Tactical Asset Allocation - September 2025

Synopsis

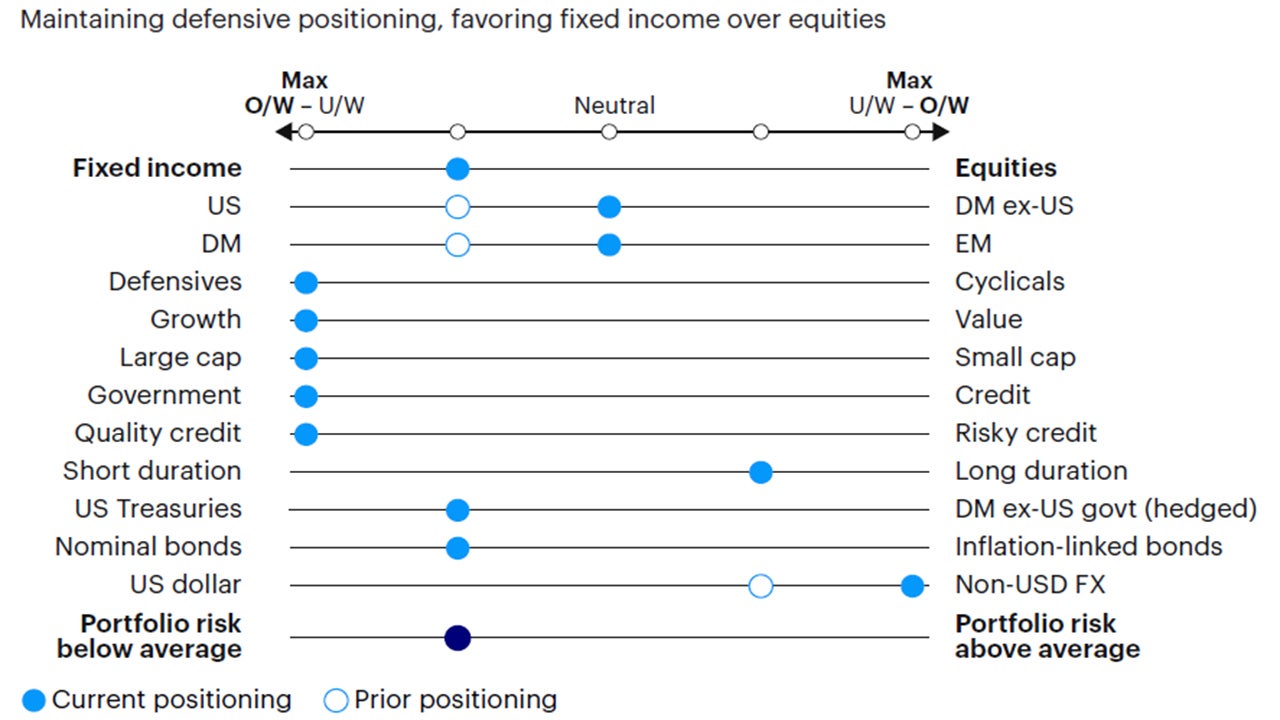

Our framework remains in a contraction regime. We maintain a defensive posture, overweighting fixed income relative to equities, favoring defensive sectors and factors, while holding the regional composition between US, international developed, and emerging market equities in line with the benchmark. In fixed income, we maintain a moderate overweight in duration and underweight in credit risk. We move to a maximum underweight in the US dollar.

