Midyear Outlook: Endurance by Design – Sustainable Investing through Resilient Thinking

Midyear Outlook for 2025

As we enter the second half of 2025, we take the time to reflect on recent months, where headlines have pointed to continued market volatility, evolving investor sentiment, and policy uncertainty with respect to sustainable investing.

What have we seen thus far in the first six months?

- Climate resilience sits at the forefront of investors’ concerns

- In 2024, over 390 natural disaster events have been recorded globally1. The frequency and intensity of these disasters continue to reflect the growing risks of environmental stressors that impact businesses, infrastructure, agriculture and human health.

- According to MSCI, 84% of market participants now believe that extreme weather events will negatively impact the economy, prompting a reassessment of portfolio exposure to physical climate risks2.

- Resilient interest from asset owners despite sustainable fund outflows

- Despite nearly 90% of global investors expressing interest in sustainable investing3, Q1 2025 saw record net outflows from ESG funds4. There’s a paradox between long-term conviction and short-term market behaviour, driven by geopolitical uncertainty, performance concerns, and changing investor expectations. However, many asset owners in Asia Pacific continue to have near-term sustainability targets and allocation priorities5.

- Building resilient investment portfolios

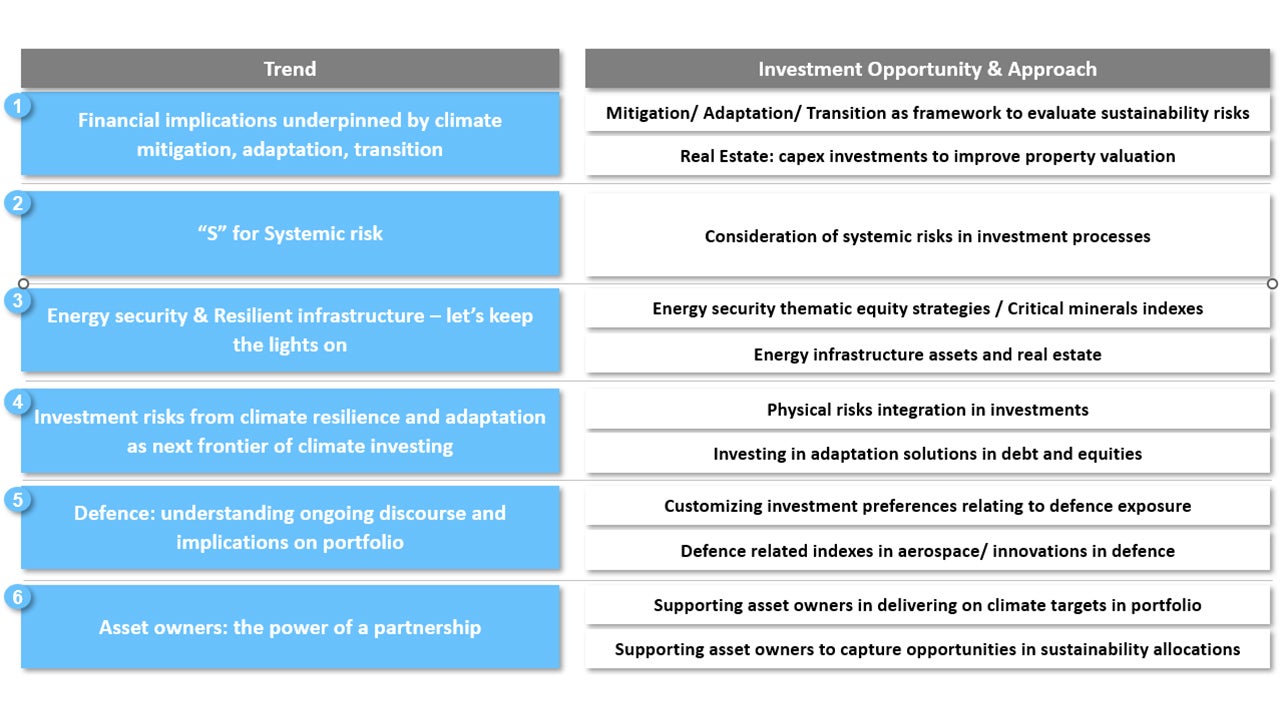

- There has been an increasing focus on understanding financial implications of sustainability and systemic risks and ensuring investment portfolios consider emerging trends and developments such as in energy security and defence considerations. For example, governments are increasingly using trade and industrial policy to support energy security, such as Japan’s Green Transformation Plan which is creating investment opportunities in transition technologies, including green energy, grid infrastructure and carbon capture6.With no shortage of sustainable investment headlines H1 2025, this midyear outlook highlights six themes to consider for the remainder of the year into 2026 and beyond.

