Find Out More

The pandemic has led to significant change in consumer habits

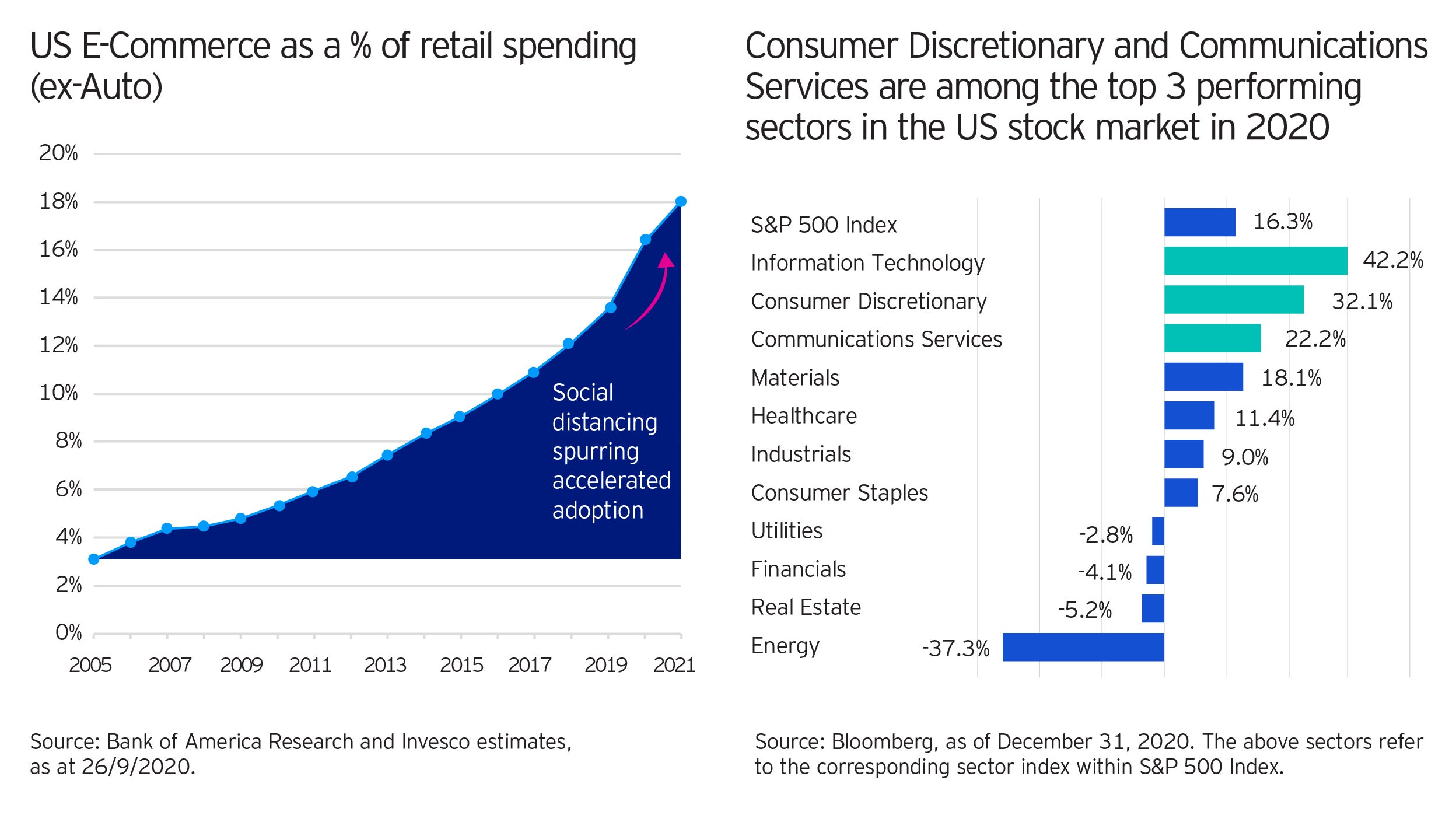

The significant growth in eCommerce has brought along investment opportunities

Changes in consumption patterns are happening everywhere, creating long-term investment opportunities. Ecommerce and Entertainment are among some of the key themes which saw significant growth. In 2020, consumer discretionary and communication services sector equities saw strong performance vs the broader market.

The vaccine rollout could be a “turning point”, the need to position for this should not be overlooked

With the rollout of vaccine, some of the traditional consumer sectors may stage a strong recovery, including sit-down restaurants, tourism, casinos and hotels.

