Tactical Asset Allocation - November 2025

Synopsis

Our framework moves to a recovery regime, driven by improving growth expectations. This transition does not represent the beginning of a new cycle, but an extension of the existing cycle given tight labor markets and credit spreads near all-time lows. Markets are pricing in a goldilocks scenario where the Federal Reserve may be able to sustain a low but improving growth environment without inflationary pressures.

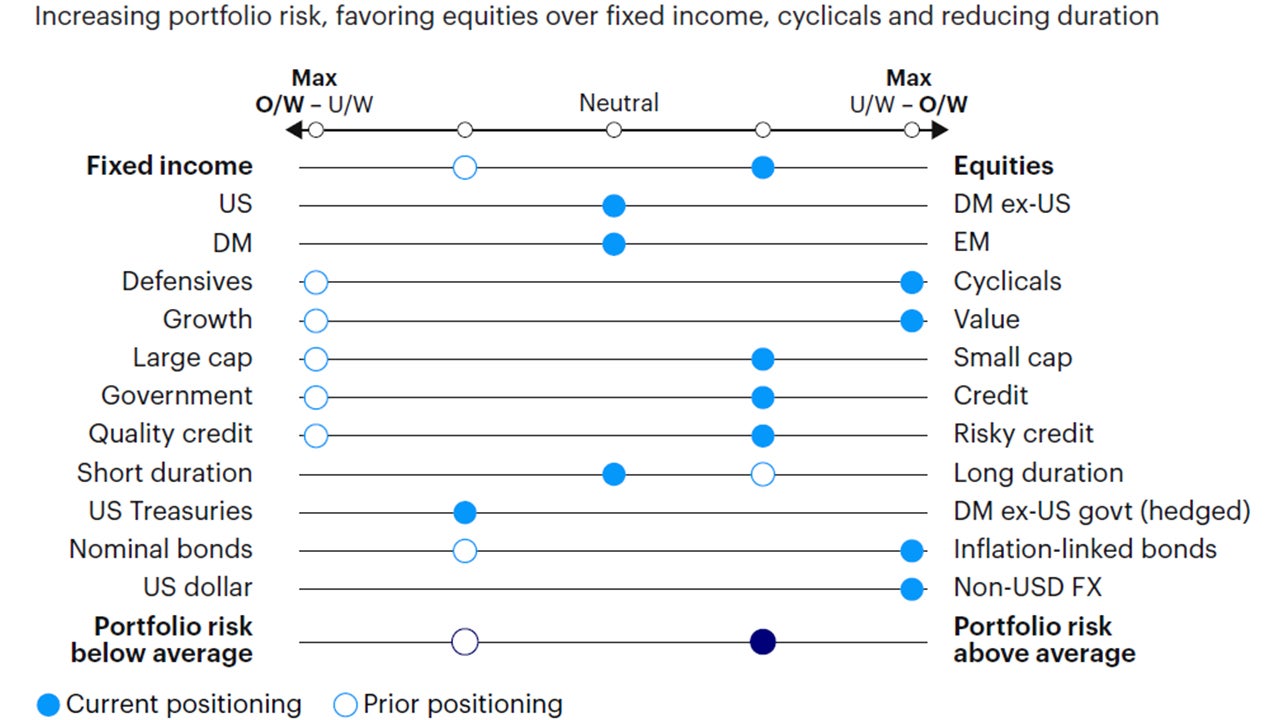

We increase portfolio risk with a moderate overweight in equities versus fixed income, favoring value, small- and mid-caps, hence cheapening portfolio valuations. In fixed income, we moderately overweight risky credit sectors and reduce duration back to neutral following the decline in bond yields year to date. Maintain underweight exposure to the US dollar.

Moving to a recovery regime. Increasing portfolio risk, overweighting equities versus fixed income, favoring value, small- and mid-caps. Moderately increasing credit risk and reducing duration back to neutral. Underweight US dollar exposure.