Source: Invesco Analysis. For illustrative purposes only.

Financial implications underpinned by climate mitigation, adaptation, transition

What is most relevant for investors is to understand the financial linkages of how sustainability and climate affect business financial performance and investment returns. CDP’s annual analysis on transition plans also highlights a 20% increase in companies drawing a linkage on how climate-related risks and opportunities can affect a company’s revenues and profitability7. Similarly, investors are also evaluating how these sustainability risks impact portfolio performance. For example, the Government Pension Investment Fund (GPIF) in Japan released an “Evaluation Project on effects of engagement” in 2024 where discussions about climate with issuers have led to an increase in the number of targets set and a reduction in scope 2 carbon intensity8. At the same time, research has also shown that engagements on board structure have achieved demonstrable results, with the market capitalization of the engaged companies increasing by 6% as compared to non-engaged companies9.

Climate mitigation, adaptation, and transition can provide an effective lens for investors to holistically evaluate systemic financial risks. In real estate for example, investors can consider opportunities in green financing to achieve lower costs of debt where issuers could obtain interest rate discounts for hitting higher sustainability performance standards10. This is particularly relevant for projects that meet higher levels of sustainability performance, such as new developments or major refurbishments, as part of the brown-to-green transition of buildings. In addition, proactively managing energy efficiency can be beneficial when underwriting investments. The Royal Institution of Chartered Surveyors (RICS) Red Book introduced significant updates to integrate mandatory sustainability criteria into property valuation practices as of Q1 202511. Several countries or individual cities have set minimum energy performance thresholds for existing buildings, posing greater levels of transition risks in certain jurisdictions.

“S” for Systemic risk

Increasingly, the conversation around sustainability continues to evolve to focus on broader systemic risks12 that can be categorized as:

- Undiversifiable: affecting entire markets or economies

- Interconnected: spreading through complex systems, triggering cascading failures

- Hidden: often unpriced into markets due to externalities and long-term horizons.

Systemic risks, ranging from climate change to technological disruption, could affect all sectors in the long term. A report from the UK Sustainable Investment Forum13 highlights how systemic risk may matter to investors:

- Threat to beta: long term returns depend on overall market growth, which systemic risks can undermine

- Mispricing: traditional models are unable to capture these risks, leaving portfolios exposed.

This longer-term view of systemic risk leads to the concept of resilient systems thinking, which is key to managing both risks and returns for institutional investors. Broadening the investment mindset to consider these risks can help to identify linkages between short-term risks and longer-term vulnerabilities , second- and third-order effects, and cross-sector dependencies, which may ultimately encourage moving beyond siloed sustainability analysis to consider whole-system resilience to long term impacts and stressors.

Many global asset owners such as Norges Bank Investment Management (NBIM)14 and GPIF15 have emphasized the impact of systemic sustainability risks on portfolios and have put in place investment processes to better consider such risks. A prime example one can consider is temperature rise, impacting working productivity and health. The UN's International Labour Organization (ILO) expects a 2-4% broad decline in global labour productivity by the early 2030s16 due to increasing heat stress, imposing significant financial costs. In the US, extreme heat currently results in $100 billion in lost productivity each year, potentially reaching $500 billion by 205017. Heat is also expected to significantly impact human health, increasing the risk of heat-related illnesses and exacerbating chronic conditions, such as cardiovascular, respiratory, and diabetes-related illnesses. It is estimated that heat events cost the United States $1 billion in excess health care costs each year between 2016-202018.

