Nikkei 225’s historical high: What’s next for Japan equities?

On the 22nd of February, the Nikkei 225 Index reached an all-time high of 39,098.68, finally surpassing its previous peak of 38,915.87 from December 1989 when Japan enjoyed a stock market bonanza amid the asset bubble.

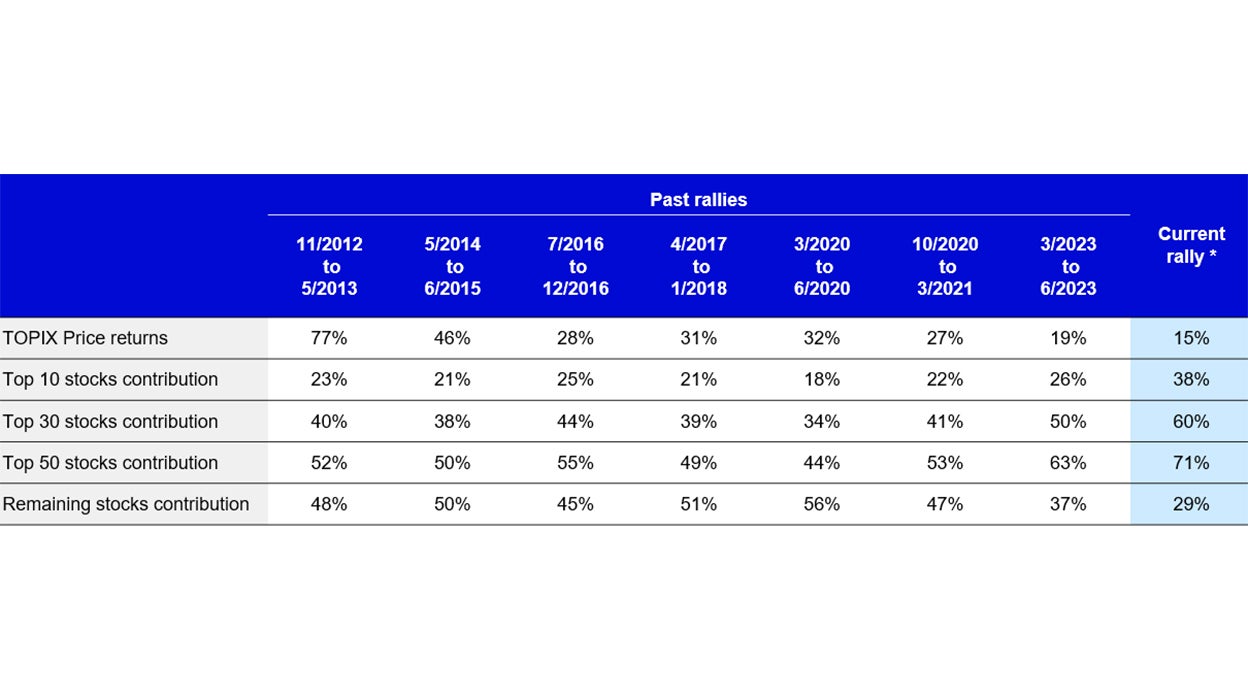

This time round the rally has been very concentrated compared to the past. The level of the TOPIX Price Index, which consists of a broad range of companies, was still 8% below the December 1989 peak. According to Goldman Sachs, nearly 40% of the contribution to the TOPIX Price Index return comes from the top ten names in the current rally (which started on 18 December). The concentration ratio is also much higher than in past stock market rallies (Table 1).

*From 18 December 2023 to 22 February 2024. Source: Goldman Sachs, FactSet. As of 22 February 2024. Past performance does not predict future returns.

Historically, a high concentration (particularly large caps), was typically seen in the early stage of the Japanese stock market when investors started to build positions using the stocks they were familiar with. If the current market rally continues, we believe the scope for stock selection is likely to widen, unearthing unique investment opportunities and prompting the rotation into laggards.

In this regard, we are constructive on Japanese equity performance in the medium to long term. Unlike 34 years ago, the current rise has been underpinned by the solid corporate earnings trend which was bolstered by Japan’s reopening, accommodative monetary policy support, and the resultant weakening yen. We’ve also witnessed structural developments on top of Japanese companies’ restructuring efforts to improve profitability after the asset price bubble burst in the 1990s. Goods price hikes which were initially triggered by a surge in import costs, have been progressing for the last couple of years and penetrating domestic service sectors. Thanks to these cyclical and structural tailwinds to corporate earnings, the current valuations of Japanese stocks remain reasonable compared to historical figures as well as to peers (Chart 1, Chart 2). We do not believe there are signs of overheating.

Source: Bloomberg. As of 31 January 2024

Source: Bloomberg. As of 31 January 2024

From a long-term perspective, considering the solid earnings combined with signs of corporate behavioral changes from a deflationary to reflationary cycle, we expect the influential “Shunto” spring wage negotiations to bring about another fruitful wage rise this year, creating a long-awaited wage-price spiral that could lead to sustained economic growth. More importantly, the Tokyo Stock Exchange’s geared-up efforts since last year are expected to support sustained capital efficiency improvement among all listed companies.

If we consider foreign investor flows, investors have now neutralized their positions (futures and cash equity combined) after selling off equity positions bought during the Abenomics rally in 2013 (Chart 3).

Source: Japan Exchange Group. As of 16 February 2024

At the same time, the recent increase in the Nippon Individual Saving Account (NISA) upon the scheme’s extension at the beginning of this year is likely to propel domestic household investment in the future, which we expect will also broaden and deepen the Japanese equity investor base.

While a near-term correction is possible given the pace of the rise, we believe that flows into Japan equities could be a multi-year trend. We expect investors, many of whom have started or will start to buy Japanese stocks, to seek broader investment opportunities and rotate to laggards to seek better returns, as earnings improvements have been rather widespread among listed companies.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.