A dynamic allocation approach to private credit

A dynamic allocation approach to private credit: Key points

- Private credit is made up of unique asset classes with a variety of return, risk, and liquidity profiles that require specialization.

- Relative value within private credit can be harnessed through a dynamic allocation approach throughout the business cycle.

- A portfolio utilizing this dynamic approach can improve income and return potential while reducing volatility relative to single private credit sectors and/or traditional assets.

- Finally, manager selection is a critical decision when allocating within private credit. We provide a checklist for investors to review when selecting private credit managers.

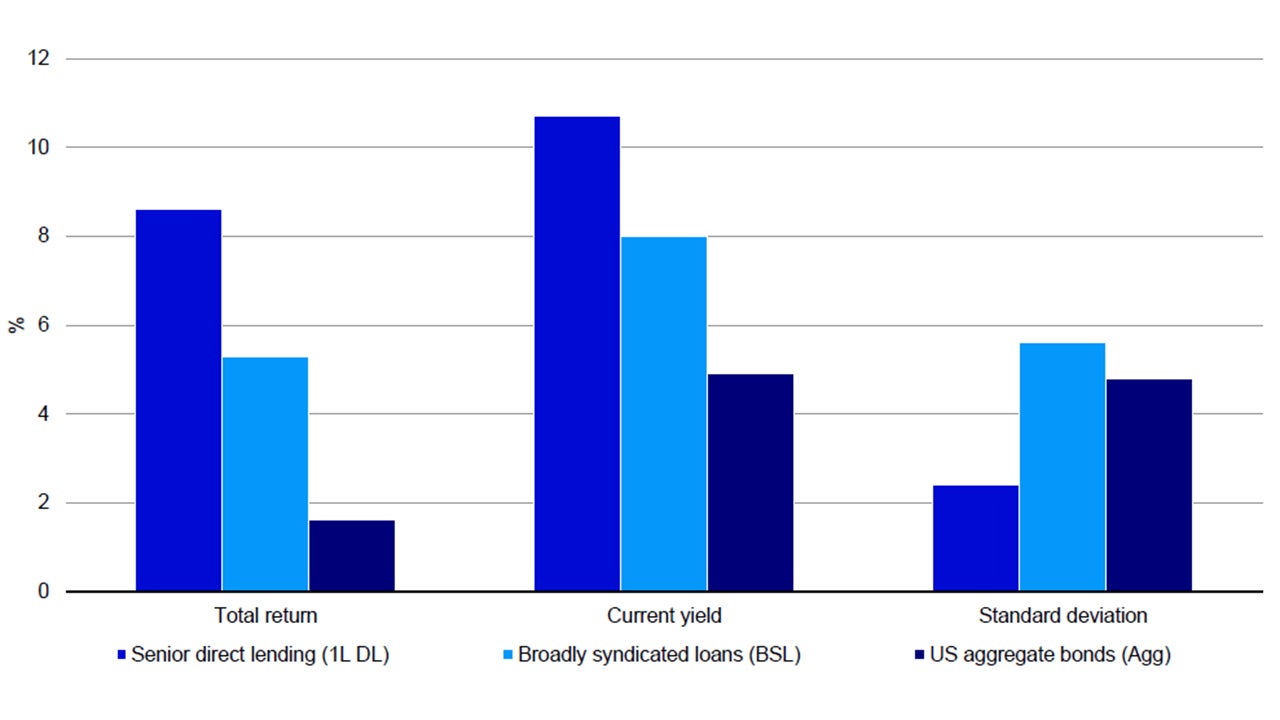

Private credit has produced outsized returns relative to public fixed income

Private credit as an asset class has performed impressively over the past decade, which included a global pandemic and one of the most aggressive tightening cycles on record from the Federal Reserve. In fact, senior direct lending outperformed aggregate bonds by 700 basis points at half the level of volatility since 2012. Current yields for private credit remain impressive with around 200 basis points of additional yield compared to broadly syndicated loans to compensate for illiquidity.

The years after the Global Financial Crisis were characterized by low and steady interest rates, benefiting equities and stable asset allocations. Today, the environment is quite different, with elevated levels of inflation and interest rates and significant volatility in both credit and equity markets. We believe this environment still favors private credit; however, it requires a dynamic approach to the credit cycle that can capitalize on opportunities and dislocations as they materialize.