Our macro process drives tactical asset allocation decisions over a time horizon between six months and three years, on average, seeking to harvest relative value and return opportunities between asset classes (e.g., equity, credit, government bonds, and alternatives), regions, factors, and risk premia.

Macro update: Moving to a recovery regime

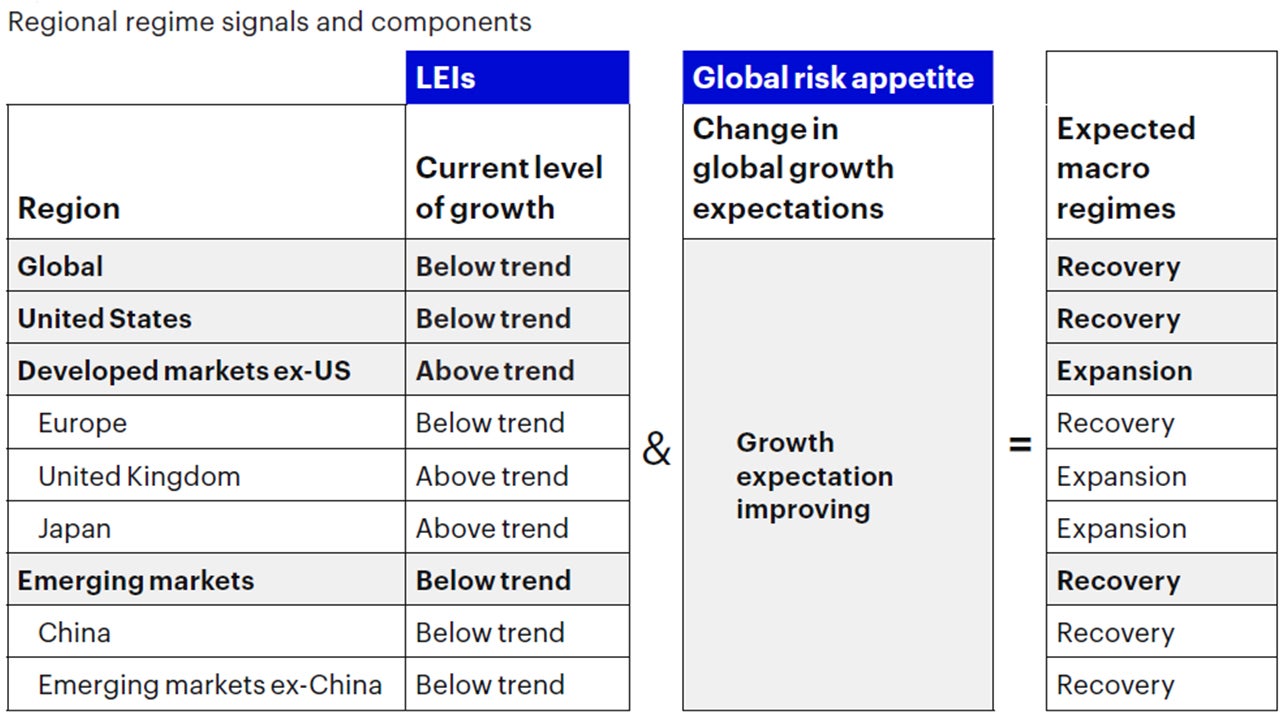

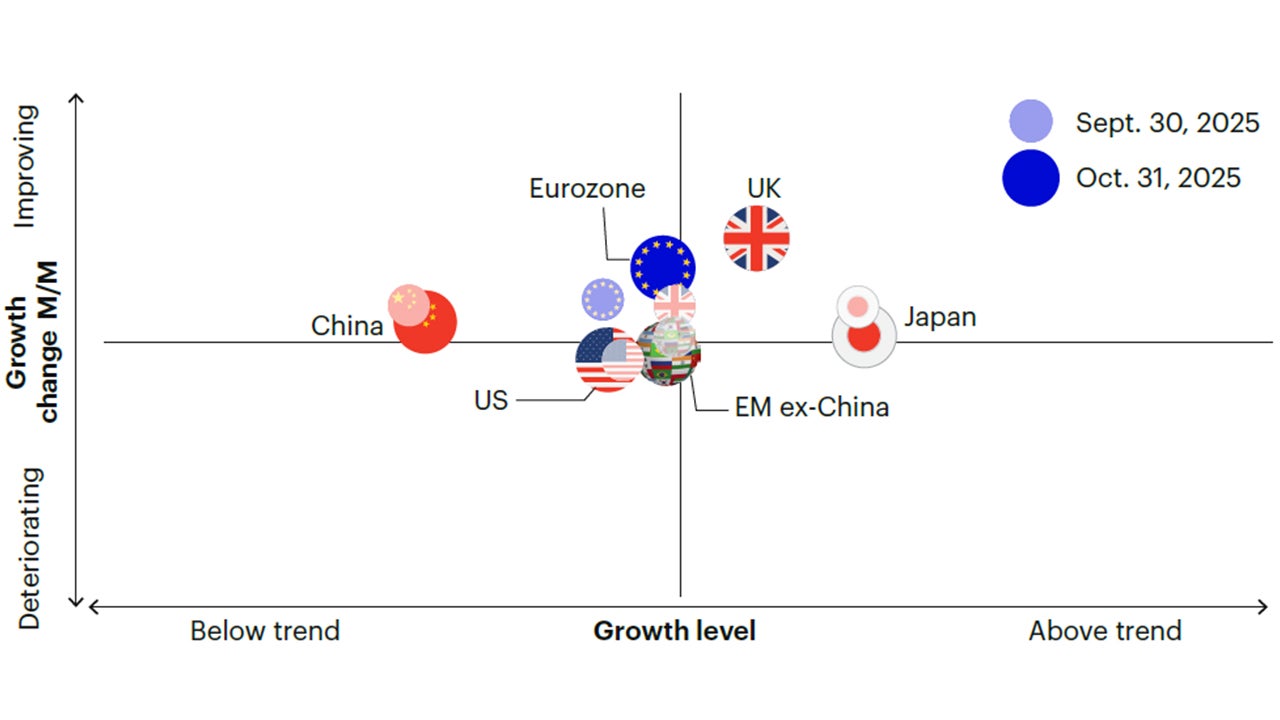

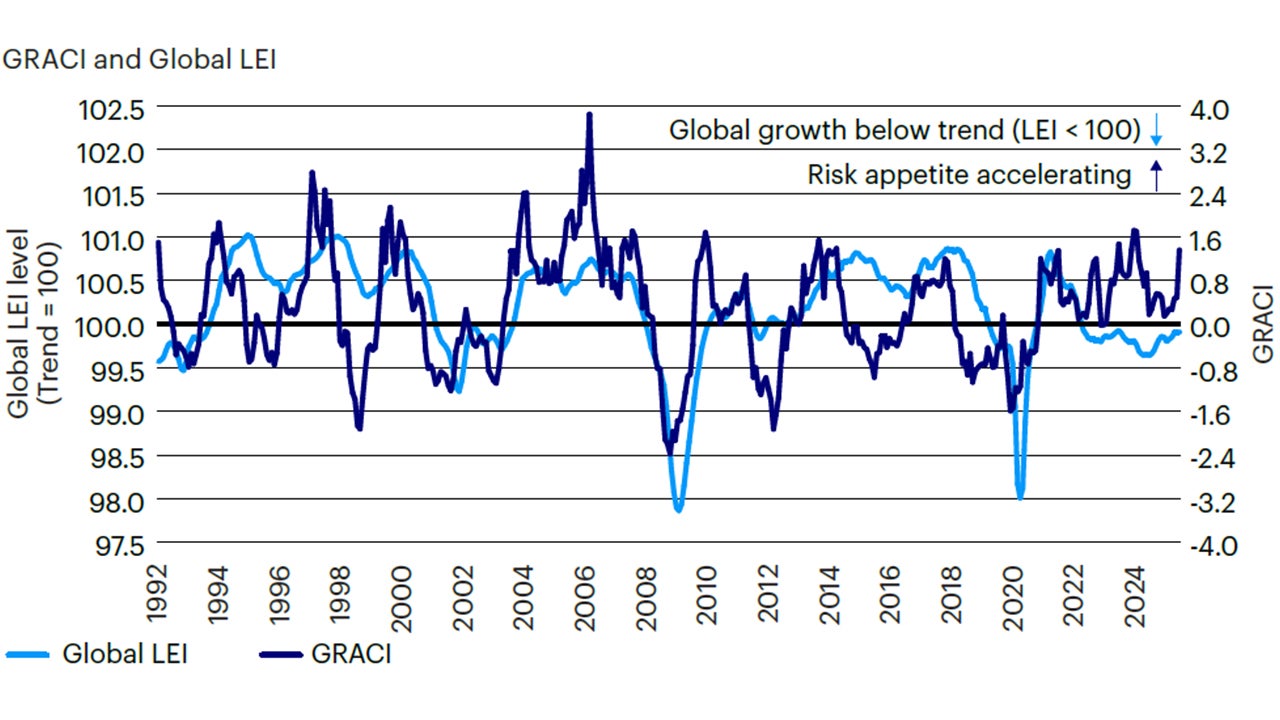

Following 16 consecutive months in a contraction regime of below-trend and decelerating growth, our macro framework moves to a recovery regime, driven by the steady rise in market-implied growth expectations, captured by our global risk appetite cycle indicator. As per our rules-based process, global risk appetite has reached a significant inflection point, indicative of a potential improvement in the growth cycle over the next few months and quarters (Figures 1 and 2). What is driving this transition, and how do we interpret its significance following a prolonged period of defensive positioning in our portfolios?

