What’s next for China’s stressed property sector?

Chinese equities have been on fire recently, with MSCI China climbing +20% November MTD. Investors have pondered how sustainable this rally is in light of new COVID outbreaks and a faltering property market.

Even though I expect that fundamentals could get worse before they get better, investors are already starting to see the light at the end of this long COVID tunnel in China.

I am convinced that the recent rally has legs since the economy and market are likely to rebound over the next year as the economy gradually reopens and the property market stabilizes. Investors shouldn’t expect a smooth V-shaped recovery, as history has shown each major economy has hit snags and even chaos during the early stages of a reopening.

Despite near-term market volatility, I am much more optimistic about Chinese assets heading into 2023, given low valuations and as the economy experiences a cyclical upswing led by household and business spending.

What happened in 20th Party Congress

Investors could have been forgiven for hoping to hear new policy support to China’s current property market woes at the 20th Party Congress. Alas, the event kept its historical focus on political developments rather than economics, and there were no new measures announced to address the various challenges facing the real estate sector.

Markets were initially disappointed after the State Council emphasized continuity to existing policies1 in the face of mounting economic challenges.

The market has been keenly waiting for updates on how to navigate the property market, which has been a key pillar of growth since private property rights expanded decades ago.

The market has seen bond defaults, unfinished construction and mortgage boycotts from protesting homebuyers, against the backdrop of the earlier deleveraging requirements for developers.

Now that the all-important Party Congress is over, policymakers can shift their attention back towards tackling growth headwinds. Policymakers are keenly aware that markets are looking for insights as to how Beijing would target soft spots in the Chinese economy. Relief measures for the property sector particularly have become a key priority.

Measures to support the property market

And just like that, hope has risen that change is afoot. Green shoots have sprouted as financial regulators recently rolled out important measures to support the property market that should prevent a hard landing.

The PBOC and China Banking and Insurance Regulatory Commission recently issued a 16-point plan on how financial institutions could support the property market. The report urges commercial banks to step-up lending to developers, extend loan and bond maturities to avoid further defaults and work with policy banks to complete unfinished units.

These measures are on top of the step up in recent months to curb the property sector downturn. Right before the October 1st National Day holiday, constraints on mortgage rate floors for first time buyers were lifted in select cities.

China’s Ministry of Finance came out with an offer of personal income tax rebates for home sellers buying a new one within one year.

This was on top of the 15bps rate cut to the 5-year loan prime rate in August, in addition to 200 billion RMB in special loans to help developers finish stalled housing projects.2

Even as policymakers maintain the principle that “housing is for living in not for speculation”, and this mantra was reiterated in the full work report of the Party Congress, regulators have suspended some high-profile regulatory restrictions on bank financing to the property sector.

These targeted, new measures are significant but do not represent a total bail-out of the industry by the government: only financially sound developers are able to benefit while the troubled ones are still expected to divest their assets. More importantly, these measures address the growing risk of more defaults that could put a strain on the banking system.