Source: Invesco Private Credit, Bloomberg, Cliffwater, as of Dec. 31, 2024. Agg is the Bloomberg US aggregate bond index, BSL is the S&P UBS (Credit Suisse) leveraged loan index, DL is the Cliffwater direct lending index – senior. Risk is annualized standard deviation of quarterly returns. Current yield measure is the 3Y takeout yield for 1L DL and yield-to-maturity for both BSL and Agg.

A review of private credit

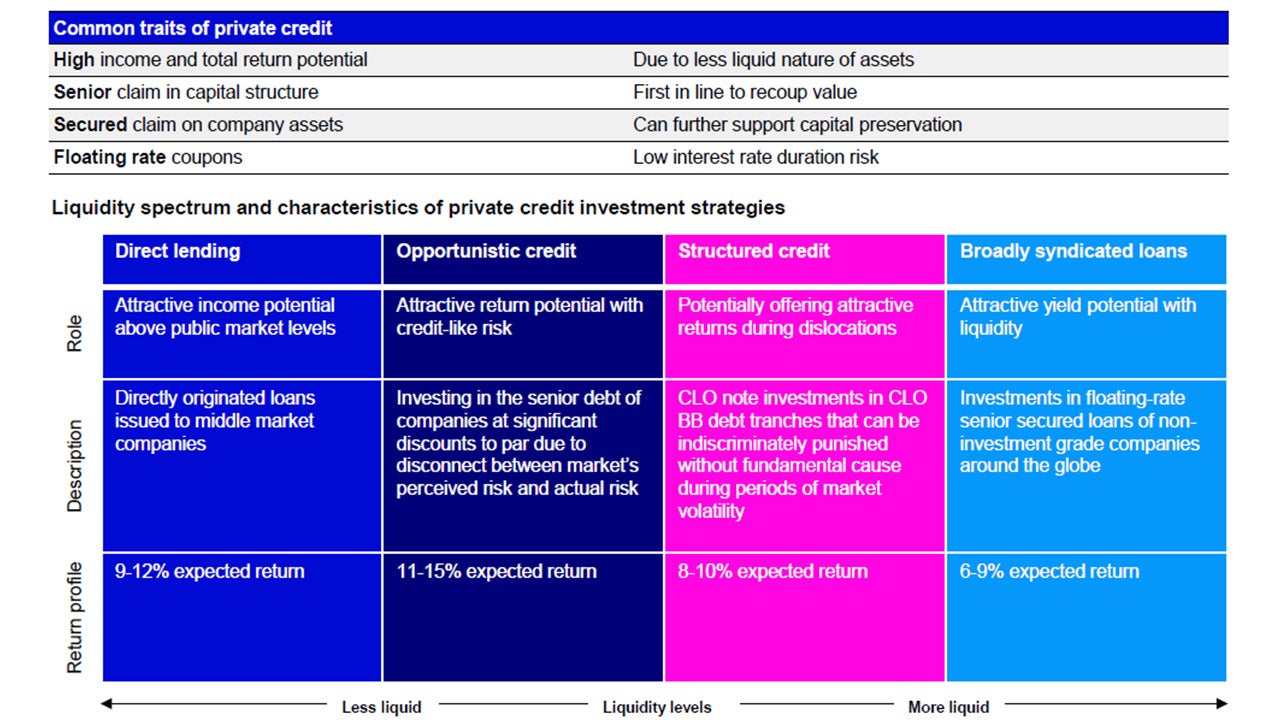

Private credit is inclusive of direct lending, opportunistic credit, structured credit and broadly syndicated loans (BSLs). We define each in the accompanying appendix of this paper.

Common traits of private credit include high income and total returns due to illiquidity, seniority in the capital structure to recoup value, a secured claim on company assets to support capital preservation, and floating rate coupons with low interest rate sensitivity.

Where these assets differ is their underlying liquidity and risk profiles, resulting in vastly different investor experiences and potential levels of expected returns.

Source: Invesco Private Credit as of Dec. 31, 2024. Net returns. There is no guarantee these targets will be achieved or expectations will be met.

