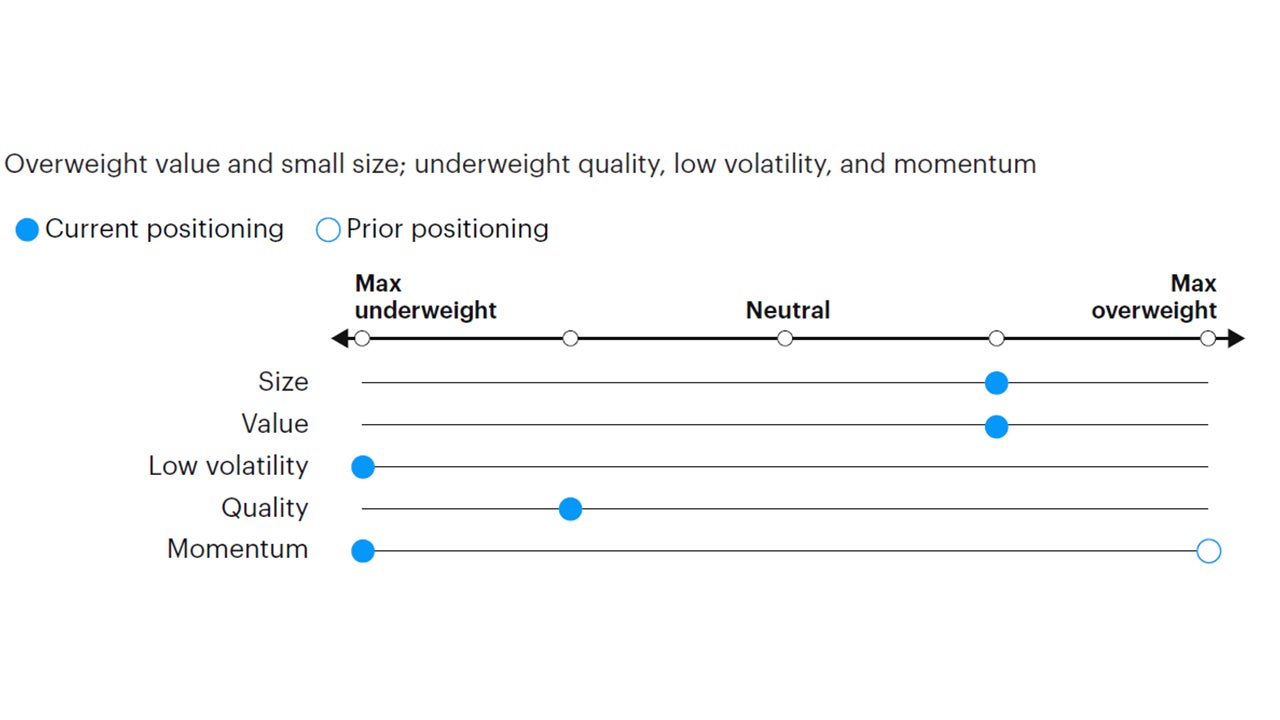

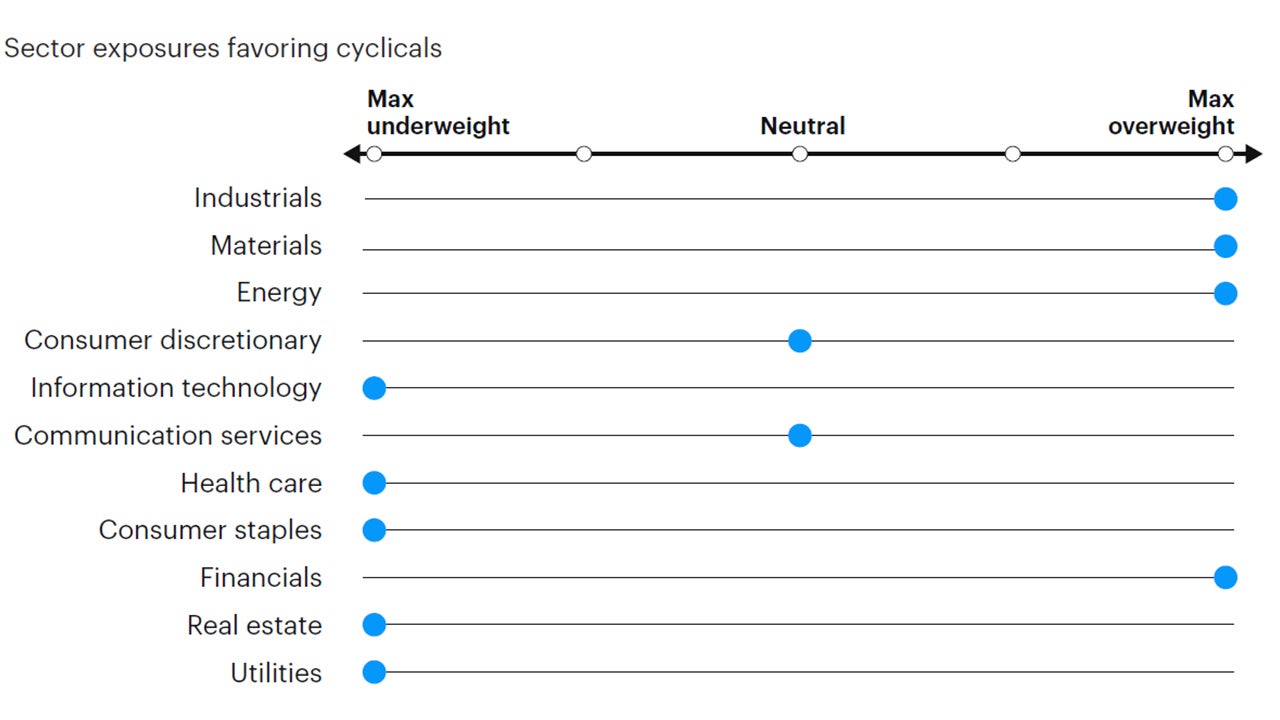

- Within equities, we overweight cyclical factors with high operating leverage and a higher sensitivity to a rebound in growth expectations, such as value and smaller capitalizations, while we underweight defensive factors such as low volatility, quality, and larger capitalizations. Similarly, we favor exposures to cyclical sectors such as financials, industrials, materials, and energy at the expense of health care, staples, utilities, and technology. From a regional perspective, we remain overweight emerging markets, supported by improving risk appetite and expectations for US dollar depreciation, as well as developed ex-US equities, driven by cyclical divergence in leading economic indicators between the US and other developed markets.

- In fixed income, we remain overweight in risky credit2 via high yield, bank loans and emerging markets hard currency debt. Credit spreads have tightened further, now hovering around historical lows in most sectors. However, we expect volatility to remain subdued and credit markets to offer stable yields in a stable macro backdrop. The case for credit assets remains limited to their income advantage over government bonds rather than capital appreciation. In sovereigns, we favor duration in nominal bonds across developed markets, driven by negative inflation momentum (Figure 3).

