Sustainable Investing Insights

Insights on trends, opportunities and challenges drawn from our global team of investment experts.

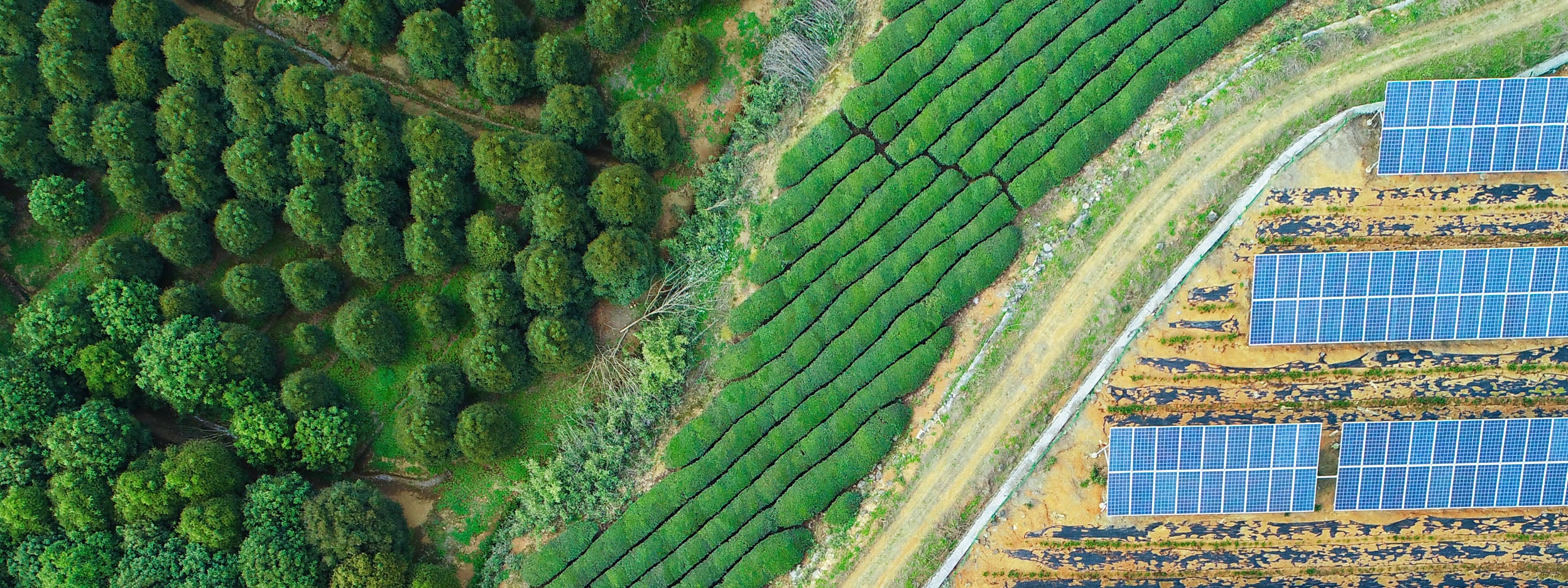

ASEAN’s transition story: Climate investing opportunities in Southeast Asia

Green investments in ASEAN rose 20 percent in 2023. At the same time, ASEAN faces significant hurdles in achieving net-zero emissions, requiring significant changes in energy infrastructure and policies, as well as enhanced financing for energy projects.

Investment Insights

Our Sustainable Investing capabilities

At Invesco, we have been implementing sustainability strategies for over 30 years. Each of our investment centers has a unique approach defined in their investment process as well as the respective asset class. We offer a variety of sustainability implementation techniques which reflect clients’ diverse needs.

1Source: Invesco, as of December 31, 2024. Sustainability-categorized AUM includes our Sustainability-dedicated product offerings (including portfolios and mandates across a variety of strategies, geographies, and client types). To be included within the category of Sustainability-categorized AUM, a portfolio or account must have binding sustainable investing criteria above minimum regulatory requirements. This characterization is evaluated separately and discretely from any integration of ESG factors into the fundamental investment process.

Industry partnerships

Invesco is actively involved in numerous industry partnerships and initiatives. Active participation in these organizations not only allows us to stay at the forefront of industry developments but also enables us to contribute to improvement and transparency of the financial markets in a way that benefits our clients and the industry as a whole.

Invesco’s partnerships include:

1) Members of global and Asia industry initiatives including:

Global:

- UN PRI: Signatory since 2013 and participate in multiple working groups

- TCFD (Taskforce for Climate Related Financial Disclosures): Support TCFD and disclose to stakeholders on our climate-related financial risks in our annual TCFD Report

Asia:

- HKGFA (Hong Kong Green Finance Association): Invesco is a member of the HKGFA (Hong Kong Green Finance Association) where Invesco is a co-chair of HKGFA’s Sustainability-related disclosures, policy and standards working group contributing to regulatory consultations in Hong Kong, member of HKGFA’s Education Council, previously a co-lead of research on Common Ground Taxonomy and previously a lecturer for HKGFA-HKUST’s Sustainable Finance Programme. We also contributed to a memo on transition investing approaches in 2024 (see Sustainability - related Disclosures, Policy and Standards - HK Green Finance Association )

- AIGCC (Asia Investor Group on Climate Change): Invesco is a member of AIGCC- a leading network of institutional investors in Asia focused on climate investing where Invesco is currently co-chair of AIGCC’s Physical Risks & Resilience Working Group.

- SFC's Hong Kong ESG Ratings and Data Products Providers VCoC Working Group (VCWG): Invesco was part of an SFC initiated industry-led working group that developed a voluntary code of conduct on ESG ratings and data providers in 2024. The voluntary code will establish a benchmark for the provision of high quality, reliable and transparent ESG information to combat greenwashing in Hong Kong’s growing green and sustainable finance ecosystem. SFC welcomes voluntary code of conduct for ESG ratings and data products providers | Securities & Futures Commission of Hong Kong

2) Supporting on industry developments of Sustainable Investing including through:

- CSRC (China Securities Regulatory Commission) International Advisory Council

- AMAC (Asset Management Association of China) Green & Sustainable Investment Committee

3) Special Partnerships on proprietary Sustainable Investing research including:

- Tsinghua University: Research partnership focused on investment opportunities in China and EM including examining opportunities in China green sectors, green & transition indexes and China’s climate transition of high emitting sectors; including proprietary research on emissions estimation and green revenue analysis. More details of the research partnership available at Tsinghua-Invesco Research Collaboration - AP Institutional | Invesco

Meet our team

Want to know more about sustainable investing with Invesco?

Get in touch and let us know how we can help.