Sources: Bloomberg L.P., Macrobond. Invesco Solutions research and calculations. Proprietary leading economic indicators of Invesco Solutions. Macro regime data as of Oct. 31, 2025. The Leading Economic Indicators (LEIs) are proprietary, forward-looking measures of the level of economic growth. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment. Developed markets ex-USA include the Eurozone, UK, Japan, Switzerland, Canada, Sweden, Australia. Emerging markets include Brazil, Mexico, Russia, South Africa, Taiwan, China, South Korea, India.

Source: Invesco Solutions as of Oct. 31, 2025.

Sources: Bloomberg L.P., Macrobond. Invesco Solutions research and calculations. Proprietary leading economic indicators of Invesco Solutions. Macro regime data as of Oct. 31, 2025. The Leading Economic Indicators (LEIs) are proprietary, forward-looking measures of the level of economic growth. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment.

Sources: Bloomberg L.P., MSCI, FTSE, Barclays, JPMorgan, Invesco Solutions research and calculations, from Jan. 1, 1992 to Oct. 31, 2025. The Global Leading Economic Indicator (LEI) is a proprietary, forward-looking measure of the growth level in the economy. A reading above (below) 100 on the Global LEI signals growth above (below) a long-term average. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment. A reading above (below) zero signals a positive (negative) compensation for risk-taking in global capital markets in the recent past. Past performance does not guarantee future results.

The contraction that never turned into a recession

As described in detail in last month's Tactical Asset Allocation note, we believe our framework correctly anticipated, by and large, the deceleration in US and global GDP growth to below-trend growth rates this year. This is further validated by the noticeable weakening in labor markets, and the underperformance in earnings and sales growth for cyclical equity sectors relative to defensive sectors. However, this low-growth environment did not experience sufficient negative momentum, tightening in credit conditions, and negative consumer sentiment, which have historically been necessary catalysts to turn a low-growth environment into a recession. Instead, the structural tech super-cycle, renewed fiscal policy stimulus, and the de-escalation of global trade tensions appear to be significant tailwinds, sufficient to offset the weakness in other sectors such as manufacturing, housing, trade, and overall employment.

Transitioning to a recovery regime, but not the start of a new cycle. What does it mean, and how long may this last?

