China Q2 Economic Review and 2H Outlook

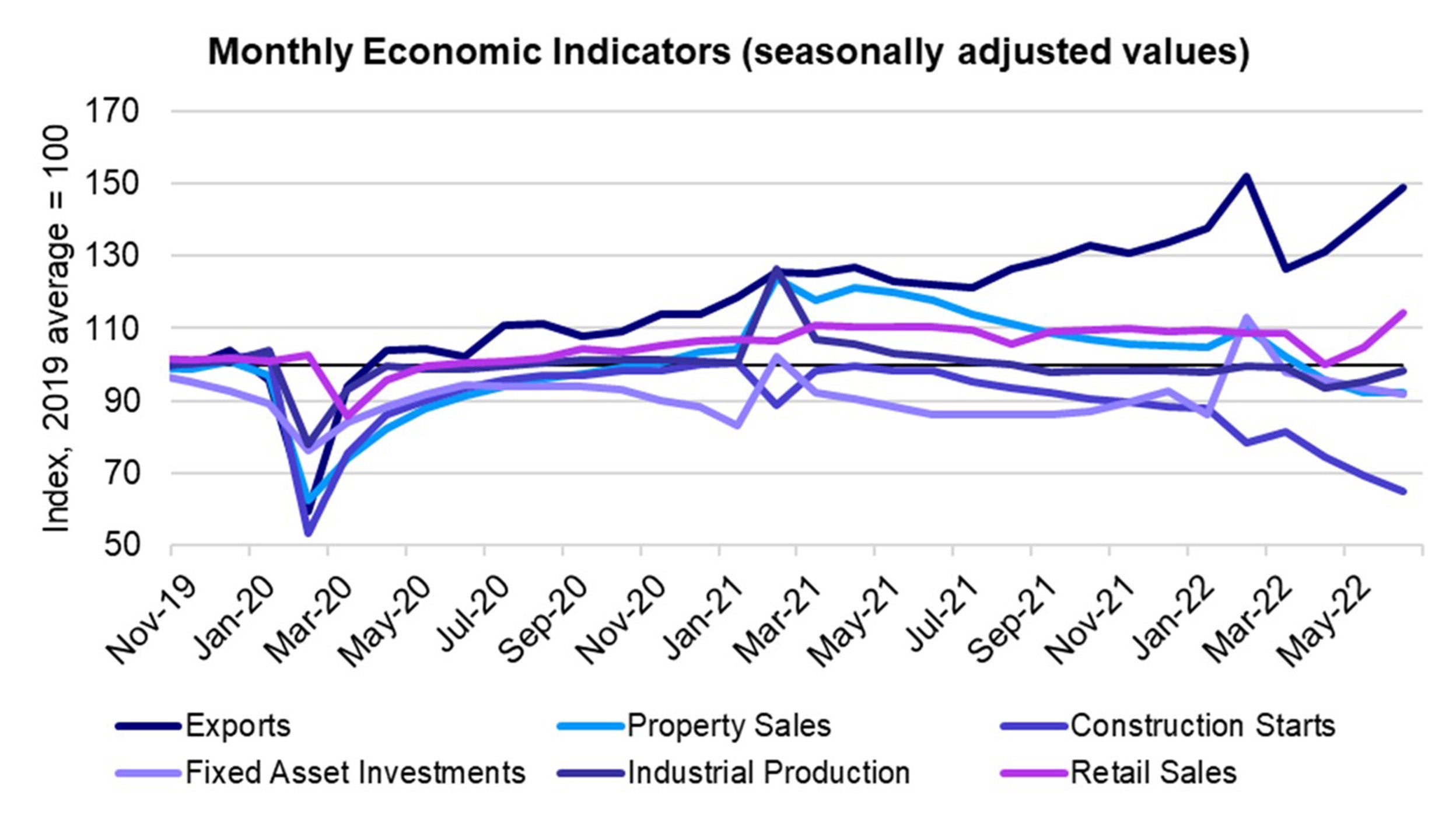

After posting a disappointing Q2 GDP growth of 0.4% y/y,1 the most recent June monthly economic data showed a measured rebound in commercial activity as COVID restrictions eased.

