ASEAN’s transition story: Climate investing opportunities in Southeast Asia

Green investments in ASEAN rose 20% to US$6.3 billion in 20231. At the same time, ASEAN faces significant hurdles in achieving net-zero emissions, requiring significant changes in energy infrastructure and policies, improvements in energy efficiency, grid connectivity, enhanced regulatory frameworks (and national policies supporting the renewable sector) as well as enhanced financing for energy projects. Energy demand in ASEAN is also projected to increase significantly, driven by factors like GDP growth per capita and ongoing urbanization. This piece deep-dives into climate investment opportunities and risks that are most relevant for the ASEAN region, through the lens of climate mitigation, adaptation, and transition.

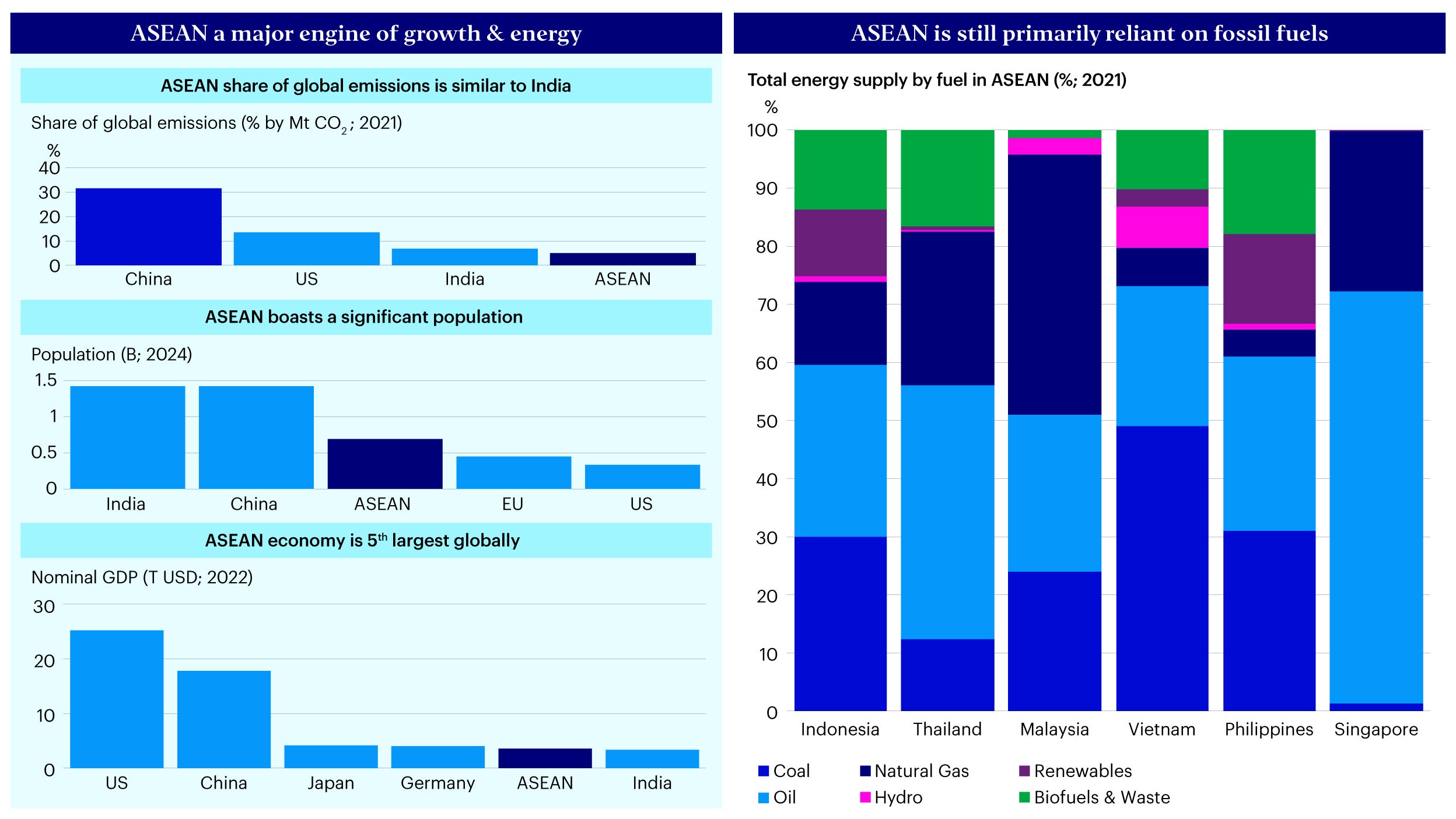

ASEAN has seen continued investor interest as urbanization, young demographics and rising incomes remain structural drivers for GDP growth. Economic growth combined with the growing population shines a light on ASEAN’s increasing energy demands and transition needs. The region is still heavily reliant on fossil fuels and 90% of the growth in energy demand is for coal, oil, and natural gas. The ASEAN region is collectively the fourth-largest energy consumer in the world with an annual energy consumption growth rate of 3% over the past two decades2.

Sources: IEA (Asia Pacific – Countries & Regions - IEA); World Data (https://www.worlddata.info/the-largest-countries.php); Investopedia (https://www.investopedia.com/insights/worlds-top-economies/); IEA / Southeast Asia Energy Outlook 2022 (iea.blob.core.windows.net)

Key drivers of broader climate and energy transition in the region include:

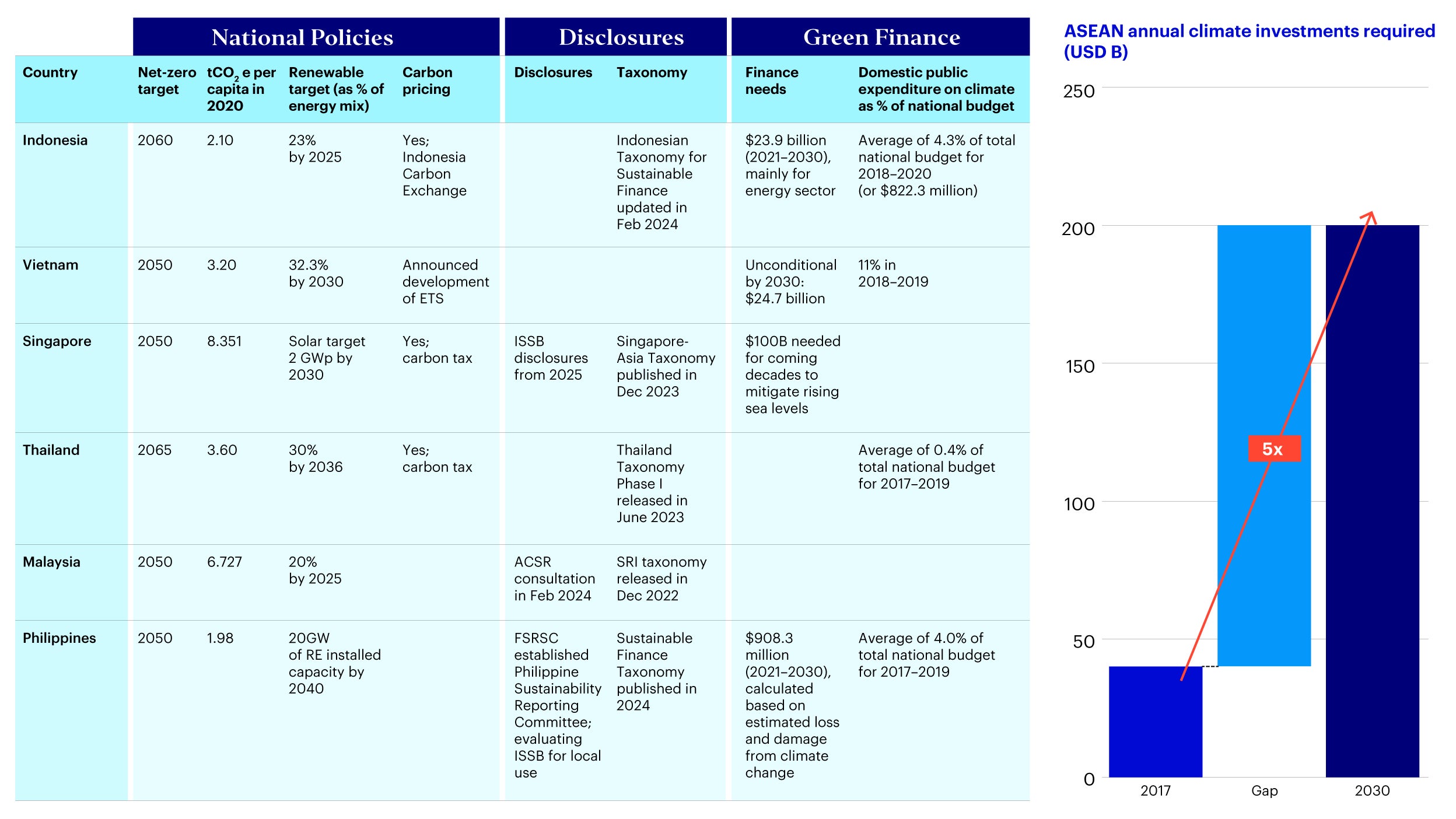

- National policies: Nine out of ten ASEAN member states have made net zero commitments3 with supporting policies such as renewable energy targets, energy efficiency targets and in some cases carbon pricing and taxes4.

- Disclosures and standards: Many in the region have indicated adoption of the International Sustainability Standards Board (ISSB) standards for sustainability disclosures with an estimated 32,400 companies across Asia expected to be in-scope for new sustainability reporting requirements5. ASEAN also released an ASEAN Taxonomy for Sustainable Finance update (its third version) in April 20246. In particular, the taxonomy is known for its multi-tiered framework including a traffic light system of classifying activities as green, amber, or red allowing for consideration of transition activities.

- Green economy and financing: ASEAN as a region is expected to have a US $300 billion green economy revenue pool by 2030, approximately 5% of Southeast Asia’s GDP. Underlying investments would be required to support the growth of this green economy.

- Indonesia: Indonesia has the largest renewable capacity as well as the largest coal capacity within ASEAN. The country is therefore crucial to ASEAN achieving its renewable energy goals. The Indonesian Stock Exchange launched Indonesia Carbon Exchange (IDX Carbon)7 in September 2023 setting a carbon pricing mechanism for various sectors including energy, waste, industrial processes and agriculture. Indonesia is ranked third globally in terms of climate risks8, with material exposure towards climate events such as severe heat and flooding. In fact, Indonesia is ranked fifth highest globally among populations exposed to lower elevation coastal regions9.

- Vietnam: Vietnam’s has shown policy support for renewable energy by approving the Power Development Plan VIII in 2023 as well as committing to its 2050 renewable energy goals. The country’s geography is estimated to be able to support wind and solar energy capacity of up to 1,000 GW10. Like Indonesia, urban areas are also prone to flood and sea-level rises with significant potential for loss and damages.

- Singapore: Singapore’s Green Plan 2030 includes positioning Singapore as a leading centre for green finance. This involves issuing US $35 billion in green bonds by 203011 and driving taxonomy development to support energy transition in the ASEAN region. It also involves a planned five-fold increase in solar energy development by 203012. At the same time land constraints have put a focus on developing the region as a hydrogen hub.

