China’s recent COVID situation and policy easing

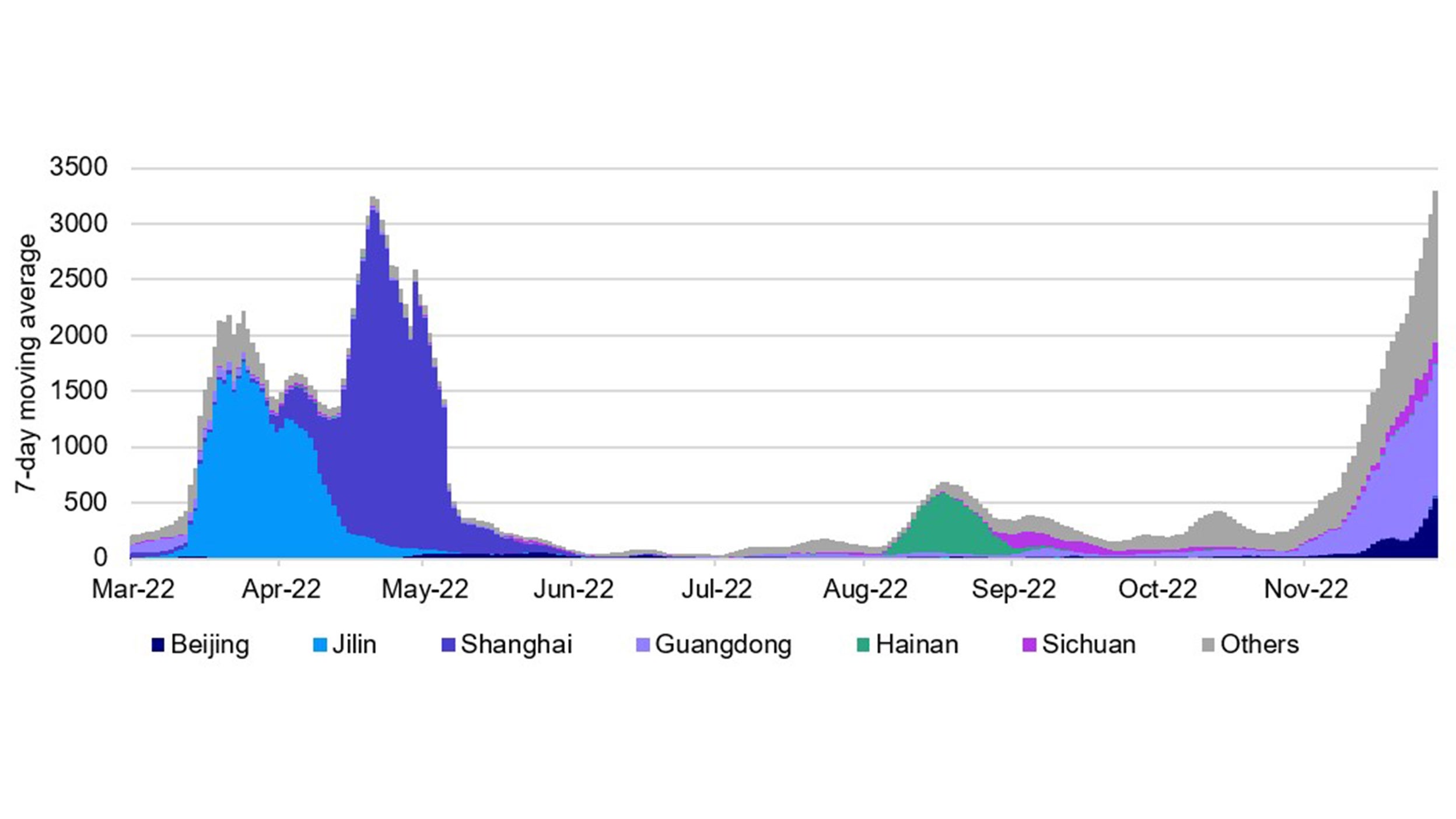

China is experiencing a record wave of Covid infections which appears to be plateauing at around 40,000 daily new cases. Estimates suggest over 20% of China’s total GDP is now under lockdown, close to the previous peak in April.1

The lockdown policies have been met with sporadic social disturbances and protests, pressuring policymakers to speed up the country’s reopening.

