Commodity ETP Digest: December 2025

Commodity market – month in review

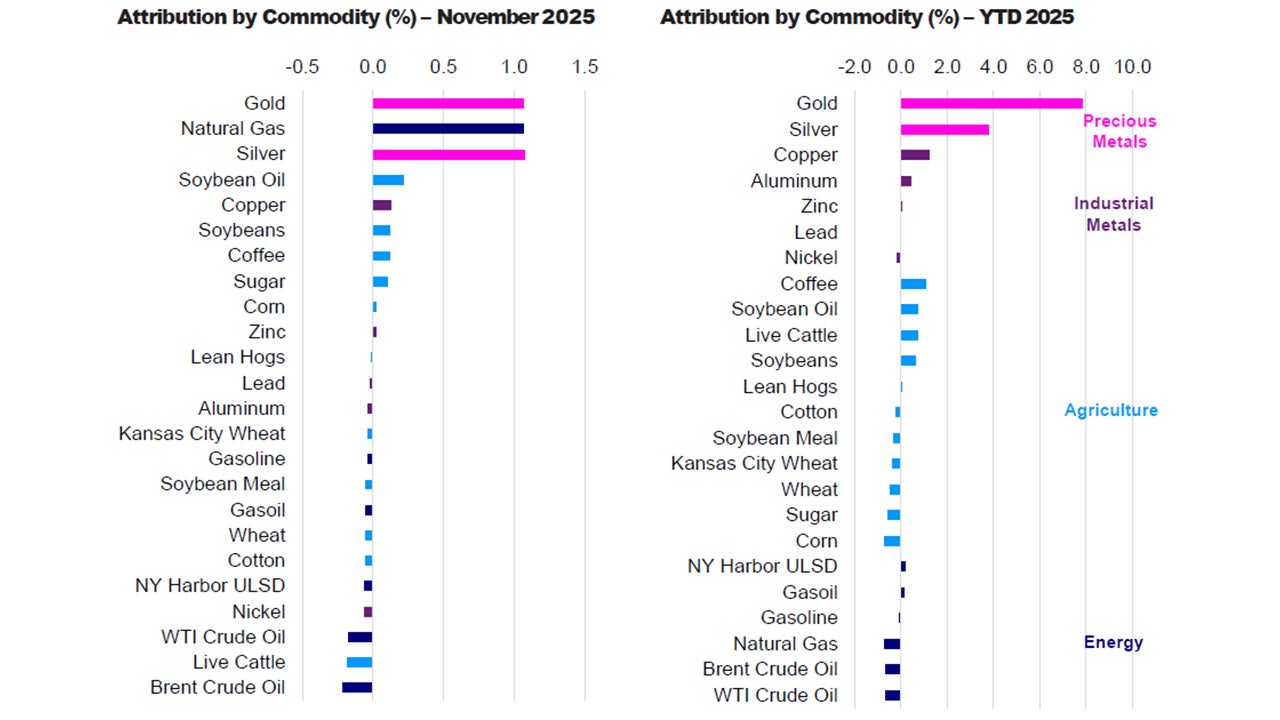

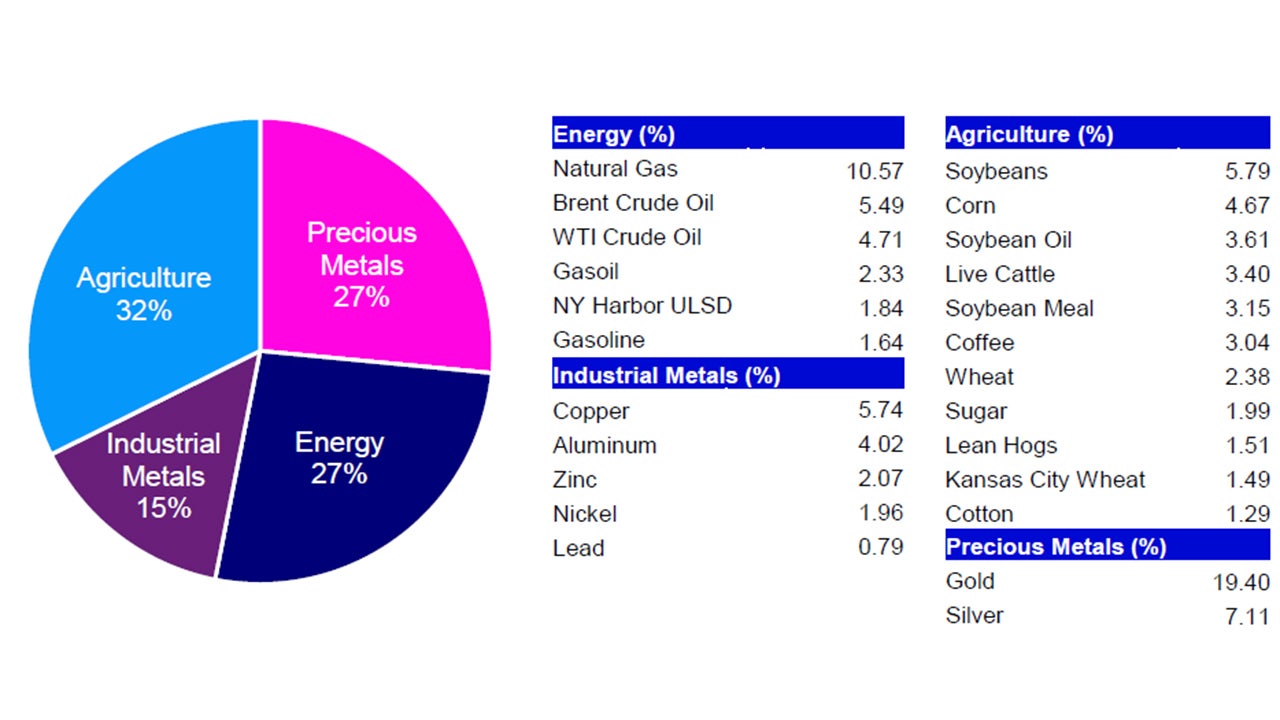

Commodities posted a gain in November, with the Bloomberg Commodity Index (“BCOM Index”) up 2.90%, lifting year-to-date (YTD) performance to +11.80%. Precious metals continued its leadership in November, with silver up 17% and gold up 6%, bringing YTD gains to an impressive 93% and 60%, respectively. Gold prices oscillated early in the month amid mixed US economic data and shifting rate-cut expectations but regained momentum as odds of a December cut increased, while silver’s record-breaking rally was fueled by strong industrial demand and persistent physical tightness. Industrial metals saw a bullish tone, with copper hitting an all-time high on US dollar weakness and US-China trade optimism; aluminum benefited from China’s production caps, while nickel and zinc faced headwinds from abundant Indonesian supply and softer activity. In energy, refined products outperformed crude as refinery closures tightened gasoline and diesel supply, contrasting with expectations of a 2026 oil glut. In agricultural markets, grains were more muted, pressured by ample supply though soybeans were propped up by early optimism from the US-China trade truce. Sugar and coffee also extended their gains while cocoa continued to retreat.

Commodities continue to present a compelling case for portfolio inclusion in 2026, supported by persisting inflation concerns from unpredictable tariff policies, heightened geopolitical tensions, and physical market imbalances.