- Thailand: Thailand’s Department of Climate Change and Environment launched a public consultation on the draft of their Climate Change Act in February 202413 which includes a national climate master plan, dedicated climate change fund to support measures on climate action, mandatory emissions reporting, and a corresponding emissions trading scheme.

- Malaysia: Malaysia plans to achieve a 70% renewable share in its power mix by 2050 at cumulative investment of US $135 billion14. The Malaysia market has seen a tripling of sustainable debt issuance over the period between 2020 and 202315.

- Philippines: The Philippines launched its Philippine Energy Transition Strategies under the Philippine Energy Plan in 2023 with an aim to increase access to affordable energy and increase the renewable energy share in its power mix to 35% by 2030 and 50% by 204016.

Source: ASEAN (https://accept.aseanenergy.org/re-ee-targets ); Ecobusiness (https://www.eco-business.com/news/from-big-four-dominance-to-more-oversight-of-assurance-providers-what-to-look-out-for-as-asia-adopts-issb-standards/ ) ; Oliver Wyman (Directing The Flow Of Green Investments Into ASEAN (oliverwyman.com) ); Explainer: How Singapore will fund its S$100b effort to mitigate climate change effects - ASEAN Centre for Energy (aseanenergy.org)

Globally, we believe climate investment opportunities will unfold around the themes of mitigation (solutions and technologies driving decarbonization), adaptation (increasing resiliency), and transition (adoption of green technologies and business models).We examine these trends in the context of the ASEAN market.

Source: EDB/ Mckinsey (Powering progress in Southeast Asia’s renewable development | Singapore EDB ); Climate Policy Initiative (Fast track to a low-carbon, climate resilient economy (adb.org) ); Standard Chartered (Part four: Market spotlights - The Adaptation Economy (turtl.co) ); Bain (https://www.bain.com/globalassets/noindex/2024/bain-southeast-asia-green-economy-2024-report.pdf )

