2023 Investment Outlook – Asia Fixed Income: Investment Grade

Investors are likely to position cautiously in IG bonds

2023 is likely to be a continuation of 2022 for Asia investment grade (IG) as the market looks for the clues of Federal Reserve policy with persistent high inflation and macro uncertainty across the globe. Asia IG remains challenging against the backdrop of aggressive US rate hikes, a strong US dollar and the global economic slowdown. The hawkish Fed remains a major risk factor at least for the first half of 2023 given the heightened core inflation and tight labor market. However, recession risks are also rising. Higher inflation and tighter financial conditions are set to be a drag on growth.

The world is edging towards a global recession in 2023, which might lead to financial crises in both developed and emerging markets. We believe the energy crisis in Europe is likely to intensify further going into the winter. Geopolitical tensions remain elevated between Russia and Ukraine and between US and China. We intend to closely monitor the situation and watch to see if event risks may change risk sentiment and our investment thesis. China’s economic growth continues to see downside risk, with the stressed property sector and zero-Covid policy being the key drags. China’s 20th Party Congress concluded, and the new Politburo Standing Committee was elected recently. There is currently no sign of China easing its zero-Covid policy. Nonetheless, we do expect some easing measures and supportive policies to be announced when the new leadership takes office in March 2023.

Asia credit has underperformed its global peers year-to-date. Technical factors clearly weakened and have pushed spreads wider. Given the global slowdown, we anticipate the broader risk-off tone to continue to determine overall credit performance. Investors are likely to position cautiously and avoid high beta Asia credit given the heightened market volatility.

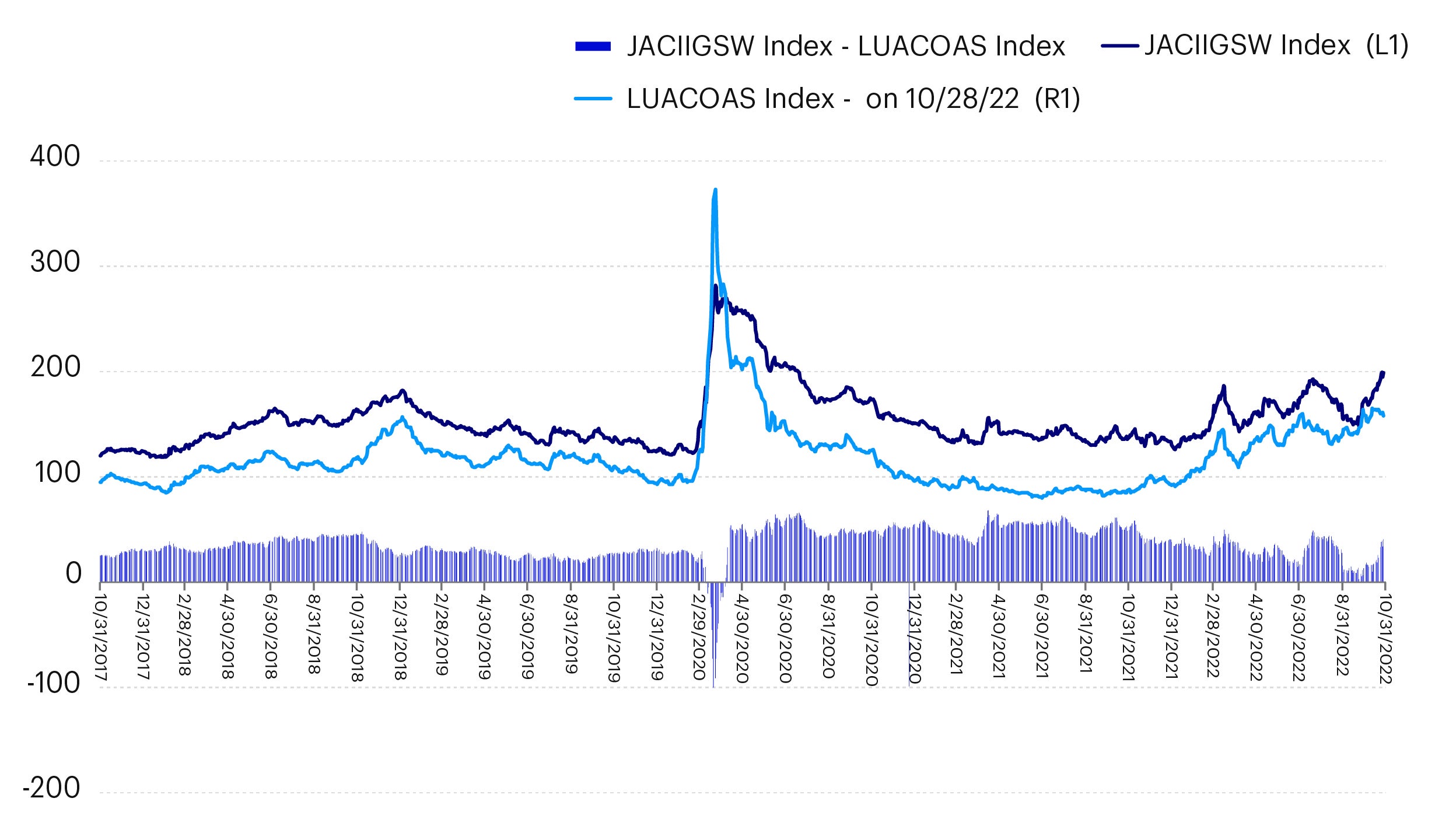

Source: Bloomberg L.P., JP Morgan JACI, Invesco, data as of 31st October 2022. Note: JACIIGSW: J.P.Morgan Asia Credit IG Index, LUACOAS: Bloomberg U.S. Corporate Bond Index. Past performance does not guarantee future results. An investment cannot be made in an index.

