Research Report – IGW ChiNext 50 ETF - December 2025 issue

Key Highlights

The A-share market rebounded from the bottom in December, with a steady upward trend in the mid-to-late

month.

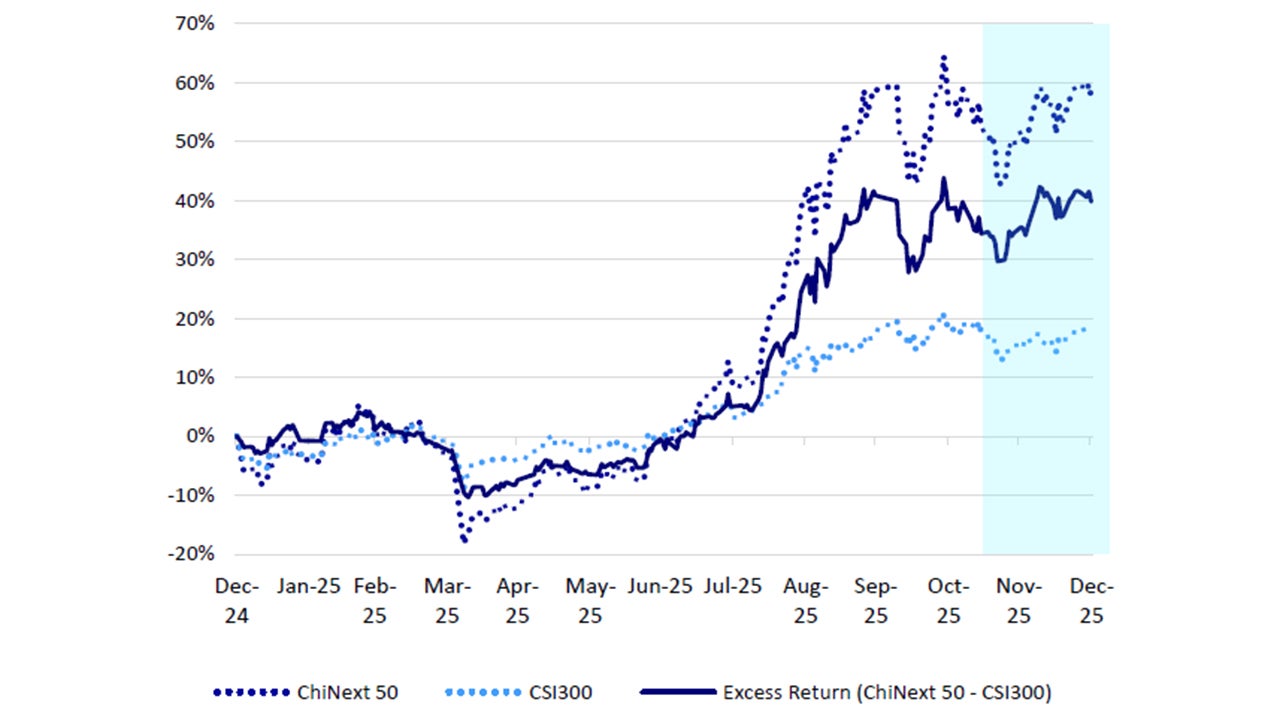

In 2025, the ChiNext 50 Index returned 57.45%, outperforming the CSI 300 Index, which returned 17.66%.

- The IGW ChiNext 50 ETF is listed on the Shenzhen Stock Exchange (SZSE) and managed by Invesco Great Wall Fund Management Company

- The ETF aims to track the performance of the ChiNext 50 Index

- Stock code of the ETF: 31355 (HK CCASS) / 159682 (SZSE)

- This is an eligible ETF under the Stock Connect between Mainland and Hong Kong

About the ETF

The IGW ChiNext 50 ETF tracks the performance of the ChiNext 50 Index. The benchmark index represents leading growth-oriented companies listed on the ChiNext Board of Shenzhen Stock Exchange. The ETF provides low-cost and liquid exposures in the leading technology in China.

| List Date | 1/3/2023 |

| Management Fee Ratio | 0.15% |

| Custodian Fee Ratio | 0.05% |

| Name | Invesco Great Wall SZSE Chinext 50 ETF |

| Stock Code | 159682 |

| CCASS Stock Code | 31355 |

| SH/SZ-HK Stock Connect Eligibility | Yes |

| Domicile | China |

| Annualized Tracking Error | 0.63% |

| AUM (Bn CNY) | 5.12 |

| AUM (Bn USD) | 0.73 |

Source: Wind, IGW, as of 31 December 2025. Past performance does not predict future results. Holding are subject to change and are not buy/sell recommendations.