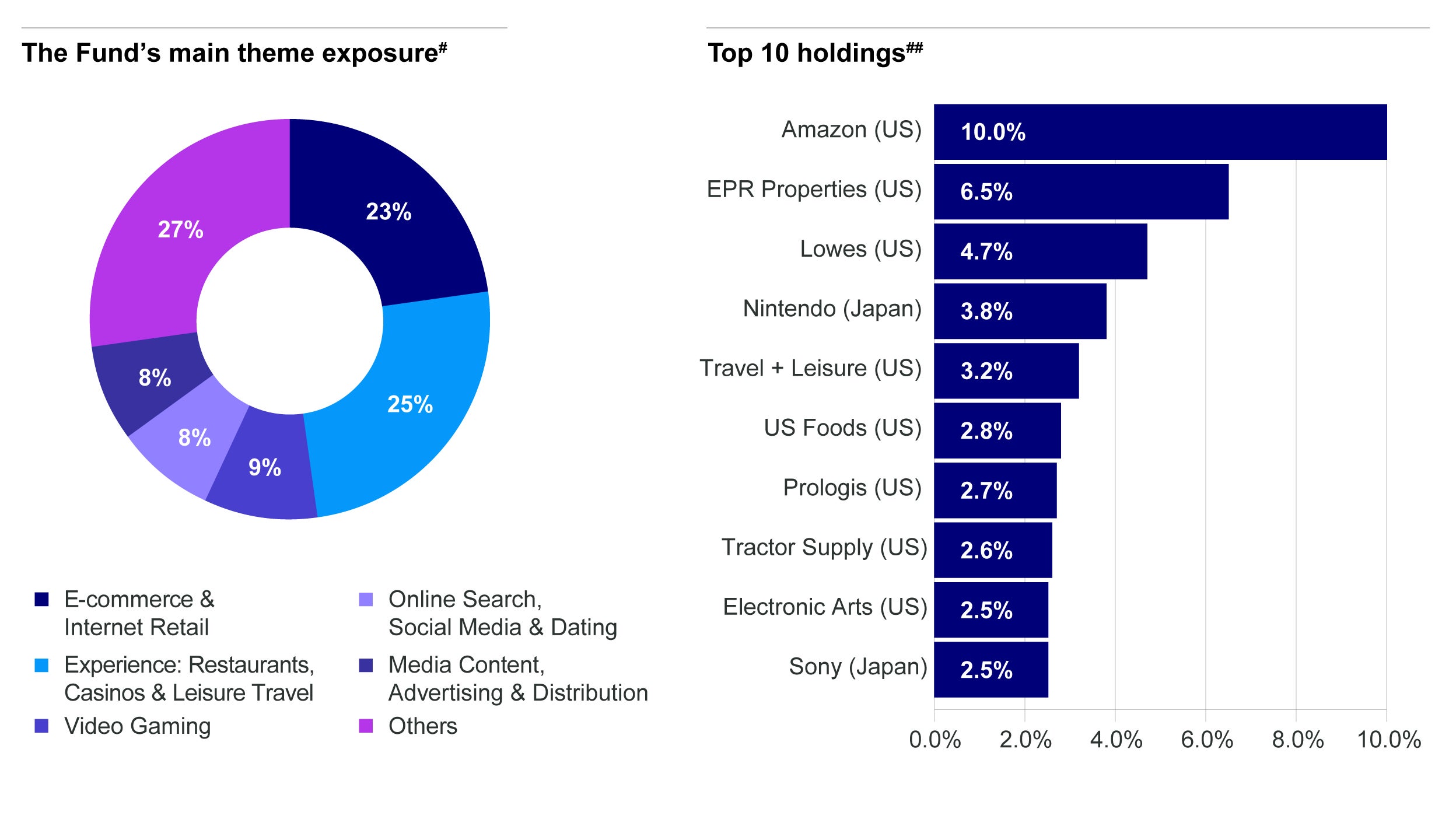

Invesco Global Consumer Trends Fund

Capture the opportunities arising from COVID-led changes in consumer trends and vaccine rollout.

#Source: Invesco, as of April 30, 2022. For illustrative purpose only.

##Source: Invesco, as of April 30, 2022. Portfolio holdings are subject to change without notice.

Important Information

Investment involves risks. Past performance is not indicative of future performance. Investors should read the relevant prospectus for details, including the risk factors and product features. This material has not been reviewed by the Securities and Futures Commission and is issued by Invesco Hong Kong Limited (景順投資管理有限公司).

©2022 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is provided for reference purposes only. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Asset allocation data is derived by Morningstar using full holdings data provided by Invesco. Morningstar Licensed Tools and Content powered by Interactive Data Managed Solutions.

How can we help?

Invesco Funds Hotline:

(852) 3191 8282

Mon – Fri: 9:00am to 6:00pm