Private credit portfolio: Why investment grade CLOs and broadly syndicated loans?

This is the first of a three-part blog series on optimizing fixed income portfolios by incorporating private credit asset classes. This piece unpacks the benefits of investment grade CLOs and broadly syndicated loans. Subsequent blogs will evaluate European private credit and distressed debt with a similar lens.

As we move through early 2025, a couple of emerging (but not necessarily surprising) themes have become further solidified in the mind of market participants: increasing equity market volatility heightened by trade tensions and geopolitical uncertainty, and a consensus view that US interest rates will not fall as precipitously as originally anticipated at the end of 2024, due to continued economic buoyancy and a general nervousness about (re)emerging inflation. We believe Asian investors are uniquely impacted by these trends, as ongoing risks due to trade and tariffs and continued divergence of central bank policy have a larger impact due to both fluctuation of asset prices and currencies. For context, rate volatility and “sticky” interest rates were something I discussed in a similar piece advocating for senior loans in January 2023. Given this backdrop, we think it’s essential to consider asset classes that can effectively mitigate these risks and enhance portfolios through consistent income without excess exposure to interest rate risk, or duration.

Investors seeking to optimize portfolio returns and income while managing risk in this current environment are increasingly turning to investment grade (IG) Collateralized Loan Obligations (CLOs) and broadly syndicated loans (also referred to as leveraged loans, bank loans, or senior loans). While these asset classes sit at different ends of the alternative floating rate spectrum, they coexist in the same ecosystem, so it made sense to address the opportunity across both spaces collectively. These asset classes could offer attractive yield premiums relative to similarly rated traditional fixed income investments, making them compelling alternatives for those looking to enhance income generation without taking on excessive risk.

It’s natural to ask ourselves why this market opportunity exists – and our primary observation is that both investment grade CLOs and broadly syndicated loans have an embedded “private markets” premium, or in other words, because broadly syndicated loans—which are also the underlying assets for CLOs-- are not securities, investors seek an excess return to be compensated for owning them. However, my objective is to simplify these asset classes in a way that is straightforward, and comparative to traditional bonds, and perhaps “de-complexify” them both in the process.

In this piece, we will explore the benefits of investment grade CLOs and broadly syndicated loans, how they compare to investment grade credit and high yield bonds, respectively, and why they serve as excellent complements to a well-diversified fixed income portfolio.

Investment grade CLOs: A strong complement to investment-grade credit allocations

CLOs are structured financial instruments that pool broadly syndicated secured loans, allocate them into tranches, and distribute cash flows to investors based on this seniority. AAA-rated CLOs, the most senior tranche, are backed by a diverse pool of broadly syndicated loans and benefit from substantial structural protections, including subordination, credit enhancements, and active management by CLO managers.

Historically, AAA CLOs have performed similarly to investment grade corporate bonds but with additional yield and risk-adjusted return benefits. The information ratio of AAA CLOs relative to the IG Corporate (fixed coupon) index is close to 1 and higher than other investment grade rated asset classes, suggesting that CLOs provide consistent excess return per unit of risk compared to investment grade corporate bonds.1

Source: Invesco Solutions. JP Morgan, Bloomberg, January 2024 – March 2024. Sample dictated by data availability. *Assuming a 10% capital allocation, funded from US Aggregate index, duration neutral, delivering approximately 0.25% of tracking error. For illustrative purposes only. An investment cannot be made in an index. Past performance does not guarantee future results.

We outline four key benefits of investment grade CLOs including the aforementioned yield and risk-adjusted return benefits.

- Higher yield compared to IG credit

AAA CLOs typically offer 50-150 basis points (bps) more yield than investment-grade corporate bonds, making them one of the attractive alternatives for fixed income investors seeking incremental income.2 - No historical credit losses in AAA and AA CLOs

The historical default rate for AAA and AA CLOs is virtually zero—even during the Global Financial Crisis (GFC), no AAA or AA-rated CLO tranches suffered principal losses.3 - Floating rate exposure

CLOs are typically floating rate instruments, which means they adjust to rising interest rates and have no duration risk. This provides a natural hedge against inflation and interest rate volatility. - Portfolio diversification and lower correlation to treasuries

Unlike IG corporate bonds, which tend to have high correlation with US treasuries, CLOs exhibit lower duration risk and are less sensitive to interest rate movements. This makes them one of the attractive diversifiers in a fixed income allocation.4

Source: Invesco Vision5, data as of February 2025. For illustrative purposes only.

The additional yield and risk-adjusted return potential of CLOs, coupled with their floating rate nature, make them a compelling complement for IG credit, particularly in an environment where there could be rate volatility.

Broadly syndicated loans: A powerful spread risk-adjusted approach to achieve credit exposure

Another complement to a well-diversified fixed income portfolio is the broadly syndicated loans asset class.6 Broadly syndicated loans are floating-rate instruments issued by non-investment grade companies. These loans are senior in the capital structure, meaning they have priority over unsecured debt and high yield bonds in the event of default.