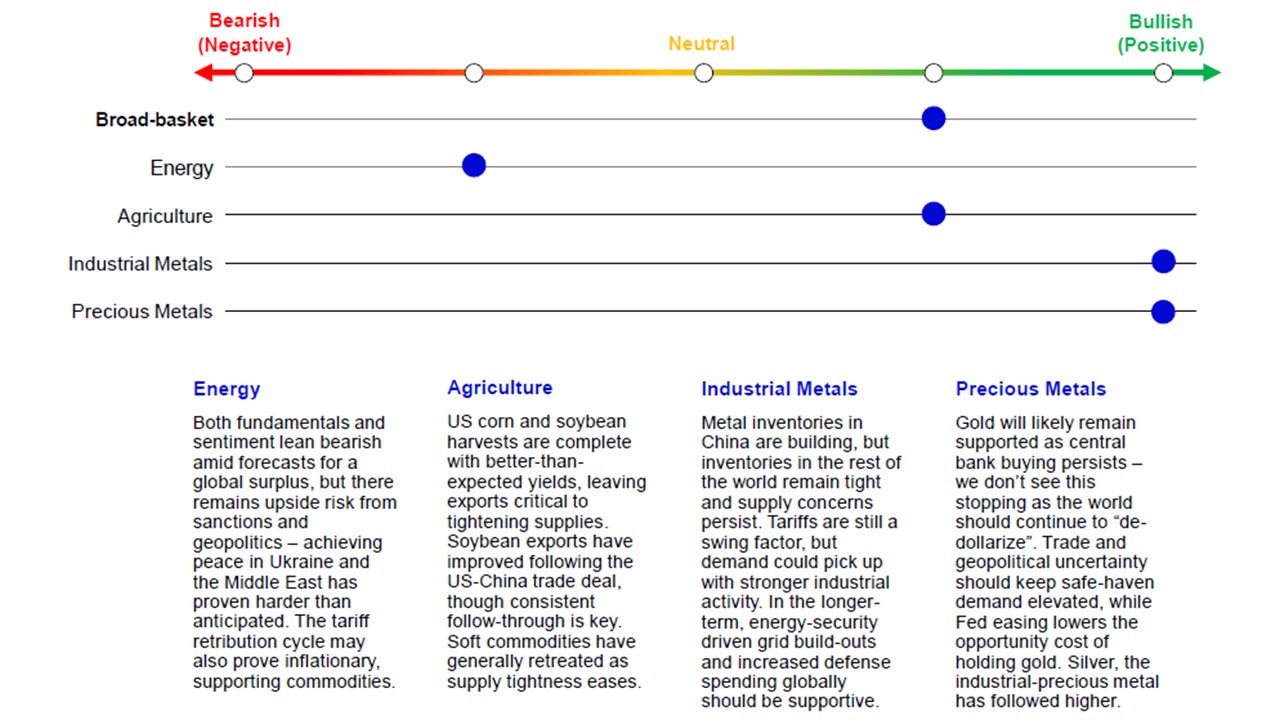

While an expected global oil surplus clouds the energy outlook, production discipline and geopolitical flashpoints could keep prices volatile with upside potential. Precious metals should remain strong, poised to benefit from further rate cuts, central bank buying, and the USD debasement trade. Industrial and battery metals—copper, aluminum, cobalt, and lithium—see support from structural trends like AI-driven growth, electrification, and infrastructure investment. Agriculture may stay pressured by ample stocks, but bullish weather and trade developments could spark rallies. Overall, commodities may offer diversification and inflation protection, with selective upside in metals and energy amid US policy and geopolitical complexity.

See index definition on page 4. Past performance is not a guarantee of future results. Please keep in mind that high, double-digit and/or triple-digit returns are highly unusual and cannot be sustained.

Energy: Stuck Between a Glut and Geopolitical Risk

- Global Oil Surplus Dominates Market Outlook – Key energy agencies —the International Energy Agency (IEA), Energy Information Administration (EIA), and OPEC— and Wall Street banks are aligned in forecasting a global oil surplus for 2026, driven by robust production growth, particularly from non-OPEC suppliers, and tempered demand amid efficiency gains and slower economic expansion. While estimates of the surplus differ, the consensus reinforces a bearish undertone for energy markets, even as geopolitical risks continue to inject volatility.

o To restore balance, supply-side adjustments will likely need to carry the weight; however, discipline from both OPEC and non-OPEC producers, coupled with expanded refinery capacity, continued Chinese stockpiling, limited OPEC spare capacity, and headline sanctions pressure should cushion some of the downside.

- Geopolitical dynamics remain a primary driver of crude oil spot prices and front-end curve structure and are expected to be a persistent source of headline volatility in 2026.

o Russia remains the most significant structural risk, with little incentive to concede despite peace efforts and ramped up Ukrainian strikes on energy infrastructure. Iran still poses follow-on action risk that could threaten regional assets, even as headlines have eased since June’s 12-day war. Venezuela also warrants attention as it approaches a potential “explosive endgame” with the risk of US intervention, but the impact should be limited its production currently accounts for less than 1% of global supplies.1 Even under a negotiated settlement and full sanctions repeal, rebuilding its energy sector will likely be a slow and costly process.2

- Russian Sanctions – In October, the US announced new sanctions on major Russian oil firms, Rosneft and Lukoil, which took effect on Nov. 21st. However, as largely expected, Russian crude flows to Asia have remained resilient with China and India continuing to import significant volumes, particularly from Rosneft, which has offset declines in Lukoil exports. Rosneft’s extensive network of intermediaries, shipping infrastructure, and fleet has enabled it to navigate regulatory hurdles and maintain supply. While Turkey has adhered closely to new guidelines, Asian refiners remain pragmatic, prioritizing pricing, logistics, and documentation risk over seller identity. 3

Precious Metals: Continuation of 2025?

