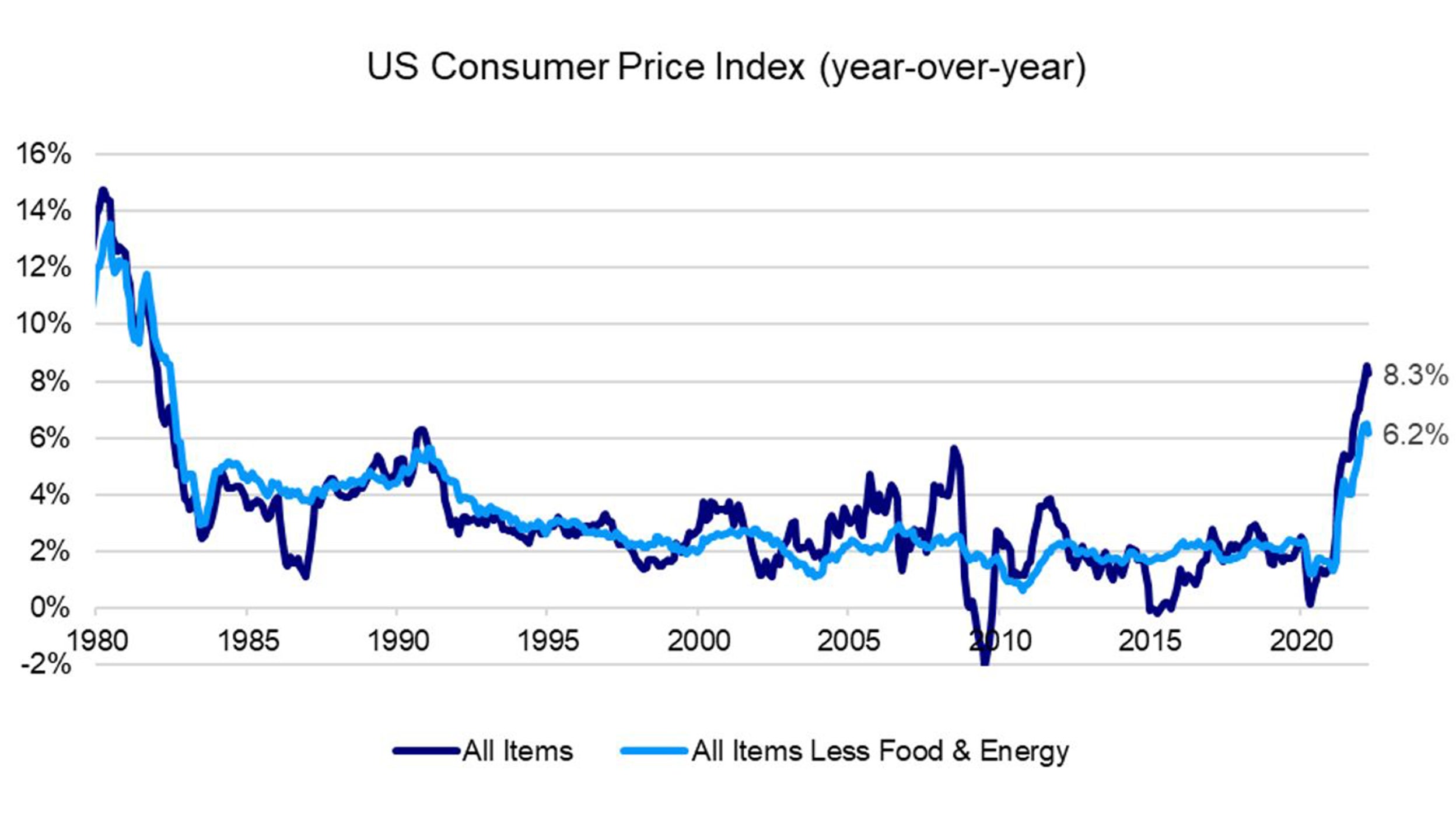

US April Inflation Print: The Bad with the Good

First, the good: US headline inflation in April fell to 8.3% y/y from 8.5% in the prior month while core inflation (which doesn’t include volatile items such as energy and food prices) fell to 6.2% y/y from 6.5% due to favorable base effects and improvements in supply shortages.1

Around this time last year, the US economy first saw large price increases -which means that over the coming months, the base effect should push y/y inflation rates lower.

Source: U.S. Bureau of Labor Statistics. Data as of April 2022

US equities initially rose as markets digested the y/y inflation data and may have preliminarily concluded that price pressures have already peaked though fell in afternoon trading as investors parsed through the data.