During the quarter, household consumption took the biggest hit – retail, property sales and construction activity fell as sentiment deteriorated, though on the positive side, industrial production, exports and infrastructure investment and manufacturing capex investment gathered steam.

I continue to expect a 2H economic rebound, driven by COVID restrictions easing and further policy support. I surmise that commercial activity has already seen a bottom and that the economy is likely to show strong sequential growth in Q3 with even stronger growth in Q4.

Growth Propellers in 2H - COVID Measures Eased & Refined

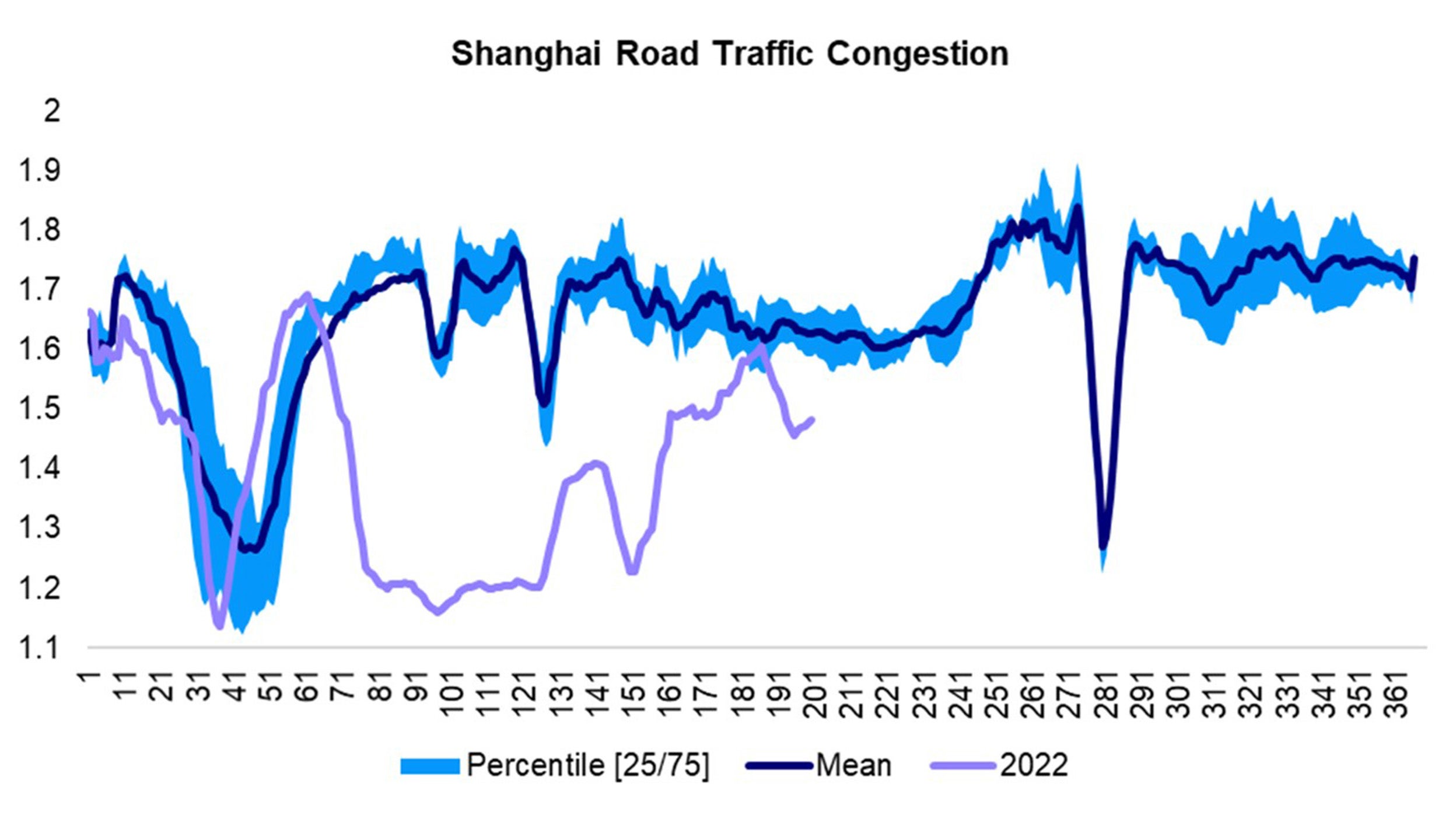

There have been recent COVID flare-ups across China from the new BA.5 sub-variants and mobility restrictions have been resumed in certain places, though overall these current measures pale in comparison to the ones we saw back in April.

