Key Takeaways from US March CPI data

March was not a good month for inflation. According to the Bureau of Labor and Statistics, core CPI for March came in at 0.359% m/m versus consensus estimates of 0.3% m/m.1

Sticky inflation appears to be back in the US economic lexicon – which is certainly not what market participants want to see.

Because March is the first “clean” CPI report for this year since the reacceleration of core CPI in January and February could largely be explained by seasonal adjustments, so the “hot” March print is particularly vexing.

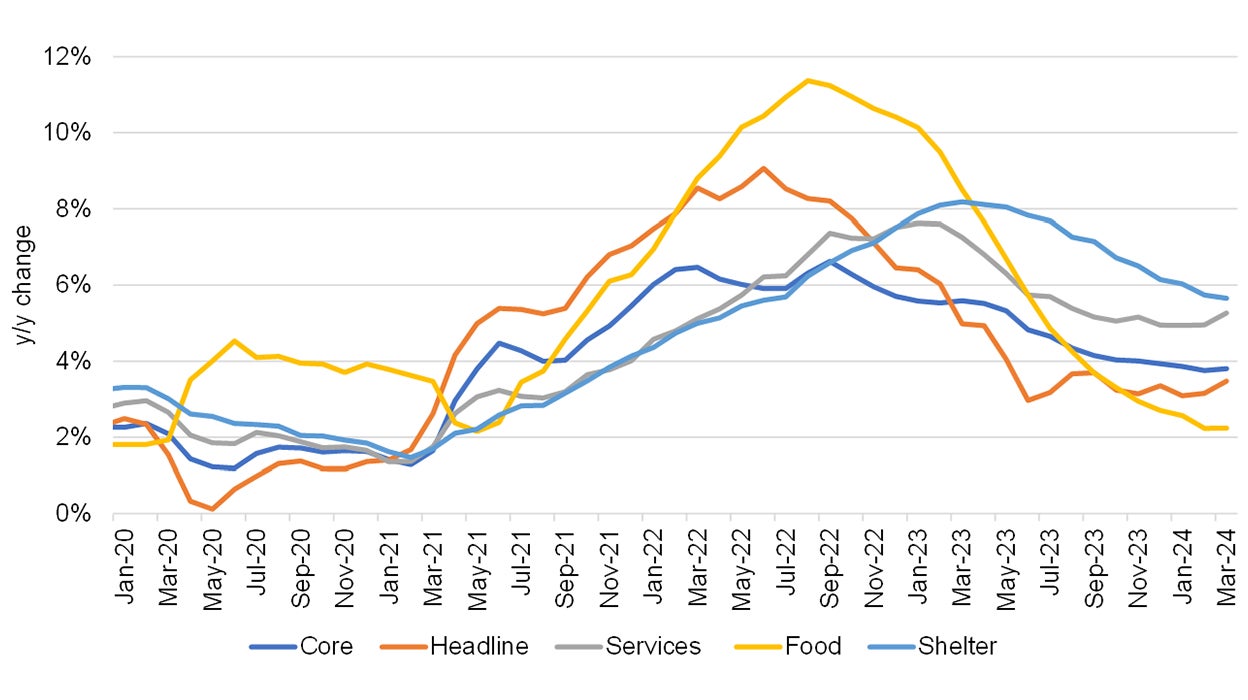

Source: U.S. Bureau of Labor Statistics (BLS). Data as of March 2024.

The stronger inflation came from non-shelter services prices

Let’s take a closer look at the March report. The stronger inflation in the month came from non-shelter services prices, which rose 0.65%, and came from categories such as car insurance inflation, car repair inflation and medical services.

These components are the caboose -- reflecting what has already happened (higher car prices, higher shelter costs that are/will be declining).

Some of these costs reflect what has already happened, such as shelter costs and higher car costs – they’re considered caboose costs since they reflect what has already happened, and these costs have been declining overall.

Though there are other costs such as medical and other services, where it’s tough to know what they’ll look like in the coming months.

Still, the bulk of the “hot” print can be blamed on automobile insurance, which soared +2.58% m/m or 22.2% y/y.1

Overall, automobile insurance’s related contribution to growth and upwards pressure in March core CPI was +0.14% m/m1 and explains almost all of the upside versus consensus estimates.

Auto insurance is surging because auto prices and related repairs have gone up previously and I don’t believe that this broadly reflects broader inflationary forces at play in the economy.

The silver lining in March’s hot CPI print is that this is not PCE (personal consumption expenditure) data, which tells a better story of inflation dynamics and is the Fed’s preferred inflation gauge.

Tomorrow’s producer price index (PPI) report is likely to fine-tune what the PCE is going to shake out for March.

Investment Implications

In sum, it feels to me like the big picture here is that growth in the US has re-accelerated, the labor market has re-tightened and that disinflation seems to be stalling – with some risk that it could perk up (though subject to what core PCE looks like).

This could explain today’s dip in US equities and rise in the USD.

This could be an opportunity to buy the dip, if we get a sustained one, since it’s supported by the idea that stronger growth and employment are good for corporate earnings, as long as there isn’t evidence of accelerating wage growth – which we haven’t yet seen.

If the US continues to reaccelerate in growth and the employment market, with some risk of a reacceleration in inflation, the stronger USD could push the Bank of England and European Central Bank away from its recent dovish steer – though there aren’t as many signs of inflation accelerating in these places.

While I don’t believe this shuts the door completely on a June rate cut by the Fed, the odds have certainly diminished with a consistently strong CPI inflation trend in the US.

I wouldn’t be surprised if we start hearing more hawkish rhetoric from Fed speakers.

In any case, I still believe that strong growth is better for risk assets even without rate cuts than weak growth and falling inflation with rate cuts. Still, that would imply fewer cuts by the Fed complicating my weakening USD narrative and preference for EM assets.

With contribution from Kristina Hooper, Andras Vig, Thomas Wu

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.