Building room for residential property

Key takeaways

Meeting many needs

Reliable income

Diversification benefits

Attractive characteristics for Local Government Pension Schemes

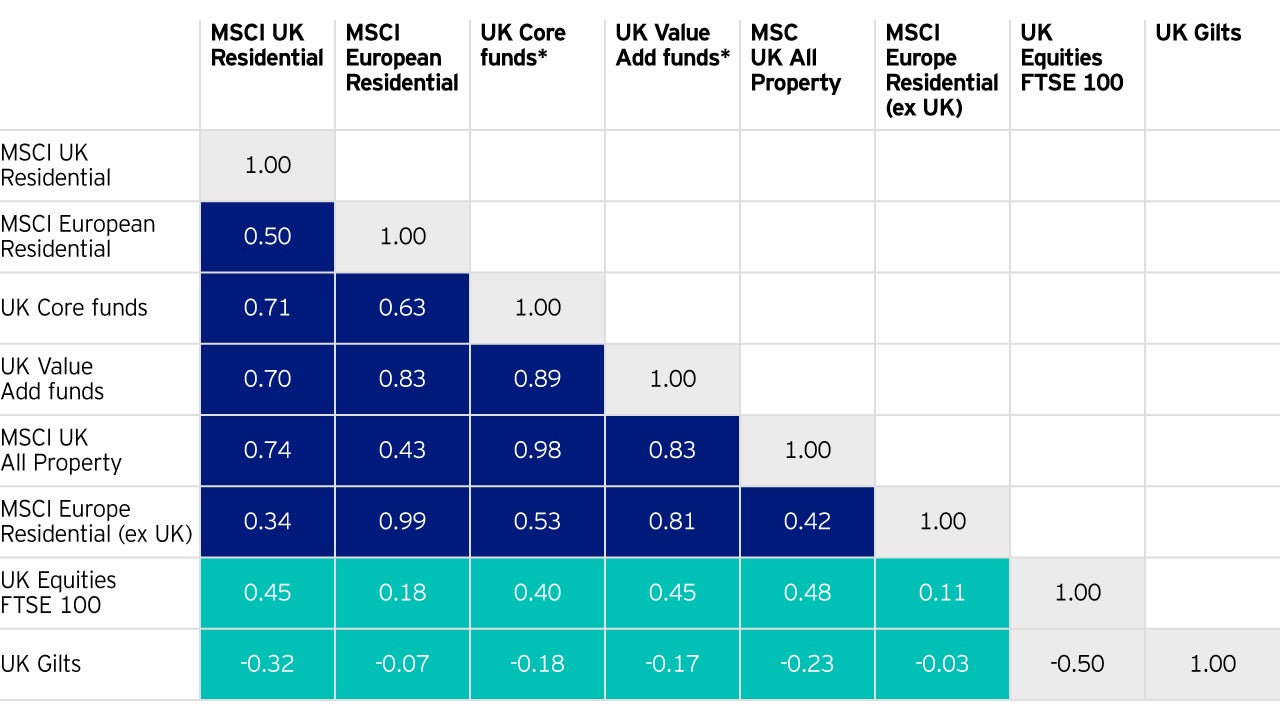

Within the 2016 Investment Regulations (and Guidance), the UK Government sought to promote investment strategy diversification to reduce overall portfolio risk. It suggested that LGPS funds can play a leading role in the development of UK infrastructure – which has come under heavy pressure in the last decade as the UK’s population has grown. Alongside this, the government also requires LGPS funds to formulate a policy on Environmental, Social and Governance (ESG) considerations. With identifiable and reliable income characteristics, PRS can potentially enhance long-term portfolio diversification through its expected low correlation with UK equities, Gilts and commercial real estate (Figure 1), and ticks the boxes for being a readily accessible infrastructure investment for the LGPS that also focuses on ESG.

Residential property is a separate asset class to commercial property and is a form of infrastructure. It can be a strong portfolio diversifier.

Meeting key criteria

An increasing number of LGPS funds are dependent on investment income to meet their expenses going forward – and we believe that UK PRS investment could provide several benefits for those looking to strengthen and diversify their portfolios to meet future liabilities. Importantly, it has the potential to be an attractive “infrastructure investment”, matching the five criteria set out by the Cross Pool Collaboration Group Infrastructure Sub-Group definition.