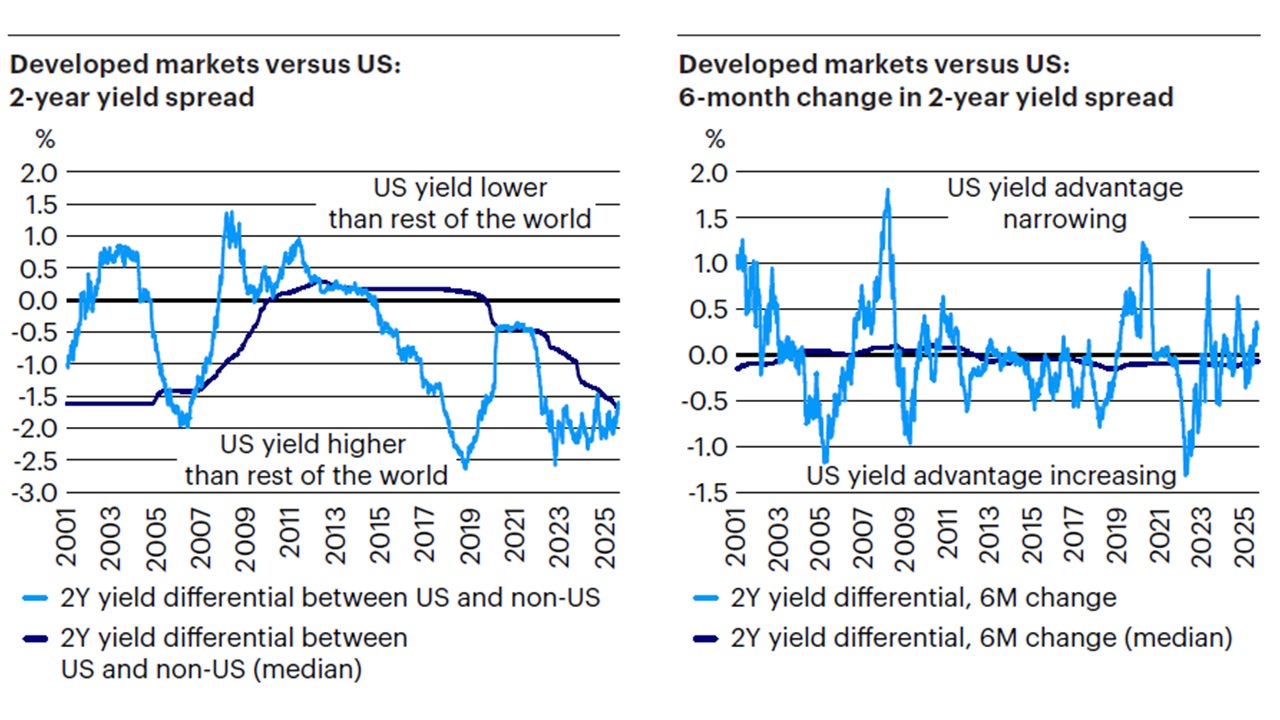

The dovish turn by the Federal Reserve at Jackson Hole is leading to a meaningful repricing of monetary policy expectations, with narrowing yield differentials between the US and the rest of the world. Expectations for US dollar depreciation lead our models to reduce US equity positioning back to neutral.

Moving to a maximum underweight in the US dollar and neutral regional equity exposures. We remain in a contraction regime with defensive portfolio positioning.

Our macro process drives tactical asset allocation decisions over a time horizon between six months and three years, on average, seeking to harvest relative value and return opportunities between asset classes (e.g., equity, credit, government bonds, and alternatives), regions, factors, and risk premia.

Macro update: Narrowing yield differentials put downward pressure on the US dollar

The global picture remains broadly stable. Economic data are performing in line with expectations and macro volatility is subdued. Developed markets continue to grow at a slow but steady rate - below the long-term trend and last year’s growth rate, but enough to maintain positive employment growth at this stage. Business and consumer sentiment surveys seem to have adjusted and stabilized in response to global trade policy uncertainty. However, the full impact of tariffs on both growth and inflation will likely be more visible in Q4, as the front-loading of imports and inventories from the first half of the year wears off.

