US Midterm 2022 Elections: What’s the Impact?

November 8th is midterm election day in the US – and the latest polls show Republicans winning back the House of Representatives while the Senate remains a toss-up.

How big the Republicans win bears watching – though with US inflation at a 40-year high and 74% of Americans thinking the country is headed in the wrong direction1 it could be a momentous night.

Still, the midterm elections aren’t likely to have a meaningful impact on markets even though investors tend to prefer a checks and balances that come with a divided government.

Thus a Republican-controlled Congress, coupled with a Democrat in the White House could be viewed as a slight positive.

Implications

Even if Republicans win both side of Congress, I don’t expect any significant changes to current policies. For example, we’re not going to see a U-turn on fossil fuel and energy supply policies.

Instead, I believe there could be 2 years of fiscal gridlock with Republicans focused on investigations, oversight and measures to embarrass the other side.

We certainly won’t see tax increases or additional significant fiscal support under a divided government – rather, Republicans are likely to push for spending cuts and fiscal prudence.

The perceived lack of future government stimulus could present downside risks to US growth if the economy dips into recession.

A Greater China perspective

From a Greater China perspective, I believe the Republicans taking back Congress could extend fraught relations between the world’s two largest economies.

The House Republican leader has promised to launch another probe into the origins of the COVID-19 virus.

House Republicans are also planning to create a select committee on China – with an ability to have hearings and subpoena power that could impact export controls, outbound investment restrictions and sanctions.

It’s no wonder that during China’s recent 20th Party Congress, leaders have prioritized supply-chain and domestic security and technology self-sufficiency policies.

A possible in-person meeting between Presidents Xi and Biden later this month could help to stabilize relations.

Investment Implications

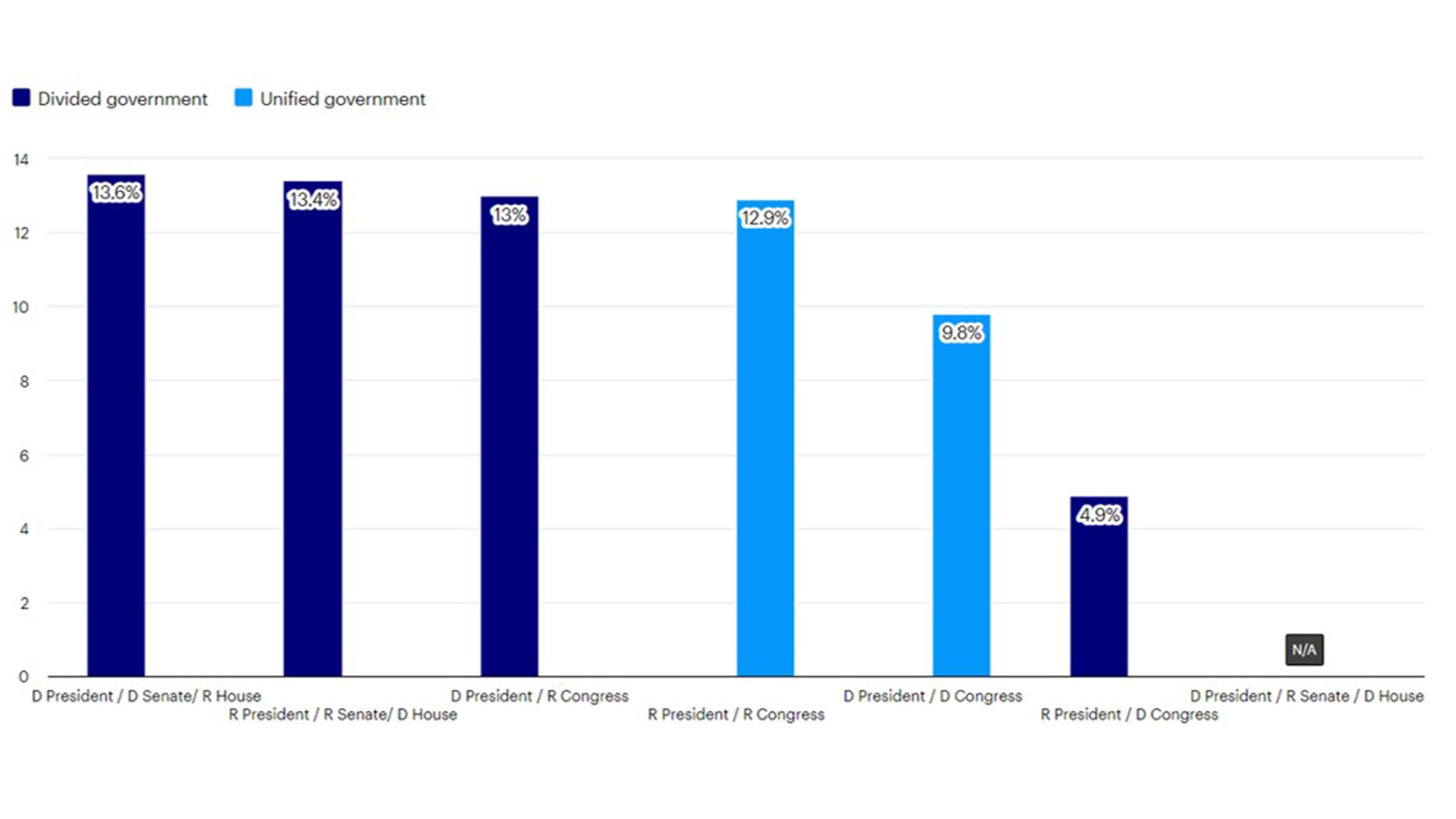

Since 1946, economic growth has been remarkably similar during single-party and divided government rule.

The US stock market has also performed well regardless of which party is in power (chart). Perhaps more interesting, is that the US equity market since 1960, has been positive in each calendar year following the midterm2 .

History has also shown that the third year of a presidential cycle (in this case, 2023) has tended to be the most positive for stock market returns3. A possible risk-on rally in the US in the coming year would certainly benefit APAC and EM markets.

With contributions from Brian Levitt & Kristina Hooper

Source: Bloomberg, Strategas Research Partners 12/31/21. Dates: D President/D Senate/R House – 2011-2015; R President/R Senate/ D House – 1911-1912, 1931-1932, 1981-1986, 2019-2020; D President/R Congress – 1919-1920, 1947-1948, 1995-2000, 2015-2016, R President/R Congress – 1901-1910, 1921-1930, 1953-1954, 2003-2006, 2017-2018; D President/D Congress – 1913-1918, 1933-1946, 1949-1952, 1961-1968, 1977-1980, 1993-1994, 2009-2010; R President/D Congress – 1955-1960, 1969-1976 1987-1992, 2007-2008. *2001 to 2002 is not listed because Jim Jeffords became independent leaving the Senate evenly divided. Past performance does not guarantee future results. Investments cannot be made directly in an index.