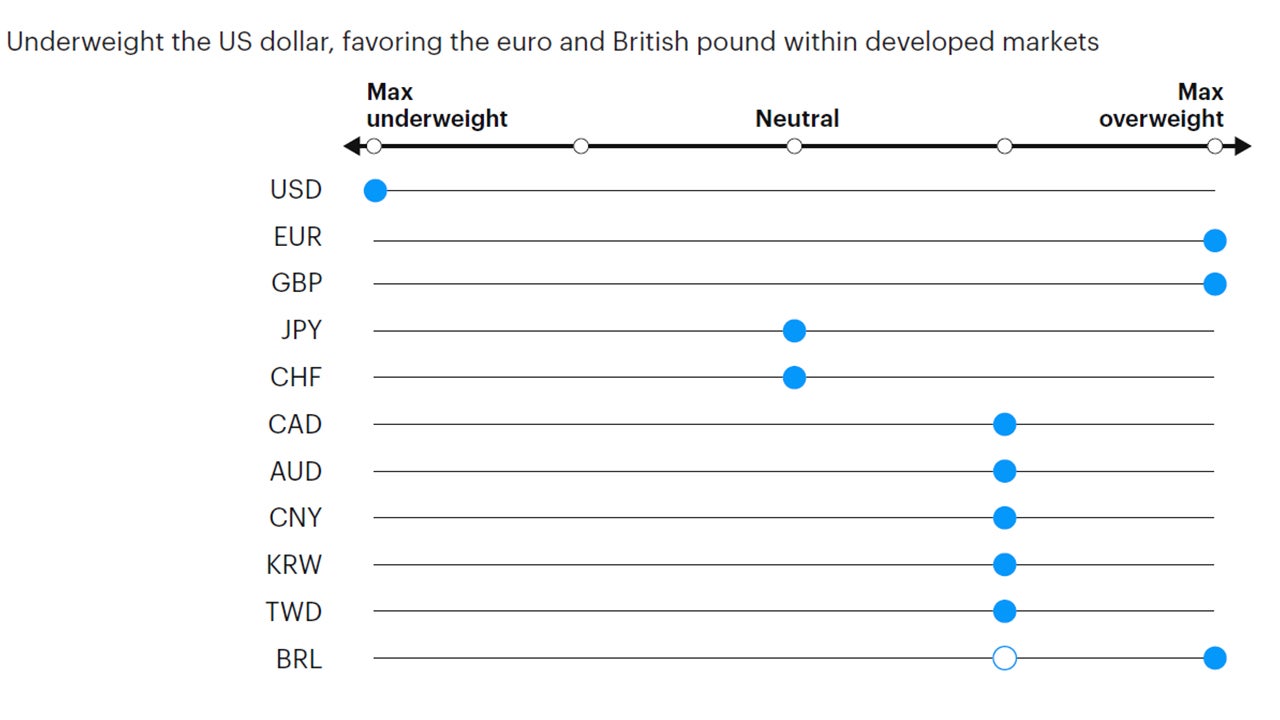

- In currency markets, we underweight the US dollar, as regimes of cyclical recoveries are typically accompanied by strong reflationary flows into non-US assets. Within developed markets, we favor the euro, the British pound, the Norwegian kroner, the Swedish krona, and the Singapore dollar relative to the Swiss Franc, the Japanese yen, the Australian and Canadian dollars. In EM, we favor higher yielding currencies with attractive valuations, such as the Colombian peso, the Brazilian real, the South African rand, and the Indonesian rupiah, relative to lower yielding and more expensive currencies, such as the Korean won, the Chilean peso, the Thai baht, and the Chinese renminbi, although we still expect these currencies to do well in a US dollar depreciation scenario.

Source: Invesco Solutions, January 1, 2024. DM = developed markets. EM = emerging markets. Non-USD FX refers to foreign exchange exposure as represented by the currency composition of the MSCI ACWI Index. For illustrative purposes only.

Source: Invesco Solutions, January 1, 2024. For illustrative purposes only. Neutral refers to an equally weighted factor portfolio.

Source: Invesco Solutions, January 1, 2024. For illustrative purposes only. Sector allocations derived from factor and style allocations based on proprietary sector classification methodology. Cyclicals: energy, financials, industrials, materials; Defensives: consumer staples, health care, information technology, real estate, utilities; Neutral: consumer discretionary and communication services.

Source: Invesco Solutions, January 1, 2024. For illustrative purposes only. Currency allocation process considers four drivers of foreign exchange markets: 1) US monetary policy relative to the rest of the world, 2) global growth relative to consensus expectations, 3) currency yields (i.e., carry), 4) currency long-term valuations.