US June CPI data opens the door for the Fed to take a less hawkish stance

The June monthly inflation data shows that consumer price pressures are unequivocally trudging down in the right direction, opening the door for the Fed to take a less hawkish stance for the rest of the year.

The near-term question is whether the Fed will hike rates later this month – with the benchmark rate now higher than core CPI, this has historically signaled an end to the Fed’s tightening path.

While a Fed hike is still on the table, it’s not as clear cut as it once was.

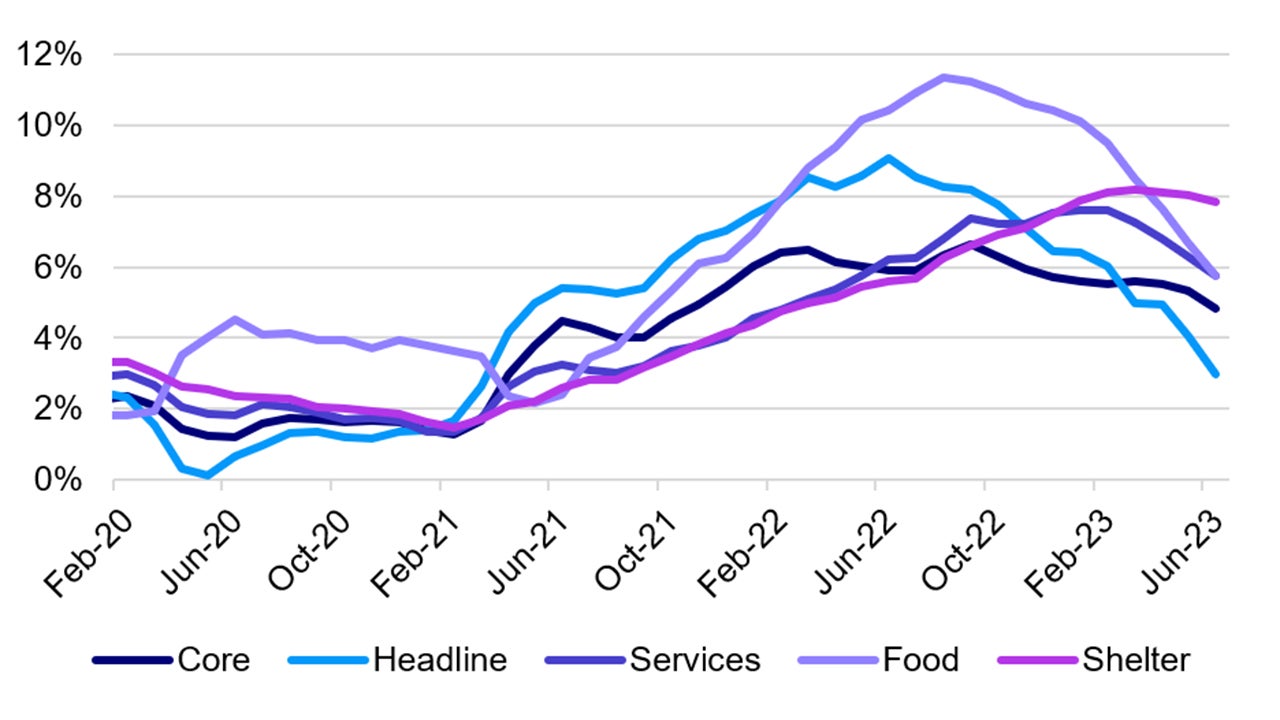

Source: U.S. Bureau of Labor Statistics (BLS). Data as of June 2023.

Core CPI appears to be trending lower

We have to remember that June’s headline inflation of 3.0% y/y is helped by base effects1, as it’s compared to last year when Russia invaded Ukraine and sent energy prices higher.

Still, the inflation report shows that some of the “sticker” components of inflation, such as used cars, airlines – are moderating.

The result is core CPI, which has been stubbornly slow to decline, now appears to be trending lower. For example, it’s good to see that core services ex-housing is finally starting to ease.