Source: China Ministry of Transport and Invesco. Data as of 19 July 2022.

This continues to be my baseline – that China’s COVID policy is likely to become more refined, targeted and nuanced in order to avoid city-wide lockdowns like the one we saw earlier.

This could mean the restrictions and quarantines are shorter in duration and have less of an impact on transport and logistics. There could be a more streamlined approach towards health data across the provinces. COVID’s path remains mercurial so the strength of the reopening could be limited.

Ultimately, I expect COVID measures to be less restrictive in the 2H and that there could even be a near-term consumption boom from the pent-up demand in Q2.

Growth Propellers in 2H - Supportive Monetary & Fiscal Policies

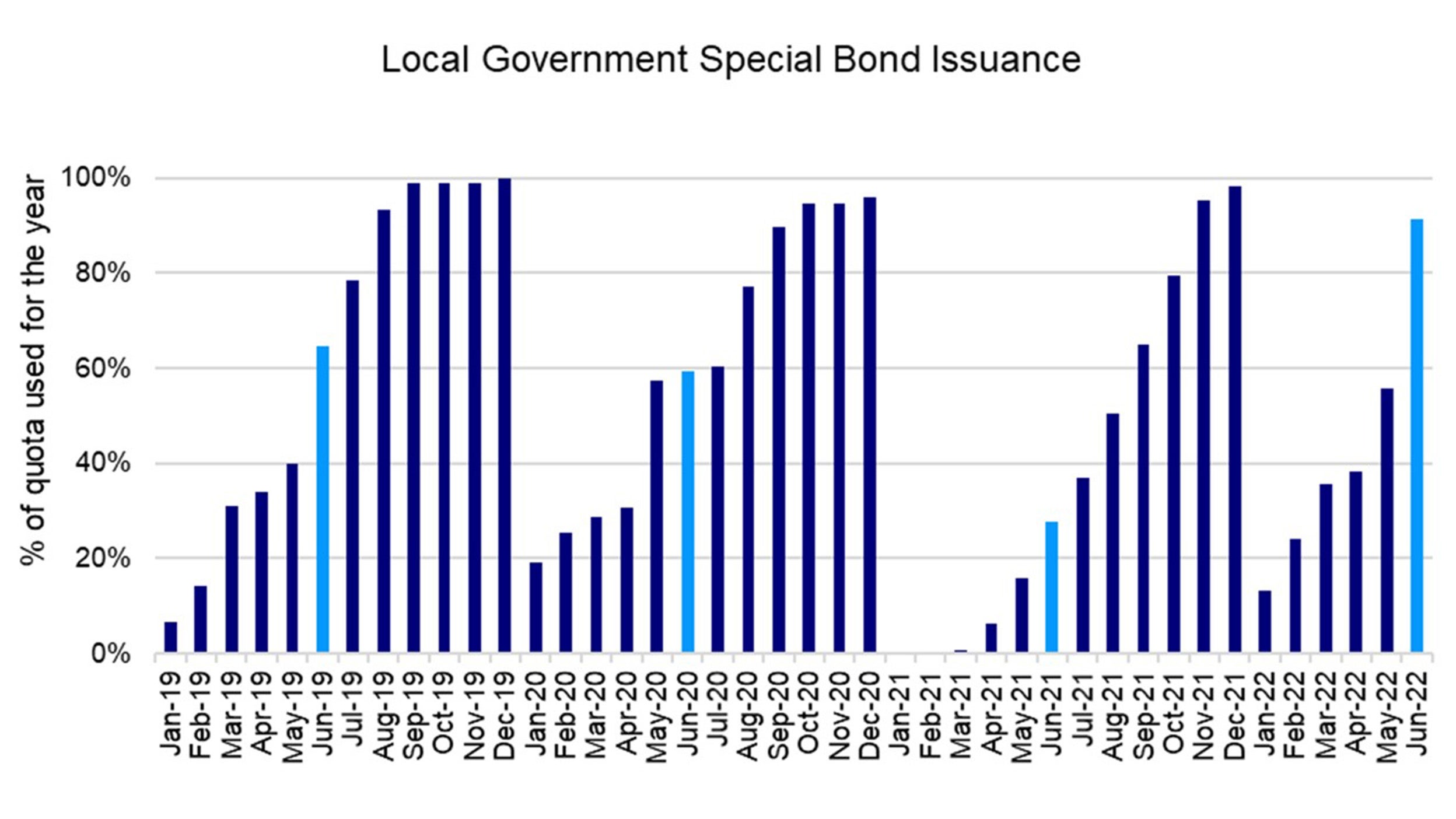

During Q2, policymakers intensified monetary and fiscal stimulus measures to stabilize the economy though the impact could take a few months. We have seen a record amount of local government special bond issuances (LGSB), around RMB 2.5trn more than last year or around 90% of the entire year’s quota.2

Source: China Ministry of Finance, China National Development & Reform Commission (NDRC) and Invesco. Data as of June 2022. Note: Light blue line shows % of LGSB quota used by June each year.

Much of that raised capital hasn’t yet been deployed, though I suspect project approvals will be accelerated and most of the capital will be used to support infrastructure investment, EV, alternative energy, high-tech manufacturing and other sectors that receive broad policy support as well as some property easing policies.

Policymakers clearly want to support growth, though it’s unlikely they will do so at all costs. It’s possible that in the 2H, policymakers could ramp up further fiscal stimulus as high as RMB 1.5trn through front-loading next year’s bond quota through special financing vehicles or the policy banks. We should find out soon in the upcoming politburo meeting.

