Asian Equity Update - Asian economies to benefit from reopening

Despite a slowdown in global economic growth, within Asia, particularly South East Asia and India, the growth momentum remains strong. As such, from an investment perspective, Asia offers diversification opportunities for global investors.

Recently, investors have been laser-focused on high inflation and monetary tightening in major developed markets. As a result, developed market equities were sold off this year.

On the other hand, stock markets in South Asian countries have outperformed their western peers on a fully reopened economy and accommodative monetary policies. Some Asian commodity exporters are benefitting from relatively higher commodity prices.

| Equity Market Index | YTD performance |

| MSCI Indonesia | +11.57% |

| MSCI India | +0.92% |

| MSCI Malaysia | -5.97% |

| MSCI Singapore | -14.21% |

| MSCI Phillippines | -7.27% |

| MSCI AW World | -21.45% |

Source: Bloomberg, as of Sep 20, 2022

Asia has attracted interests from investors, especially those who are looking for diversifications.

We believe that the momentum of Asian stocks could continue given the reopening story continue to play out while the structural drivers such as urbanization and digitalization remain intact, which in turn become key drivers for domestic consumption.

South Asia – a reopening story

- Recent data such as international flight numbers and visitors have been positive following the reopening of some Asian economies.

- Since tourism and related industries contribute 12% of the ASEAN countries' GDP,1 the spill-over effect could lead to a strong recovery of activities and domestic demand to boost the economy.

- For example, in Thailand, international flights have gone up following the announcement of quarantine-free travel.

- In Indonesia, the number of visitors rose by five times in April vs last year, with more than 11,000 foreign visitors.2

- In Singapore, the country welcomed over 1.5 million in 1H 2022 as travel restriction was relaxed in April. Fully vaccinated travelers can come to Singapore without pre-departure testing and quarantine.3

- The Singapore Tourism Board expects 4 to 6 million international visitor arrivals for 2022 - 12 times compared to 2021.4

