Key takeaways from US October CPI print and China’s latest economic data

US October CPI Print

October’s CPI print in the US is certainly welcome news in the markets. There has been a nice downward reaction from the 10-year UST yield thus far and the USD has weakened.

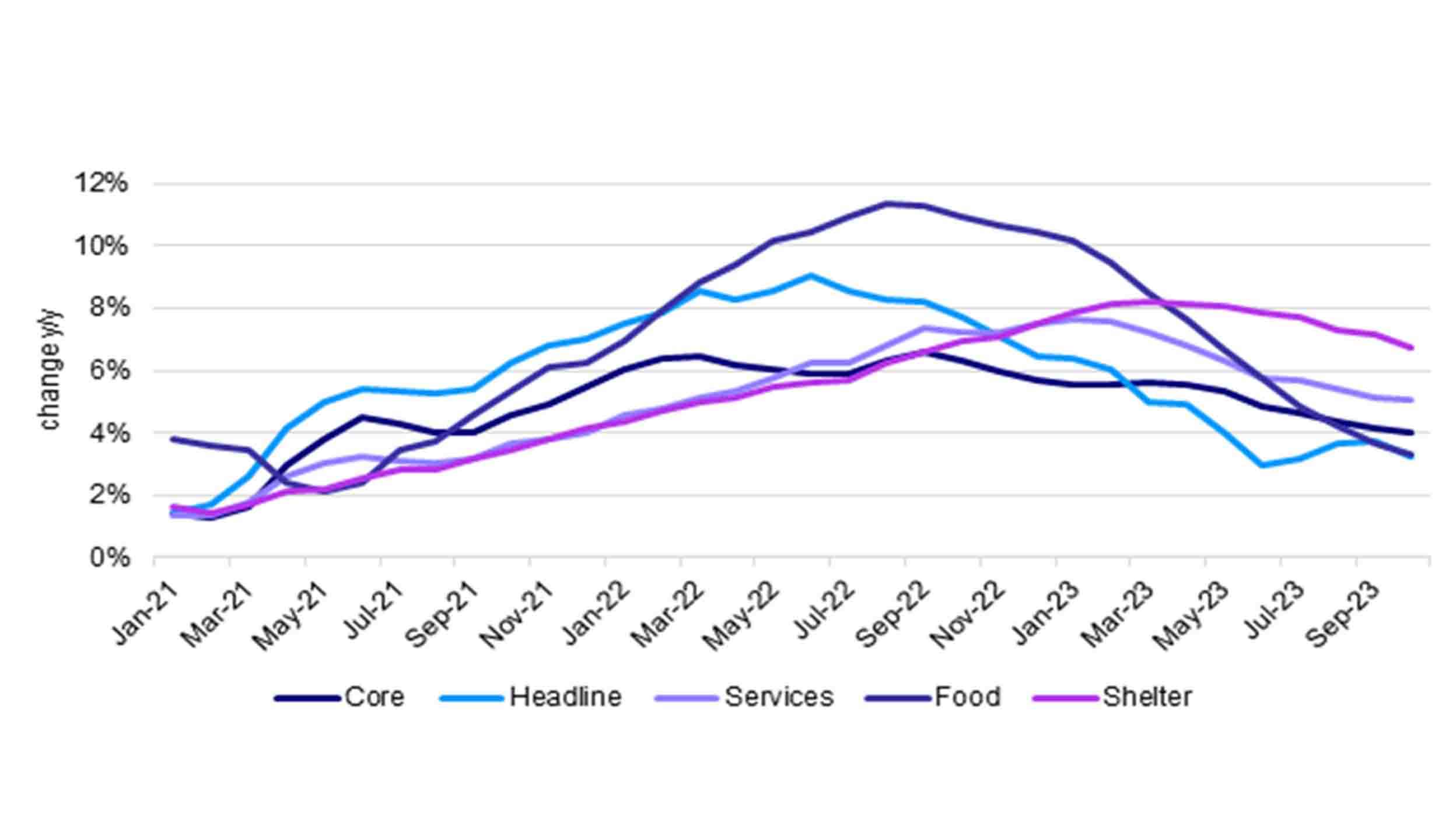

Core CPI is looking good and edged down to 4.0% y/y.1 Even ‘supercore’ CPI has eased nicely.

Source: U.S. Bureau of Labor Statistics (BLS). Data as at 15 November 2023.

When looking more closely at the data, it’s good to see food price disinflation and rent and owners’ equivalent rent still high, but also easing to 0.4% from 0.6% in the prior month.1

Health insurance premiums rebounded by 1.1% m/m but overall medical care services only rose by 0.3% m/m.1 This all suggests that disinflation is well underway.

And I expect inflation to continue falling in the coming months – aided by downward pressure on prices for used cars, rents and overall goods prices.

Recent manufacturing supplier surveys show that goods prices are falling due to falling delivery times which could mean that core goods inflation could soon be zero.