Growth Headwinds - Property Market Woes

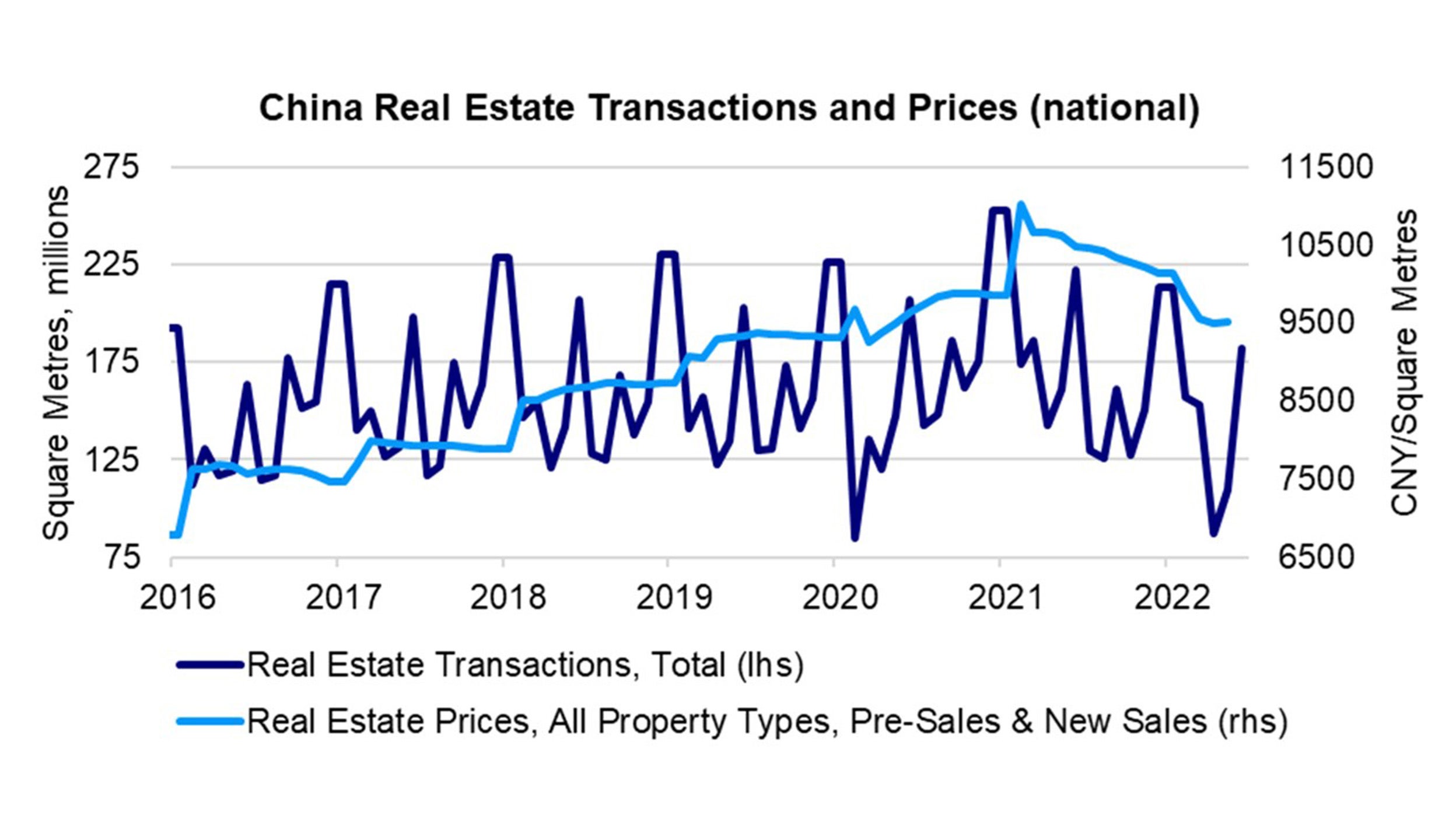

On the other hand, storm clouds have gathered recently for an already unloved asset class. COVID restrictions hit the sector hard in April and in May though June saw a rebound in property sales and stabilized prices. That has all changed in the first weeks of July, as sales have fallen substantially as sentiment sours.

Recently, a large number of homebuyers in China have boycotted paying their mortgages for unfinished units. This is serious problem that may fan the systemic risk flames to other sectors, such as banks and the developer’s suppliers.

Source: China National Bureau of Statistics, SouFun-CREIS and Invesco, as of June 2022.

Estimates are as high as 20% of existing property projects could be affected by the boycott, based on weekly steel re-bar production (used to gauge the number of projects that have been suspended).

While there aren’t any clear solutions yet and policymakers remain in a monitoring mode, I believe the government has the tools to ensure these risks don’t spread to the financial system.

Policymakers are likely to strongly encourage consumers to pay their mortgages on time less they risk legal action from the banks while also providing more liquidity to developers to restart dormant projects without violating the 3 red lines of financing leverage.

Global Macro Risks

Growth is slowing in most other parts of the world and recessionary risks run high. The EU and the US are China’s largest trading blocks and these regions could be further disrupted from persistently high inflation and further energy supply risks.

Source: China National Bureau of Statistics (NBS), China General Administration of Customs (GAC) and Invesco. Data as of June 2022. Note: Seasonally adjusted X-11.

It’s possible that 2H exports could slow to mid-single digit y/y growth from the +17.9% y/y seen in June.3 Still, China is somewhat insulated from hawkish Fed, as the PBOC continues an easing cycle and consumer price inflation remains benign.

Investment Implications

While I remain overweight regionally on China and prefer onshore equities - which I believe can claw back some gains in the 2H given the rebound and strong earnings growth for 2023 - risks remain and may have intensified in the near-term due to recent property market woes.

It’s possible that Q2 corporate earnings could miss expectations and that overall CSI 300 earnings estimates for 2022 need to be ratcheted down to around 0% y/y, though investors may start to position themselves ahead for 2023 earnings growth, which is expected to be +15% y/y.