China’s COVID outlook – market volatility to persist in short-term; policymakers to deploy more effective and targeted policies

Recent news of the Omicron variant spreading into China’s capital city Beijing and the resulting lockdown of an area on the eastern side of the city have led to domestic market jitters.

Local residents in the area have been asked to stay at home until 27th April, until two mandatory mass COVID tests have been completed. As much of Shanghai remains under lockdown, fears are growing that the variant could lead to further supply chain disruption across China and impair business and consumer sentiment.

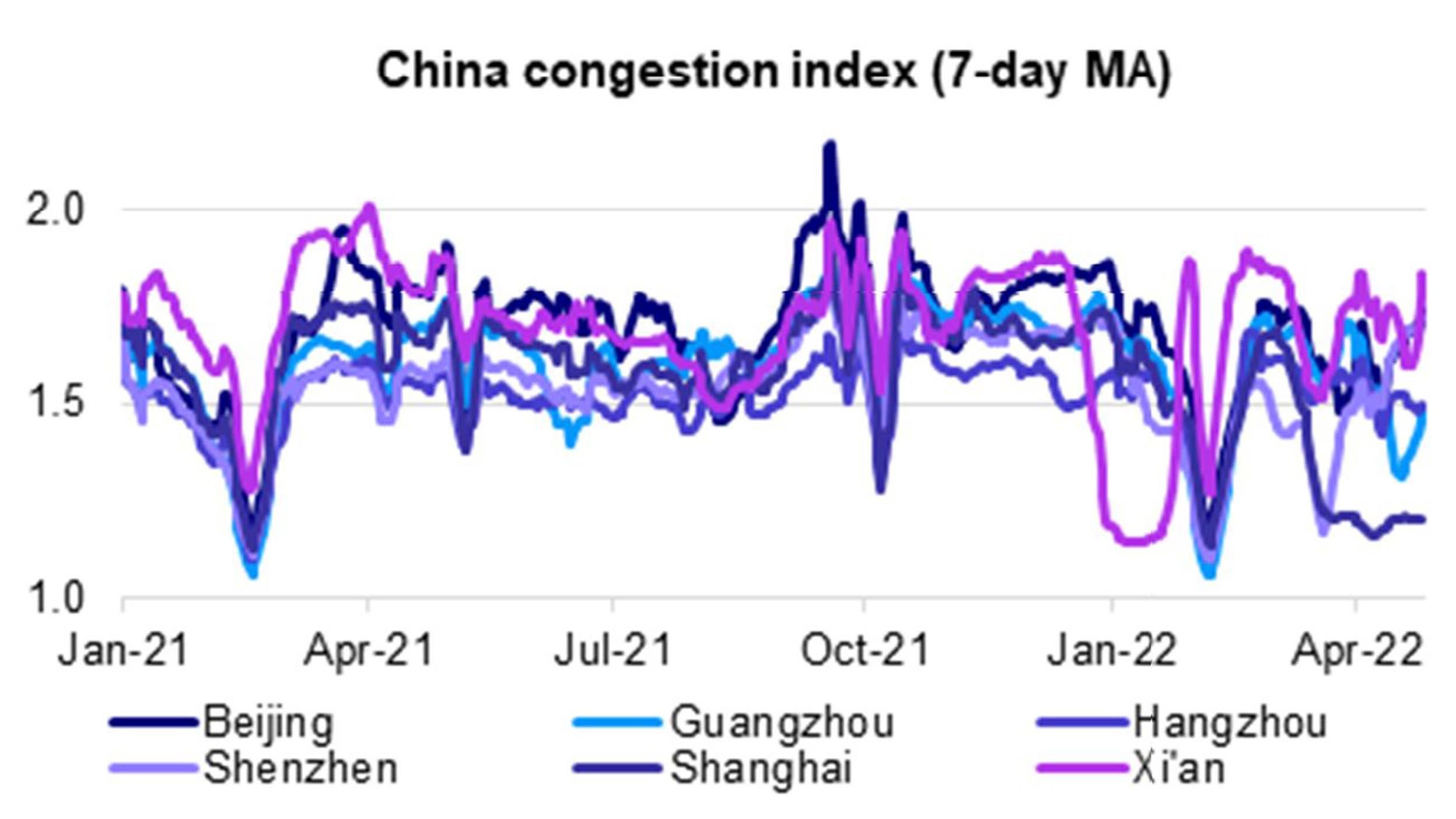

Source: China Ministry of Transport. Data as of 25 Apr 2022.

Market sentiment is understandably weak as the economy is facing headwinds that have led to recent economic and earnings markdowns. For Chinese risk assets, I believe there could be further near-term COVID-related volatility. It’s important for investors to remember that we have seen this Omicron wave hit every major economy before and I expect China to get through this wave of infection and for the market to recover perhaps even before the peak of infections has been reached.

