Re-globalization series: Positive developments during Chinese New Year

At the beginning of the Year of the Dragon, we have already seen positive developments in China in areas such as the policy front and economic data.

Supportive policies

The People's Bank of China today announced that the five-year Loan Prime Rate (LPR) was lowered from 4.2% to 3.95%, a larger reduction than market anticipation.1 Meanwhile, the one-year LPR remains unchanged.

On Sunday, the People’s Bank of China announced its first medium-term lending facility (MLF) operation in the Year of the Dragon.2

The 500-billion-yuan injection means a continuation of a streak of 15 consecutive months of net fund injections through MLF loans2 to maintain reasonable and ample liquidity in the banking system.

Robust consumption data during CNY holidays

Data showed robust consumption, tourism, entertainment and catering during the Chinese New Year (CNY) holidays.

- During CNY holidays, service sector daily revenue was up 52.3% YoY, according to the State Taxation Administration.3

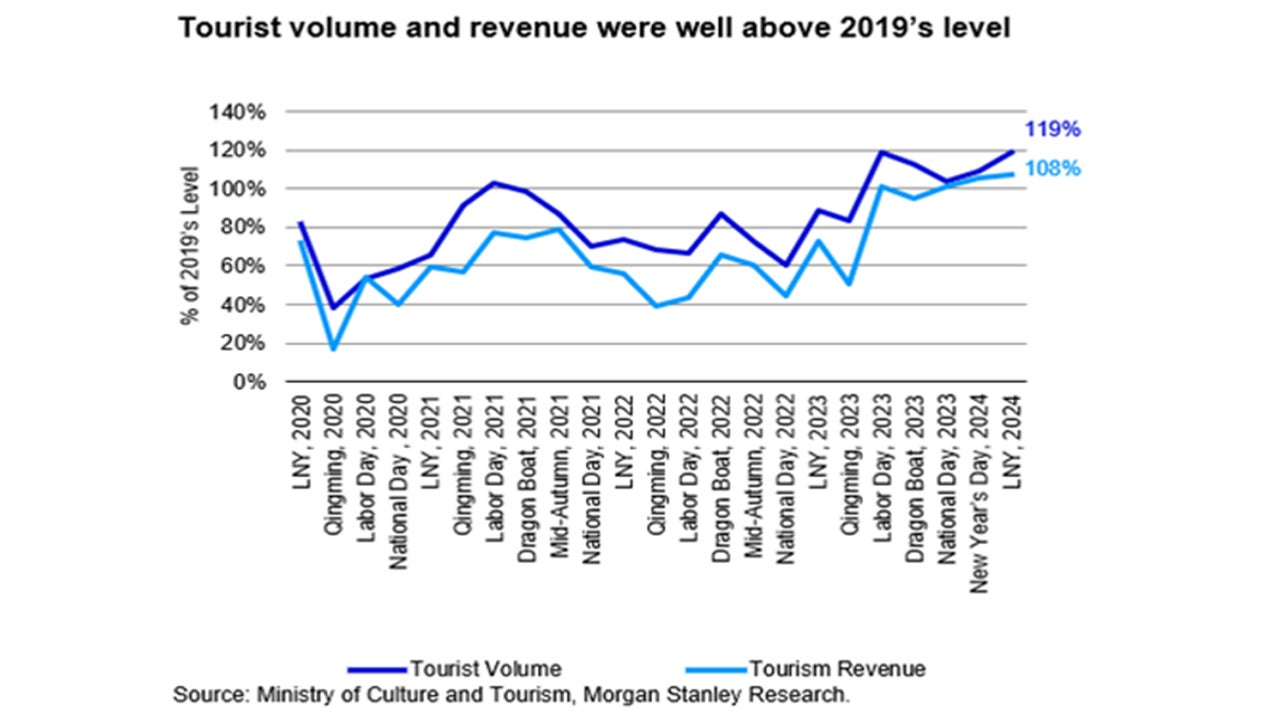

- A total of 474 million trips were made within mainland China, up 34% compared to the same holiday in 2023 and 19% higher than in 2019, according to the Ministry of Culture and Tourism. Domestic tourism revenue reached Rmb632.7bn during this year’s CNY.4

- According to the National Immigration Administration, total in/outbound trips reached 13.5m over the eight days, 8% higher than the 2019 CNY full period (seven days). Daily in/outbound trips was at 1.69m, 2.8x vs 2023.5

- Box office reached a historical high of Rmb8.02bn during CNY, up 18% YoY.6

- During the Lunar New Year holidays from February 10 to 17, Hong Kong welcomed 1.25 million visitors from the Mainland China, which has surpassed the visitor levels recorded in 2018.7

Outlook for the Year of Dragon

In the Year of Dragon, we are likely to see a supportive policy backdrop in China that seeks to boost growth.

This could present investment opportunities for Chinese equities given the attractive valuation – Chinese equities are trading at 53% discount compared to US equities.8

Chinese stocks present a compelling opportunity for patient investors, as the risk/reward ratio is skewed favorably towards the upside.9

We expect that Re-globalization and Greenization to be the key investment themes in China with long term potential.