What’s next for Japanese equities in 2H 2024?

Japanese equities are facing a market correction after rallying over the past year or so. We believe current valuations look attractive and this is a strategic entry point for long-term investors.

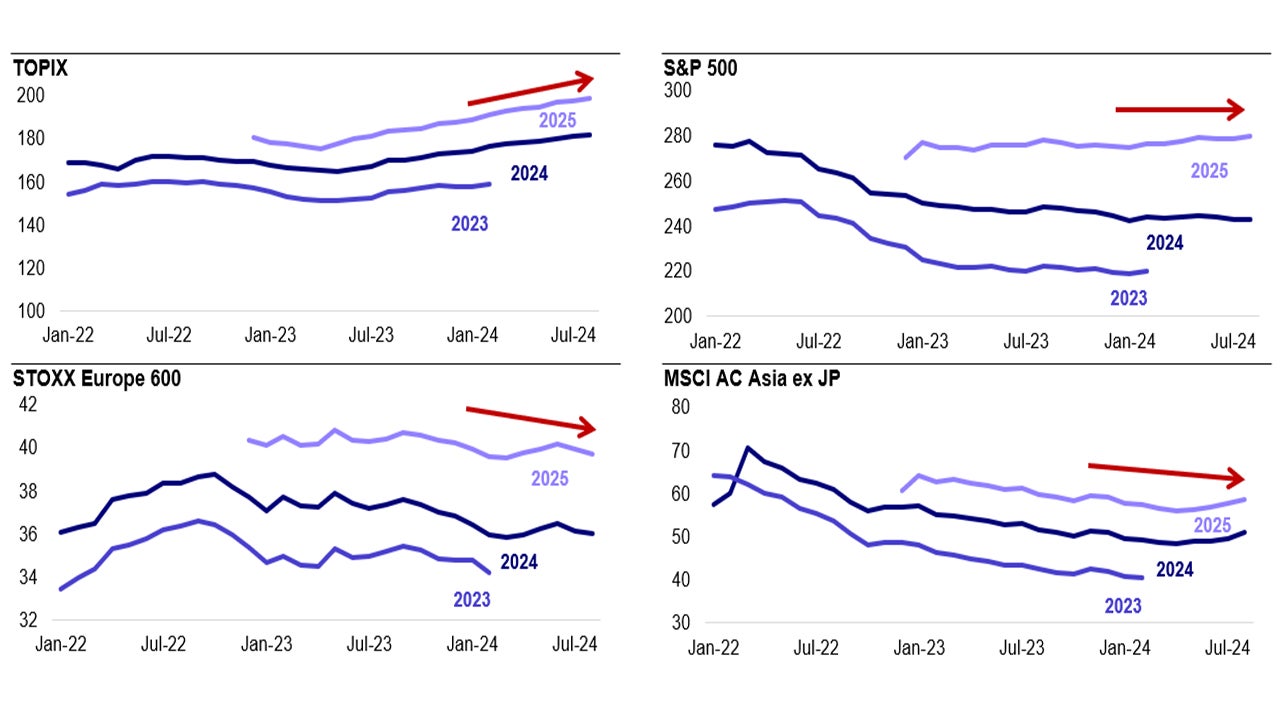

Concerns over US economic conditions and the timing of the Fed rate cut has increased volatility in Japanese equities. At the same time, we believe fundamentals for this market are healthy. Recent quarterly results confirm sustained corporate earnings growth among Japanese companies. Earnings prospects continue to improve in Japan, which stands in contrast to flat or stagnant earnings trends in the other regions.

Source: FactSet. Data as of 31 August 2024.

Corporate profits in Japan have been boosted primarily by price increases, a continued rise in economic activity after Covid-19, and a weakening Japanese yen (JPY). Now, expectations for monetary policy normalization in both Japan (raising interest rates from a negative level) and the US (cutting interest rates from a very high level) have caused the JPY to rally from a 38-year low of 160 to the US dollar. Going forward we expect that a long-awaited wage-price spiral reviving domestic demand will support Japanese corporate earnings.