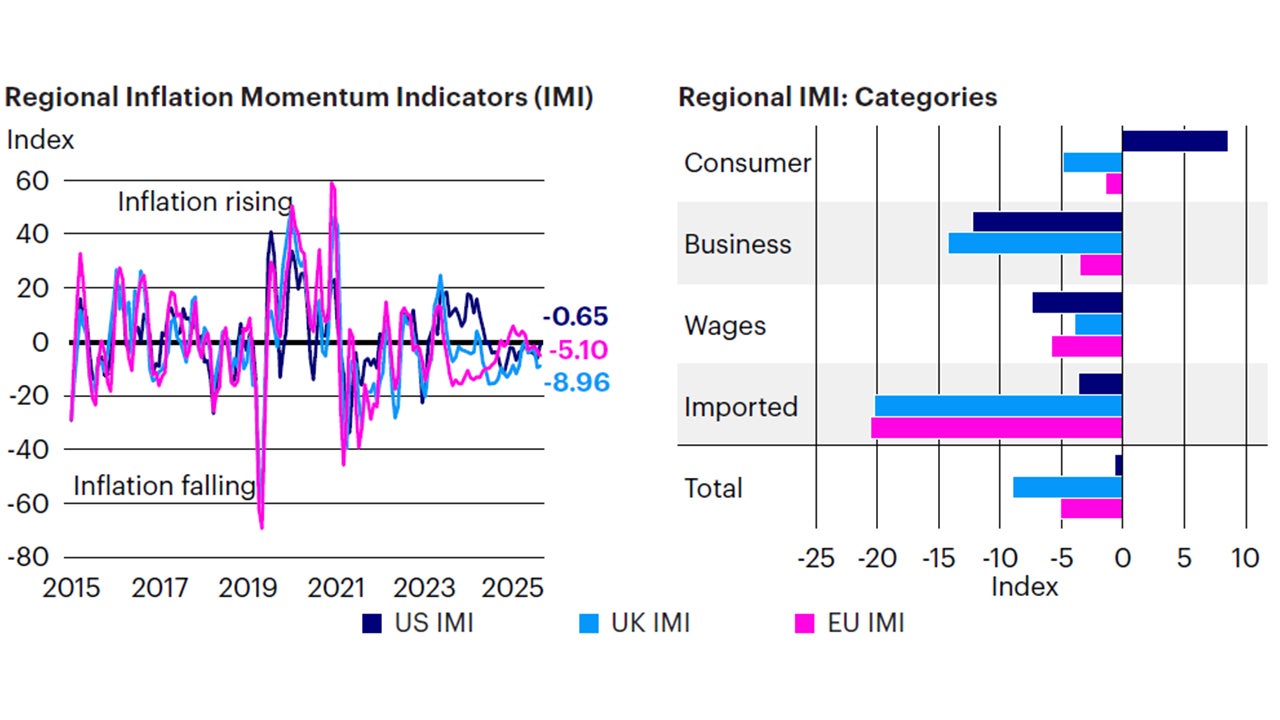

At this stage, the resilience in global equity and credit markets has the potential to further extend this business cycle, supporting consumption via wealth effects. Furthermore, stable inflation and soft labor markets are supporting a gradual, but steady, easing in monetary policy, lower borrowing costs, and easing in credit conditions. Our interpretation is that markets are anticipating a goldilocks scenario where broad-based policy support, both fiscal and monetary, will be sufficient to offset the deterioration in private sector fundamentals, keep inflation stable (Figure 3), and push back recession risks, yet again. This interpretation is further evidenced by shifts in monetary policy pricing year to date, with expectations moving from two rate cuts to four cuts by the end of 2026, and stable breakeven inflation expectations over the past 10 months. This unique ‘goldilocks’ scenario is typically supportive of risk assets.