- Central banks have remained a steady source of gold demand, with record purchases in recent years likely to persist into 2026 as part of a broader move away from US dollar–centric reserves (“USD debasement trade”). This structural buying, coupled with expected Federal Reserve (Fed) easing, a weaker dollar, and ongoing geopolitical and macro uncertainty, should anchor prices and provide a supportive backdrop for further upside into 2026.

- Fed Independence – The Fed faces a pivotal year as Chair Powell’s term ends in May 2026, with President Trump expected to nominate a successor—widely speculated to be Kevin Hassett—early in the year. This leadership transition has raised questions about Fed independence and policy direction, with markets anticipating a more dovish stance that could accelerate rate cuts. Such a shift would likely further weaken the US dollar and suppress real yields, both classic tailwinds for the yellow metal.

- Silver: The Best of Both Worlds? – While gold has captured most of the market’s attention, silver has been the standout performer in 2025, surging 127% YTD versus gold’s 65%.4 Beyond shared macro tailwinds for precious metals, silver’s rally reflects a persistent supply deficit fueled by green tech demand (solar, EVs, AI data centers) and strong investor flows. Its sharp rise, however, raises concerns about demand destruction, particularly in solar, where silver now accounts for ~20% of module costs vs. less than 5% pre 2024.5 Still, uncertainty around Section 232 tariffs targeting critical minerals/metals and silver’s dual role as both a precious and industrial metal continue to skew risks to the upside, making it a more “growth-driven” alternative to god.

Past performance is not a guarantee of future results.

Industrial Metals: Starting Off Strong

- Supportive Fundamentals – Copper markets face a deepening structural deficit in 2026 as stagnant mine supply collides with surging demand from green technologies and data centers. At the same time, China’s production caps on aluminum add another bullish layer by tightening global metal availability and reinforcing cost pressures across industrial supply chains. This year’s tariff uncertainty amplified these dynamics, triggering precautionary stockpiling and front-running that squeezed physical markets and sent prices skyrocketing.

- Heightened focus on critical minerals amid trade and national security concerns is likely to drive investment in electrification, infrastructure, and supply chain resilience, boosting demand for copper and aluminum; stockpiling and domestic incentives should also provide price support. Furthermore, ongoing Section 232 investigations6 on US critical mineral imports could spur front-loading, causing a temporary tightening in ex-US markets.7

- AI Drive Demand Boost – Estimates for data center power demand continue to rise, driven by rapid AI adoption and new use cases. The surge in projected power needs supports copper demand, with data centers expected to consume ~500 kt (thousand tons) in 2025 and ~740 kt in 2026, adding 0.6 percentage points to global growth and contributing to a projected 600 kt supply deficit.8

Macro Trends Provide Support

- Anticipated Fed rate cuts in 2026 should boost investor risk appetite, further pressure the US dollar, and incentivize economic activity and business investments, skewing US and global growth risks to the upside. This should be bullish for commodities, especially energy and metals. Lower rates reduce the opportunity cost of holding non-yielding assets like gold, while also stimulating industrial demand tied to infrastructure buildouts and green tech.