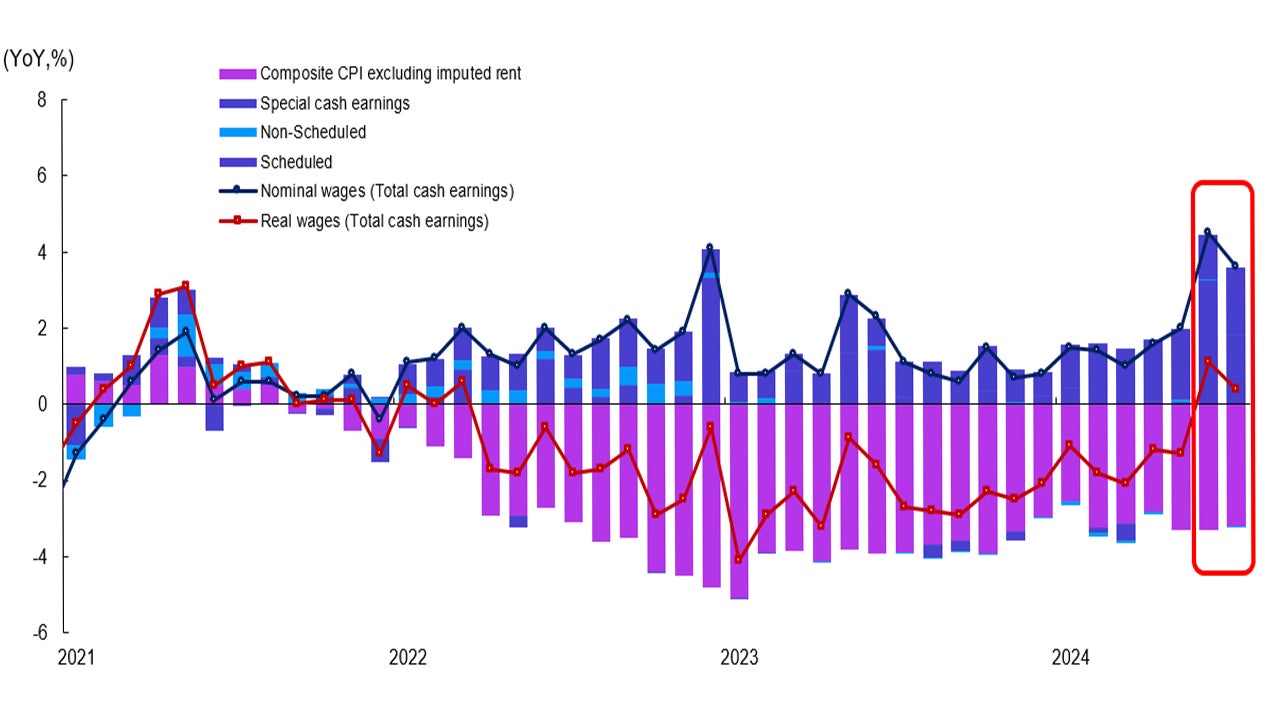

In fact, real GDP growth, which has been curbed by inflation, finally picked up in Q2 2024, achieving a higher-than-expected increase of 2.9% quarter-on-quarter (seasonally adjusted), as domestic demand figures sharply recovered from negative territory. While temporal factors contributed to this, namely auto production and shipment recovery amid safety test manipulation issues, we still believe conditions for domestic spending have been improving. For example, after another successful wage rise in the “Shunto” negotiations last spring, year-on-year real cash earnings growth was positive for the first time in two years in June and July, finally beating inflation.

Source: Ministry of Health, Labour and Welfare and Mizuho Securities. Data as of 31 July 2024.