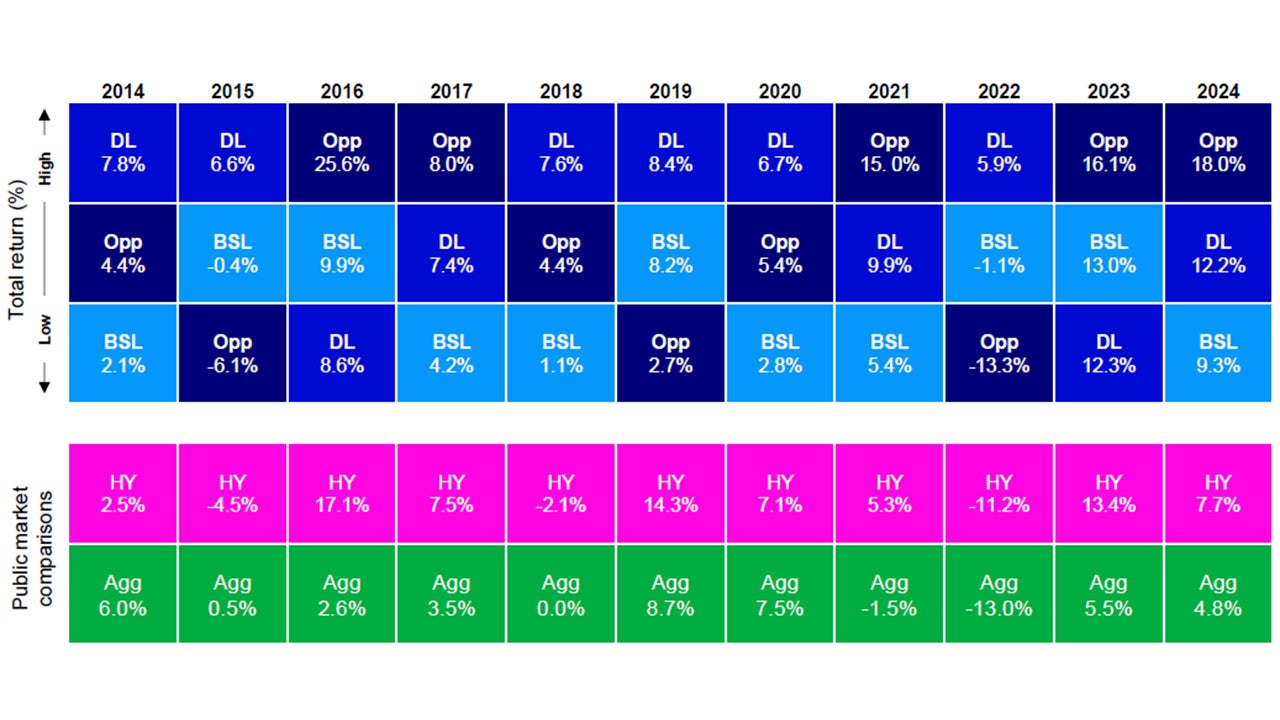

Credit sectors display a level of cyclicality

It is difficult to predict the returns of an asset class in any given year. When isolating the annual performance of these credit assets over the business cycle, a few patterns become clear;

- Full cycle returns of an asset class have been commensurate to the level of risk assumed, with structured credit and opportunistic the top performers.

- Senior direct lending is a standout without a single negative year and averages high single digit returns with low volatility.

- Interest rate risk has become a critical issue for long duration fixed income, namely HY; specifically in a world where yields have been low and rising to levels not seen in decades.

Sources: HY Corp is the Bloomberg high yield bond index, Agg is the Bloomberg US aggregate bond index, BSL is the S&P UBS (Credit Suisse) leveraged loan index, DL is the Cliffwater direct lending index – senior, and Opportunistic Credit is the S&P UBS Leveraged Loan Index (CCC/Split CCC) , all as of Dec. 31, 2024. Past performance does not guarantee future results. An investment cannot be made in an index.