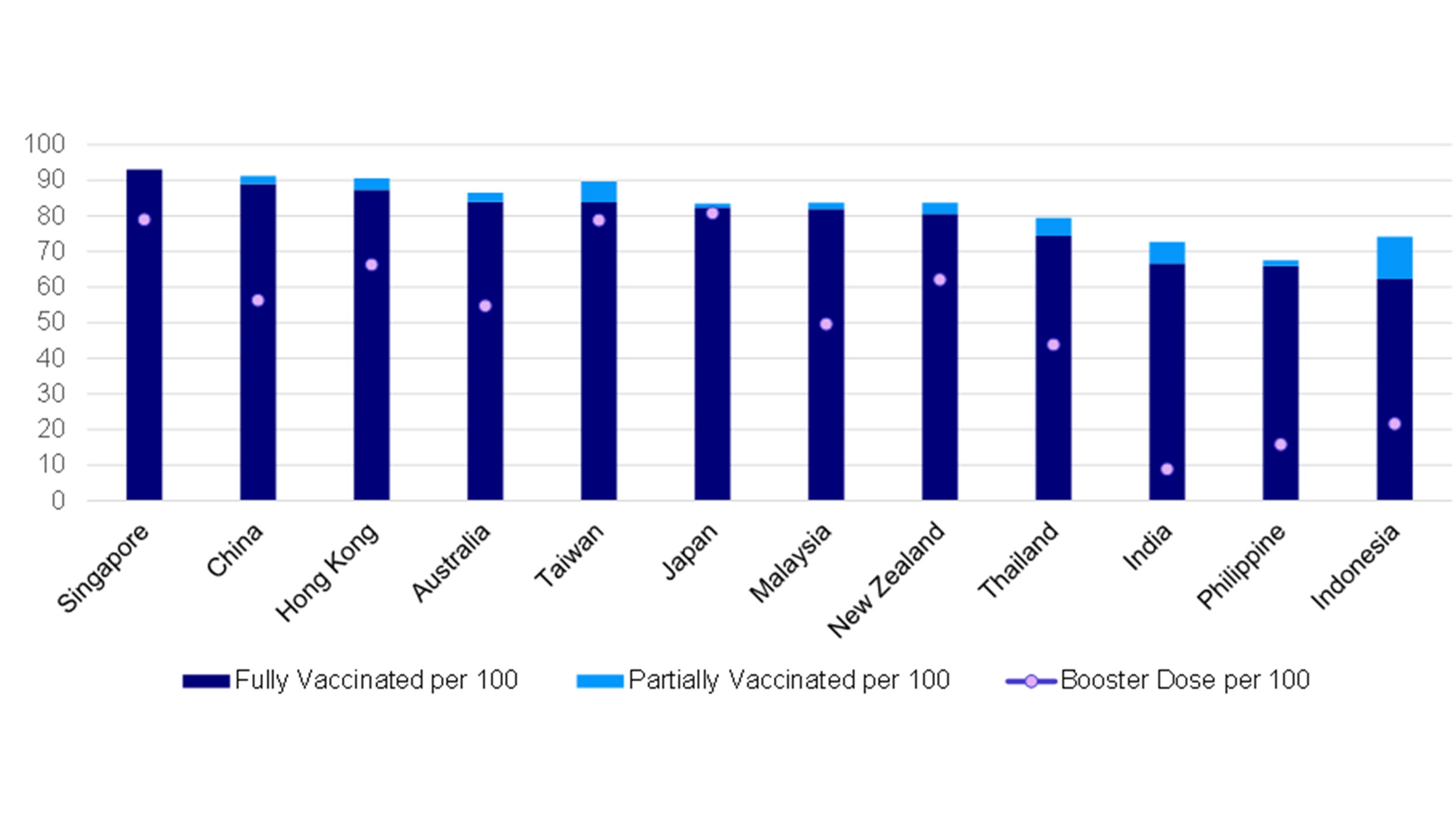

Source: Our World in Data, HSBC, August 2022

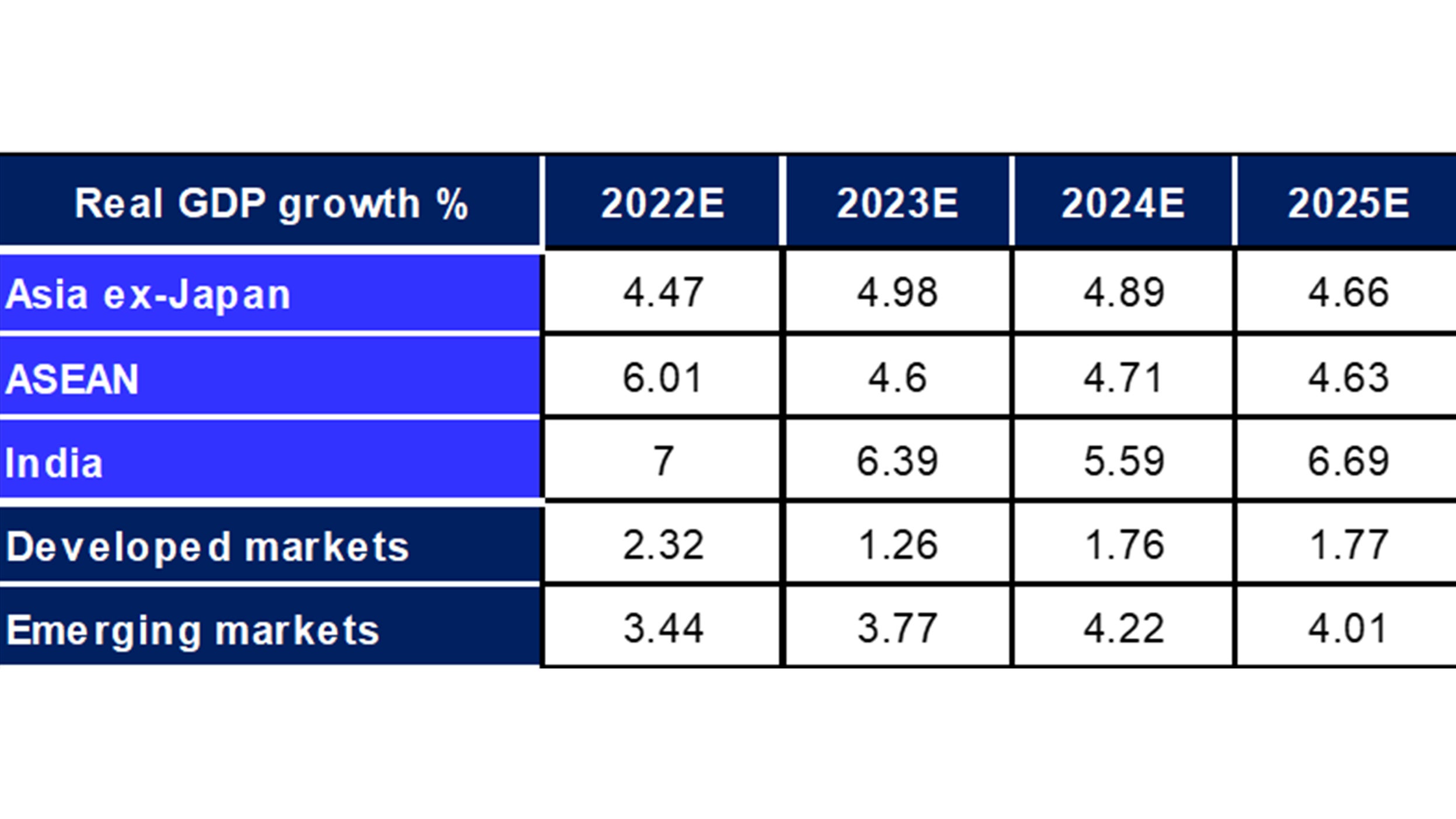

Real GDP growth in Asia, Developed markets and Emerging markets

Source: Goldman Sachs Global Investment Research. August 2022

Key highlights of selected Asian markets

India

- India reopened the economy in early 2022, the recovery is broad-based, including car sales, property and goods and services. The composite PMI stayed at 57.7 on average in the past few months.5

- India is set to deliver an average of 7% growth over 2022-2023, the strongest among the largest economies, contributing 28% and 22% to Asian and global growth respectively.6

- The key change in India’s structural story lies in the shift in the policy focus towards lifting the productive capacity of the economy.

Malaysia and Indonesia

- Both Malaysia and Indonesia are beneficiaries of rising energy and commodities prices. Malaysia is an oil and gas exporter whereas Indonesia benefits from commodities such as palm oil exports.

- We may see export income to go up for net commodity exporters like Malaysia, which in turn benefit domestic consumption on spill-over effects.

Inflationary pressure in Asia relatively lower

- Inflationary pressure in Asia is less severe than that of developed markets.

- For example, China’s CPI rose 2.5% yoy in August 2022, while inflation in the US and EU hit historical highs with high single-digit or even double-digit growth in the past few months.7

- We believe that Asian inflation is mainly driven by goods & commodity prices, i.e. cost-push inflation. The recent correction of commodity prices may lower inflationary pressure in Asia.

- We anticipate that core inflation will likely remain stable in the near term and put less pressure on central banks in the region to tighten monetary policies.

- Hopefully, inflation could come down and return to central banks’ comfort zone next year.

- Even with inflationary pressure, we believe that the domestic demand and reopening recovery in Asia, particularly ASEAN countries, will continue to boost the growth in Asia.