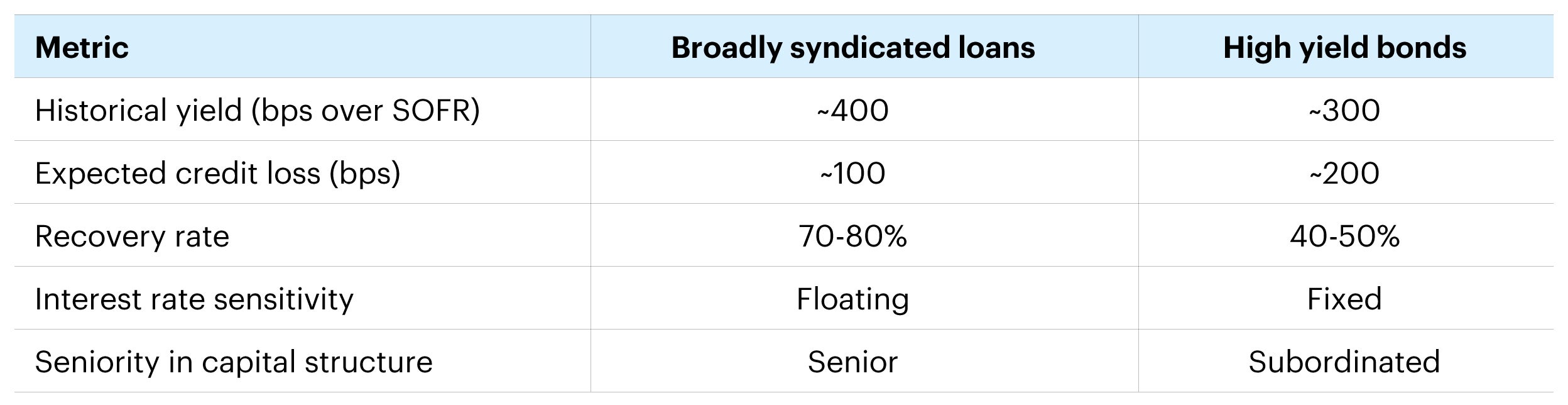

One of the major advantages of broadly syndicated loans is their attractive spread premium relative to high yield bonds, combined with lower expected credit losses. We outline this and other key benefits of broadly syndicated loans.