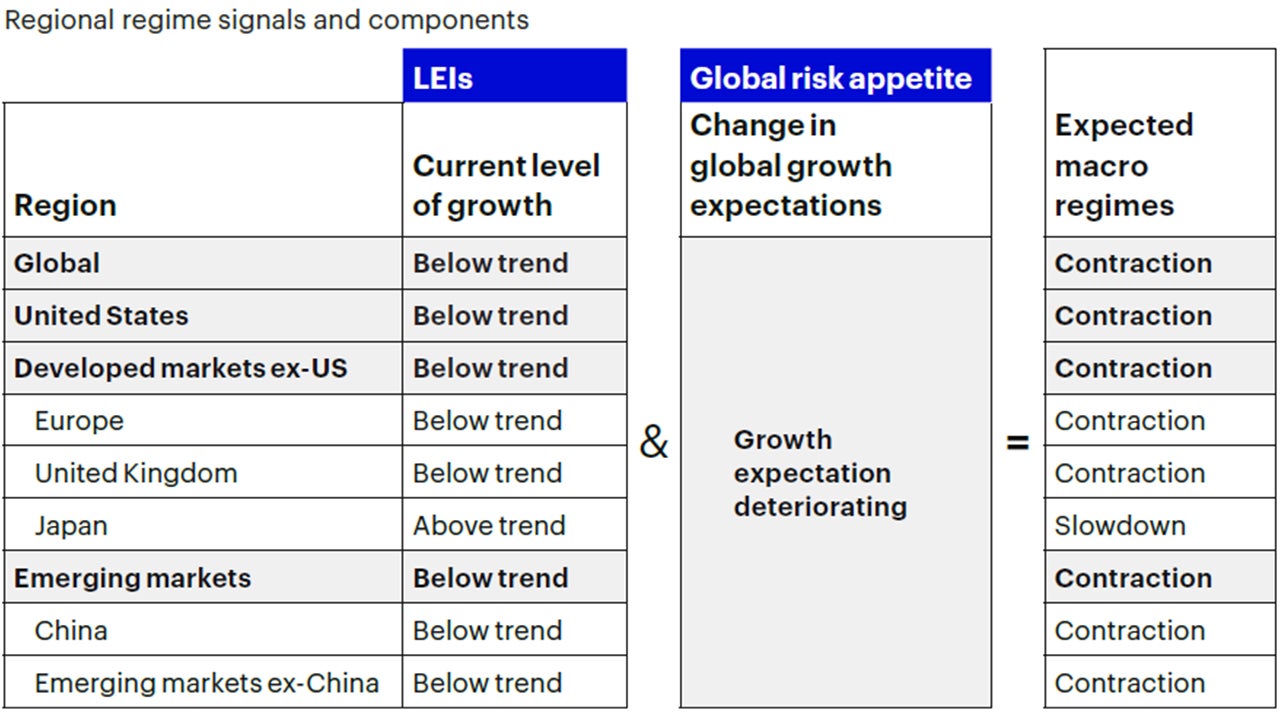

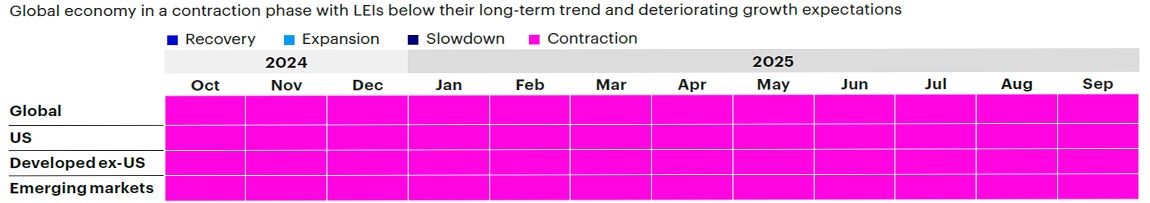

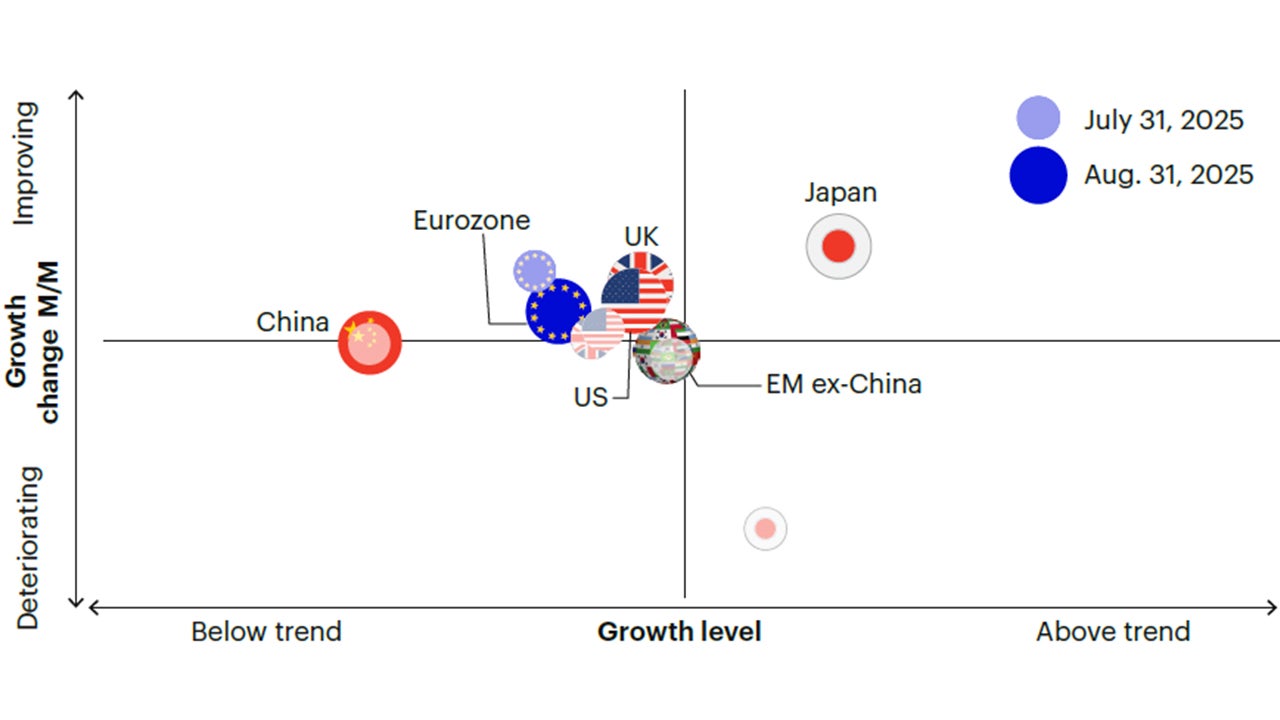

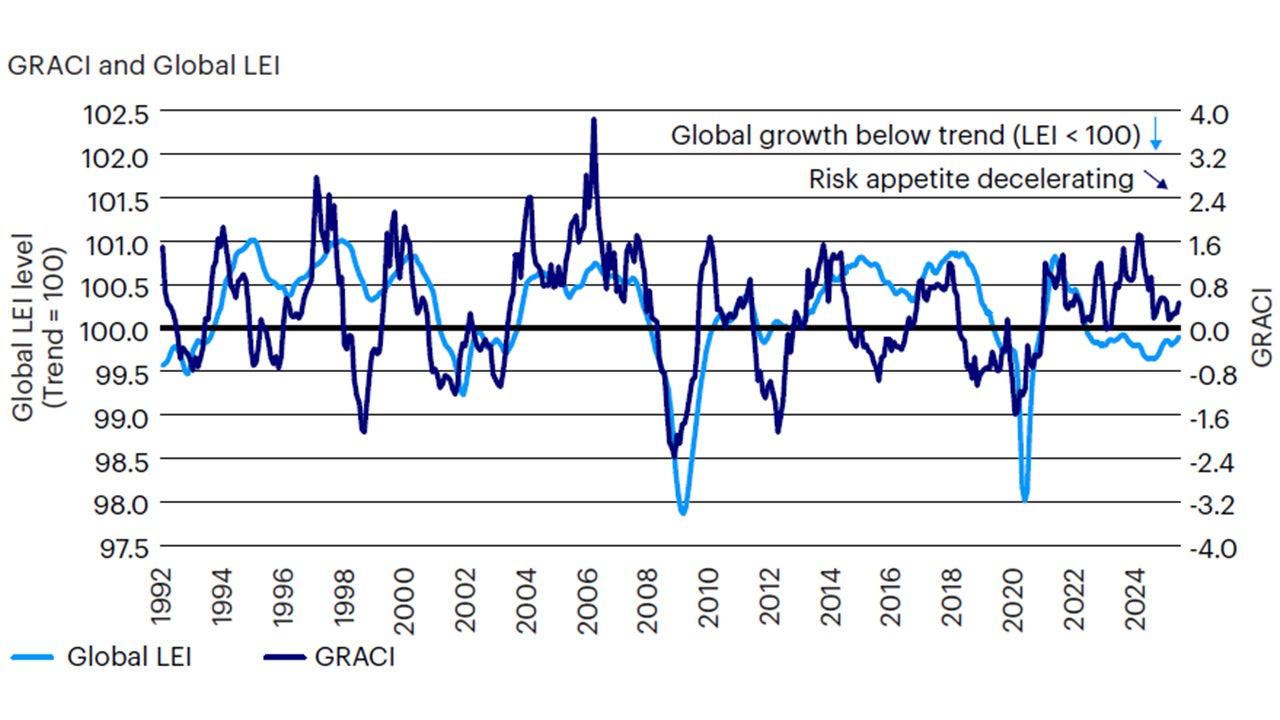

Our barometer of global risk appetite improved marginally over the past month, with global equities outperforming fixed income markets and credit spreads stabilizing at cyclical lows, but remains on a decelerating trend. Therefore, our macro framework remains in a contraction regime for the global economy for the 15th consecutive month (Figures 1 and 2).