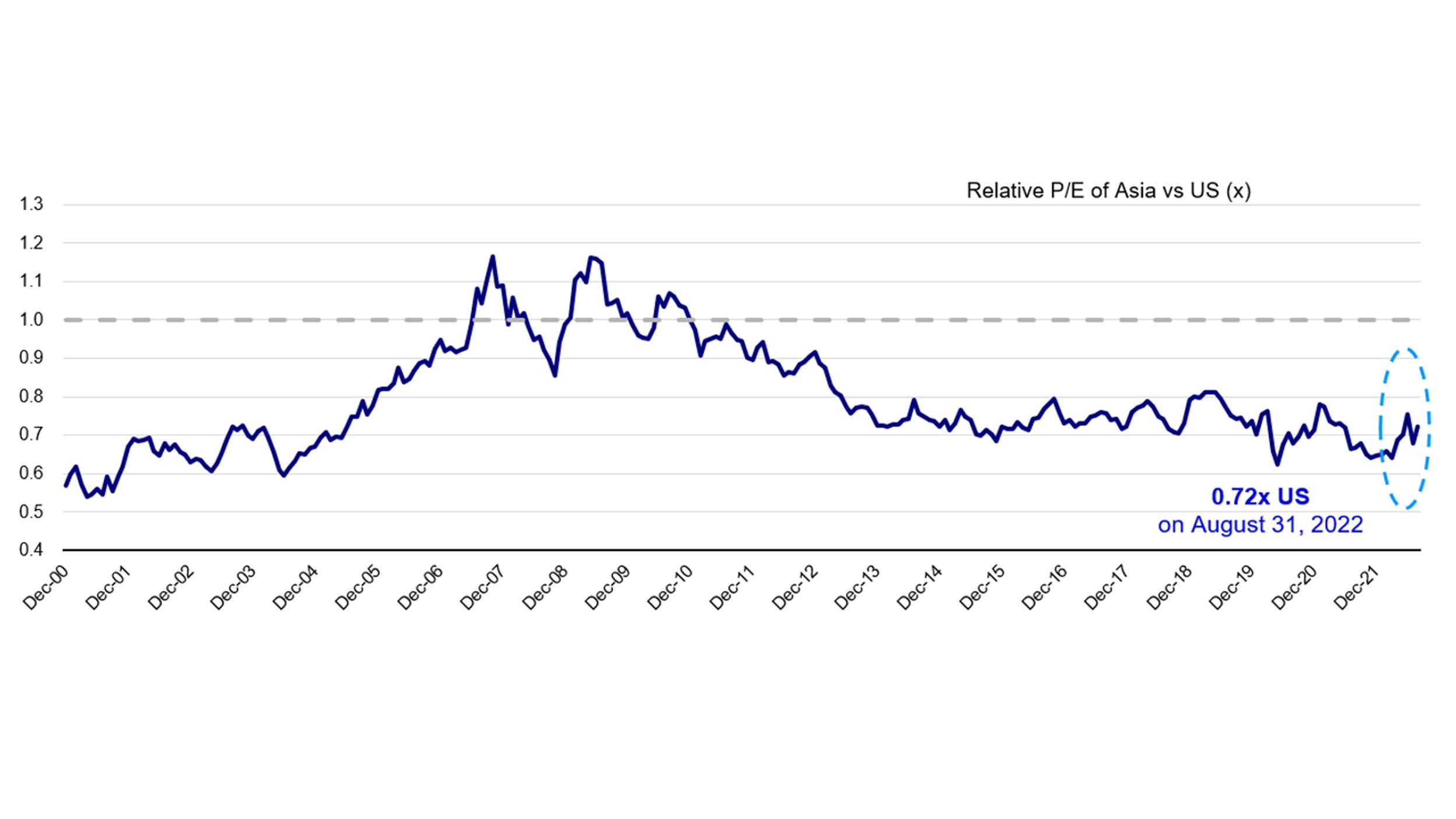

Valuation

- MSCI Asia ex-Japan is currently trading at 12.3x price-to-earnings, at the lower quartile of its historical range, and around 28% discount to MSCI US. US equities, though corrected early this year, are still above the upper quartile of its historical range.8

- We see the same from the price-to-book perspective, where MSCI Asia ex-Japan is at ~1.5x, and again towards the low end of its 5-year range.9

- Cheap valuations could further emerge as a catalyst for Asian equities given continue reopening of the economies and relative lower inflationary pressure.

Source: FactSet data as of 31 August 2022.

Relative P/E of Asia vs US refers to Price-Earnings ratio for the next 12 months of MSCI Asia ex Japan vs MSCI US.