Commodity ETP Digest: November 2025

Commodity market – month in review

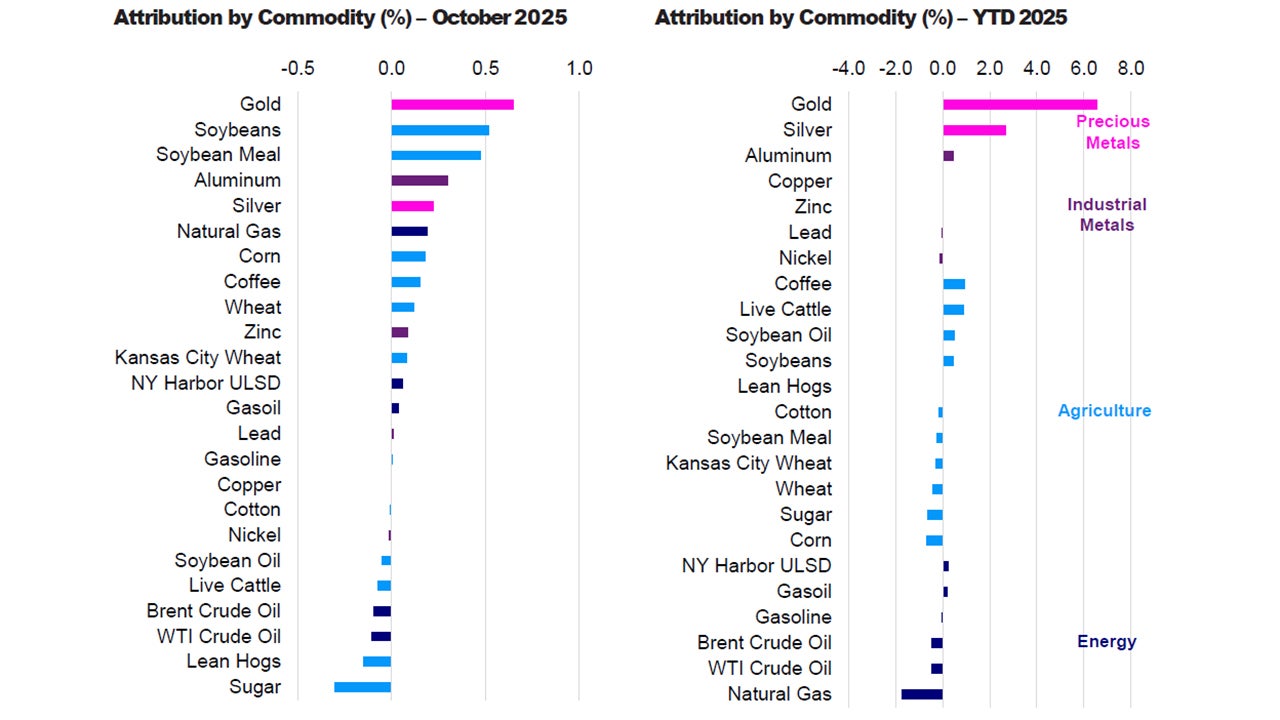

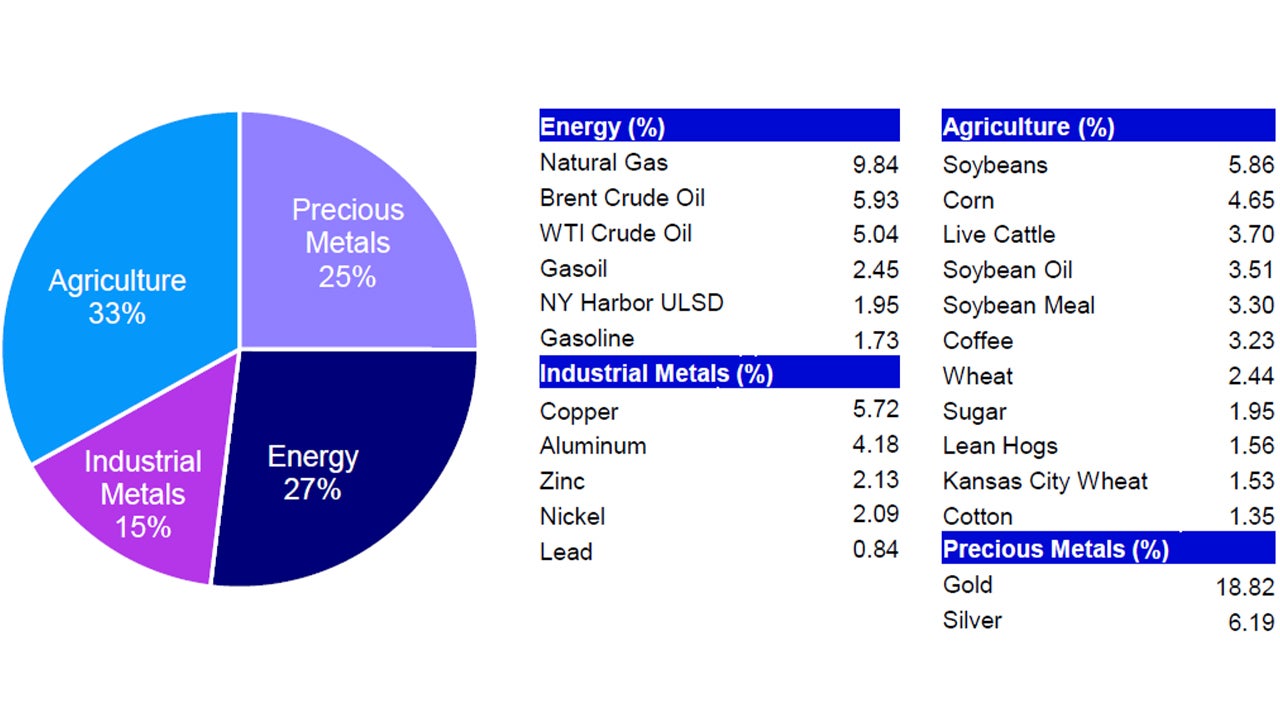

Commodities posted broad gains in October, with the Bloomberg Commodity Index (“BCOM Index”) up 2.56%, lifting year-to-date performance to +8.64%. Strength was led by precious and industrial metals, while sugar, livestock and crude oil led to the downside. Gold stood out, surging past $4,300/oz mid-month on safe-haven demand amid the US government shutdown and renewed trade tensions with China, before retreating sharply on profit-taking and a technical correction. Aluminium and copper also delivered strong returns, supported by rising power costs in Asia, Chinese production cap concerns, US dollar weakness, and optimism around US-China trade talks, with speculative buying and gold’s rally adding momentum. Soybeans rallied nearly 10% on US-China trade optimism and China’s first cargo purchases in months, reversing early volatility from tariff headlines. Conversely, sugar was the weakest performer in the index, pressured by easing supply tightness and expectations of resumed Indian exports, sending prices to their lowest level since December 2020 and marking a sharp reversal from the commodity’s breakneck rally in 2023.