Energy security & Resilient infrastructure – let’s keep the lights on

As governments and corporates re-evaluate the future of their supply chains in the current macro environment, a parallel theme is that of ensuring energy security, whether for national security purposes or to safeguard reliable access to energy to power operations. In particular, electricity demand from data centers and the growth of AI are expected to more than double by 2030,19 becoming one of the most significant drivers of energy consumption, placing stress on aging energy infrastructure in handling modern demands. In the absence of increased focus on resilient infrastructure, we may continue to observe issues affecting critical services and communities. In April 2025, blackouts across Spain, Portugal and parts of France and Andorra affected transport, businesses and essential services such as ATMs, highlighting the vulnerability of modern societies to power disruptions. Increased frequency and severity of extreme weather events such as heatwaves, storms and wildfires can damage energy infrastructure, causing a domino effect of failures across interconnected systems. In March 2025, a fire causing the super grid transformers to trip at Heathrow Airport led to a complete loss of power. This affected thousands of customers at the airport, cancelled over 1,000 flights, and disrupted more than 270,000 passenger journeys20, with losses estimated between $80-$100M USD21. This incident led to a review of design standards and highlighted the need for resilience planning for critical infrastructure.

Given this backdrop, industry estimates highlight investments into energy infrastructure will reach record levels in 2025 exceeding $1.5T USD with a growth of 6% vs 202422. Investors can consider mapping out of energy-related opportunities by energy source and sectors alongside investable strategies across asset classes. This will include demand growth in nuclear (large scale and small modular reactors (SMR)), grid and battery storage, hydrogen infrastructure, and critical minerals for green technologies. Some examples include:

- Grid technologies: By 2040, the International Energy Agency (IEA) estimates that electricity grids across the globe must double their capacity23 creating corresponding investments in grid technology innovations such as superconductor cables for transmission, smart meters, automation and management systems as well as upgrading of existing infrastructure, where the European Network of Transmission System Operators for Electricity (ENTSO-E) estimates that 400B EUR of investments are needed for offshore transmission assets like offshore cables24.

- Transformers: A global shortage of transformers25 has been causing delays to power projects; in the US alone, demand for transformers could increase by 260% by 2050 compared to 2021 levels26.

- Critical materials: Demand is expected to grow for copper (used across transmission lines, cables, transformers, circuit breakers due to its conductivity etc.), aluminium (for overhead cables) and steel (used in supporting structures and cabling). Forecasts estimate copper demand to grow by 46% by 2031 to 36.6M MT while aluminium is expected to grow by 42% to 12.8M MT by 204027.

These demand trends can be customized into asset class opportunities and strategies, such as investing in energy security thematic equity strategies or specific energy infrastructure assets or critical minerals-related indexes.

Investment risks from climate resilience and adaptation as next frontier of climate investing

With broader investment themes surrounding mitigation, adaptation and transition developing in the industry, there is a growing recognition that overall resiliency will be a key consideration in assessing investments. Looking at the impacts of natural catastrophes thus far, record economic losses have reached $110 billion in Q1 2025, making it the third-costliest first quarter since 200028. This was driven largely by:

- Unprecedented wildfires in the Los Angeles metro area (≈$65 billion in losses)29.

- Severe convective storms and earthquakes in other regions.

The increased occurrence and scale of these natural catastrophes continue to strain both insurance and reinsurance markets, estimated at $40 billion, double the 10-year Q1 average30. While manageable for the re/insurance sector, these losses are reshaping pricing and risk models, especially in catastrophe-prone regions which may be a growing factor of consideration for companies with operations in at-risk areas or investors into real assets. A 2024 study31 found that short-term disasters (i.e., storms) increase the probability of corporate defaults, while long-term disasters (i.e., droughts and wildfires) lead to financial tightening and greater investor caution. Taking a broader view of these systemic risks impacting corporate credit risks are new ways in which climate mitigation, adaptation, and transition are supporting investment analysis to focus on in months to come. Natural disasters continue to influence investor sentiment32, especially in sectors like energy, agriculture and real estate.