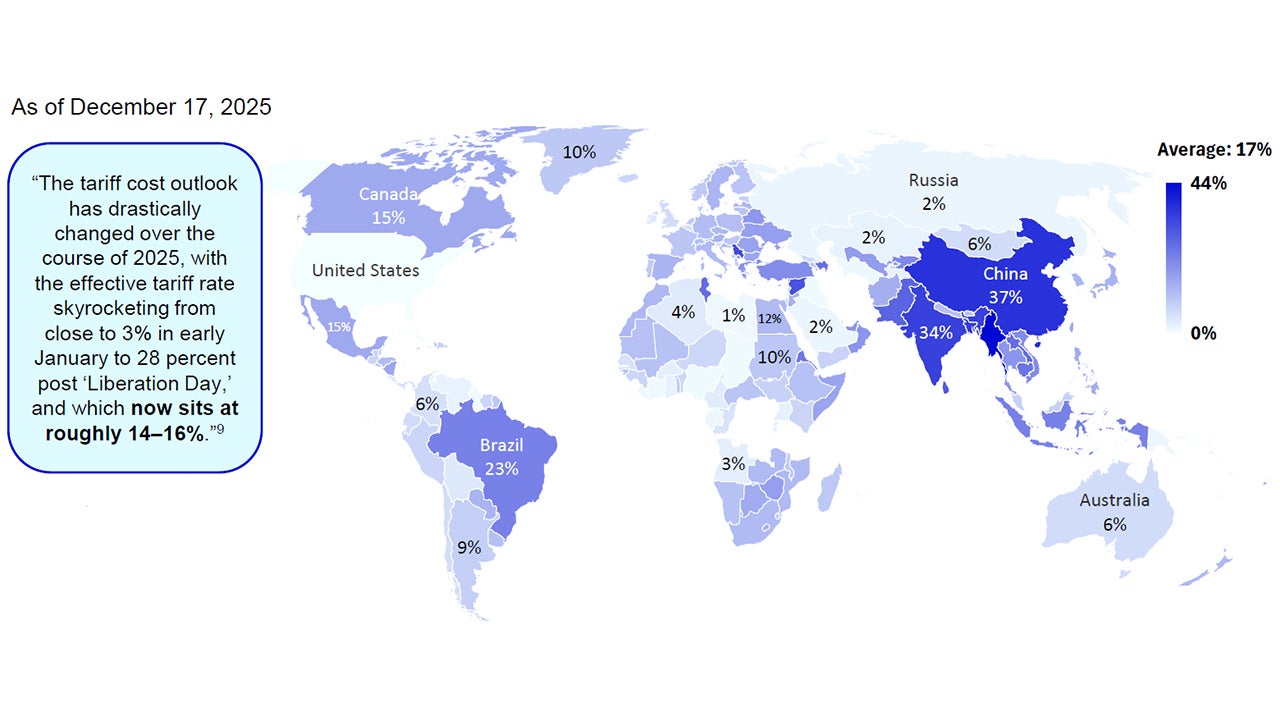

- Tariff uncertainty will likely continue to inject volatility and upside risk into metals and broader commodities by challenging supply chains and driving strategic stockpiling—as seen in copper this year. Front-running and precautionary buying distort prices, creating artificial short-term demand and volatility spikes. Without concrete tariff guidelines, businesses are hesitant to reroute their supply chains, ultimately passing higher costs to consumers.

- The Midterm election is critical for President Trump as it determines control of Congress, directly affecting his ability to pass legislation and shape economic policy going forward. Winning both the House and Senate would give him maximum leverage to push through fiscal stimulus, tax cuts, and deregulation without gridlock. To strengthen his position, he would likely aim to stimulate the economy—or at least create the perception of prosperity—through aggressive fiscal measures (i.e., tax cuts, infrastructure spending), pressure for deeper Fed rate cuts, and policies that boost asset prices. A strong stock market and lower borrowing costs foster a “wealth effect,” making households feel richer and reinforcing consumer confidence, even if structural risks persist.

Source: Tax Policy Center (TPC), Tracking the Trump Tariffs, December 17, 2025. Note: Estimated total tariff rate is an average of a country’s product-specific tariff rates, weighted by 2024 import volume. Tariffs on specific products can vary from their country’s estimated rate. Estimates exclude Anti-Dumping and Countervailing Duties (AD/CVD) tariffs.

Past performance is not a guarantee of future results.

Source: FactSet as of November 30, 2025. The Bloomberg Commodity Index (BCOM) is made up of 24 of the most traded commodities futures across energy, industrial metals, precious metals and agricultural commodities., and is often used as a financial benchmark for commodity performance. An investment cannot be made into an index.

Source: Bloomberg L.P. as of November 30, 2025.

The opinions expressed are those of Kathy Kriskey and Lucy Lin and are based on current market conditions, subject to change without notice. These opinions may differ from those of other Invesco investment professionals. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions, there can be no assurance that actual results will not differ materially from expectations.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. Commodities may subject an investor to greater volatility than traditional securities such as stocks and bonds and can fluctuate significantly based on weather, political, tax, and other regulatory and market developments.