Criteria 1: substantially backed by durable assets

Institutional grade PRS assets will likely pass the durability test if they are purpose designed “built to rent” properties (“BtR"); these are focused on providing both the level of accommodation and associated facilities that is expected to attract a pool of tenants who may want to rent both over the short and long term. The basis of a quality, core PRS strategy is not to purchase individual units or “broken blocks” from house builders or existing investors, but instead investing in whole blocks of flats which have been specifically designed for the purpose of “build to rent”. In addition, it is expected that these purpose designed BtR buildings have dedicated on-site management staff who oversee any amenity facilities and the communal areas and ensure the ongoing quality of individual flats for the tenants is maintained over the long term.

This, in our view, is a point of differentiation from many other rental properties currently available in the private rented sector. Strong ESG characteristics are a feature of genuinely durable physical assets. ESG and sustainability are becoming key drivers during acquisition planning, development and ongoing property management of BtR assets. This should include energy efficiency, water, waste and recycling, renewable energy, tenant and community engagement, and health and well-being. Based on current planning requirements, a new build residential scheme in the UK is initially required to start with an energy statement /strategy, which is then demonstrated through the PEA (Predictive Energy Assessment) at design stage. This is later confirmed at the end of construction with the EPC (Energy Performance Certificate). Since October 2016, in Greater London, developers have to deliver “zero carbon” (over and above the 2013 Building Regulations) residential developments – which currently sees the design of the building typically achieving a 40- 50% carbon reduction, with the remaining 50-60% being achieved via a financial contribution to the Local Authority. There is also new regulation which makes it unlawful to rent a property which breaches the requirement for a minimum “E rating” for energy performance on an EPC, unless there is an applicable exemption. UK PRS investments should also support the functioning of communities and could provide a targeted contribution to economic growth and development. An investment strategy should concentrate on geographic locations where there is a proven rental market, potentially combined with a shortage of quality rented accommodation, but focusing on the “mainstream” rental market to maximise the potential tenant base in each of these locations.

Certain parts of Greater London, selected towns in the South, South East and South West of the UK, as well as major gateway towns and cities in the Midlands and North provide the potential locations for BtR developments. These are locations where there is already a proven demand for rental properties and which also offer quality living for workers, which is vital to promoting UK economic development and growth.

Criteria 2: long life and low risk of obsolescence

The UK is facing a long-running demand and supply imbalance in the housing market. Demand for housing continues to increase, with supply failing to keep pace with an increasing population and the number of households being formed through changes in lifestyle choices. Levels of unaffordability have reached historic highs, which means that many people are unable to afford the deposits required to purchase a property. At the same time, changes in aspirations for home-ownership in some age groups are further encouraging renting. Both population growth forecasts and current projections on the supply of new build properties suggest that the strong demand for BtR will continue over the coming years.

With institutional quality buildings, dedicated on-site management teams assist in ensuring that the buildings are maintained to standards that seek to extend its life through well programmed and regular maintenance programmes.

Therefore, institutional grade PRS strategies are well-placed to take advantage of this demand. Such strategies should provide risk-adjusted returns over the long term, while positively supporting the functioning of society through the provision of quality housing.

Criteria 3: identifiable and reliable cash flow, preferably inflation-linked

UK PRS investments can potentially provide long-term income through the rents paid by tenants under Assured Shorthold Tenancies (“AST”). These tenancy agreements provide the tenant with protection, and the investor with a contractual rent that is payable through the tenancy term. The weighting of a portfolio of PRS assets will ultimately define how closely correlated the returns are to the CPI. A feature of UK PRS investment is also the early generation of income once the asset has been built – as this occurs as the flats are let following completion of the development, with some cases “pre-lets” being achieved to secure immediate income streams.

There is clear inflation linkage through rental growth which is provided through the ability to periodically adjust rents. Returns are also expected to be generated through

Criteria 4: revenues largely isolated from the business cycle and competition

Institutional quality UK PRS assets (and their revenues) are largely protected from the business cycle through investing in quality purpose-built BtR assets and the macroeconomic conditions that exist in the UK housing market. The UK has experienced a long-term structural imbalance between the supply of new housing and the demand from households, which is not expected to materially improve in the coming years.