Latest property sector data

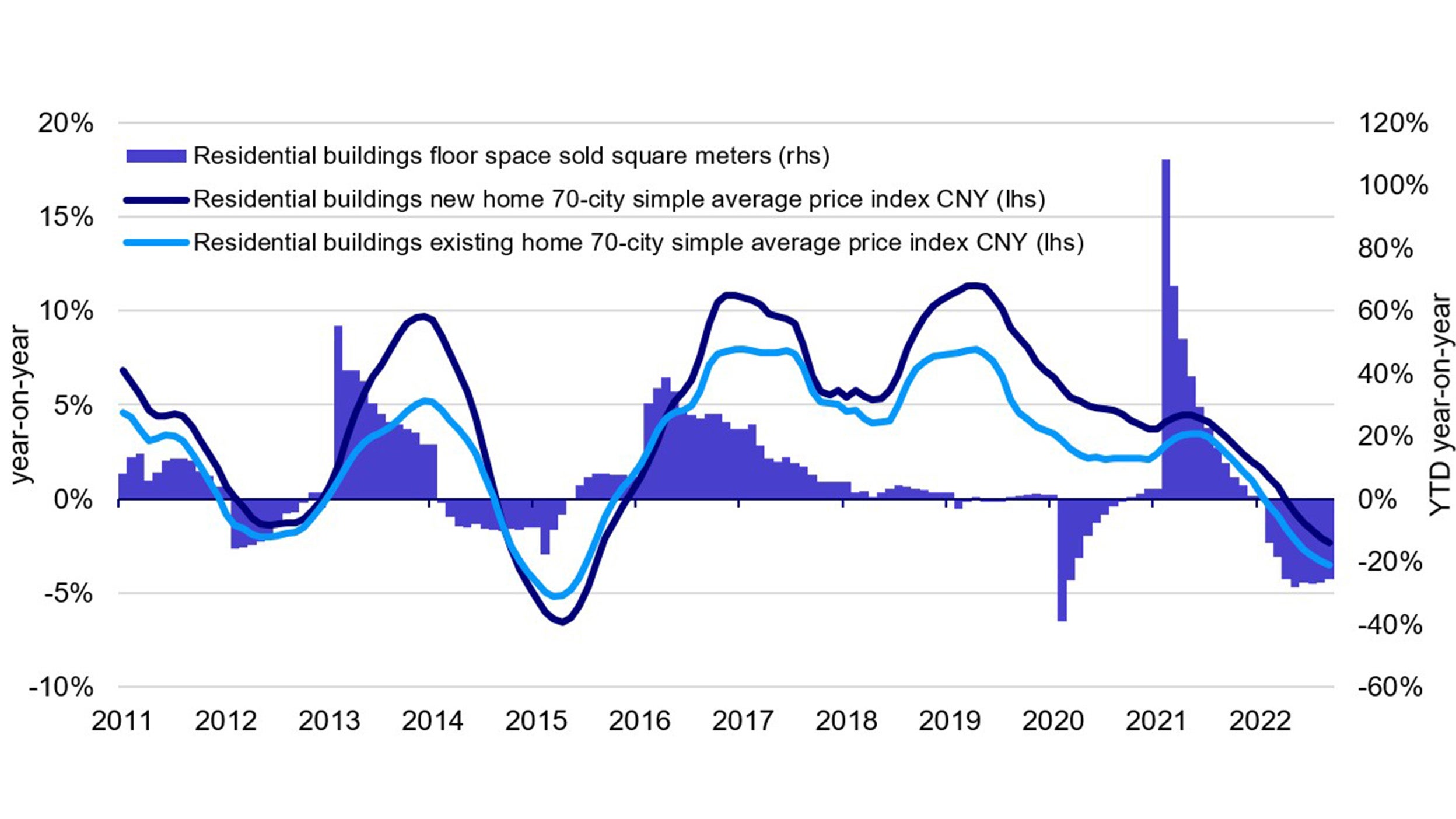

Even so, the latest property sector data has not been that encouraging. Traditionally the Golden Week holiday starting on China’s National Day is strong period for activity in the real estate market, but new residential transactions for the holiday week declined by 26% from the same period last year on a floor space sold basis, suggesting continued sales weakness.3

Source: China National Bureau of Statistics (NBS). Data as of September 2022.

Prices have held up slightly better. Average new home prices in China's 70 major cities fell by -2.3% year-on-year in September.4 Prospects for the more prosperous so called “tier 1” cities have improved, while lower tier cities continue to struggle with oversupply and under-occupation, resulting in relatively steeper price declines.

Policymakers targets lower leverage and sustainable growth

The property sector along with construction is one of the economy’s cornerstones, accounting for 29% of GDP when considering upstream and downstream linkages.5

China’s delayed economic data showed that investment in property development fell by -8.0% year-on-year in September, though overall fixed asset investments held up as manufacturing saw year-on-year growth.6

We should remember that more affordable housing along with lower leverage are policy goals for a more sustainable and healthy property sector, which aligns squarely with the “common prosperity” ethos. We should expect that there may not be a return to the “high leverage, high growth” model that drove the sector over the past decade.

Now that the Congress is over, we are more likely to see better policy implementation and coordination in efforts to de-lever the sector and managing loan risks without allowing a notable rebound in property-related credit demand.

It’s likely policymakers may continue to prioritize protecting homebuyers. Measures such as the credit quota of 200 billion RMB to ensure completion of construction for pre-sold homes could be extended in scope and size.7

We can also still reasonably expect additional support for cash-strapped local governments. Revenues were highly reliant on land sales to property developers, a source which has now dried up. While local government financing vehicles have stepped in to buy land in their place, there are limits to how far this can run.

The outlook of property sector

We should maintain perspective that there is little chance that the property market’s woes will devolve into systemic risks to the broader financial market. Tightened financial regulations over the years have led to very tight prudential mortgage standards and modest bank exposure to the housing sector.

