What's next for China AI after DeepSeek's debut?

The dust is starting to settle after Chinese start-up DeepSeek’s recent debut roiled US tech stocks last week, with follow-on effects across corollary industries such as energy, infrastructure and software.

Despite the company releasing earlier models back in December and a follow-on model on 20th January, investors have only recently begun to discover that this little-known Chinese artifactial intelligence (AI) company has achieved a similar level of performance as industry-leading US AI companies.

What’s most impressive, is that DeepSeek has achieved these results at a fraction of the cost and with limited access to advanced semiconductor chips.

Hundreds of billions of dollars in US stock market capitalization were wiped off last week as investors start to price in a future with a lower demand for high-tech semi chips.

To put in detail, DeepSeek noted that its V3 model, released back in December 2024, required 2,048 chips at a cost of USD 5.6mn.1 These chips were older and less advanced, in order to comply with US export restrictions to China. In contrast, a leading US-based AI provider spent around USD 100mn to train its latest model.2

I don’t believe that it is an apples to apples comparison. DeepSeek mentioned in its technical report that the USD 5.6mn doesn’t account for research and development costs and the firm’s parent company supposedly had an R&D budget of around USD 400mn.3

Still, it remains clear that DeepSeek has achieved a remarkable milestone in AI software development at a fraction of the cost.

The performance gap between Chinese and American AI development is shrinking

I believe that the broader ramification of this recent development could be that Chinese technology companies are still able to innovate, especially on software, despite US export restrictions on hardware.

This is evidenced by a recent report from the UC Berkeley AI Research Lab titled, Whack-a-Chip: The Futility of Hardware-Centric Export Controls.4 In this report, the author details how a large Chinese AI company is finding ways to innovate by relying on software and modeling techniques.5

While the recent development suggests that the performance gap between Chinese and American AI development is shrinking - and probably at a much more rapid pace than previously anticipated - this doesn’t mean that American export restrictions aren’t having its intended effect.6

DeepSeek’s founder recently said in an interview that his company’s biggest headwind is the lack of access to advanced chips – something money can no longer buy.7

Meanwhile, it appears as though US AI software breakthroughs have plateaued because existing models have reached peak data.8

Top executives from US tech giants have acknowledged that a new model may be required for the next leg up, one based on inference instead of raw data.9

This development could pivot AI models in the future to rely more on application-specific integrated circuits (ASICs) rather than the current graphics processing units (GPUs).10

Investment Implications

If indeed the future AI trend is towards inference, then Chinese AI companies could compete on a more even playing field.

The US currently does not impose significant restrictions on ASICs exports to China and it’s not clear any global semiconductor company will take the manufacturing lead and market share of inference chips in the future.

Inference chips are much cheaper and less difficult to manufacture when compared to GPUs, thus many large technology companies, including Chinese ones, are likely to become formidable players.11

DeepSeek is a good reminder that dominant companies do not remain dominant forever. New competition will always come along to displace them.

What’s clear though, is that the development gap between Chinese AI and its global counterparts is shrinking and that Chinese technology companies are making impressive accomplishments.

And if the AI future relies less on advanced computing power and more on inference, then this software optimization shift could allow more AI companies a fair shot.