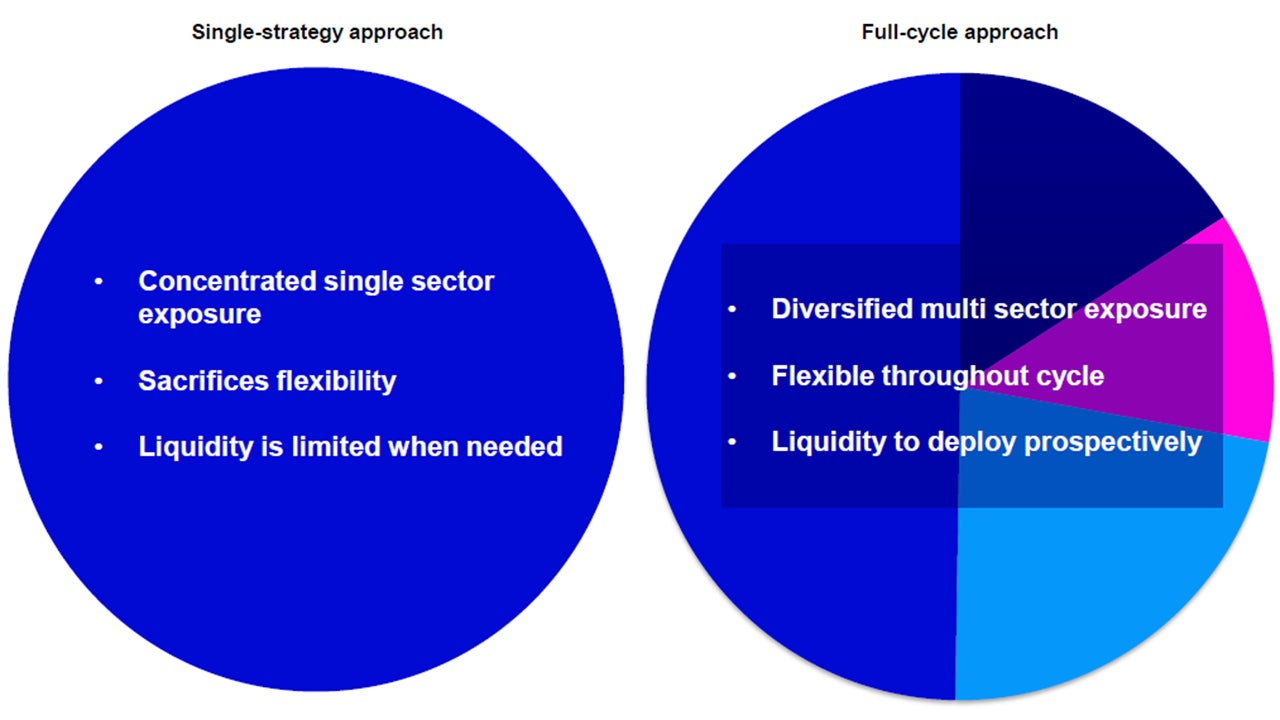

Single-strategy approach to private credit compared to a full-cycle approach

Implementing a dynamic credit strategy within private credit is not so simple. There are numerous frictions within opaque and illiquid private markets. It takes time to pick the right manager for an asset allocation and for them to source deals that match their investment strategy. Further, the average maturity of private credit funds is around 5 years. This illiquidity is statistically likely to span multiple phases of the business cycle with limited room to maneuver or exit, regardless of macroeconomic or credit conditions.

A diversified full-cycle approach to private credit may be able to navigate the business cycle in a way that single-strategy allocations cannot. This approach can add to potential total returns by dynamically allocating to opportunistic or structured credit, all the while maintaining a core holding within direct lending. The liquidity component from broadly syndicated loans acts as a lever to deploy capital for positioning and fund shareholder liquidity.

Sources: Invesco Private Credit, NBER as of Dec. 31, 2024.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations), and investors may not get back the full amount invested.

Alternative strategies may include investments in private equity, private credit, private real estate and infrastructure, which may involve additional risks such as lack of liquidity and concentrated ownership. These types of investments may result in greater fluctuation in the value of a portfolio. Private Market investments are exposed to risk, which is the risk that a counterpart is unable to deal with counterparty obligations. Changes in interest rates, rental yields and general economic conditions may result in fluctuations in the value of any underlying strategies. These types of strategies may carry a significant risk of capital loss and other market risks.