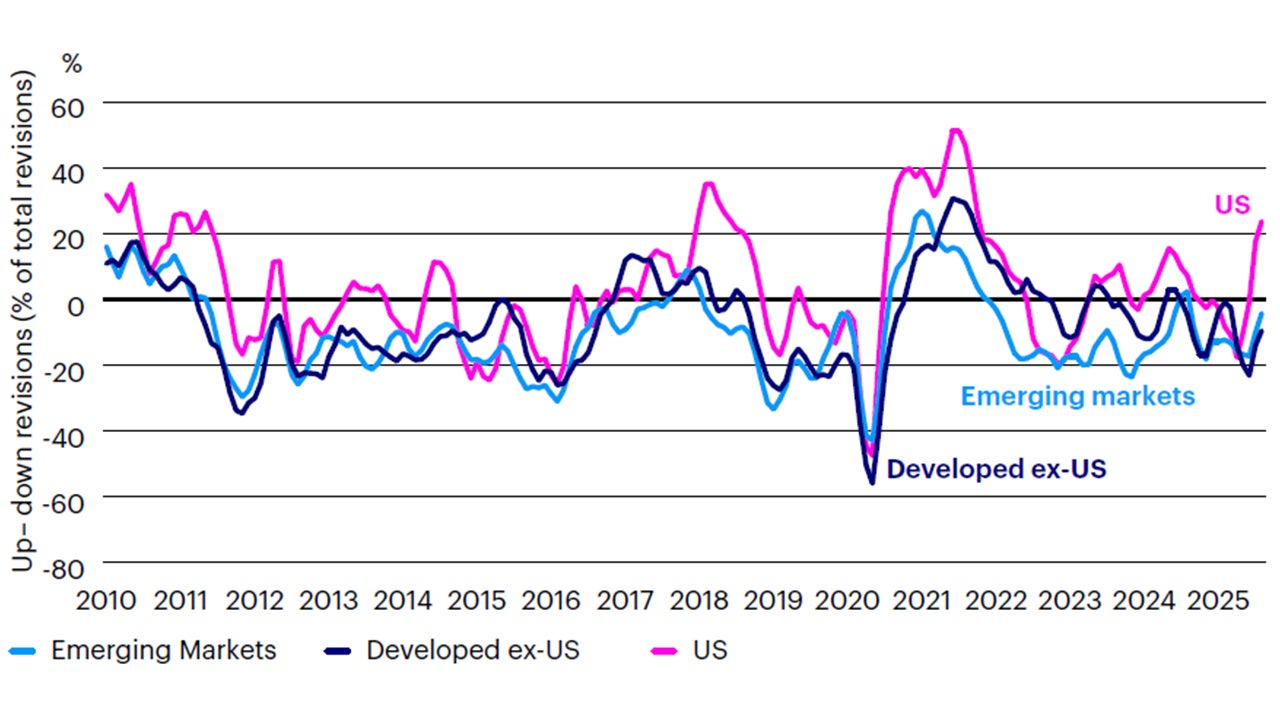

The perceived disconnect between equity market valuations and weakening economic fundamentals continues. The earnings season for US equities confirmed well-established trends, namely the discrepancy between the health of the mega-cap technology sector, seeing +20% earnings growth year-over-year, and the flat or negative performance in earnings growth for cyclical and defensive sectors, outside of tech. Nonetheless, US equities, in aggregate, continue to see strong upward revisions in earnings expectations, outpacing the rest of the world (Figure 3), indicators that have led us to maintain a moderate overweight in US equities versus the rest of the world in recent months.

Sources: Bloomberg L.P., Macrobond. Invesco Solutions research and calculations. Proprietary leading economic indicators of Invesco Solutions. Macro regime data as of Aug. 31, 2025. The Leading Economic Indicators (LEIs) are proprietary, forward-looking measures of the level of economic growth. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment. Developed markets ex-USA include the eurozone, UK, Japan, Switzerland, Canada, Sweden, Australia. Emerging markets include Brazil, Mexico, Russia, South Africa, Taiwan, China, South Korea, India.

Source: Invesco Solutions as of Aug. 31, 2025.

Sources: Bloomberg L.P., Macrobond. Invesco Solutions research and calculations. Proprietary leading economic indicators of Invesco Solutions. Macro regime data as of Aug. 31, 2025. The Leading Economic Indicators (LEIs) are proprietary, forward-looking measures of the level of economic growth. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment.

Sources: Bloomberg L.P., MSCI, FTSE, Barclays, JPMorgan, Invesco Solutions research and calculations, from Jan. 1, 1992 to Aug. 31, 2025. The Global Leading Economic Indicator (LEI) is a proprietary, forward-looking measure of the growth level in the economy. A reading above (below) 100 on the Global LEI signals growth above (below) a long-term average. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment. A reading above (below) zero signals a positive (negative) compensation for risk-taking in global capital markets in the recent past. Past performance does not guarantee future results.

Sources: Bloomberg L.P., JPMorgan, Invesco Solutions research and calculations, from Jan. 31, 2010 to Aug. 31 2025. 12-month forward earnings revisions computed as the number of upward revisions minus the number of downward revisions divided by total number of revisions. Past performance does not guarantee future results.

The recent dovish turn by the Federal Reserve at Jackson Hole is leading to a meaningful repricing of monetary policy expectations, with narrowing yield differentials between the US and the rest of the world. Our models indicate this trend is likely to continue (Figure 4). While the US dollar still enjoys higher yields than its developed market peers, this anticipated erosion of the US yield advantage has historically put downward pressure on the greenback. This provides a potential catalyst for outperformance in non-US equities, driven by US capital outflows seeking international diversification and foreign currency appreciation. Given these opposing macro forces, namely US earnings' upward revisions and US dollar depreciation pressures, our models lead us to neutralize the regional composition of our equity positioning, closing the moderate overweight in US equities and bringing exposures in line with global equity benchmarks.

Source: Bloomberg L.P., Macrobond, and Invesco Solutions calculations. 2-year bond yield differential between the US and basket of developed bond markets including Australia, Canada, Eurozone, Japan, New Zealand, Norway, Singapore, Sweden, Switzerland, UK. Median lines plot the median value over trailing 10-years. Data from January 2001 to Aug. 31, 2025.