The big question is whether the recent infections wave and demonstrations are going to push policymakers to resort back to stringent lockdowns across the country or shift towards a more discretionary, targeted policy.

The economic costs of China’s zero-COVID policy are well known and tolerated to a certain degree by policymakers though I believe the policy’s impact to social stability is a new variable that could expedite the pivot.

Policy actions in the face of Covid surge

Beijing’s policy decisions are not made in an ivory tower – and it’s apparent that the party genuinely tries to respond to the people’s concerns as it prioritizes social harmony above all else.

For example, the recently announced 20-point fine-tuning measures make clear that Beijing is looking to pull back from sweeping lockdowns to a more targeted approach – though it could be a tricky juggling act for local officials to balance softer restrictions along with suppressing the spread of infections.

Case in point, this latest wave is very concerning given the infection’s spread across economically and politically important cities - Guangdong, Chongqing and Beijing being hit hardest – though policymakers have so far resisted a Shanghai-style blanket lockdowns.

Source: DXY (Lilac Garden Family Clinics), China National Health Commission and Invesco. Data as of 22 November 2022. Note: Daily confirmed COVID-19 cases totals exclude asymptomatic cases.

Still, stricter curbs such as the suspension of non-essential services, shutting down of public venues and requirements of negative test results for public transportation have been put in place.

High frequency mobility data suggests that economic activity is being constrained again. Subway ridership in hard hit cities is close to zero and traffic congestion indices are down 20% year-over-year.2