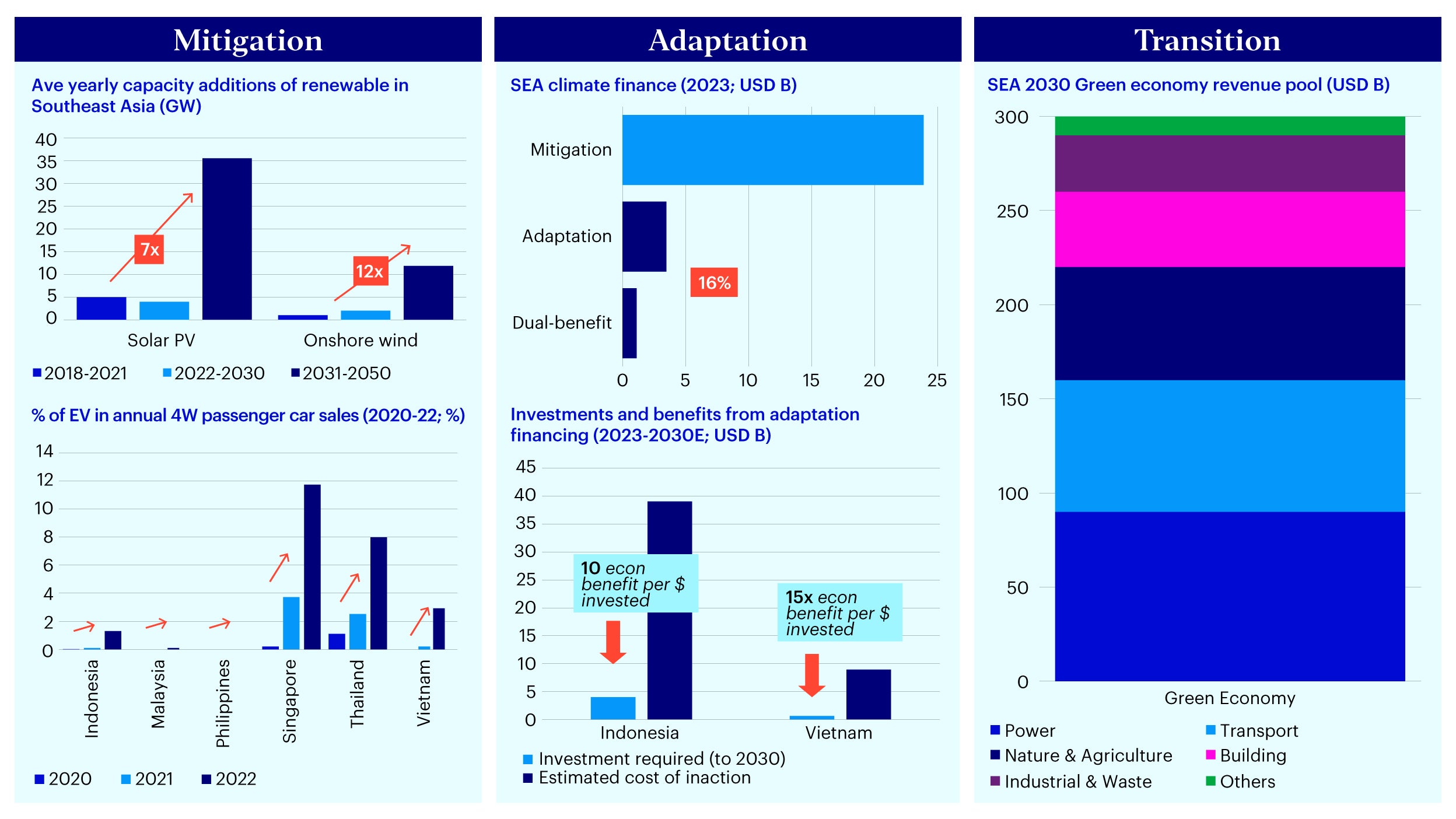

Mitigation:

- Renewables: ASEAN has significant growth potential for renewables, yet to date the region has attracted the second-lowest level of investment in solar and wind (second only to sub-Saharan Africa). We believe annual capacity additions need to increase by around seven to twelve times to meet regional needs17.

- Grid: There’s a need to grow grid infrastructure to support the growth of renewables and electric vehicle (EV) charging, particularly cross-border grid infrastructure that can integrate supply from a variety of energy sources and markets.

- EVs: The electrification of transport is a key theme with countries like Indonesia, Thailand, and Malaysia enacting policies to electrify new vehicle sales18.

- Hydrogen: We believe hydrogen will play a key role in diversifying energy sources and is also critical for industrial decarbonization. Singapore has implemented a national hydrogen strategy focused on green hydrogen R&D while many Indonesian state-owned companies are also actively developing pilot hydrogen projects19.

Adaptation: Increasing interest in the development of national adaptation plans are expected to drive global demand for adaptation financing in Southeast Asia.

- Financing gap: Southeast Asia is one of the most vulnerable subregions for physical risks with countries like the Philippines and Thailand ranking amongst the top ten countries most affected by extreme weather events in 2000 to 201920. However, as a region adaptation finance only amounted to 16% of total climate finance from 2018 to 201921.

- Adaptation areas & benefits: Following COP27 and COP28, more countries are likely to develop national adaptation plans which will provide further clarity on priority adaptation areas. For example, Indonesia’s priorities include addressing the potential of flood impacts on agricultural production with an estimated US $4 billion in minimum investment required from now until 2030 that could yield 10X in economic benefits22. Similarly, Vietnam will need to focus on managing potential drought impacts on water access and biodiversity conservation with an estimated US $600 million in investments required between now and 203023.

Transition: We believe broad climate transition across sectors will create opportunities to identify transition leaders. Sectors that are particularly interesting for ASEAN include:

- Power: The main roadmap is for existing players to scale up their renewable energy mix. Adoption is mainly being impacted by power market structures and “feed-in tariffs” across different markets like Indonesia and Vietnam.