Investment Implications

I believe that October’s CPI print, which showed that core CPI only grew by 0.2% m/m, will obviously be strong encouragement for the Fed to not hike again.

But positive market reactions could well likely mean more hawkish rhetoric from the Fed in the coming days in an attempt to tamp down those animal spirits.

China monthly economic data

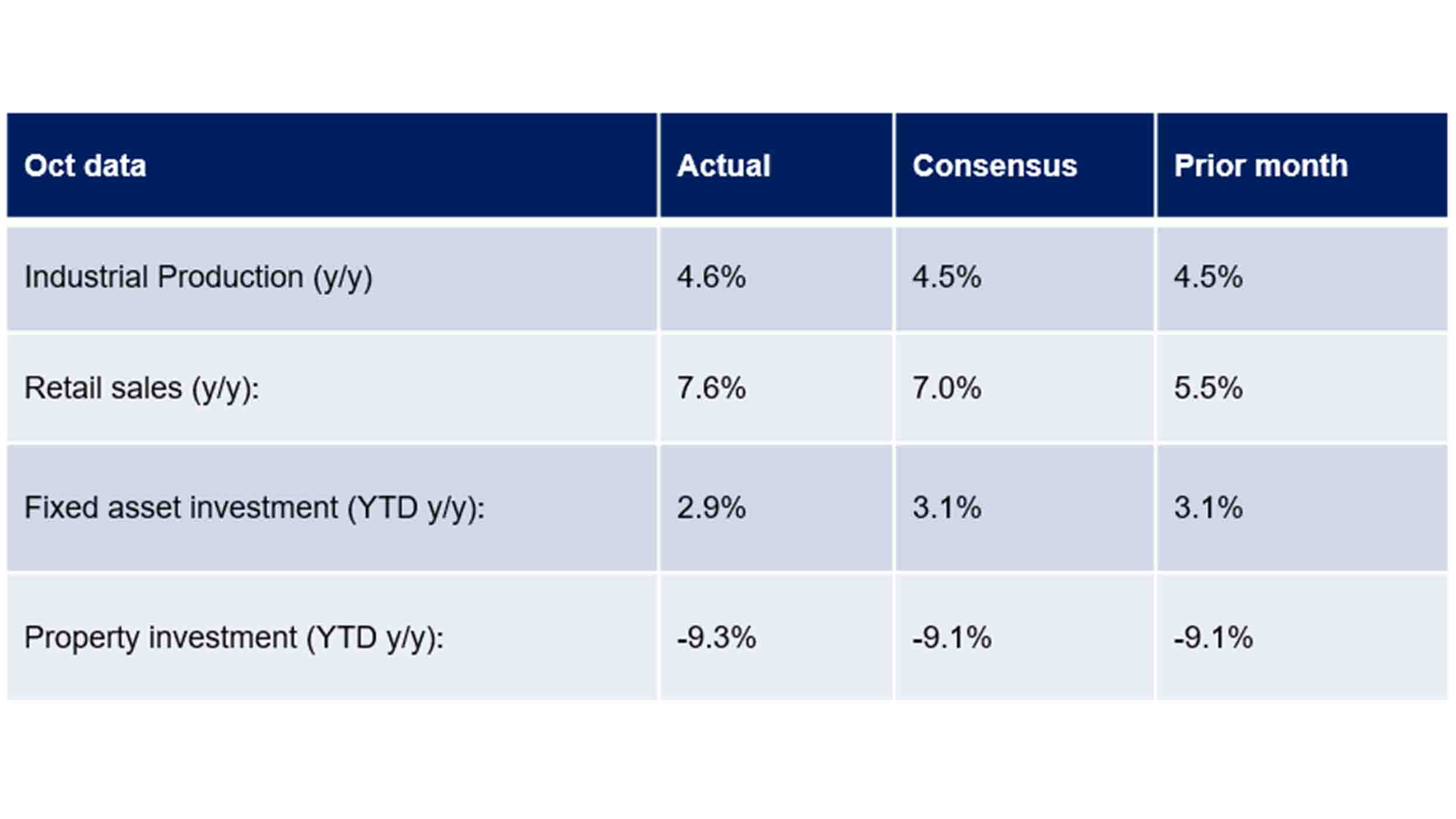

China’s October monthly economic data shows that two out of three growth propellers have largely stabilized, though the third and perhaps most watched propeller – property investments, continues to be weak and deteriorated slightly in the month.

Source: China National Bureau of Statistics and Bloomberg. Data as at 15 November 2023.