Crucially, this recovery regime does not represent the start of a new business cycle but a continuation of the current cycle that followed the COVID-19 recession in 2020, as the unemployment rate and credit spreads remain close to cycle lows. In other words, both the economic and financial systems have not experienced the typical resets indicative of the end of the cycle, such as the creation of spare capacity in labor markets, inventory depletion, decreased industrial capacity utilization, and deleveraging of balance sheets. We believe this recovery regime is likely to last between a few months and a couple of quarters, with the potential to deliver modest positive returns across risky assets, hence warranting a change in portfolio positioning until new economic developments become available.

Sources: Bloomberg L.P. data as of Oct. 31, 2025, Invesco Solutions calculations. The US Inflation Momentum Indicator (IMI) measures the change in inflation statistics on a trailing three-month basis, covering indicators across consumer and producer prices, inflation expectation surveys, import prices, wages, and energy prices. A positive (negative) reading indicates inflation has been rising (falling) on average over the past three months.

Investment positioning

Following the transition of our macro framework to a cyclical recovery, we have implemented several changes in the Global Tactical Allocation Model.1 We increase overall portfolio risk above benchmark, moving to a moderate overweight in equities relative to fixed income, tilting towards value, small- and mid-capitalizations. Therefore, this higher equity allocation is accompanied by cheaper equity valuations, in sectors and styles that have lagged the market rally of the past two years, effectively rebalancing from expensive defensive sectors and factors, which now trade at an average forward P/E of 19.5x in the S&P 500, to cheaper cyclical sectors trading at an average 8.5x forward multiple. In fixed income, we increase credit risk2 to a moderate overweight relative to benchmark and reduce duration back to neutral following the decline in bond yields (Figures 4 to 8). In particular:

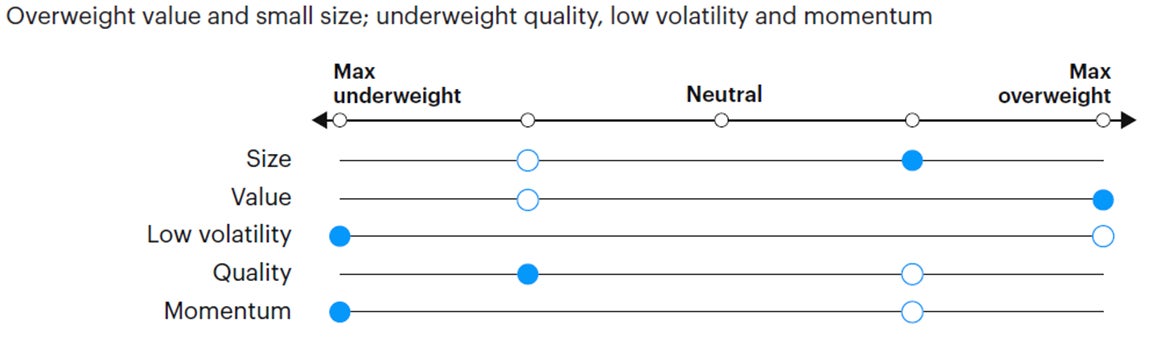

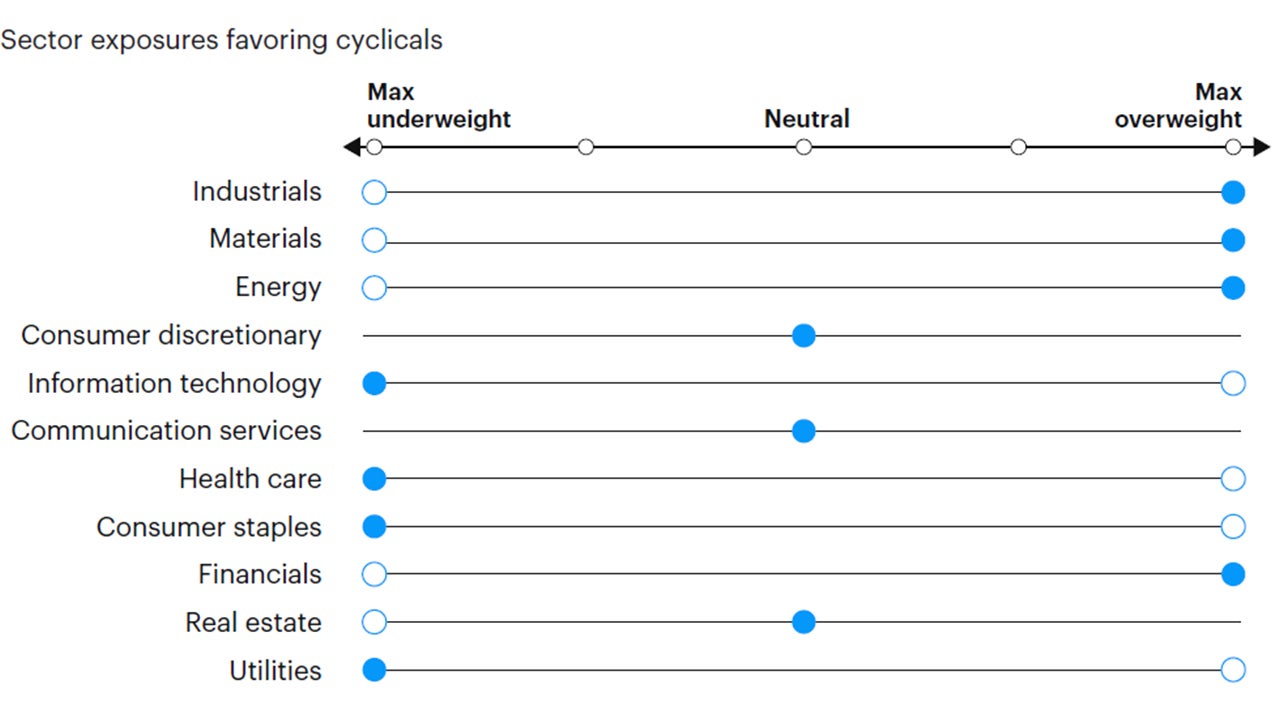

- In equities, we reduce exposure in defensive sectors, quality, low volatility, and momentum stocks, going overweight in cyclical sectors, value, small/mid-cap equities as these segments of equity markets carry higher operating leverage and tend to outperform during cyclical economic rebounds. Hence, we favor sectors such as financials, industrials, materials, and energy at the expense of health care, staples, utilities, and technology. We maintain a regional composition in line with the benchmark given offsetting drivers of relative performance between US, developed ex-US, and emerging market equities. On one hand, US earnings momentum continues to outperform other markets, mostly driven by technology, favoring US equities. On the other hand, our currency framework still points towards US dollar depreciation, driven by narrowing yield differentials for the greenback and positive surprises in global growth, hence favoring non-US unhedged equity exposures. As a result, we express no active views in regional exposures.