While summer bonuses boosted recent wage increases, we believe real wage growth will take root in Japan amid solid corporate earnings and labor shortages. Although typhoons and the government’s warning of the possible Nankai Trough earthquake are likely to impact household consumption during the summer holiday season negatively, we still expect a virtuous cycle from rising income to increase domestic spending.

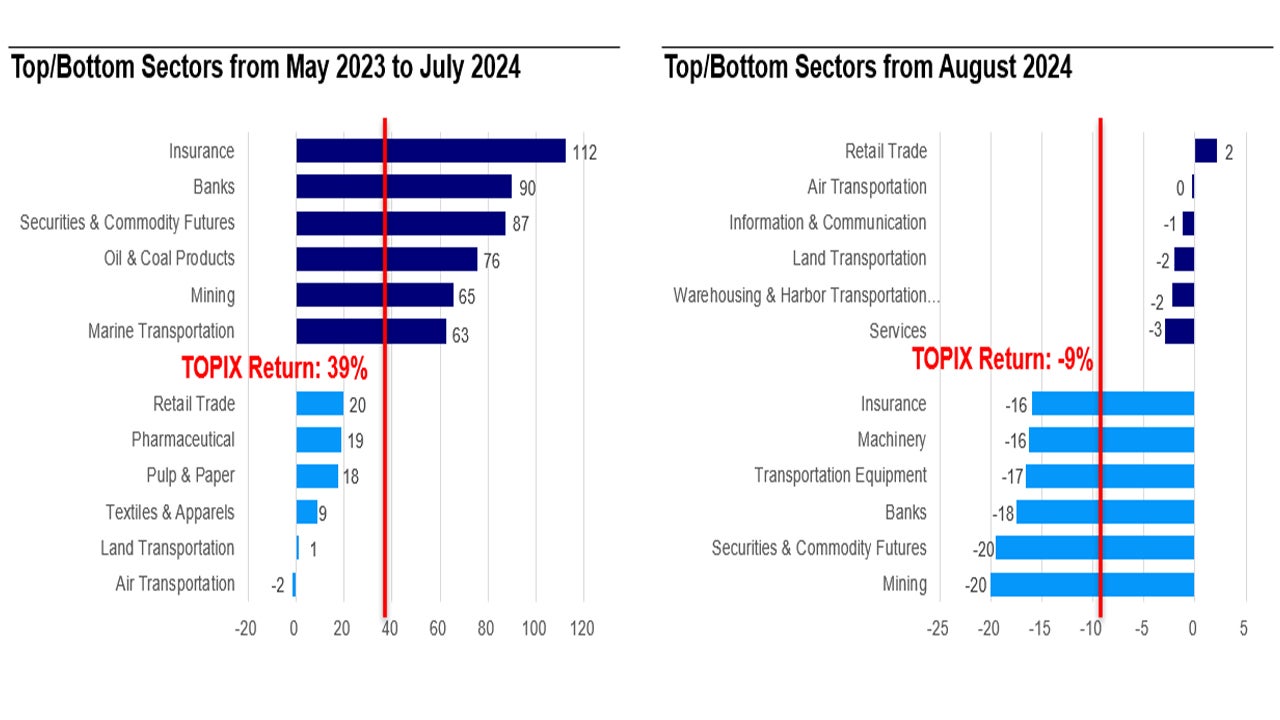

Among domestic demand-oriented sectors, we saw outperformance concentrated only in financial sectors before the August correction, such as in insurance companies and banks. However, as the domestic economy improves, we expect to see investors broaden their domestic stock search beyond the interest rate play. In fact, since August, domestic sectors such as retail trade, land transportation, and services have demonstrated resilience.

