Source: Tongcheng Travel, as of January, 2023.

China saw strong mobility and consumption recovery after reopening. During the CNY, passenger trips reached 1.59 billion, a year-on-year increase of 50.5%, recovering to 53.5% of the same period in 20191. Consumer spending in January registered a 30% annualized growth2, signaling consumer demand has been back on the growth track.

Source: Tongcheng Travel, as of January, 2023.

The International Monetary Fund (IMF) raised China, Asia, and global growth forecasts to 5.2%, 5.3%, and 2.9% respectively. The IMF expects China and India alone to contribute more than half of global growth this year3. With China’s reopening, it is expected that Asia will be the primary driver of global growth in 2023.

Source: International Monetary Fund, as of February 20, 2023.

Due to frequent lockdowns in the past three years, Chinese households have accumulated a staggering amount of excess savings at RMB 6.55 trillion, equivalent to 5.4% of nominal GDP4. It is expected that the pent-up demand will drive growth for sectors such as retail, eCommerce, tourism, casinos, hotels and catering.

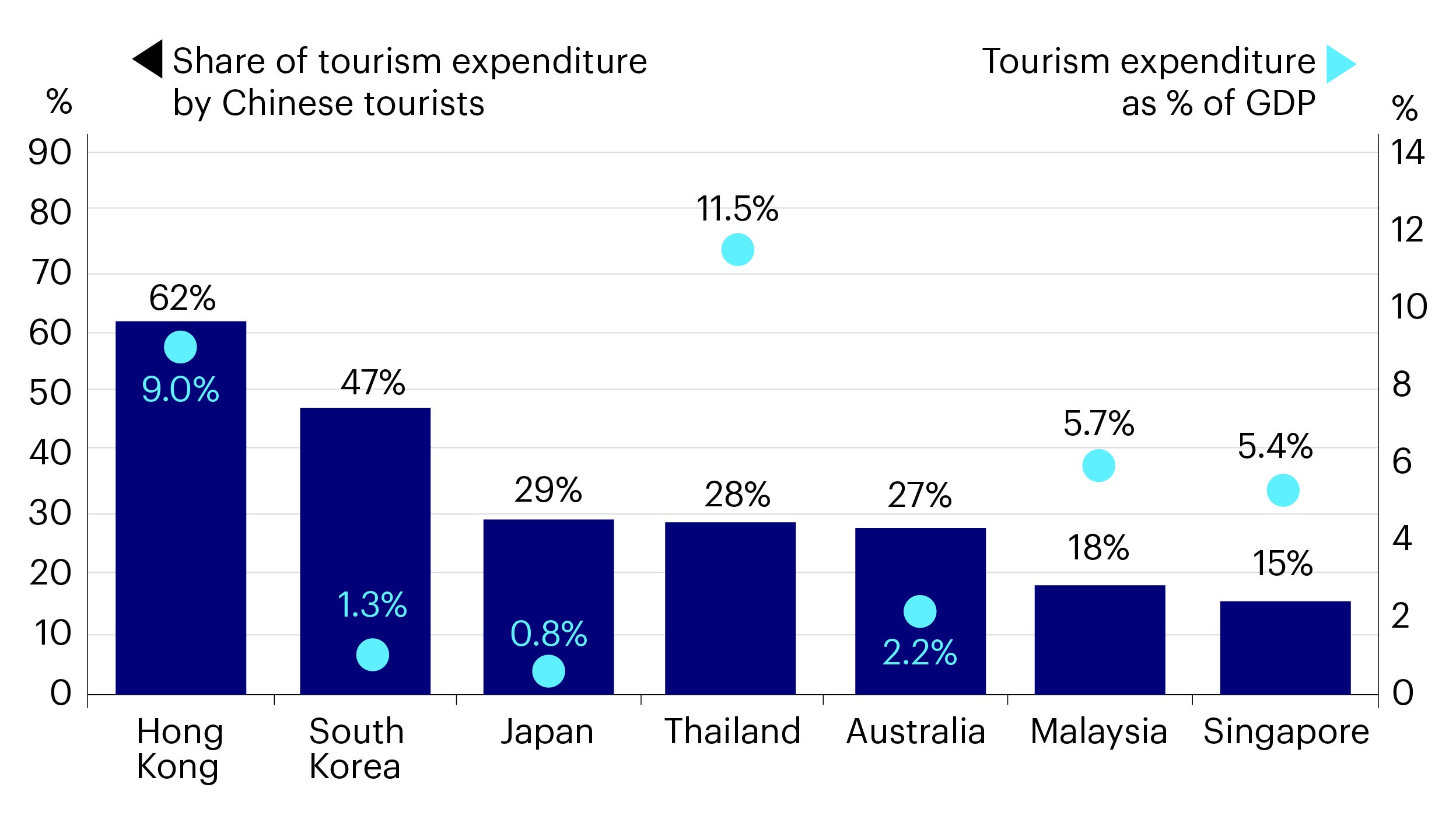

China’s reopening could further boost demands in the wider APAC region. Hong Kong and Singapore are the key beneficiaries of China’s reopening due to their dependency on Chinese tourists, according to J.P. Morgan5. It is estimated that reopening could drive up China’s domestic demand by 5% and contribute 0.4% of GDP growth to most APAC economies, according to Goldman Sachs6.

Source: J.P. Morgan, as of January 10, 2023.

Source: Invesco, as of February 28, 2023. Past performance information is not indicative of future performance.

Important information

Invesco Global Consumer Trends Fund: The Fund invests in a global portfolio of investments in companies predominantly engaged in the design, production or distribution of products and services related to the discretionary consumer needs of individuals. Investors should note the concentration risk of investing in companies predominantly engaged in the design, production or distribution of products and services related to the leisure time activities of individuals, currency exchange risk, equities risk, volatility risk, and general investment risk. Financial derivative instruments (FDI) may be used for efficient portfolio management purposes or to hedge or reduce the overall risk of investments. Risks associated with FDI include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The leverage element/component of a FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund. Exposure to FDI may lead to a high risk of significant loss by the Fund. The value of the Fund can be volatile and could go down substantially. Investors should not base their investment decision on this material alone.