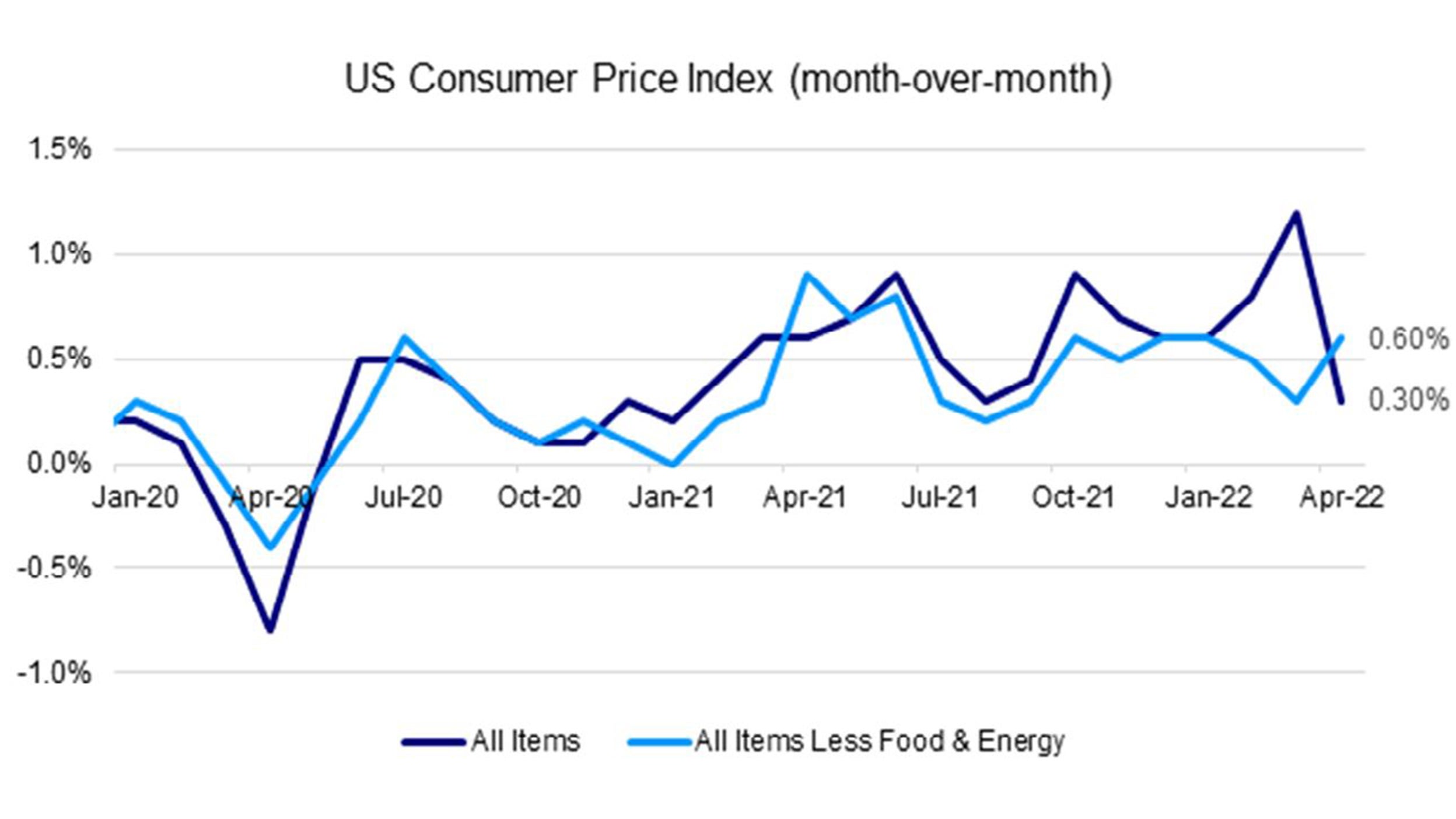

Second, the bad: while inflation dipped on a y/y basis due to favorable base effects, inflation actually picked up on a month/month basis, which perhaps reflects a more accurate picture of underlying price growth dynamics. The much higher than expected monthly jump in core prices of 0.6% (vs. consensus 0.4% and 0.3% in the prior month) reverses the downward trend since January.1

Source: U.S. Bureau of Labor Statistics. Data as of April 2022

April’s core inflation reflected an eye-catching 18.6% y/y growth in airfares due to higher jet fuel prices but more so from travel demand experiencing a post-Omicron rebound. Airfares are up 40% over the past quarter and are now around 10% above pre-pandemic levels. Hotel rates also rose again.1

On the plus side, the 0.8% decline in clothing and major appliance prices could indicate that supply chain shortages are improving as many Southeast Asian economies reopen post the Delta wave and the US West Coast’s port congestion starts to ebb.

Implications

April’s above consensus 6.2% y/y core price growth could strengthen the Fed’s determination to fight inflation with its planned 50bps rate hikes in the coming months. I don’t believe April’s data indicate more aggressive tightening to come though it does open the market speculation door again for a 75bps hike.

April’s data also puts to bed the fear that the US economy is slipping into a recession: to the contrary – the unemployment rate continues to be low and Americans are spending money due to pent-up impulses. I believe today’s data print indicate that the US economy can withstand tightening policies and that the Fed should be able to thread the needle between tamping down on inflation while orchestrating a soft landing.

As supply chain issues start to improve coupled with early signs that wages may start to cool, I expect inflationary pressures to noticeably tick down in the 2H of this year, which could give the Fed more wiggle room in their tightening policies