Insight

China economy and equity market outlook in 2025

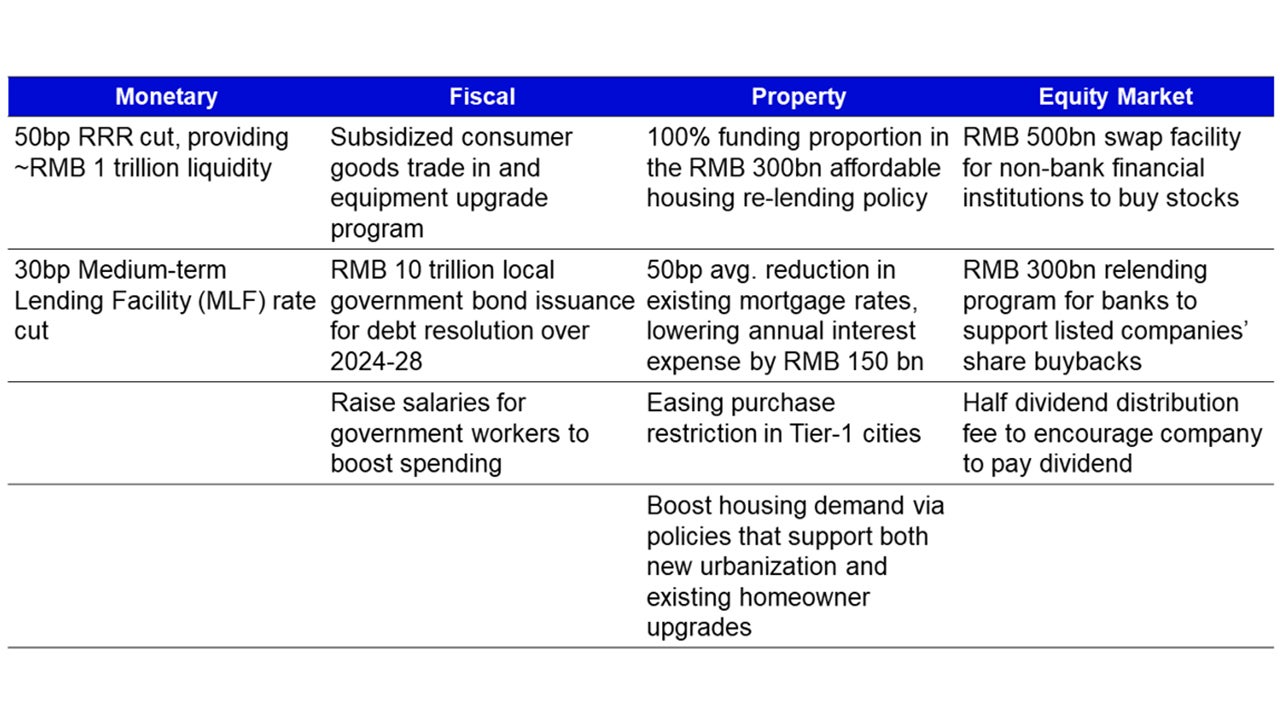

Overview of 2024 Policies: Sustained Economic Support

- We observe continuous policy support from the government, which is important as it demonstrates the government’s ongoing efforts to boost market sentiment.

- China’s Politburo last month announced that monetary policy will shift to a “moderately loose” stance, from the previous “prudent” approach - the first time in 14 years.1

- The policies so far have been supportive and gradual, benefiting the broad-based economy, including sectors such as property, consumption, and the stock market.

Key easing package announced lately

Source: PBOC, NAFR, CSRC, Bloomberg, Reuters, Goldman Sachs, 6 Jan 2025

Anticipating More Supportive Policies and Broadening Consumption in 2025

- Looking forward, we believe there will be more policies announced and implemented.

- Continuous monetary and fiscal easing policies are expected, including gradual policy rate cuts and RRR reductions. Market anticipated that the fiscal deficit could increase from 3% to 4% of GDP, a significant change from the past.2

- Consumption support is broadening, not only during festive seasons or for particular industries.

- For example, last year’s trade-in policies for small electric appliances and home appliances were successful.

- The expansion of the consumer trade-in program in China to include smartphones, tablets, and smartwatches is anticipated to boost consumption. Last year, the campaign resulted in 920 billion yuan in auto sales and 240 billion yuan in home appliance sales.3

- We also see domestic and overseas travel returning to normal as evident in previous National Day holiday.

- More and various sectors are benefiting from the mild recovery in the property market, and we believe consumer sentiment will be on the right track for recovery. Additionally, market sentiment is changing with the improving economy, a more stabilized property market, increasing shareholder returns, and an increasing wealth effect.

Chinese equities - Policy support has emerged as a powerful catalyst

- Stimulus measures: Continuous stimulus measures are expected to have a more meaningful impact on economic recovery.

- Dividends and buybacks: In 2024, listed Chinese corporates returned nearly RMB 3 trillion to shareholders through dividends and buybacks, it is expected to increase further in 2025.4

- The capacity for Chinese corporates to return cash to shareholders also appears strong given their high cash balances (relative to market cap) and increasing dividend payout ratios. We expect that increasing dividend payouts and share buybacks will support investor returns and the equity market.

- Valuation: Chinese equities remain attractive from a valuation standpoint, trading at relatively low levels compared to historical averages and other developed markets.

- Ample investment opportunities: The large domestic market in China provides deep and vast potential investment opportunities for investors to consider.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.