China Market Recap

In December, the overall A-share market rebounded from the bottom, with major broad market indices steadily rising in mid-to-late month. The market performance was as follows:

- Phase 1 (12/1–12/16): Market fluctuated downward

In early December, overseas liquidity dominated focus. The Fed’s wavering rate cut expectations and the BoJ’s hesitant hikes drove market adjustments. Major broad market indices declined, with growth-value balance in style and steep drops in pharmaceuticals/biotech. Industrially, national defense and telecommunications outperformed, fueled by commercial aerospace momentum that lifted the entire defense sector, whereas media and real estate lagged due to weak high-frequency data and insufficient policy support. Risks finally eased as both the Fed and BoJ aligned their rate decisions with market expectations.

- Phase 2 (12/17–12/31): ETF Inflows Surge, Market Rallies

The CSI A500 ETF recorded daily net inflows exceeding CNY 10 billion, and provided strong upward momentum for the market. Small-cap growth stocks led the rally, with a broad-based market upturn. Key industry highlights included: precious metals surged across the board driven by inflation logic; commercial aerospace strengthened continuously under policy and news-driven catalysts; oil prices received strong support from improved supply-demand fundamentals, compounded by persistent geopolitical tensions, leading to a surge in the oil and petrochemical sectors; policy initiatives prioritized domestic demand by 2026 and introduced favorable commercial and retail policies in multiple regions, catalyzing strong structural rallies in department store and retail sectors. The ChiNext 50 Index experienced a significant rebound during this phase.