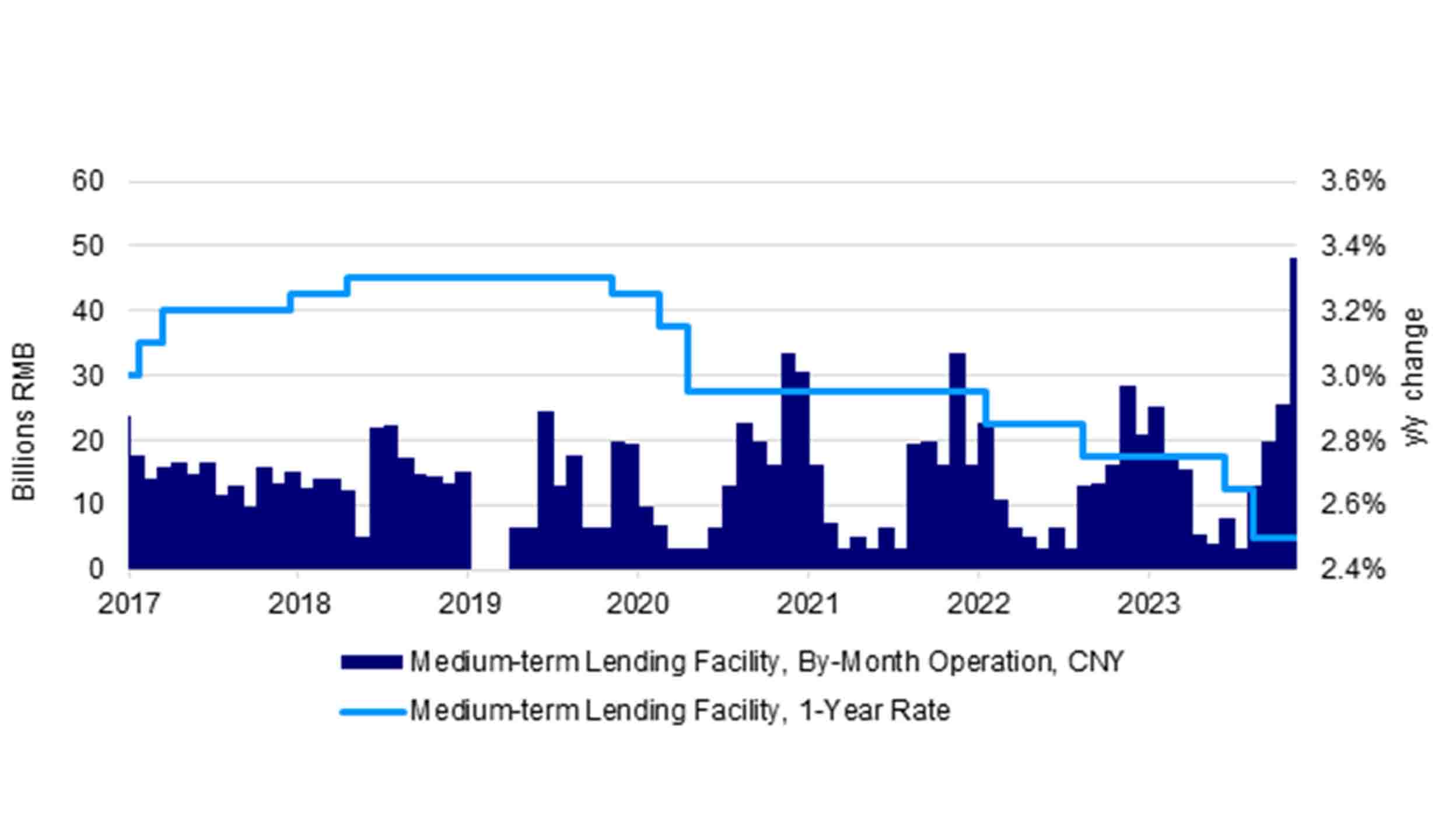

Greater China markets broadly cheered the data as it puts to bed investor fears of any near-term downward dip. The PBOC also pleasantly surprised the market with a net liquidity injection of RMB 600bn2, the most since 2016.

Source: People’s Bank of China. Data as at 15 November 2023.

While markets were expecting a RRR and even policy rate cut by the end of this year, this net cash injection is still a welcomed move on the back of the recent unconventional issue of RMB 1trn of sovereign bonds to support infrastructure investment.

After a strong economic rebound in Aug and Sept, the Oct economic data coupled with the surprise contraction in the Oct manufacturing PMIs and lower CPI print suggest that growth remains fragile.

Outlook

Even though China’s 5% GDP target for 2023 is squarely in the bag, I believe that more monetary and fiscal stimulus from policymakers may be in the offing as officials look to boost all growth propellers to more stable grounds heading into 2024.

Recent efforts by the government, such as the RMB 1trn pledge to provide low-cost financing to China’s urban village renovation and affordable housing could set a floor, at least for housing starts.

While I don’t expect this new measure alone to turn around the housing market, it certainly could be the catalyst to help solve the glut in supply in lower-tiered cities and sends another signal that the government is serious on tackling property market problems.