- Buildings and real estate: Buildings in ASEAN are expected to see growth in electricity usage and cooling and appliances usage given continued urbanization24. Built and real estate sectors will play a key role in regional decarbonization and on-site renewable energy generation and storage alongside energy efficiency measures will be key. Minimum energy performance standards for appliances in countries like Singapore, Vietnam, and Malaysia25 will also drive opportunities in energy efficient appliances like light bulbs, washing machines, and air conditioners, feeding into the decarbonization of real estate.

- Aviation: Singapore has mandated that all outbound flights use 1% sustainable aviation fuel (SAF) from 2026 with a target to increase to 3 to 5% by 203026. These policy developments will help create opportunities for SAF technologies and have implications on costs for aviation operators. Southeast Asia could also become a key supplier of sustainable aviation fuel with countries like Indonesia and Malysia able to leverage their access to feedstock such as waste oil, fats, and non-food crops.

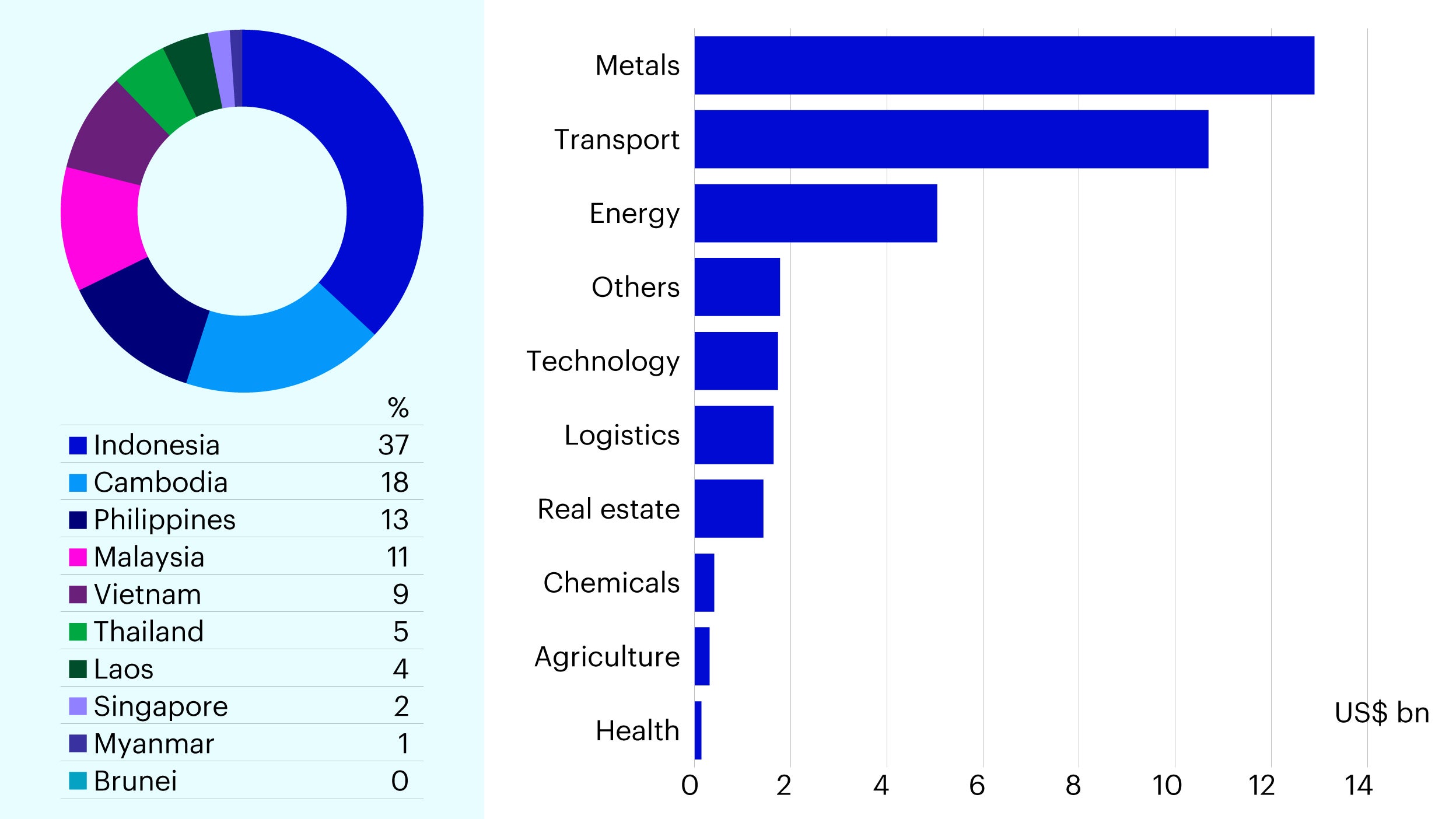

1) Growth of China’s green sectors in ASEAN

Chinese manufacturers have been increasing their exports and investments overseas to remain competitive and strengthen their supply chain. Since 2020, ASEAN has become China’s largest trading partner. We continue to see opportunities for China to grow its green sectors by investing in ASEAN considering the region’s large working population, low labor costs, abundant natural resources, geographic proximity, and cultural similarities.

Several industries are capitalizing on globalization trends to provide carbon transition and green solutions. These industries include metals and mining, new materials, solar and wind energy, smart grid transmission, batteries, new energy vehicles (NEVs), and technology (semiconductor, advanced driver assistance systems or ADAS, electronic components etc.). The top three investments by China into the ASEAN region during the past few years (2019 to 1H23) have been in the metals, transport, and energy sectors.