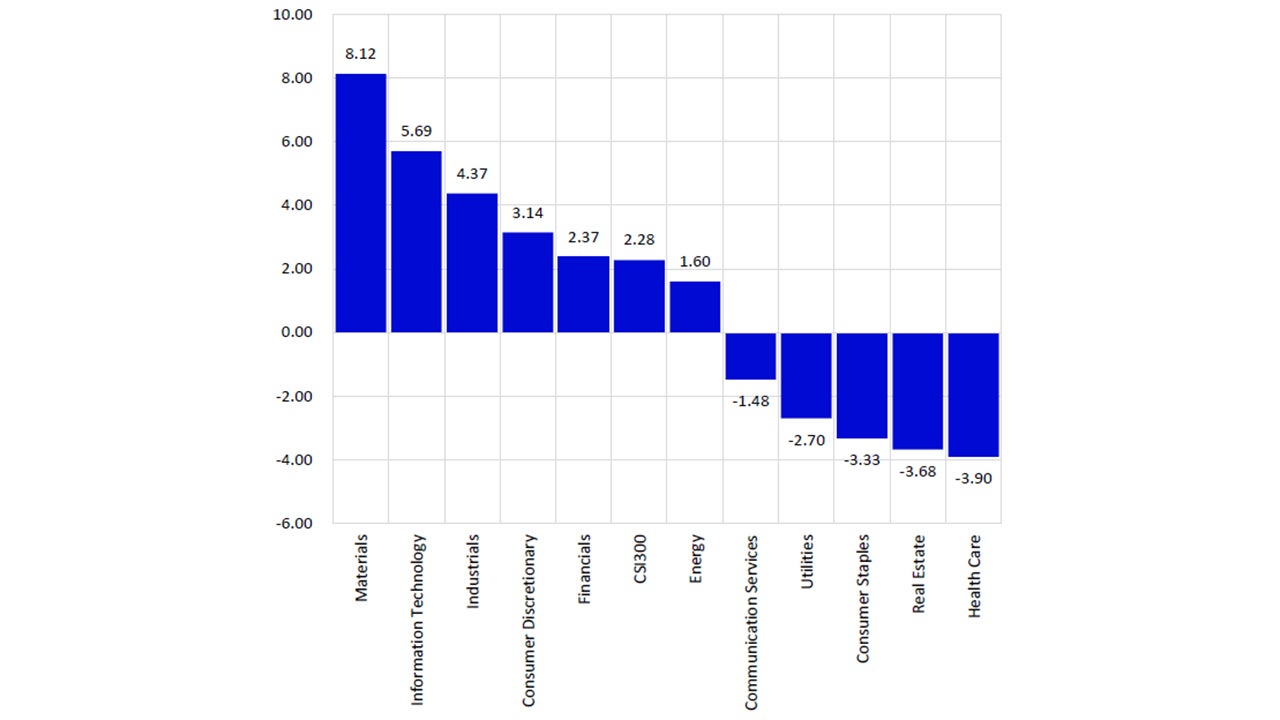

Sector performance diverged in December. Among GICS Level 1 industries, Materials (+8.12%), Information Technology (+5.69%), and Industrials (+4.37%) ranked at the top in terms of gains, while Health Care (-3.90%), Real Estate (-3.68%) and Consumer Staples (-3.33%) experienced the sharpest declines.

Overall, December saw more sectors declining than rising. Strength in Materials stemmed from price increases in metals, with inflation-driven demand lifting nonferrous metals; Information Technology benefitted from stabilized overseas AI markets, where optical modules and AI hardware demand remained robust, further boosted by GPU IPOs. Weakness in Healthcare reflected style and theme rotation reducing pharmaceutical/biotech trading activity, while Real Estate struggled with lackluster data and insufficient policy-driven marginal improvements.

Note: Market Cap and Sector Allocation represent the composition of the underlying index (ChiNext 50 Index) tracked by the ETF as of 31 December 2025. Data sourced from Wind. All industry performance presented reflect Wind’s proprietary A-share GICS classification methodology.

Funds carry risks, and investment requires caution. The above data reflects secondary market price fluctuations. The intraday price changes of the fund do not represent its performance. For specific fund performance, please visit the official website of Invesco Great Wall. The operation history of mutual funds in China is relatively short and may not reflect all phases of the stock market development. Past performance of the fund does not indicate its future results, and the performance of other funds managed by the fund manager does not guarantee the performance of this fund

Source: Wind, IGW, as of 31 December 2025. Past performance does not predict future results. Holding are subject to change and are not buy/sell recommendations.

ChiNext 50 vs. CSI 300: Short- and Long-Term Return Comparison

The ChiNext 50 and CSI 300 indices exhibited divergent returns across different time horizons. Over the past five years, the ChiNext 50 has demonstrated an increasingly upward trend. Notably, during periods of broad market rallies, the ChiNext 50 has consistently outperformed the CSI 300, suggesting that overweighting ChiNext 50-linked assets could be a strategic choice when constructing investment portfolios during bullish phases. Furthermore, the current market cycle has been characterized by a pronounced technology-driven growth style, with the ChiNext 50 delivering strong excess returns.

Looking ahead, global liquidity easing, combined with recent CNY appreciation, has significantly strengthened foreign capital’s appetite for technology growth stocks. The ChiNext 50 Index, which heavily weights artificial intelligence and semiconductors—sectors closely aligned with national strategic priorities—is expected to sustain growth momentum amid accelerated AI computing power iteration and deepening domestic substitution trends. The ChiNext 50 Index constituents, supported by high R&D investment and strong growth visibility, are better aligned with asset allocation demands in an accommodative monetary policy and weak US dollar environment, and could serve as a key vehicle for foreign investors to increase exposure to Chinese assets.

ChiNext 50 vs. CSI 300: Short- and Long-Term Return Comparison (%)

Index Name |

YTD |

1Y |

3Y(Ann.) |

5Y(Ann.) |

|---|---|---|---|---|

ChiNext 50 |

57.45 |

57.45 |

13.16 |

3.51 |

CSI 300 |

17.66 |

17.66 |

6.14 |

-2.34 |

Note: Past performance does not predict future results. Data sourced from Wind, as of 31 December 2025. Funds carry risks, and investment requires caution. The above data reflects secondary market price fluctuations. The intraday price changes of the fund do not represent its performance. For specific fund performance, please visit the official website of Invesco Great Wall. The operation history of mutual funds in China is relatively short and may not reflect all phases of the stock market development. Past performance of the fund does not indicate its future results, and the performance of other funds managed by the fund manager does not guarantee the performance of this fund.