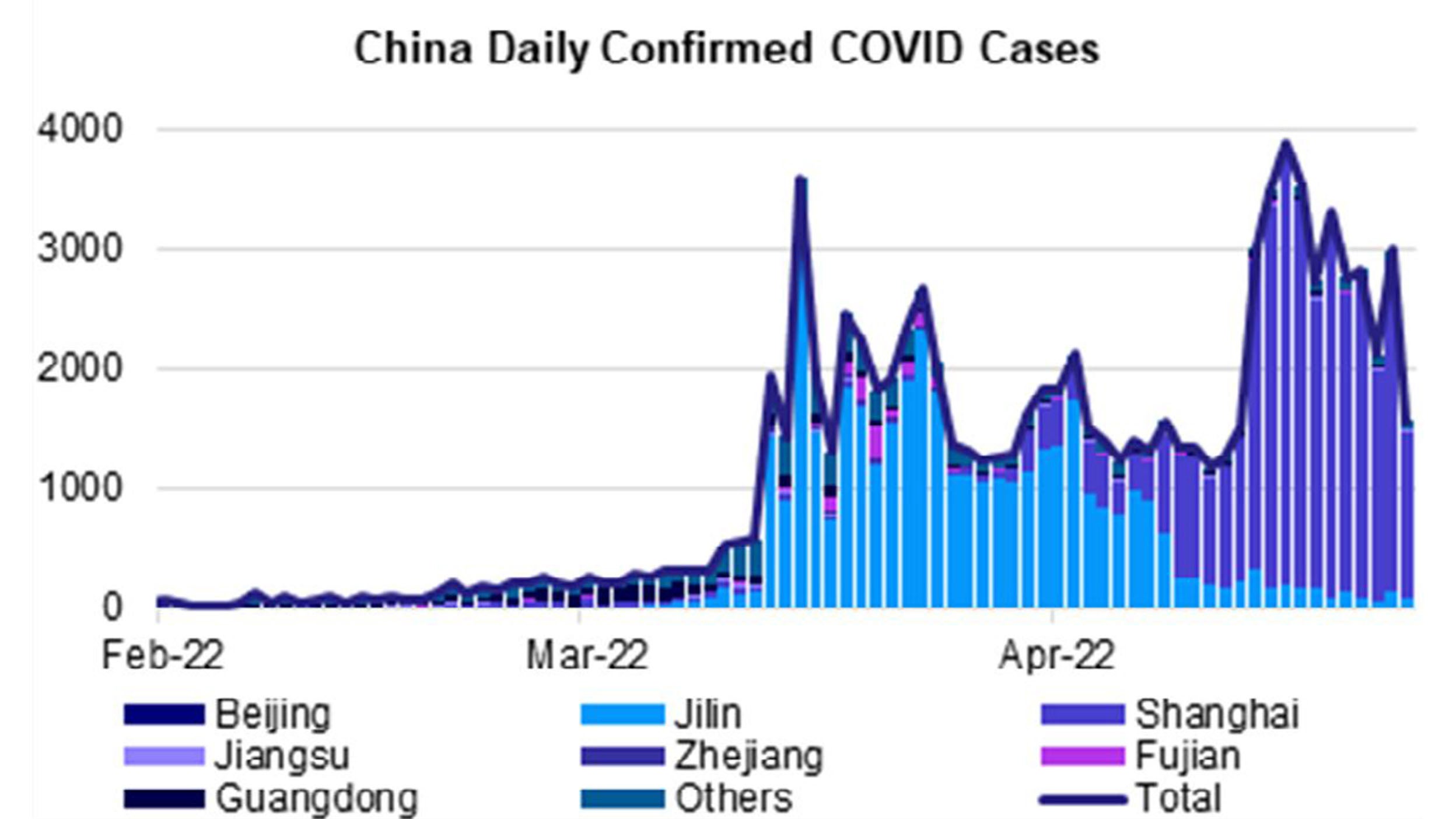

Source: DXY (Lilac Garden Family Clinics) and China National Health Commission. Data as of 24 Apr 2022.

Investment Implications

Despite the recent market downdraft, I believe that domestic investor sentiment could be nearing a bottom. Looking at the recent trading data, the A-share average daily turnover rate was only 1.2%i last week and margin trading is at significantly lower levels now when compared to 2018’s A-share market rout.

This implies that the chances of forced selling and another downward leg to Chinese stocks are relatively low. Recent outflows have mainly been in cyclical stocks from retail and hot money investors whereas institutional flows have been inactive

From a valuation point of view, the top 100 Chinese stocks held by mutual funds are now trading at forward P/E levels not seen since 2010. As of 22nd April, the forward P/E of the CSI 300 indexii is now at the 25th percentile since 2010 and the CSI 500 indexii is at the 3rd percentile.

Even though geopolitical risks and China’s COVID situation may deteriorate further before getting better, I believe that the path towards recovery has already been laid with more monetary and fiscal policy support that should stabilize growth fundamentals.

Policymakers could deploy more effective & targeted policies

Looking at Omicron and new infections data in other parts of the world, it’s feasible to think that the current wave of infections could start to subside in a matter of months and that policymakers could deploy more effective and targeted policies going forward.

Most assets are still finding their footing in this market, including Chinese Government Bonds which are seeing their yield premium over US Treasuries evaporate due to divergent monetary conditions.

At current valuations, A-shares are starting to look relatively attractive, especially for longer term investors that can stomach a bit of near-term market volatility.

Equity investors may consider to start building positions in sectors that receive policy support, such as alternative energy, electric vehicles and high-tech manufacturing.

For fixed income investors, policymakers are likely to ramp up more fiscal stimulus, which means that there could soon be more opportunities in debt issued by financially sound local government financing vehicles.