Global emerging market (EM) bond flows have turned negative on Asia credit. Asian hard currency bond funds have also recorded continuous outflows. One supportive factor against declining demand is that net supply in Asia’s credit market especially from Chinese issuers is also dropping sharply. We expect supply to remain muted given the rate volatility and cheaper funding costs in the local currency market. Shrinking supply could help to mitigate negative flows.

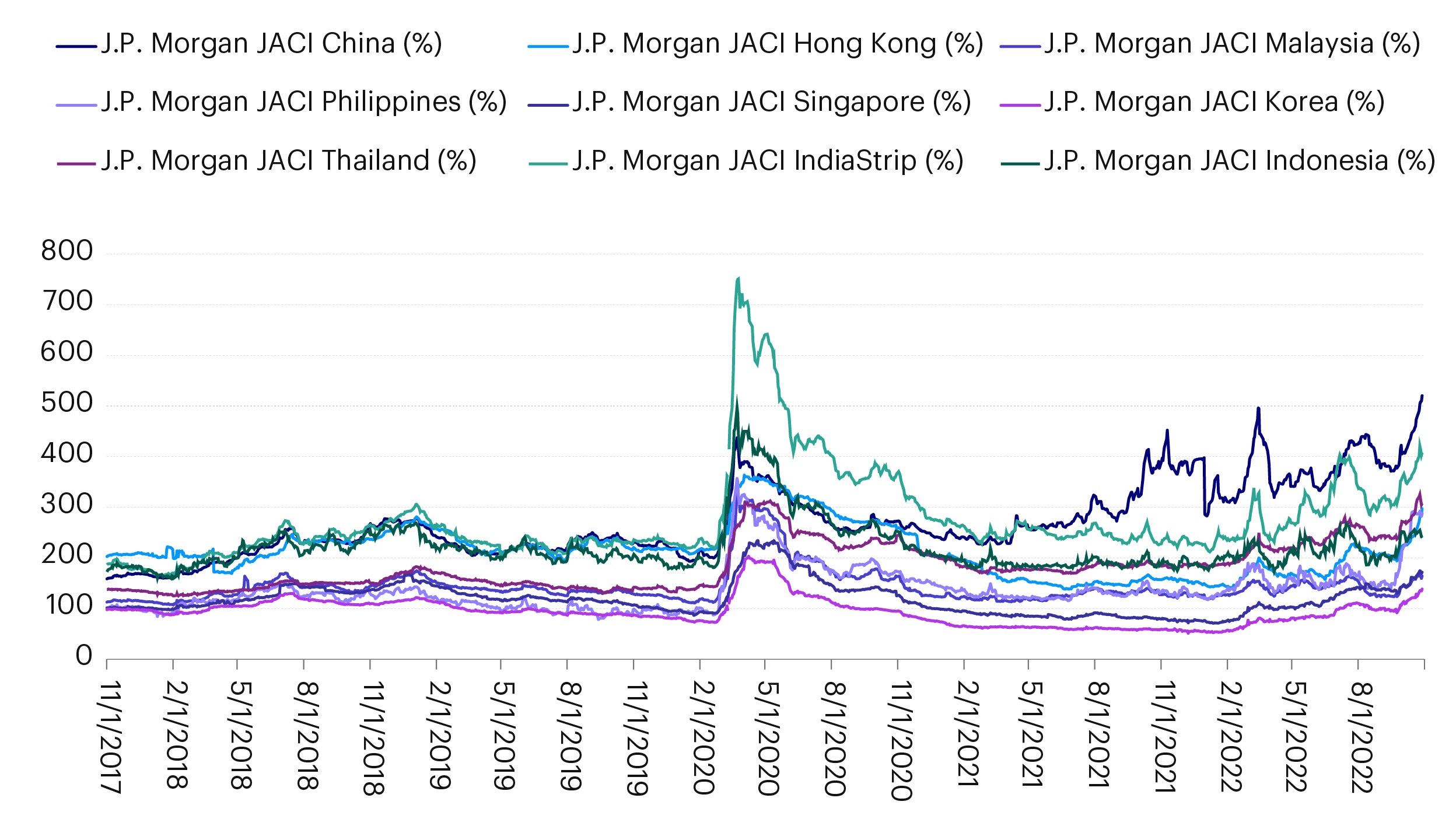

Asia IG still looks cheap relative to other regions – especially after adjusting for rating differential and durations. With the US Treasury yield curve inversion expected to persist in the near future, investors are likely to maintain their preference for short-duration high quality bonds. Investors are reluctant to go down the credit curve, causing overall valuations for high quality Asia names to be expensive relative to their global peers. For China, we expect to continue to see strong onshore buying at the front-end and belly of senior bank papers and high-quality state-owned enterprises. Performance divergence is likely to remain between high quality and high-beta names. Also, we believe government-related entities or state-owned enterprises are likely to outperform private credit in 2023. Strong government support and ease of access to funding are essential for Asian credit. In terms of country allocations, China stands out from a valuation perspective, followed by India IG, whereas Korea, Singapore and Malaysia are relatively expensive and provide little buffer against higher US rates.

Source: Bloomberg L.P., JP Morgan JACI, Invesco, data as of 1st November 2022. Past performance does not guarantee future results. An investment cannot be made in an index.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.