Invesco Asian Equity Fund: The Fund invests primarily in equities and equity related securities with exposure to Asian countries. Investors should note the emerging markets risk, liquidity risk, concentration risk of investing in equities and equity related securities with exposure to Asian countries, currency exchange risk, equities risk, volatility risk, and general investment risk. Financial derivative instruments (FDI) may be used for efficient portfolio management purposes or to hedge or reduce the overall risk of investments. Risks associated with FDI include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The leverage element/component of a FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund. Exposure to FDI may lead to a high risk of significant loss by the Fund. The value of the Fund can be volatile and could go down substantially. Investors should not base their investment decision on this material alone.

Invesco Asia Consumer Demand Fund: The Fund invests in equity securities of Asian companies whose business is likely to benefit from, or is related to growth in domestic consumption in Asian economies, excluding Japan. Investors should note the emerging markets risk, liquidity risk, concentration risk of investing in Asian companies whose business is likely to benefit from, or is related to growth in domestic consumption in Asian economies, excluding Japan, risk of investing in REITs, currency exchange risk, equities risk, volatility risk, and general investment risk. Financial derivative instruments (FDI) may be used for efficient portfolio management purposes or to hedge or reduce the overall risk of investments. Risks associated with FDI include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The leverage element/component of a FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund. Exposure to FDI may lead to a high risk of significant loss by the Fund. The value of the Fund can be volatile and could go down substantially. Investors should not base their investment decision on this material alone.

Source: Invesco, as of January 31, 2023. For illustrative purposes only. There is no guarantee that the securities/industries/regions mentioned above are currently held or will be held by Invesco funds in the future. It does not represent a recommendation to buy/hold/ =sell the securities/industries/regions.

^Any reference to a ranking, a rating or an award provides no guarantee for future performance results and is not constant over time.

^^Data as of January 31, 2023. The inception date of A (USD)-AD Shares is September 10, 2018. Peer group: EAA Fund Asia ex-Japan Equity. The historical performance shown above up to September 7, 2018 relates to the historical performance of the Irish domiciled fund, which was merged into the Luxembourg-domiciled fund on that date. This change has no impact on the investment objective, strategies, risk profile or fee structures of the fund. Any reference to a ranking, a rating or an award provides no guarantee for future performance results and is not constant over time. Source: © Morningstar 2023 (see disclaimer at end of document). Quartile rankings shown are for the A(USD)-AD share class. Past performance is not a guide to future returns.

©2023 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is provided for reference purposes only. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Asset allocation data is derived by Morningstar using full holdings data provided by Invesco. Morningstar Licensed Tools and Content powered by Interactive Data Managed Solutions.