Financing interest in climate adaptation has grown in the past year, whether amongst national governments or global investors. The Asia Investor Group on Climate Change (AIGCC) recent report on National Adaptation Plans highlights 9 priority Asian markets that have all made different progress on adaptation planning33. The past year has also seen newly developed standards like Climate Bonds Initiative’s Resilience Taxonomy34 alongside Singapore sovereign wealth fund GIC’s release of a guide on investing into the climate adaptation opportunity- where they expect the investment opportunity set across public and private debt and equity will grow from $2 trillion USD today to $9 trillion USD by 205035. Historically, the two major challenges with adaptation investing have been definitions, which is increasingly addressed by new standards like CBI above and the economics and bankability of adaptation projects. On the latter, investors should prioritize climate adaptation solutions that lead to clear incremental revenue or cost reduction and savings. For example, an agriculture project that demonstrates increased agriculture yields can lead to both enhanced food security and additional revenue.

Defence: understanding ongoing discourse and implications on portfolio

Defence has become a top-of-mind issue in sustainable investing with the growth in defence spending as a fiscal stimulus in Europe. Europe is increasing defence spending under the “Re-Arm Europe” plan, with the European Commission estimating that an increase of 1.5% of GDP can create fiscal space of EUR 650 billion over the next four years36. Against this backdrop, many investors are reconsidering defence as an allocation in sustainable investing portfolios, viewing it as a way to preserve peace through deterrence. Additionally, a core activity of European defence is supporting NATO, whose involvement in humanitarian aid and protecting the vulnerable in conflict provides social benefits. Bloomberg reported that Article 8 and 9 funds could potentially drive between $53 billion and $119 billion USD in flows to the aerospace and defence sectors37. When it comes to sustainable investing, there may be an increased role for defence exposure in selected strategies, but within our Article 8 and 9 funds exclusions on controversial weapons remain. Investors interested in defence as a broader thematic can also consider strategies such as indexes tracking aerospace & defence (such as companies in development, manufacturing, operations and support of defence) or innovations in defence (such as critical defence infrastructure, robotics, space systems, drones).

Asset owners: the power of a partnership

Most of the headlines on sustainable fund flows measure open-end and exchange-traded fund flows38 yet this does not capture institutional investors’ mandates or accounts. In addition, such measurement of flows is also partly related to regulatory changes on how sustainable funds are defined or labelled. When changes like the ESMA guidelines for sustainable labelled funds occur, many funds are “downgraded”39 and are no longer included in flow calculations, even though the actual fund strategies have not changed. However, the key driver of sustainable investing is in the institutional investing space. In Invesco’s recent asset owners research, nearly 80% of the 52 largest APAC asset owners, with over $15 trillion in assets under management, have a dedicated ESG policy where sustainability is part of their investment process and external manager assessment40. Seventy percent of these asset owners have also made dedicated mandates and allocation into sustainable investing strategies, with allocation ranging from 1 to 10% of their total AUM41. Asset owners may also have 2030 and 2050 climate targets they are navigating to meet in their investment portfolios and are looking to work with asset managers on relevant strategies. One example is The People’s Pension partnership with Invesco to manage fixed income investments using an approach that will feature net zero alignment alongside ESG analysis and active engagement with issuers to promote sustainable business practices while delivering robust long-term returns. Additionally, a coalition of asset owners also released an “Asset Owner Statement on Climate Stewardship” highlighting why climate stewardship is important for their investment process and what expectations are for asset managers42.

Setting clear expectations for targets, goals, and outcomes enables asset owners and managers to work together as partners in achieving client-driven objectives. For relevant strategies with sustainable investing guidelines, tailoring solutions to meet specific client needs or developing products to meet a growing sustainable investment thematic support the alignment of capital with achieving sustainability goals that help mitigate climate risk, drive systemic change and enhance long-term returns.

What’s next for sustainable investing?

In a world-characterized by Volatility, Uncertainty, Complexity, and Ambiguity-endurance is key when navigating changing market dynamics and shifting investor expectations. Sustainable investing will continue to be of relevance, particularly for asset owners with sustainability or climate targets, or for those who see sustainability as a longer-term structural trend to address systemic risks and investible opportunities for diversification and resiliency. In the near term, continued focus on understanding the linkages between climate mitigation, adaptation and transition to financial outcomes will be key.

Investment Risks:

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations), and investors may not get back the full amount invested.