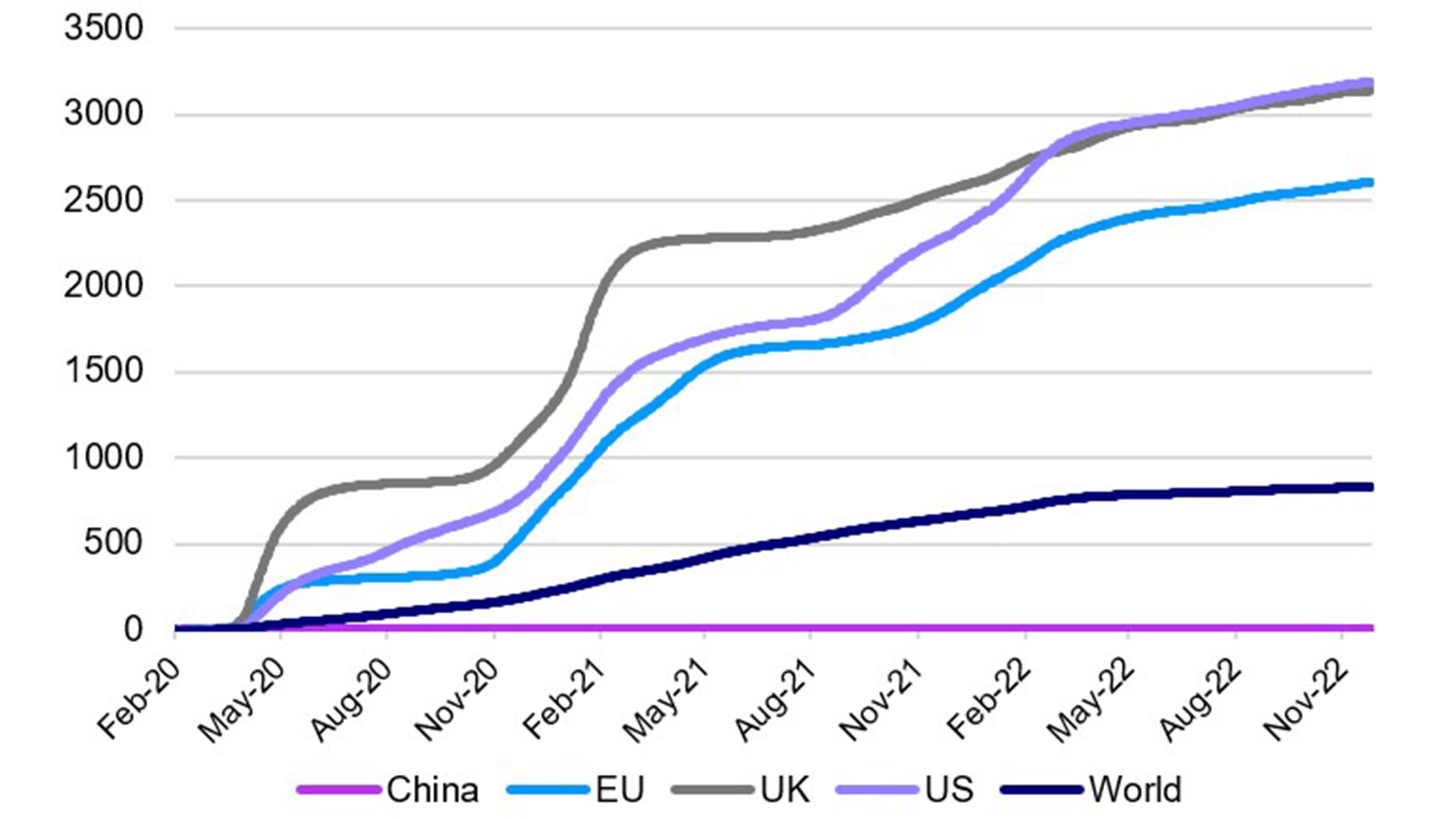

We expect a similar situation to previous waves where industrial activities remain relatively more stable and retail sales is hit hardest. The number of cases and deaths in China remain low when comparing the historical trajectory of Covid spread in other major economies.

China’s leaders have emphasized that they have prioritized saving lives over economic growth – if China had the same cumulative death rate as the US, there could have been as many as 4.5 million COVID-related deaths vs. the 5,232 that have been reported.3

Source: Johns Hopkins University, Our World in Data and Invesco. Data as of 26 November 2022.

The path to China’s gradual reopening

We have long maintained that China’s gradual reopening would likely be preceded by 1) another vaccine campaign targeting seniors and 2) a shift in the COVID messaging.

This week, China’s National Health Commission announced another vaccine campaign for seniors and we are closely watching to see how policymakers may start to convey an evolved pandemic message to the public.

Chinese equities as of date 29 November 2022, remain volatile and have seen daily swings as much as 5% in recent days. We believe that investors are already starting to see the light at the end of this long Covid tunnel in China.

That said, recent history has shown that each major economy has hit snags and even chaos during the early stages of a reopening and the same could be expected for China.

Much is at stake; the timing and impact of China’s reopening is the most important market driver for commodities and equities in the APAC and EMEA region.

Despite near-term market volatility, we are more optimistic about Chinese risk assets for 2023, given low valuations and as the economy experiences a cyclical upswing led by household and business spending from a controlled reopening next year – as we have seen in other countries.