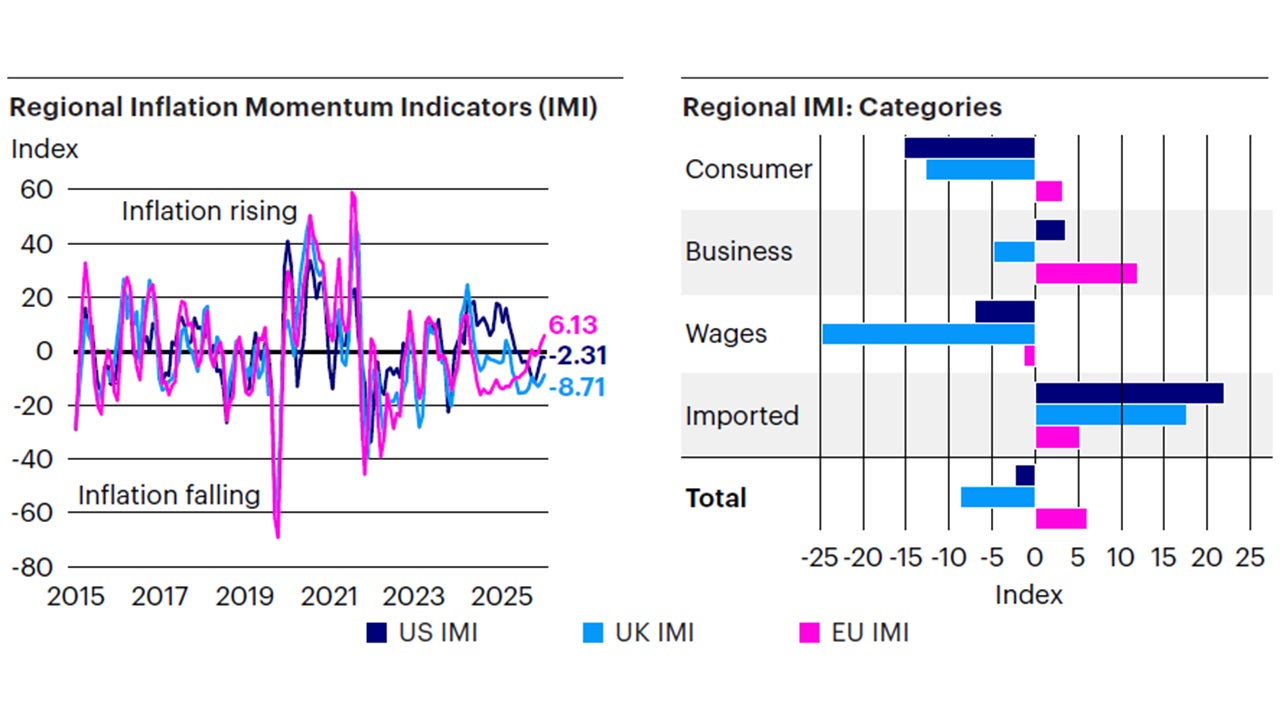

Sources: Bloomberg L.P. data as of Aug. 31, 2025, Invesco Solutions calculations. The US Inflation Momentum Indicator (IMI) measures the change in inflation statistics on a trailing three-month basis, covering indicators across consumer and producer prices, inflation expectation surveys, import prices, wages, and energy prices. A positive (negative) reading indicates inflation has been rising (falling) on average over the past three months.

Investment positioning

We implemented a few changes this month to the Global Tactical Allocation Model.1 We continue to hold a lower risk profile than the benchmark, underweighting equities relative to fixed income. We have increased the exposure to international developed markets and emerging market equities at the expense of US equities. This change is driven by increased bearish (bullish) positioning in our models towards the US dollar (foreign currency exposure). The regional composition of the equity portfolio is now neutral and in line with the benchmark. We continue to overweight defensive sectors with quality and low volatility characteristics. In fixed income, we underweight credit risk2 relative to benchmark and overweight duration via nominal Treasuries (Figures 6 to 9). In particular:

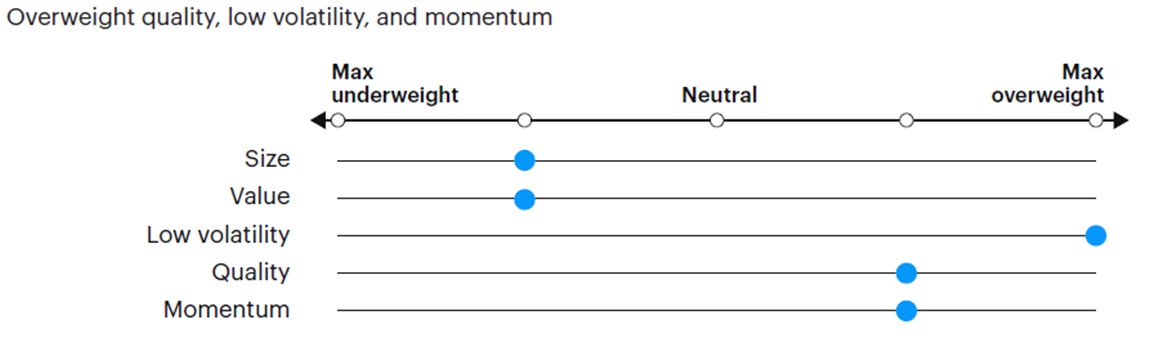

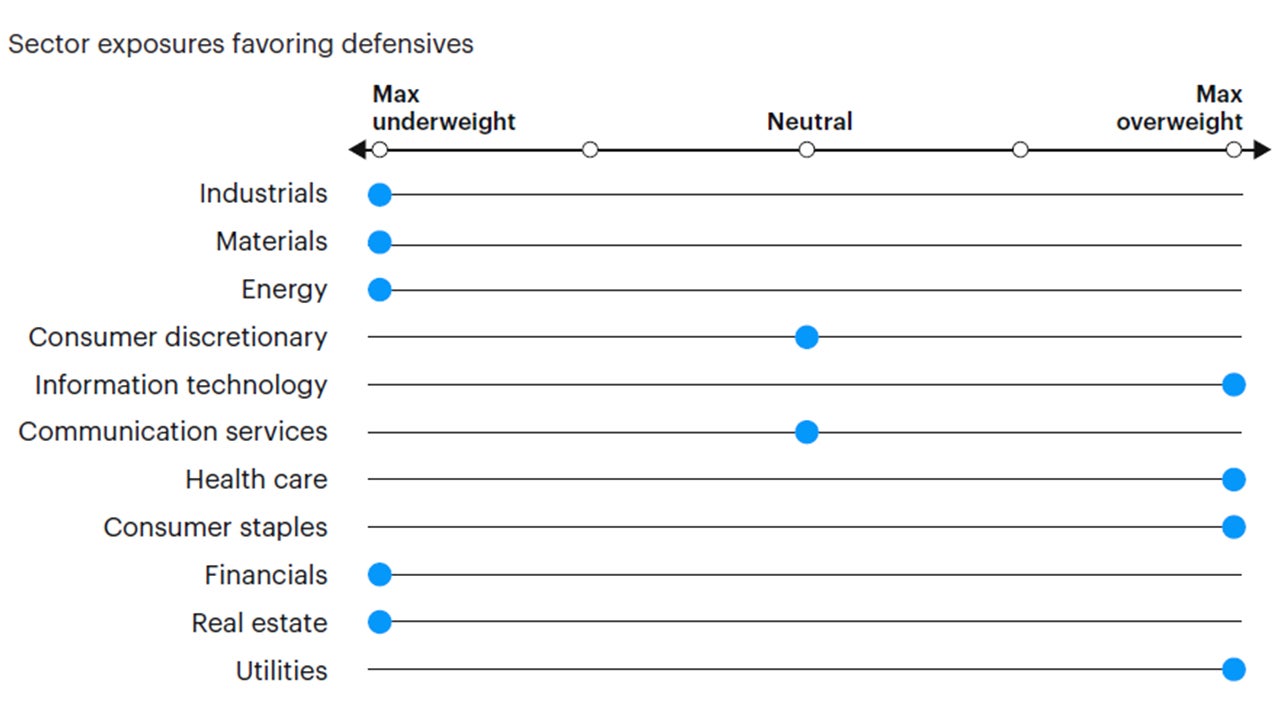

- In equities, opposing macro forces lead our models to neutralize the regional composition versus benchmark. On the one hand, Q2 earnings season delivered renewed upward revisions to US earnings, primarily in the mega-cap technology sector, strongly outperforming international developed and emerging markets (Figure 3). On the other hand, increased expectations for Fed easing are leading to a rapid spread compression in yield differentials between the US and the rest of the world. That has been historically conducive of US dollar depreciation and outperformance in unhedged developed ex-US and emerging market equities (Figure 4). Conflicting signals lead our models to a neutral positioning in emerging markets relative to developed markets, and US relative to developed ex-US equities. We favor defensive sectors with quality and low volatility characteristics, tilting towards larger capitalizations at the expense of value, and mid- and small-caps. Hence, we favor sectors such as health care, staples, utilities, and technology at the expense of cyclical sectors such as financials, industrials, materials, and energy.

- In fixed income, we underweight credit risk and overweight duration, favoring investment grade and sovereign emerging fixed income relative to high yield. Given the decelerating growth environment and historically tight spreads, we believe the risk-reward in this position is attractive. Our bearish positioning on the US dollar also favors emerging markets local debt relative to core domestic fixed income. We favor nominal Treasuries versus TIPS given weaker inflation momentum (Figure 5).