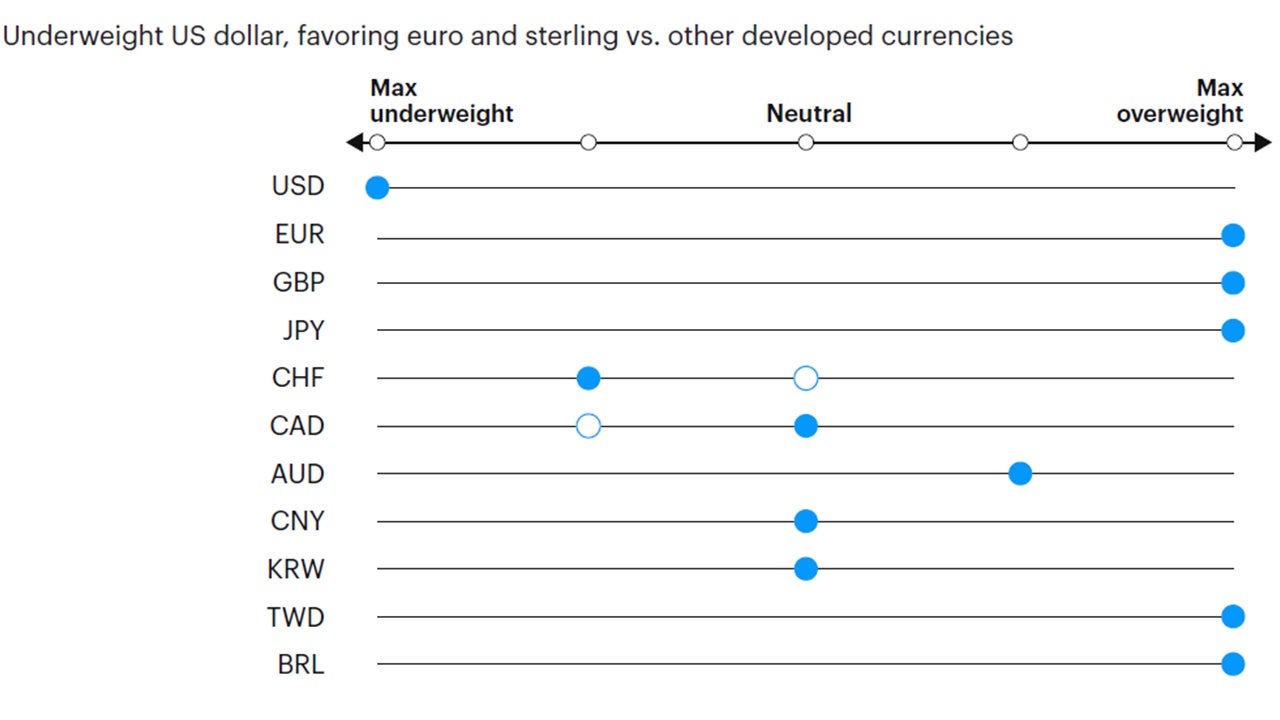

- In fixed income, we increase credit risk to a moderate overweight. However, given spreads near all-time lows, the case for risky credit is limited to harvesting higher yields relative to quality credit and government bonds in an environment of improving growth and stable inflation. Therefore, we look for diversification across high yield, leveraged loans, and emerging markets dollar debt, and underweight investment grade credit and sovereign fixed income. Our bearish positioning on the US dollar also favors emerging markets local debt and global fixed income, currency unhedged, relative to core domestic fixed income. We increase the allocation to TIPS relative to nominal Treasuries, following the transition to a recovery regime, historically accompanied by widening breakeven inflation.

- In currency markets, we continue to underweight the US dollar, driven by narrowing yield differentials relative to the rest of the world, and positive surprises in economic data outside the US. Within developed markets, we favor the euro, British pound, Norwegian kroner, Australian dollar, and Japanese yen relative to the Swiss Franc, Canadian dollar, Swedish krona, and Singapore dollar. In EM, we favor high yielders with attractive valuations as the Colombian peso, Brazilian real, Indian rupee, and Indonesian rupiah, relative to low yielding, and more expensive currencies, such as the Korean won, Philippine peso, Thai baht, and Chinese renminbi.

Source: Invesco Solutions, Nov. 1, 2025. DM = developed markets. EM = emerging markets. Non-USD FX refers to foreign exchange exposure as represented by the currency composition of the MSCI ACWI Index. For illustrative purposes only.

Source: Invesco Solutions, Nov. 1, 2025. For illustrative purposes only. Neutral refers to an equally weighted factor portfolio.

Source: Invesco Solutions, Nov. 1, 2025. For illustrative purposes only. Sector allocations derived from factor and style allocations based on proprietary sector classification methodology. As of December 2023, Cyclicals: energy, financials, industrials, materials; Defensives: consumer staples, health care, information technology, real estate, utilities; Neutral: consumer discretionary and communication services.

Source: Invesco Solutions, Nov. 1, 2025. For illustrative purposes only. Currency allocation process considers four drivers of foreign exchange markets: 1) US monetary policy relative to the rest of the world, 2) global growth relative to consensus expectations, 3) currency yields (i.e., carry), 4) currency long-term valuations.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations), and investors may not get back the full amount invested.