IGW ChiNext 50 ETF Information

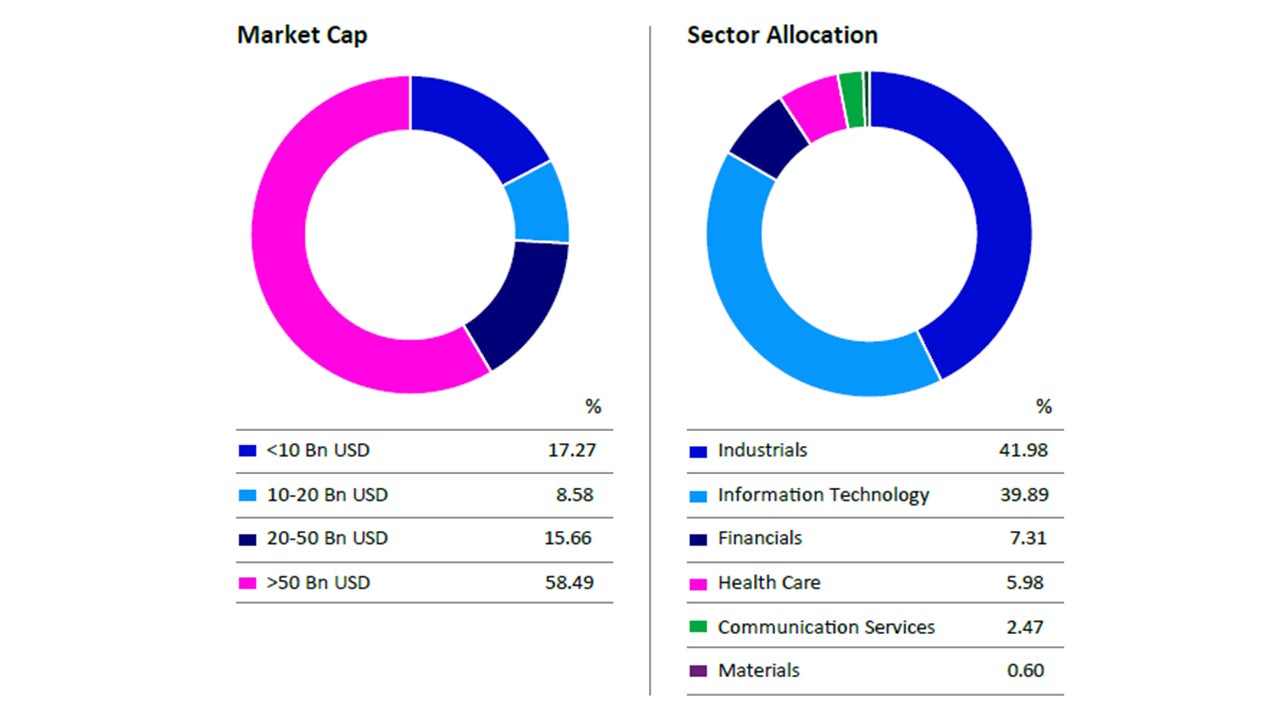

IGW ChiNext 50 ETF focuses on large-cap growth leaders in China, with over 80% invested in firms exceeding 10 Bn USD market cap. Sector allocation emphasizes Industrials and Information Technology, aligning with China’s representative emerging growth industries.

The fund offers cost-efficient access at an expense ratio of 0.20% (including Management Fee Ratio 0.15% and Custodian Fee Ratio 0.05%) and manages CNY 5.12 billion (USD 0.73 billion) AUM. As of 31 December 2025, since its listing on 3 January 2023, IGW ChiNext 50 ETF maintains a tight annualized tracking error of 0.63%, delivering cumulative returns of 48.89% and annualized returns of 14.23% (calculated based on daily closing prices of the ETF).

Note: Market Cap and Sector Allocation represent the composition of the underlying index (ChiNext 50 Index) tracked by the ETF as of 31 December 2025. Data sourced from Wind. All industry performance presented reflect Wind’s proprietary

A-share GICS classification methodology. For illustrative purposes only. Weightings and allocations are subject to change without notice.