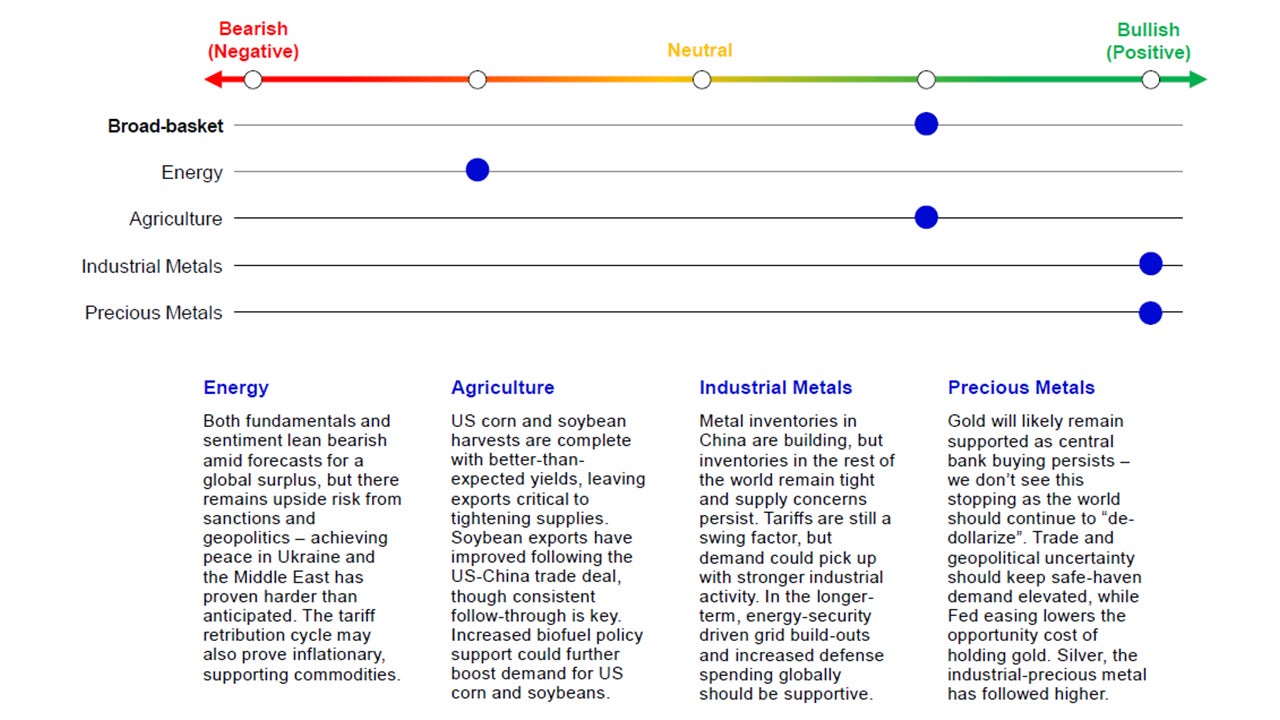

Commodity prices have been under pressure through most of 2025, but green shoots are emerging as we enter the new year. The US-China trade truce brings temporary tariff relief and commitments on critical minerals and agricultural purchases, while sanctions on Russia intensify, buffered by ample global oil supply. OPEC+ has paused first quarter (Q1) 2026 hikes to counter seasonal softness, returning to a more cautionary tone, while refined products continues to outperform crude on tight capacity and escalating attacks on Russian refineries. Markets are increasingly constructive on base metals, with aluminium and copper facing power constraints and supply disruptions that should keep those markets in deficit through 2026. Commodities remain sensitive to macro headwinds and geopolitical risks, but steady allocation can offer diversification and hedging benefits amid tariff-driven trade distortions, rising global power competition, and a shifting world order.

