Previewing Jackson Hole Symposium: Will the Fed cut rates more than what the market is anticipating?

We agree with markets that Fed rate cuts will resume and are around the corner. Inflation remains in check despite the recent tariffs and the most recent labor market data has shown some initial cracks.

The Kansas City Federal Reserve will host the 2025 Jackson Hole Economic Policy Symposium this week. The focus for markets will be on Fed Chair Jay Powell’s comments. Historically this meeting has been used by the Fed to signal policy shifts.

For example, at last year’s Symposium, Powell said that the “time has come for policy to adjust.” And then, 100 basis points of cuts followed during the rest of 2024.

Still, back in 2024, Powell’s comments represented a broader swath of the FOMC committee as most members expected two or three cuts for that year.

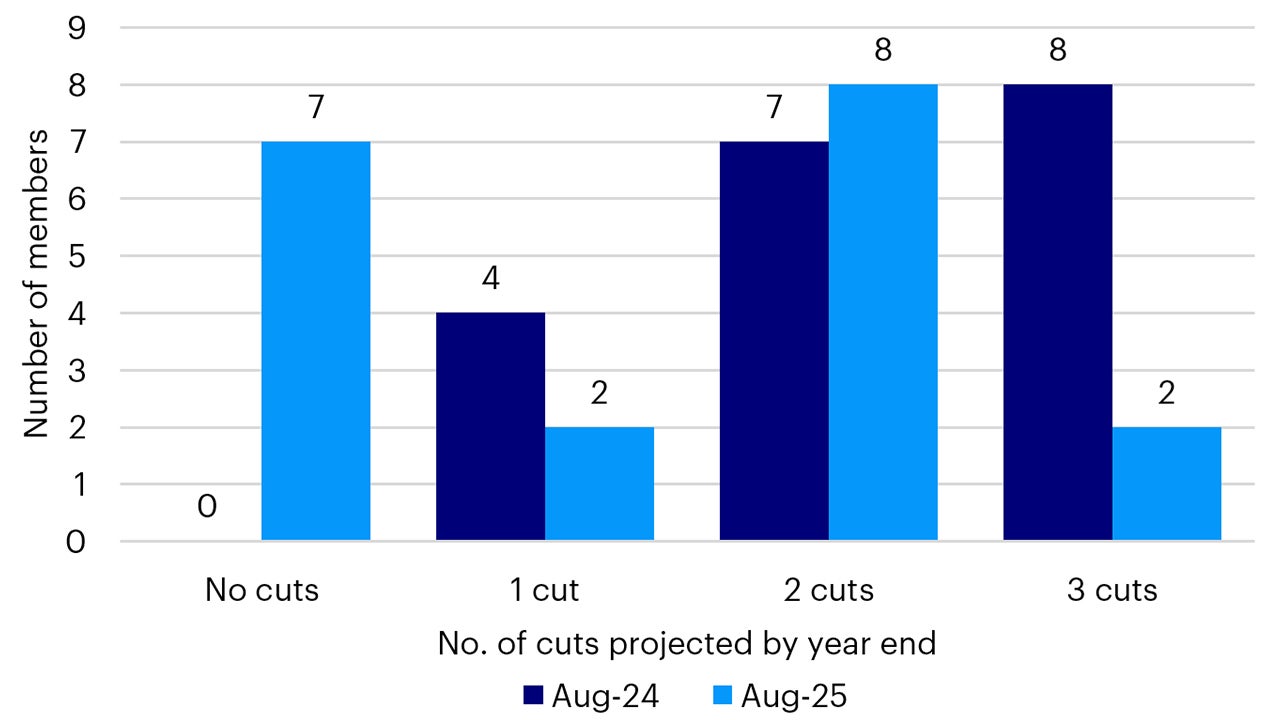

Fast forward to today, the dot plot now shows a much wider distribution of opinions, with seven members expecting no cuts, and just two members expecting three cuts for the remainder of the year.

While we should view the dot plot with a grain of salt as it’s been inaccurate in the past and significant revisions have occurred over the past year – our point is that the dot plot was a lot more dovish going into last year’s Jackson Hole symposium when compared to this year.

Source: Invesco, Bloomberg, as of 15 August 2025

In the just-released Fed minutes for the July FOMC meeting, there was no broader support for a rate cut beyond the two formal dissenters.

Although these minutes precede the weak July jobs report which indicated a bigger drop in labour demand over the summer, the minutes could be considered hawkish.

Still, I wouldn’t read too much in the minutes as the subsequent data releases have rendered them less relevant and they don’t really tell us anything about the prospects for a rate cut in the next FOMC meeting in mid-September.

We expect 2 – 3 rate cuts this year

Instead, Powell’s comments this Friday will likely indicate whether the market pricing a full 25bps rate cut in September is a done deal.

Unless August’s payrolls show a marked improvement, we anticipate the Fed will cut the fed funds rate by 25 basis points to a range of 4.00%–4.25% next month.

We believe that we will likely get something closer to 2 – 3 rate cuts this year and that the probability for the Fed to cut more than what the market is currently pricing is low.

We believe that the only reason for the Fed to cut more than what markets are anticipating is if the US economy starts to materially falter from here. But that’s unlikely.

While concerns that tariffs could slow economic growth and raise prices are reasonable, fears of stagflation are overstated.

The current data paints a convincing story: Atlanta Fed GDPNow model estimates US GDP growth at ~2.5% and the bond market pricing suggests ~2.5% inflation over the next 5 years. This is not stagflation.

Instead, the data points to a resilient economy with stable inflation expectations – which is potentially a bullish backdrop for equity markets.

Thus, we don’t believe that it matters for equity investors if we ultimately just get 1 or 3 rate cuts this year for the US market to churn higher, in our view.

With contributions from Brian Levitt and Ben Jones.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.