China’s recent policy easing

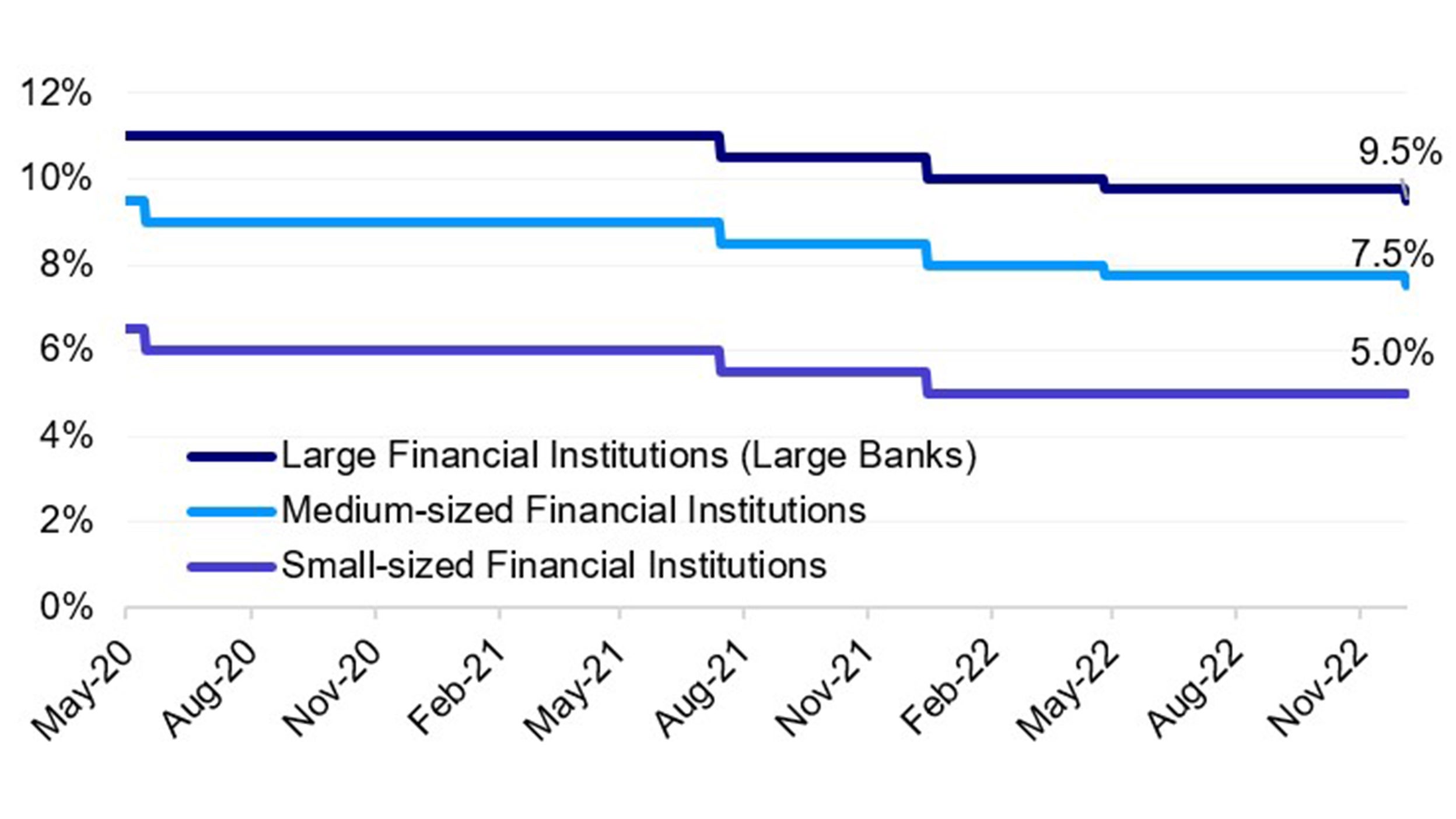

The People’s Bank of China (PBoC) has cut the reserve requirement ratio (RRR) by 25bps for large and medium-sized institutions, effective 5 December 2022.

The move was largely in line with expectations as markets have been anticipating a cut to the RRR and other monetary instruments based on the recent State Council’s statement and signaling by policymakers.

According to the PBoC, the 25bps slash to the RRR will release long-term liquidity of about 500 billion RMB into the banking system.

Source: PBoC. Data as of 29 November 2022.

The timely policy easing decision comes on the heels of near-term growth pressures from the latest Covid restrictions and resultant suppression of economic activity.

Though the net impact is still contingent on the rollover of maturing medium-term lending facility (MLF) loans next month, the decision is significant in its signaling that the PBoC is attentive to the economic challenges and keen to ensure adequate liquidity and ample credit support to bolster the economy.

Economic Implications

The move was likely partially aimed at the still ailing property sector and should potentially boost lending to large private property developers. A key priority for policymakers is for developers to have sufficient financing to finish uncompleted projects.

Small and medium-sized enterprises (SMEs) are also being targeted as the recent State Council meeting hinted that banks are being guided to disperse more loans to SMEs.