Source: FactSet. Data as of 11 September 2024

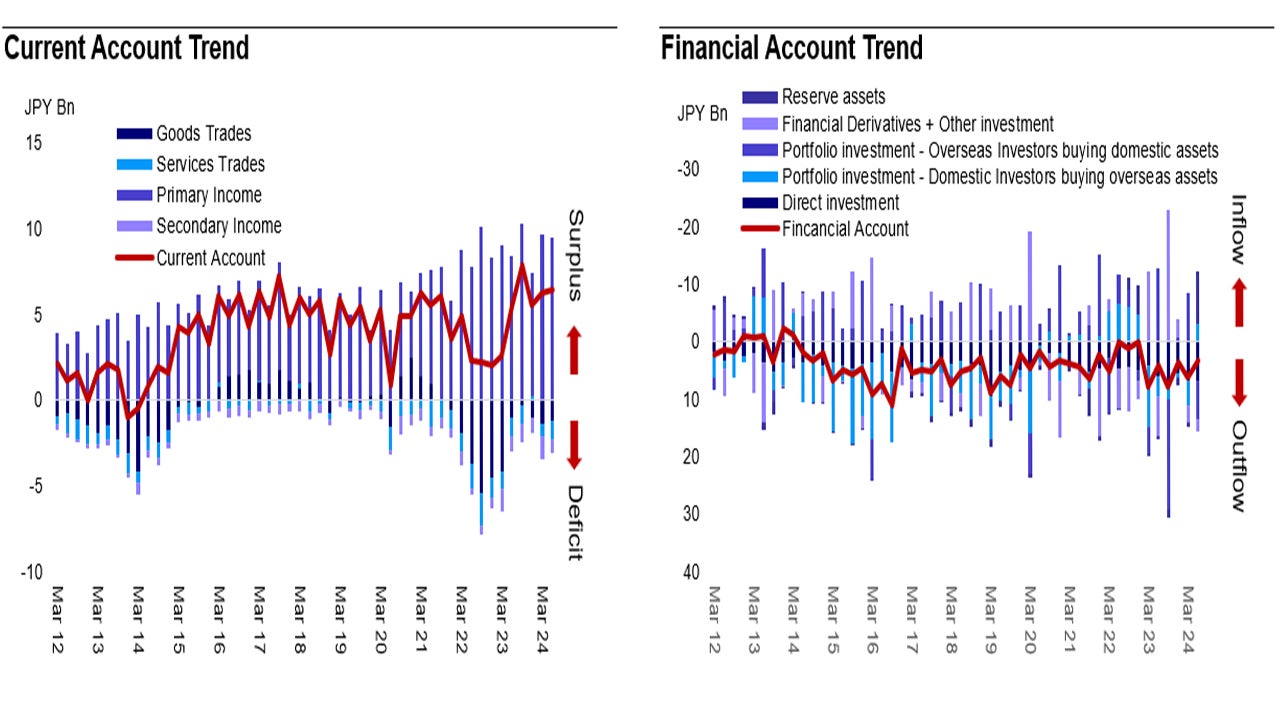

Currency-wise, we believe the likelihood of the JPY strength hurting corporate earnings is low. Our base scenario is that the JPY will stabilize at current levels. Unless a recession hits the US hard, the interest rate gap between the US and Japan will remain, limiting further upside for the JPY. Given that historically high levels of short positions in the JPY have already been squared, we do not think there will be a further unwinding of speculative trades betting on the depreciation of the JPY. Structurally, Japan’s balance of payments remains stable. Although Japan is running a trade deficit, its current account is in surplus thanks to overseas investment income. Overall, we also expect capital flows to remain relatively stable.

