2023 Investment Outlook – Asia Fixed Income: Emerging Markets

Asian sovereigns expected to outperform other emerging markets

Emerging market (EM) Asian sovereign credit fundamentals may not be as weak as what the market fears right now.

High levels of inflation in most of the developed world and the interest rate hiking cycle around the globe is certainly putting downward pressure on the growth outlook for Asia’s domestic economies. Yet at the same time, many factors are working in Asian sovereign issuers’ favor.

If China’s strict COVID controls ease, this could improve economic activity in neighboring Asian countries. Also, unlike other commodity-exporting EM countries where fiscal revenue has benefited from high commodity prices, most Asian sovereign issuers are not commodity exporters, so their fiscal policies have not been as expansionary as their other EM peers in the past two years or so.

Rising interest rates mean the funding costs are higher for Asian governments looking to borrow hard currency debt. However, aside from Sri Lanka, which has already defaulted, the short-term external bond maturities for most other Asian countries do not pose high default risks in the short run given these nations have learned from the 2013 “taper tantrum” and have built up comfortable foreign exchange reserves.

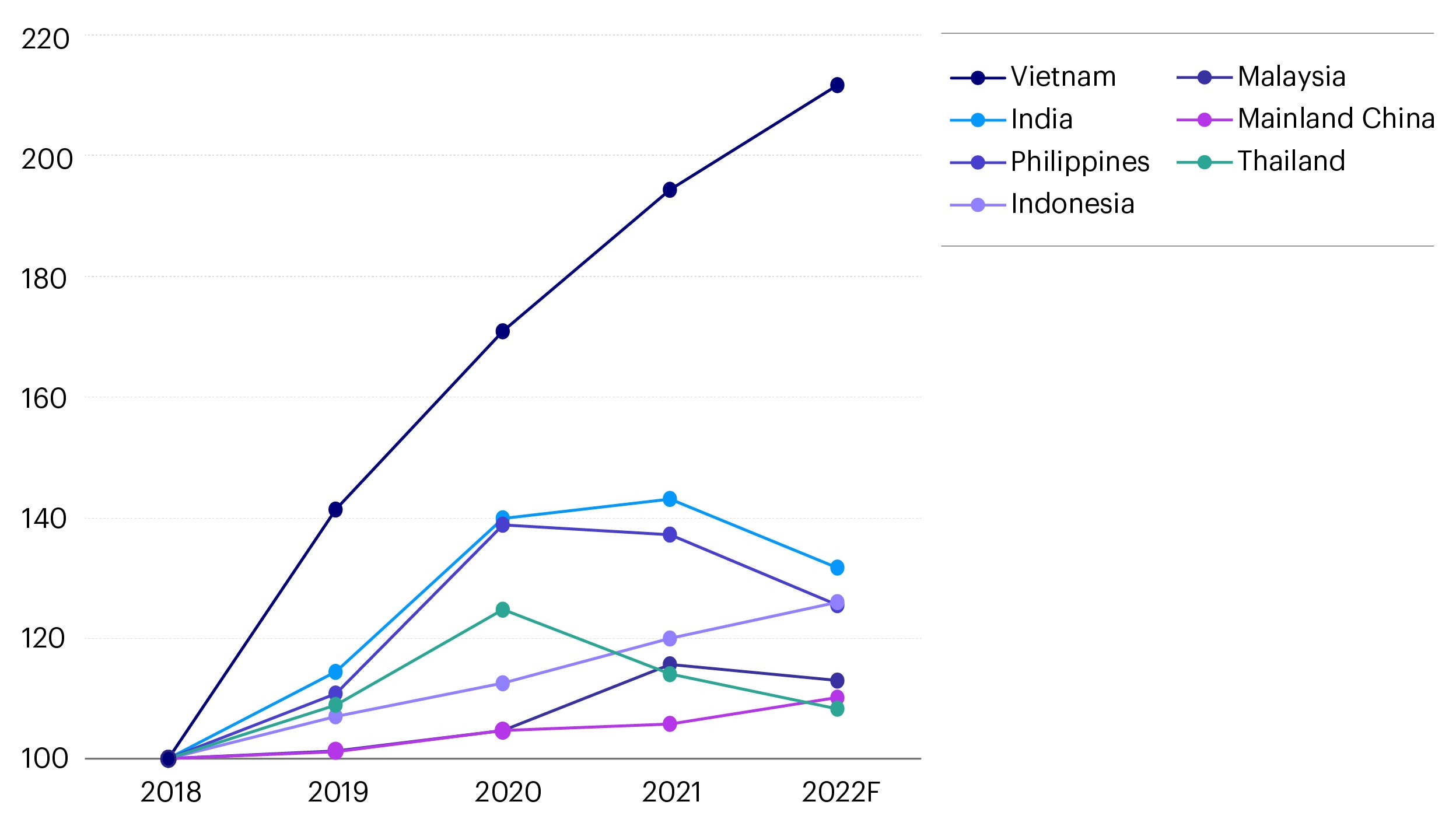

Note: Data normalized against 2018 at 100. Source: HSBC, Invesco, data as of Sep 2022.

Depending on the pace of the interest rate hikes in the US, Asian hard currency sovereign bonds may continue to see selling pressure in the coming months. That said, we anticipate that Asian sovereign issuers may be the first group to rebound in 2023, once the hiking cycle in developed economies comes to an end and are the most likely to outperform their EM peers when this occurs.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.