The affordability of house purchases is now at record highs and throughout the period since 2002 has remained above the long-term average. Even during the financial crisis of 2007-2010, these ratios did not fall below the long-term average. With such a strong supply demand imbalance, the pressures on the market may assist in protecting revenues including rents from downward volatility even in future economic downturns. Based on the Association of Residential Lettings Agents’ June 2019 PRS Report, the average length of ASTs in the UK is 18 months. Many institutional PRS strategies are looking to grant tenancy agreements of up to 3 years, providing greater length to the contracted income. However, it is expected that tenants will also seek to secure the longest possible terms for their ASTs and so provide greater certainty on the long-term nature of the income streams, which will benefit the tenants in terms of security and investors in terms of reducing void income periods.

Criteria 5: returns with low correlation to other asset classes

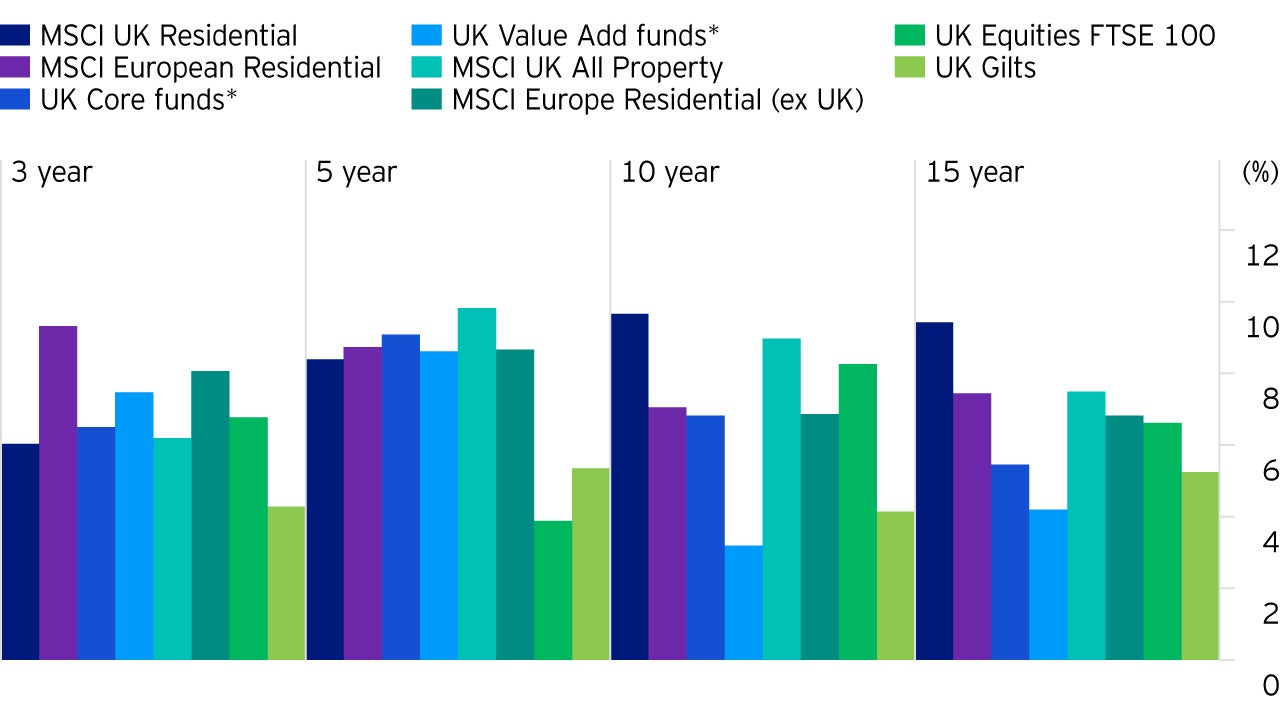

Residential property is a separate asset class to commercial property and is a form of infrastructure. It can be a strong portfolio diversifier for many LGPS funds and has historically provided superior risk adjusted returns. Residential property has low correlations to other asset classes and, on a risk-adjusted basis, it performed better than listed equities, core and value add commercial property over the long term (Figure 2). Together this suggests that UK PRS is a strong diversifier in a multi-asset investment portfolio.

A clear conclusion

UK PRS has the potential to be an attractive infrastructure investment for LGPS funds on many levels, helping to address specific investment challenges, embrace Government Guidance and redress the UK’s housing shortage. Alongside BtR investment’s identifiable and reliable cash flow characteristics, it can potentially enhance long-term portfolio diversification through its expected low correlation with other asset classes and help LGPS funds mitigate funding pressures from ongoing public sector funding constraints.

Related insights