Using managed volatility in multi-asset portfolios

Executive Summary

Financial markets have become quite turbulent over the past few years. Starting with the outbreak of COVID-19 and subsequent supply shocks, followed by runaway inflation and the responses of central banks, all amidst elevated geopolitical risk, markets have been reacting forcefully and this has led to significant price swings. These intense movements have highlighted the importance of volatility management as part of the overall portfolio construction process. In this white paper we highlight how adding uncorrelated asset classes can reduce portfolio volatility. Beyond this common approach, we propose two strategies to manage risk through the utilization of our volatility forecast model. The first employs a static volatility cap, whereas the second leverages a dynamic risk target (cap) to adjust for business cycle conditions. Integrating either of these strategies into the investment process can lead to more attractive investment outcomes, particularly in volatile market conditions such as the environment we currently find ourselves in.

Modern portfolio theory and the dynamic nature of correlation among asset classes

Nobel Laureate Harry Markowitz developed Modern Portfolio Theory (MPT) in his paper entitled “Portfolio Selection” in the 1952 edition of the Journal of Finance. This paper revolutionized the investment management industry and has led risk-aware investors to manage their portfolio risk by utilizing diversification.

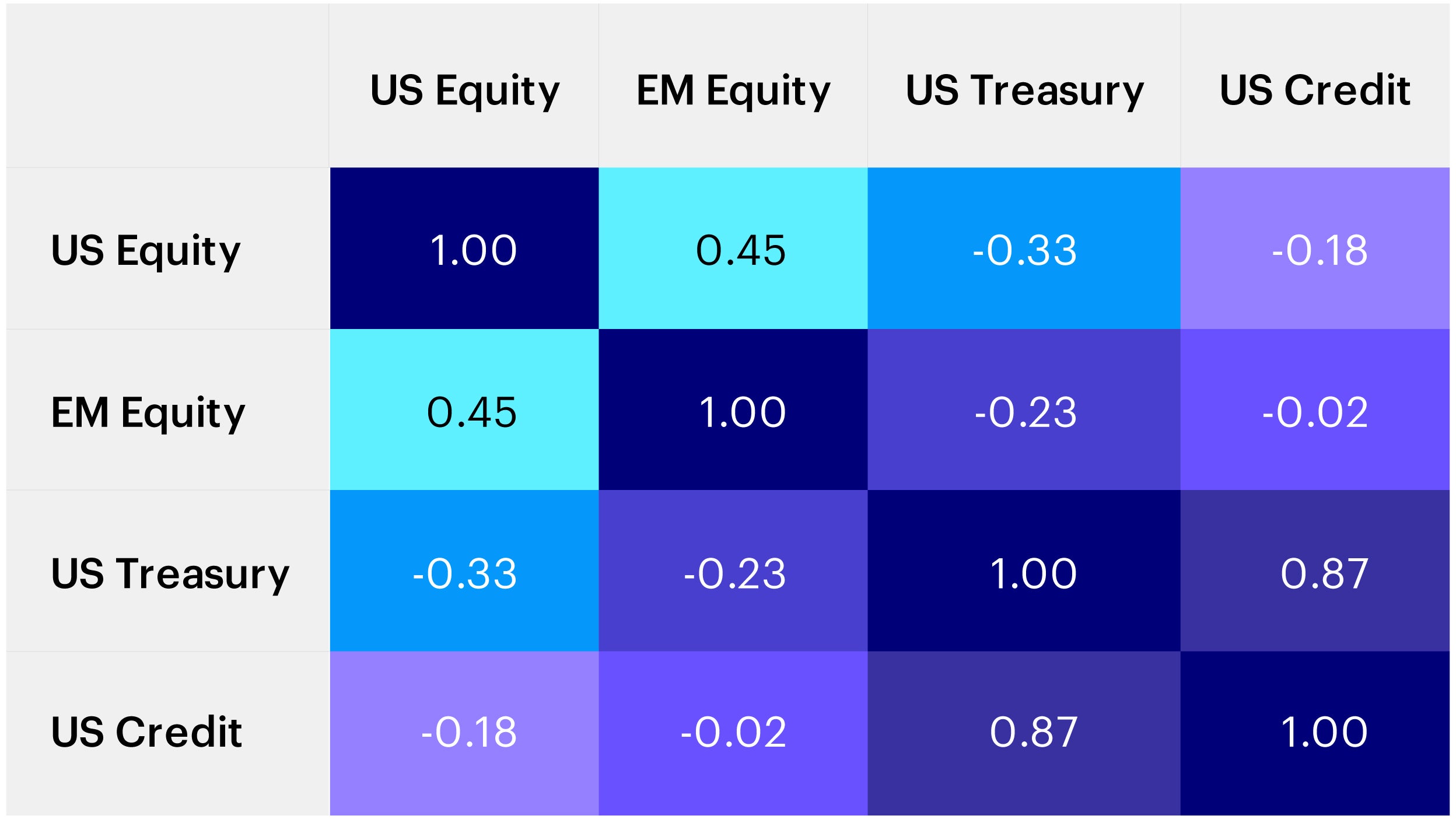

Correlations between various asset classes are extremely important when we think about diversification benefits for a multi-asset portfolio. The lower the correlation is between two assets, the more diversification combining them can provide. We can see that between the years 1999 and 2021, the correlation between US Equity and EM Equity was 0.45 (Figure 1). Although positive, this is still moderate in terms of overall magnitude, meaning that these two asset classes provide some level of diversification. While the correlation between US Equity and US Treasury during this period was -0.33, substantially lower than the correlation between the aforementioned pair of assets. This explains why US Treasury as an asset class can typically do a better job in decreasing portfolio volatility when combined with US Equity.

Source: Bloomberg, data as of Dec. 31, 2021. Data range from 1999-2021. Data is represented by the S&P 500 index, MSCI Emerging Market Index, Bloomberg US Treasury Total Return Index and Bloomberg US Credit Total Return Index. An investment cannot be made in an index. Diversification does not guarantee profit or protect against loss.