Recently a Chinese new energy vehicle (NEV) battery manufacturer has invested in Indonesia to support the development of the NEV ecosystem and utilize the abundant supply of nickel, a raw material essential for NEV batteries. For NEV original equipment manufacturers, Chinese brands already account for 75% of the market share in ASEAN, including an 80% market share in Thailand27. NEVs are not just limited to exports, and some NEV makers have built factories in Thailand, while one company is building an artificial intelligence and autonomous driving R&D center in Singapore.

Source: AEI; UBS report “China+1 expansion”, Data as of February 2024.

2) Adaptation financing in ASEAN

Within the climate finance space in ASEAN, we see a significant financing gap in adaptation financing (only 16% went towards adaptation categories in 202328) and see exciting opportunities for thematic investments in the region:

- Agrifood: Climate change is likely to lead to a decrease in yields and reduce the amount of arable land, which may also lower water availability. We see good opportunities in investing in agritech solutions that can be scaled up with proven technologies as well as climate proof agriculture businesses.

- Water: This is a key thematic within the region as countries are suffering from too much or too little water due to climate change. We see opportunities within the blue economy that can be accessed via investments in blue bonds. Examples of use of proceeds include water supply, water sanitation, ocean sectors and products as well as aquaculture. We look for alignment with international best standards such as the IFC Blue Bond Guidelines in our investments.

- Nature based solutions: The ASEAN region has unique opportunities to apply nature-based solutions that can be effective to restore nature capital and lower the overall consequence of climate change. This also has tertiary benefits for the target population not to mention biodiversity considerations. Real world applications include the rehabilitation of costal mangrove areas, reforestation and avoided deforestations.

With its fast-growing regional economy (7% GDP growth per annum versus the global growth rate of 4%29) and high levels of energy consumption, we believe global energy transition will present significant opportunities for the ASEAN region. Investments will be required to scale the adoption of climate solutions and technologies while also helping broad sectors to decarbonize. Regional vulnerabilities will also drive further needs for adaptation financing. As such we believe ASEAN is a key region to watch for when considering climate investing opportunities.