See index definition. Past performance is not a guarantee of future results. Please keep in mind that high, double-digit and/or triple-digit returns are highly unusual and cannot be sustained.

US Reaches Deal With China… For Now

- On Nov. 1, the White House announced a landmark one-year truce with China. Under the deal, China will lift export controls on rare earths and critical minerals, buy 12 million metric tons (MMT) of US soybeans by year-end and 25 MMT annually in 2026–2028, and suspend retaliatory tariffs on key US farm goods, in exchange for US tariff relief.1 These measures should support commodities, though the ultimate impact will hinge on implementation.

- China has since resumed purchases of US soybeans, which had screeched to a halt in May 2025. While the reported purchases have not yet lived up to the agreed levels and skepticism persists given China’s ample reserves, the uptick offers a welcome source of optimism.

Sanctions Pressure Grows

- In October, the US and European Union (EU) imposed new sanctions on Russia targeting major oil firms and financial institutions. Notably, the US sanctioned Rosneft and Lukoil (effective Nov. 21), while the EU’s 19th package added restrictions on Russian banks. Pressure is mounting as Chinese and Indian buyers suspend purchases, and President Trump signaled support for sanctioning countries that trade with Russia—underscoring growing enforcement appetite amid ample global oil supplies.

Energy Round Up

- OPEC+ announced a 137k barrel per day (b/d) quota increase for December, but paused monthly hikes in Q1 2026, citing seasonal demand softness and a precautionary approach. This cautious stance may help temper pressure from the looming supply glut that has weighed on prices this year.

- Refined products continue to outperform crude as refinery closures and underperforming new capacity have tightened gasoline and diesel supply, and no meaningful capacity additions are expected before second half 2026.2 Escalating attacks on Russian energy infrastructure and refineries have been a tailwind and, despite their resilience to date, underscore the country’s growing vulnerability.

- Consensus on natural gas remains structurally positive, driven by LNG capacity growth and AI-related demand, though near-term trends are weather-driven with two-way risk. Bearish concerns center on a potential LNG glut in 2027–2028, while strong US production poses an underappreciated headwind.2 China could absorb some of the excess LNG, but this would likely only partially offset the glut, keeping US natural gas prices volatile.3

Metals: Constructive Conviction

- China’s aluminium output has hit its capacity cap, creating room for smelter margins to improve after decades of surplus. Power constraints are a major challenge, with smelters competing against AI-driven electricity demand, making Western restarts unlikely. Outages and potential shutdowns will likely keep the market in deficit through 2026 despite Indonesia’s rapid production growth.4

- Markets remain strongly bullish on copper, driven by acute supply disruptions that will tighten the refined market and strain already low inventories outside the US. While Chinese demand growth may slow, its ability to delay purchases is limited; once China starts buying, the market will turn sharply bullish as London Metals Exchange (LME) prices rise to incentivize copper flows from the US to regions with immediate needs.5

- With uncertainty easing after the US government reopened and the Fed back in focus, gold remains resilient above $4,000/oz, supported by sustained demand interest from central banks and long-term investors—reinforcing its role as a store of value and signaling potential upside into next year.2

o In October, the People’s Bank of China (PBoC) purchased gold for the 12th consecutive month, lifting gold’s reserve share to 8%.6,7 While exchange-traded product (ETP) investor flows came under pressure in the latter half of October, investor demand remains sticky. JP Morgan sees room for gold’s increasing share in investor portfolio allocations, which are currently at around 2.8% of total AUM of equities, fixed income and alts, and could grow to 4-5% over the coming years.8

Past performance is not a guarantee of future results.

Source: FactSet as of October 31, 2025. The Bloomberg Commodity Index (BCOM) is made up of 24 of the most traded commodities futures across energy, industrial metals, precious metals and agricultural commodities., and is often used as a financial benchmark for commodity performance. An investment cannot be made into an index.

Source: Bloomberg L.P. as of October 31, 2025.

The opinions expressed are those of Kathy Kriskey and Lucy Lin and are based on current market conditions, subject to change without notice. These opinions may differ from those of other Invesco investment professionals. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions, there can be no assurance that actual results will not differ materially from expectations.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. Commodities may subject an investor to greater volatility than traditional securities such as stocks and bonds and can fluctuate significantly based on weather, political, tax, and other regulatory and market developments.