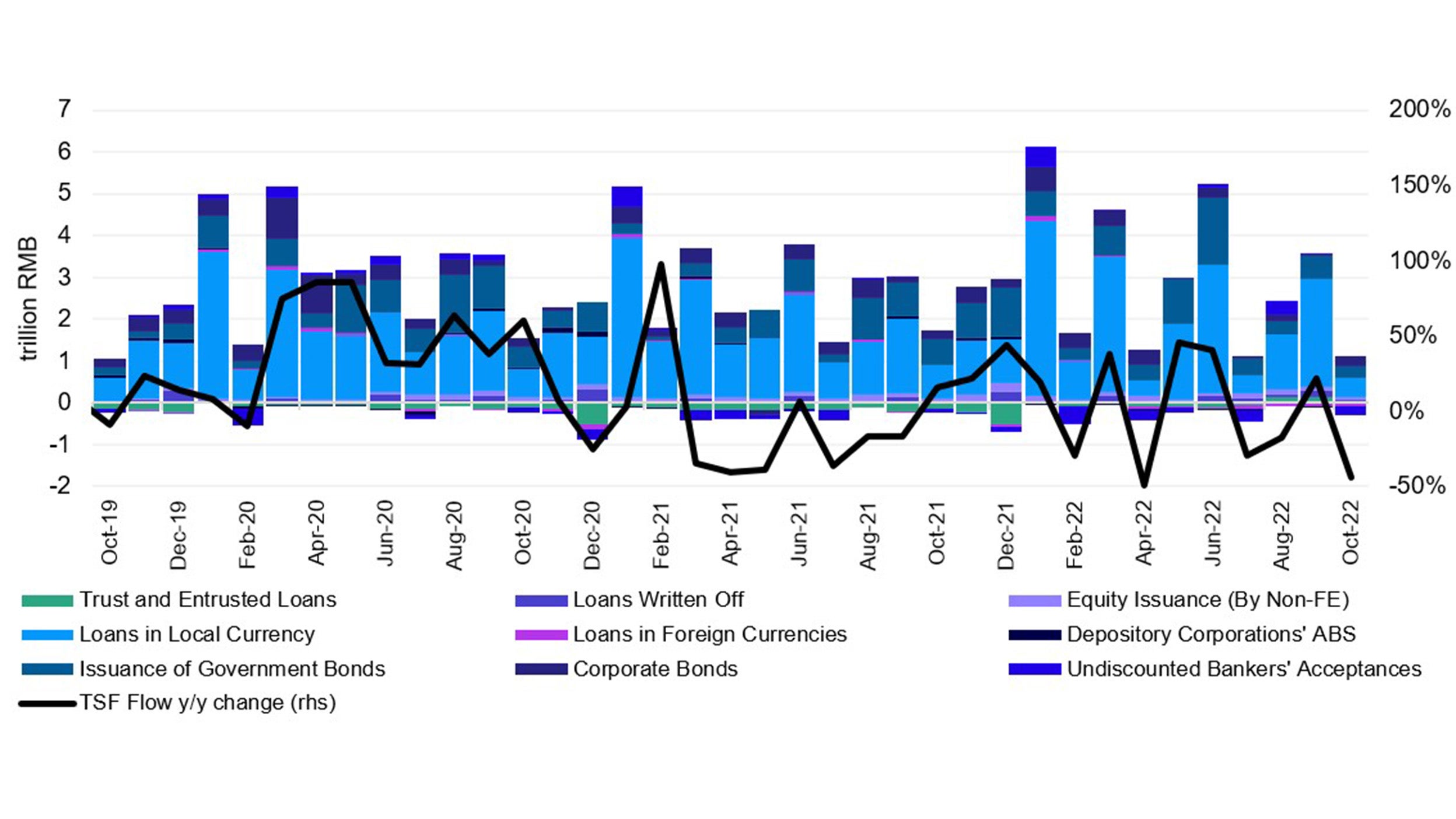

We are cautious of being overly optimistic. Genuine credit demand is still weak and is likely to remain so until we see a full economic reopening and greater clarity on the Covid exit path – likely coming sometime after the “2 sessions” next year.

Total social financing (TSF) composition was weak in October and missed expectations by a large margin. New RMB loans were down 26% year-over-year driven by weak demand from the retail side.4

While policymakers have been encouraging further lending, bank managers are more prudent after a tumultuous year and will likely impose restrictions when extending loans.

China is moving at odds with the US and other economies – easing at a time when elevated inflation is forcing continuous rate hikes from major central banks.

The scope for further easing policies may well be limited going into 2023. The PBoC is forward looking and has warned that inflation may accelerate, citing global energy concerns and the fast growth in M2 money supply, and we may well be looking at a more controlled easing approach from here on.

Source: People’s Bank of China (PboC). Data as of October 2022.