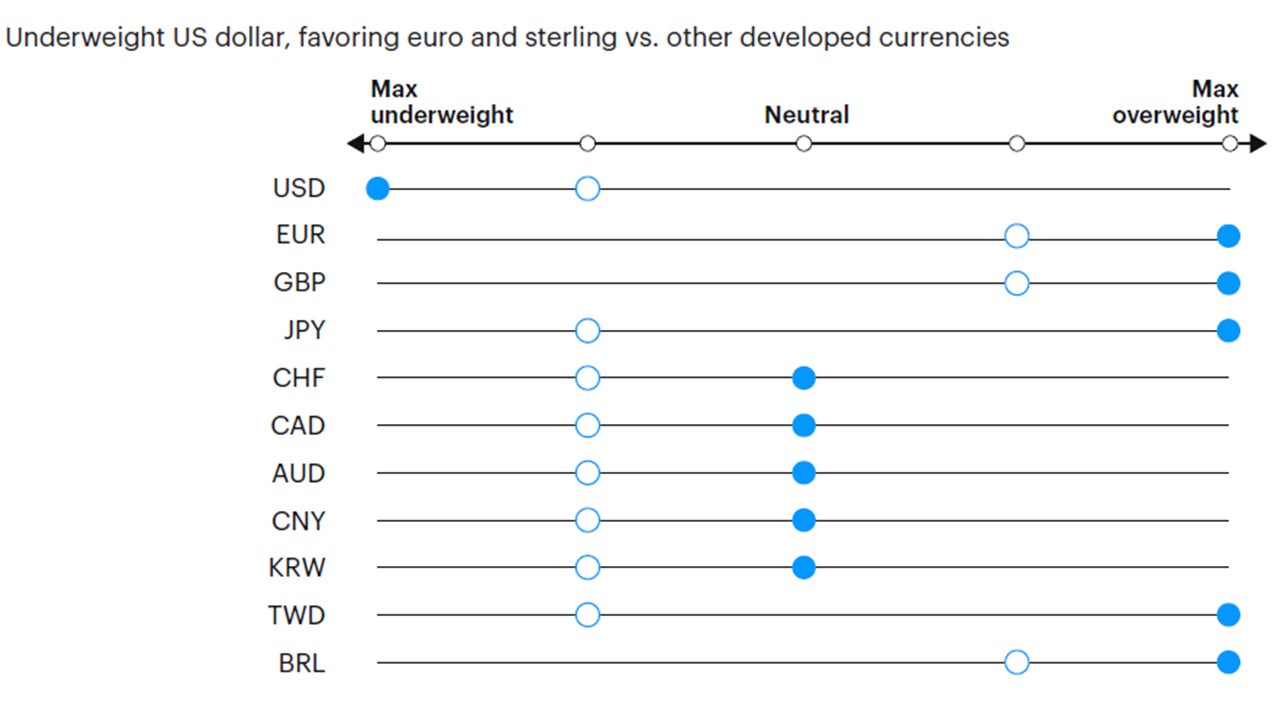

- In currency markets, we moved to a max underweight exposure in the US dollar, driven by continued narrowing in yield differentials relative to the rest of the world and positive surprises in economic data outside the US (Figure 4). As described in recent months, we believe this positioning is further supported by the deteriorating fiscal position of the US and rising funding requirements, putting downward pressure on the greenback. Within developed markets we favor the euro, the British pound, Norwegian kroner, Australian dollar, and the Japanese yen relative to the Swiss franc, Canadian dollar, Swedish krona and Singapore dollar. In EM, we favor high yielders with attractive valuations such as the Colombian peso, Brazilian real, Indian rupee, and Indonesian rupiah relative to low yielding and more expensive currencies such as the Korean won, Philippines peso, Thai baht, and Chinese renminbi.

Source: Invesco Solutions, Sept. 1, 2025. DM = developed markets. EM = emerging markets. Non-USD FX refers to foreign exchange exposure as represented by the currency composition of the MSCI ACWI Index. For illustrative purposes only.

Source: Invesco Solutions, Sept. 1, 2025. For illustrative purposes only. Neutral refers to an equally weighted factor portfolio.

Source: Invesco Solutions, Sept. 1, 2025. For illustrative purposes only. Sector allocations derived from factor and style allocations based on proprietary sector classification methodology. As of December 2023, Cyclicals: energy, financials, industrials, materials; Defensives: consumer staples, health care, information technology, real estate, utilities; Neutral: consumer discretionary and communication services.

Source: Invesco Solutions, Sept. 1, 2025. For illustrative purposes only. Currency allocation process considers four drivers of foreign exchange markets: 1) US monetary policy relative to the rest of the world, 2) global growth relative to consensus expectations, 3) currency yields (i.e., carry), 4) currency long-term valuations.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations), and investors may not get back the full amount invested.