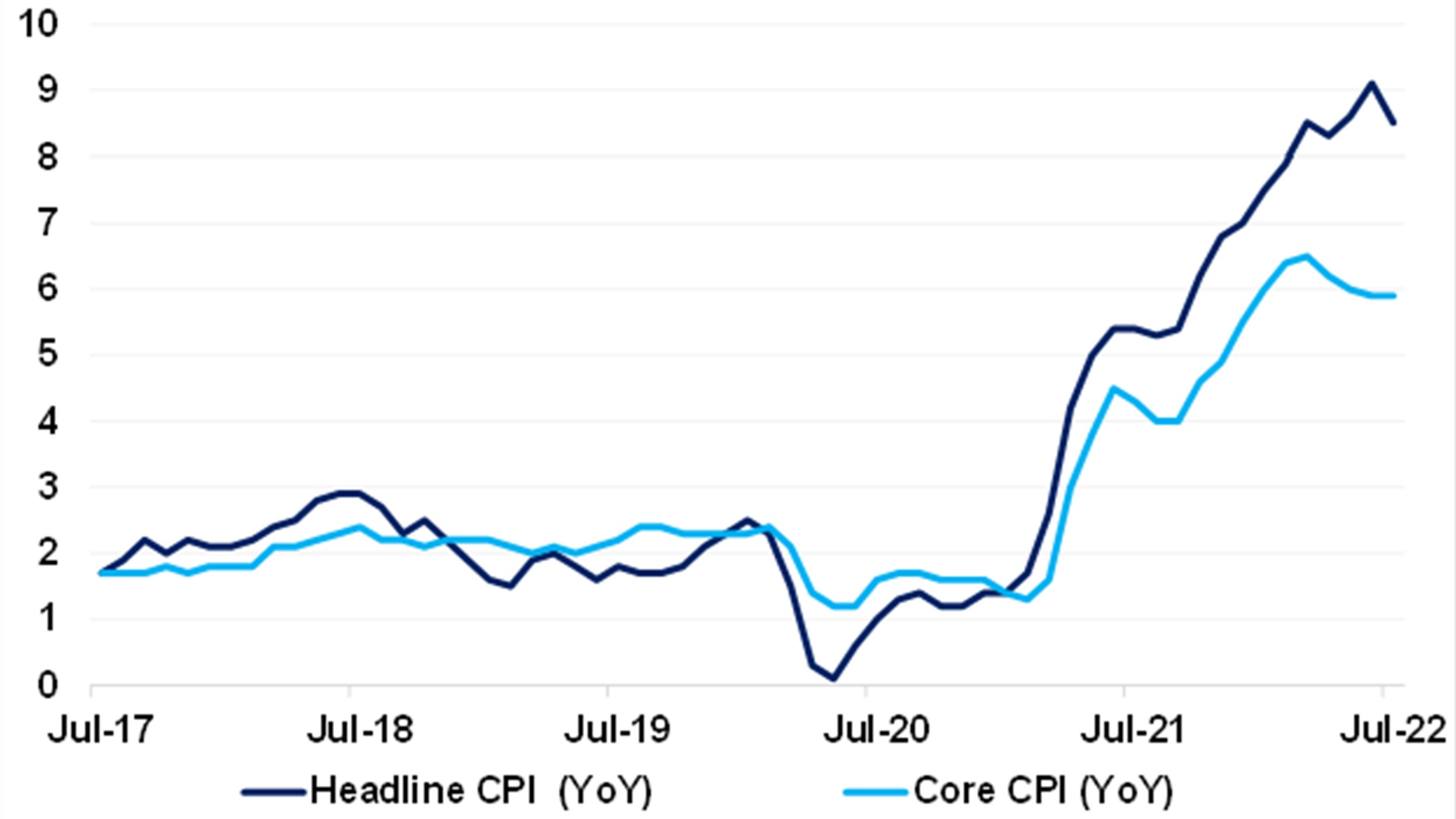

US Inflation Eased to 8.5% in July

And just like that, July’s softer-than-expected US inflation data has started to pivot the market narrative about consumer prices and the Fed policy outlook, but I caution market participants from jumping to such a conclusion. I don’t believe the Fed will be convinced that one month’s data calls for a slowing inflation trend.

A deeper dive reveals that many “temporary” factors contributed to this month’s weaker CPI; other underlying components continue to be very robust.

This is not the meaningful decline that the Fed is looking for, though it is a step in the right direction and should ratchet down calls for a 100bps hike in September and keep the debate centered around a 75bps versus a 50bps hike.

Of course, Fed officials will be eagle-eyed about the next couple of month’s CPI and employment data.

Source: Bloomberg, as of July 31, 2022

On the surface, headline inflation moderated more than expected in July to 8.5% y/y (vs cons 8.7% y/y and June’s 9.1% y/y) due to a decline in energy prices, partly offset by another rise in food prices.1

Core inflation (ex energy and food), also came in softer than expected for July at 5.9% y/y (vs consensus 6.1% y/y and June’s 5.9% y/y). 1 Weakness in the data is attributed to a fall in transient components, such as airfares, hotel rates and used autos.

If removing these one-offs, then the core inflation reading would have been closer to consensus expectations. Rents and general services remained strong due to labor shortages.

Last week’s jobs data revealed that the labor market remains very tight – there’s a lack of available labor particularly in the services sector and these are driving wages and the cost of services up.

Economic Implications

I can understand why investors may be feeling a bit puzzled right now about the US economy and capital markets. Real incomes have been falling, consumer spending is decelerating and spending on fixed investments is shrinking. Yet, the Q2 earnings season so far has been surprisingly robust and July’s payroll report showed a huge gain in jobs.

What’s clear to me, is that the US economy has already started to decelerate and is likely to continue doing so. This means that earnings growth is likely to slow further especially in sectors exposed to high input and supply costs. These factors lead me to expect broader signs of cooling price pressures over the coming few months.

Investment Implications

After July’s CPI print, some investors may have concluded that we’ve already seen peak Fed hawkishness. The S&P 500 has rebounded +13% since the 16th June bottom on the hopes of a dovish Fed pivot.1

I don’t believe we’re out of the bear market woods just yet. The US economy is set to slow further and the Fed is expected to continue hiking rates.

July’s softer than expected CPI checks rising bond yields and could breathe more confidence into global fixed income markets.

I believe that US equities could be rangebound until we see more conclusive inflation and employment data in the coming months.

Still, it’s fair to assume that the Fed isn’t going to take a more aggressive stance from here, which may weaken an already very expensive USD and may provide a floor to EM and APAC assets.