1. Higher spread vs. high yield bonds

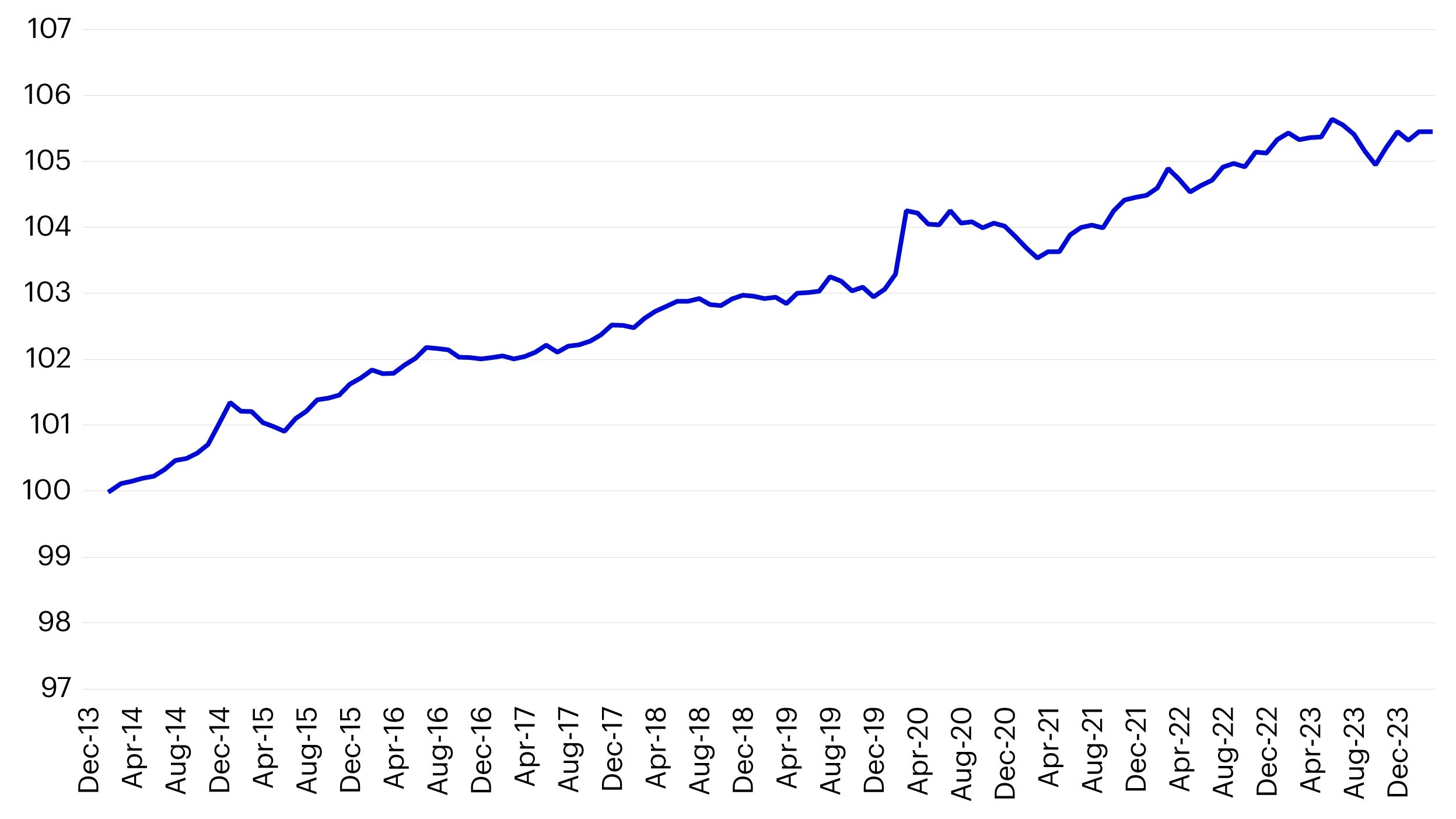

As of 2024, broadly syndicated loans are trading at approximately 400 bps over Treasuries, while high yield bonds trade closer to 300 bps over Secured Overnight Financing Rate (SOFR).7 It’s important to note this spread differential has fluctuated over time, with high yield bonds often trading at spreads closer to and even above broadly syndicated loans. This indicates an attractive entry point for broadly syndicated loans.

2. Lower expected credit losses

Broadly syndicated loans could provide a higher risk-adjusted return versus high yield bonds.8

- Broadly syndicated loans: ~100 bps of expected credit loss

- High yield bonds: ~200 bps of expected credit loss

3. Floating rate nature

Like CLOs, broadly syndicated loans pay floating rates, which could reduce interest rate risk and makes them more resilient in rising-rate environments. High yield bonds, by contrast, are fixed rate and have embedded risk from duration.

4. Stronger recovery rates

Historically, broadly syndicated loans have had higher recovery rates than high yield bonds.

This further supports the case for broadly syndicated loans as a strong proxy for high yield bonds

- Broadly syndicated loans recovery rate: ~70-80%

- High yield bonds recovery rate: ~40-50%

Source: Invesco Vision, data as of February 2025. For illustrative purposes only.

The case for combining CLOs and broadly syndicated loans in a portfolio

Both investment grade CLOs and broadly syndicated loans offer unique benefits and combining them in a portfolio can enhance income generation, improve risk-adjusted returns, and reduce duration exposure.

Portfolio benefits include:

1. Enhanced yield without excessive risk

- AAA CLOs provide a yield boost over IG bonds while maintaining strong credit protection.

- Broadly syndicated loans offer higher spreads than high yield bonds but with lower credit loss risk.

2. Reduced duration risk

- Both CLOs and broadly syndicated loans are floating rate instruments, offering insurance against volatile rate environments, making them very complementary to traditional fixed income portfolios

3. Diversification across credit risk profiles

- AAA CLOs provide investment-grade-like safety with extra yield

- Broadly syndicated loans offer high yield-like returns with better recovery rates

- In 2022, the Bloomberg Global High Yield and Global Aggregate Credit Indices were down at -12.7% and -16.25%, respectively. This is compared to the Morningstar LSTA U.S. Leveraged Loan Index and J.P. Morgan CLO AAA index which fared much better, with broadly syndicated loans slightly down at -0.7% and AAA CLOs achieving 1.0% positive returns.9 If the macro backdrop and inflationary forces put stress on duration sensitive assets, these assets have shown the ability to provide ballast in a diversified portfolio.

Conclusion

Investment grade CLOs and broadly syndicated loans are highly effective complements to a traditional fixed income portfolio. AAA CLOs serve as a strong proxy for investment grade corporate credit, offering relatively high yield, lower duration risk, and structural protection. Broadly syndicated loans provide a compelling alternative to high yield bonds, delivering higher spreads with lower expected credit losses. This additional investor compensation due to the embedded complexity can be a source of improved investment outcomes in what we believe could be a more volatile environment. While duration can be an effective portfolio tool to diversify against equity market volatility, we often find investors taking an “all or nothing” approach to fixed income portfolio implementation, and we advocate a mix of floating and fixed rate exposure given the ongoing market and rate volatility. Asian investors can use these asset classes to provide improved income and volatility mitigation in an environment of ongoing macro tensions.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Many senior loans are illiquid, meaning that the investors may not be able to sell them quickly at a fair price and/or that the redemptions may be delayed due to illiquidity of the senior loans. The market for illiquid securities is more volatile than the market for liquid securities. The market for senior loans could be disrupted in the event of an economic downturn or a substantial increase or decrease in interest rates. Senior loans, like most other debt obligations, are subject to the risk of default.