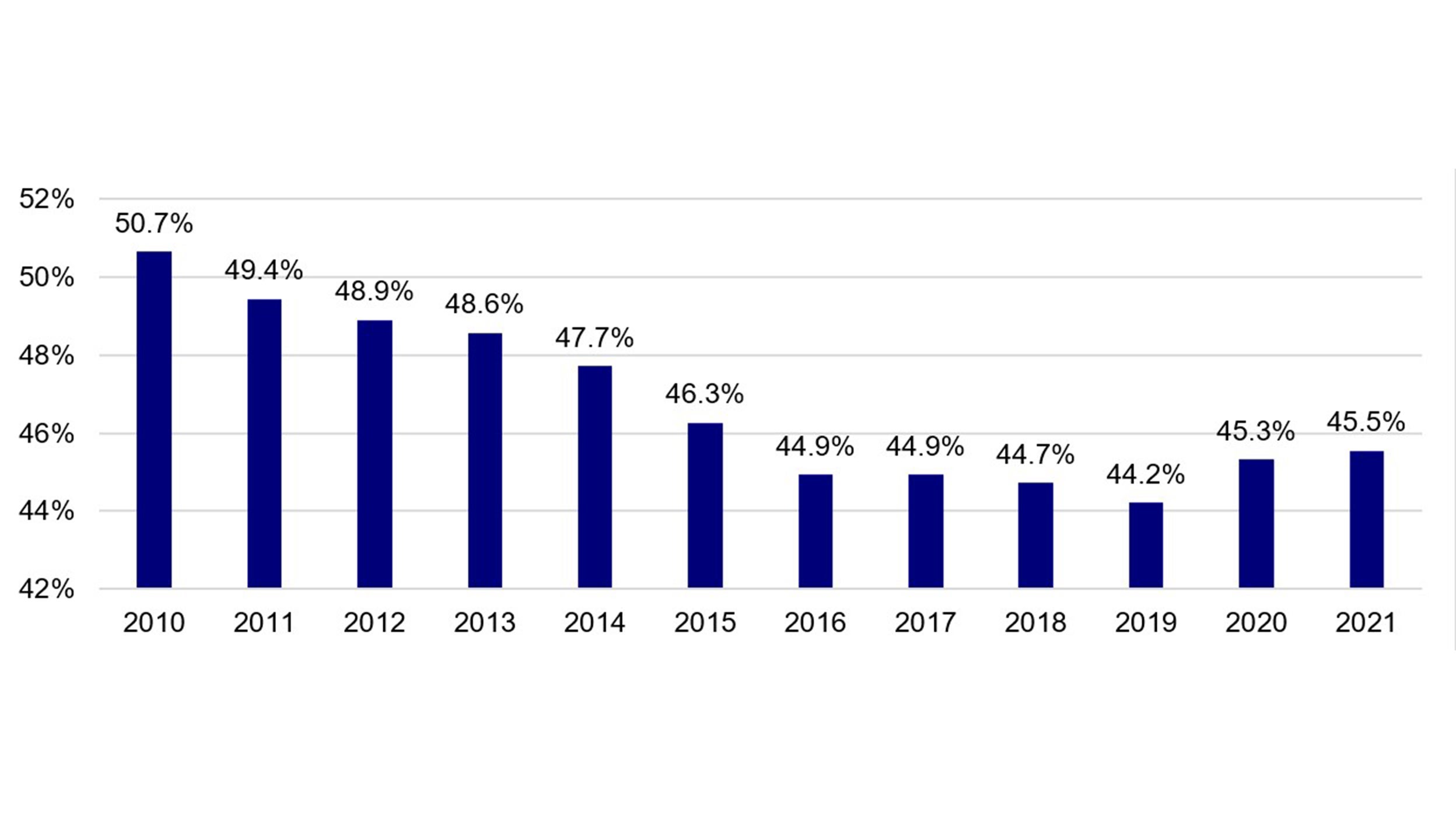

China’s high savings rate of 46% of GDP remains among the highest in the world, providing deep pockets to service high debt and absorb losses.8

Source: CEIC. Data as of 2021.

Meanwhile, declining property and land values don’t necessarily mean a wave of bad loans is coming. In China, mortgages are considered one of the safest bank assets – with a NPL ratio of 0.34% in 1H22 compared to 1.34% for all other loans. The low default rate in China is due to the full-recourse structure of the mortgage –banks have charge over all of the borrower’s assets.

Property sector and economic rebound

Nonetheless, for China to experience any kind of material economic rebound, the property market’s woes must be fixed first. Property related loans account for around 39% of total bank loans and so declining property values would create downward pressure on credit growth.9

The current plethora of measures to stabilize the property market may start to provide a floor to the market, but the risk of a negative feedback loop between home prices and real economy remains very real. The market should gird itself that the past era of breakneck property price growth are likely fleeting memories.

A version of this article appeared in South China Morning Post on October 31, 2022.