Source: Ministry of Health, Labour and Welfare and Mizuho Securities. Data as of 31 July 2024

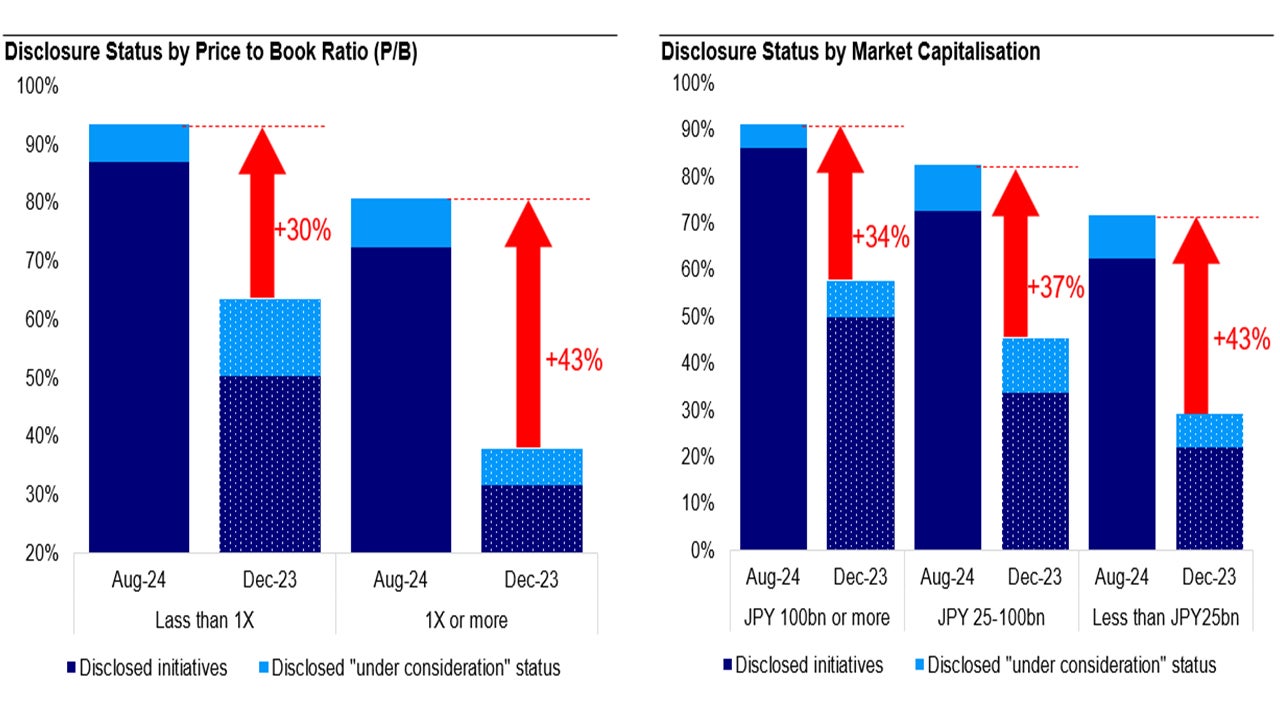

Corporate governance reforms have also been progressing. Since 2023, the Tokyo Stock Exchange (TSE) has stepped up its market restructuring efforts. Since the beginning of 2024, the TSE has started to publish a list of companies meeting their capital efficiency improvement requests to facilitate further investor engagements and improvements among all listed companies. While under the TSE reform theme investors focused on companies trading below their book value, especially among large-cap stocks, these latest actions have sparked a catchup among laggards.

Companies listed on the TSE Prime market as of August 2024

Source: Japan Exchange Group.

Capital efficiency improvements are now starting to pervade all listed companies, strengthening overall corporate fundamentals. Accordingly, we expect the market to price in such improvements, accounting for each company’s initiatives and developments instead of focusing on specific styles or market capitalization segments from a top-down perspective.

In summary, while we acknowledge US recession risks and its impact on Japan, we maintain a constructive view on Japanese equities. While it is unlikely that further JPY depreciation will boost corporate earnings, we believe an eventual shift from domestic price/wage stagnation over the past three decades to a more stable economic environment and growth prospects will support corporate earnings. Furthermore, corporate governance reform remains a secular trend in Japan. After the volatile summer months, investors are focusing more on fundamentals and looking at companies that can capitalize on these structural changes. In this environment, bottom-up stock picking is key.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations), and investors may not get back the full amount invested.