Funds carry risks, and investment requires caution. The above data reflects secondary market price fluctuations. The intraday price changes of the fund do not represent its performance. For specific fund performance, please visit the official website of Invesco Great Wall. The operation history of mutual funds in China is relatively short and may not reflect all phases of the stock market development. Past performance of the fund does not indicate its future results, and the performance of other funds managed by the fund manager does not guarantee the performance of this fund.

Important Information

Risk Disclaimer

There are risks involved with investing in ETFs, including possible loss of money. Shares are not actively managed and are subject to risks similar to those of stocks, including those regarding short selling and margin maintenance requirements. Ordinary brokerage commissions apply. The ETF’s return may not match the return of the Underlying Index. The ETF is subject to certain other risks. Please see the current prospectus for more information regarding the risk associated with an investment in the ETF.

Stocks of medium-sized companies tend to be more vulnerable to adverse developments, may be more volatile, and may be illiquid or restricted as to resale.

The risks of investing in securities of foreign issuers can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

The ETF is non-diversified and may experience greater volatility than a more diversified investment. Investments focused in a particular industry, such as semiconductor, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.

Index returns do not represent ETF returns. An investor cannot invest directly in an index. Neither the underlying Index nor the benchmark indexes charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown; nor do any of the indexes lend securities, and no revenues from securities lending were added to the performance shown. In addition, the results actual investors might have achieved would have differed from those shown because of differences in the timing, amounts of their investments, and fees and expenses associated with an investment in the ETF.

ChiNext 50 ETF Historical performance (%)

| 6M | YTD | 1Y | 3Y | 5Y | Fund Inception | |

|---|---|---|---|---|---|---|

NAV return (%) |

57.75 | 58.59 | 58.59 | 47.93 | - | 47.62 |

Market Price return (%) |

57.97 | 58.48 | 58.48 | 48.89 | - | 48.89 |

Index return (%) |

58.13 | 57.45 | 57.45 | 44.88 | - | 48.16 |

Note: NAV return is calculated based on net asset value (NAV) data verified by the custodian bank, both market price return and index return are calculated using data sourced from Wind, as of December 31, 2025. Past performance does not predict future results. Where no past performance is shown there was insufficient data available in that year to provide performance.

Conflict of Interest

Invesco Great Wall Fund Management Co., Ltd. (“IGW”), Invesco Hong Kong Limited (“IHKL”) and respective affiliates may engage in asset management service and hold the ETF in this report. As a result, investors should be aware that IGW and IHKL may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.

Direct or indirect compensation or other benefits relating to this report may be provided between IGW and IHKL.

IGW is the management company of the ETF. Currently 49% owned by Great Wall Securities, 49% by Invesco Asset Management Limited (“IAML”)*, 1% by Kailuan Group, and 1% by Shide Group. There is business segregation between IGW and its shareholders who are not directly involved in the investment and operation of funds’ assets. * IAML and IHKL (as the distributor of this report) are both ultimately owned by Invesco Ltd.

Disclaimer

This report is published for general circulation only and does not constitute an offer or a solicitation of an offer to buy or sell any investment products. This report does not have regard to any individual-specific investment objectives or financial situation. Individual investors should seek professional advice from an independent financial adviser and refer to the relevant offering documents and/or other latest published information on the ETF including the risk factors regarding the suitability of specific investment products.

Information in this report has been obtained and/or derived from sources generally available to the public and believed to be reliable. All investments carry risks, and it is possible to lose the entire investment amount. Any past performances, projections, forecasts or simulation of results are not necessarily indicative of the future performance of any investments. The ETF has not been and will not be authorized by the Securities and Futures Commission under section 104 of the Securities and Futures Ordinance. This report does not constitute an advertisement, invitation or document which is or contains an invitation to the Hong Kong public to acquire an interest in or participate in a collective investment scheme under section 103 of the Securities and Futures Ordinance.

This report is intended only for investors in Hong Kong. Circulation, disclosure, or dissemination of all or any part of this report to any unauthorized persons is prohibited. This report is distributed in Hong Kong by Invesco Hong Kong Limited 景順投資管理有限公司, 45/F, Jardine House, 1 Connaught Place, Central, Hong Kong.