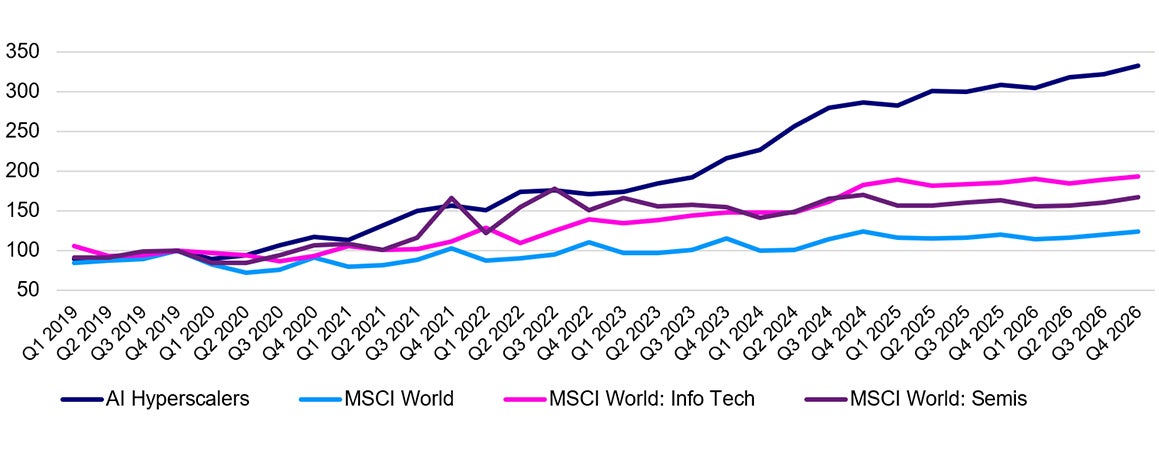

I believe that this episode also raises questions about the vast sums that are currently being invested in AI and whether it will turn out to be money well spent. This is why I expect the current high concentration in the US stock market to be a temporary phenomenon.

I would just add that it favours an equally weighted approach to the US market, US small-mid caps over mega caps and Chinese equities vs US equities.

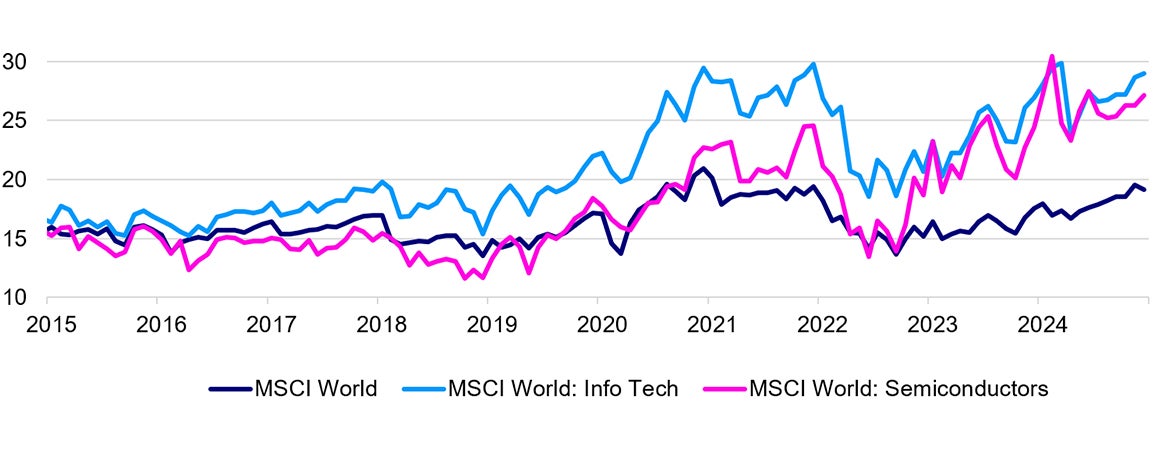

Chinese equities, and especially Chinese technology companies are priced at a steep discount compared to their American counterparts, and similar to the AI development gap narrowing, so too is the valuation gap.

Source: Bloomberg and Invesco. Quarterly data as of 30 September 2024. Note: “AI Hyperscalers” is a market capitalization-weighted composite of Oracle, Microsoft, Alphabet, IBM, and Amazon. We classify these companies as “AI Hyperscalers” in that they have significant, global cloud computing platforms and resources as well as preexisting access to AI expertise. It does not represent a recommendation to buy/hold/ sell the securities. It must not be seen as investment advice. An investment cannot be made directly into an index.

Source: Bloomberg and Invesco. Monthly data as of 31 December 2024. An investment cannot be made directly into an index.

With contribution from Paul Jackson

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.