Much of the rise in the CPI can be attributed to housing but because of the way it is calculated tends to not reflect current conditions.

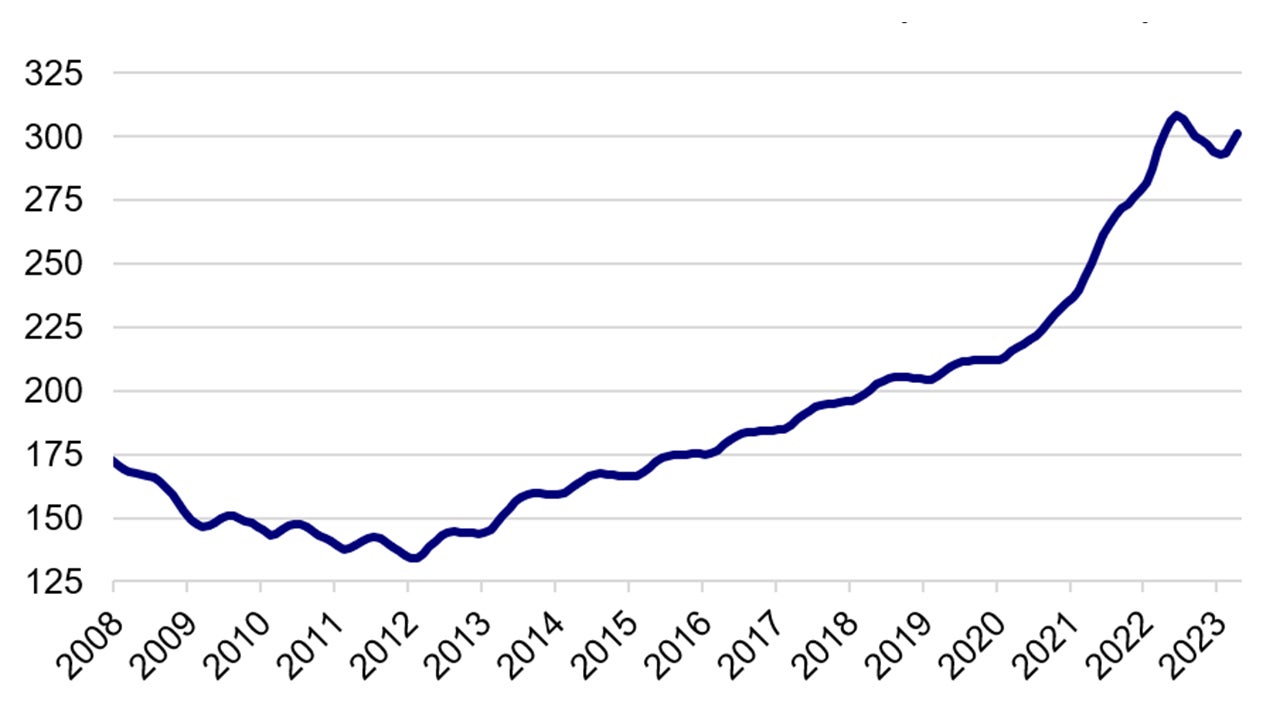

For example, the S&P Case/Shiller Home Price Index, which tends to lead CPI shelter by roughly a year, is already flat while the apartment rental market appears to be softening.

Still. the run rate of the shelter component is down to 6.0% over the last four months2 and I expect it to go lower.

Source: S&P Global. Data as of April 2023.

Investment Implications

The net takeaway is that this is a positive report for risk assets, especially emerging markets assets - which have been sitting on pins and needles waiting for the Fed to finish its tightening path once and for all.

Looking ahead, the Fed must balance a still-robust labor market with the declining inflation data - I believe that core inflation is likely to continue falling, given that headline is below it.

Today’s monthly CPI print coupled with the most recent NY Fed survey which shows that inflation expectations have fallen to 3.8% from 4.1% in the prior month3 anchor our non-consensus view that the Fed has at most, one hike left.

With contributions from Kristina Hooper and Brian Levitt.