Enhancing returns and managing risk using factor ETFs

In the second episode of the “Rethinking Possibility” podcast series, Chris Crea, Chris Hamilton and Tim Herzig discuss how investors should think about blending factors to solve different investment outcomes.

Factors, or common betas, are persistent characteristics of assets—whether stocks, bonds, or other securities—that can help explain risk and returns and can be applied through fundamental or systematic approaches.

Increasingly, Asia-based investors are using exchange traded funds (ETFs) to harness and incorporate factors into client portfolios as a method to enhance portfolio returns and manage risk.

We explore the core considerations of factor investing, the applications and challenges of incorporating factors into portfolios and how quantitative and dynamic multi-factor frameworks can help investors navigate changing market environments.

Types of factors

At its core, factor investing seeks to capitalize on specific characteristics that have been shown to persistently deliver performance over time.

One of the most well-known factors is value, popularized by legendary investor Warren Buffett. Value investing focuses on buying assets that appear undervalued relative to their intrinsic worth, and research suggests that value-oriented strategies tend to outperform over the long term. Other common factors include quality (which emphasizes financially sound companies), momentum (which favors stocks with upward price trends), low volatility (which seeks stable assets), and size (which tends to favor smaller companies).

Blending factors to solve for different outcomes

The real power of factor investing lies not just in identifying individual factors, but in how investors can combine or blend factors to achieve specific outcomes or to navigate certain market regimes. Investors can select individual factors via single-factor ETFs or combine multiple factors through a diversified approach – this can be achieved by blending single-factor ETFs or allocating to actively managed or systematic (rules based) multi-factor ETFs.

While individual factors can be highly effective, they may underperform during certain market periods. For example, size and value tend to be cyclical, with higher operating leverage and more reliance on external funding; quality and low volatility tend to be defensive, with lower operating leverage and more reliance on internal cash flows; and momentum is more transient and tends to perform well in later stages of cyclical upturns and downturns.

By blending different factors together investors can reduce the risk of any single factor underperforming. Additionally, by diversifying across multiple factors, investors may achieve a more stable return profile while controlling for risk.

For example, combining defensive factors like quality and low volatility can help reduce risk during periods of market contraction, while cyclical factors like value and size can enhance returns during market expansions.

Static, yet compelling: a stable multi-factor approach

Invesco has been managing multi-factor strategies based on well-known and proven factors for decades by applying the key principles of value, momentum and quality investing. The team provide core solutions with the overarching target of offering equal exposure to the factors throughout a market cycle (i.e. explicitly not tilting or timing factors and instead reaping the benefits of diversification at very controlled active risk levels). Such solutions come with low tracking errors and deliver consistent and transparent outperformance purely driven by factors.

Another source of outperformance is derived from proprietary factor definitions. Instead of using generic factors, a broad team of researchers have designed a set of factors that are supposed to deliver higher returns and/or are more stable (i.e. cause less transaction costs).

On top of this, smart portfolio construction is key. The aim is to neutralize unwanted risks such as idiosyncratic or even sector and country risks for the sake of broad diversification, while establishing a stable and balanced exposure to the factors.

Invesco’s dynamic multi-factor framework

Invesco’s dynamic multi-factor framework uses such a diversified approach but with an additional layer of tactical asset allocation. Rather than selecting factors based on long-term strategic objectives, a dynamic approach adjusts factor exposures based on changing market conditions.

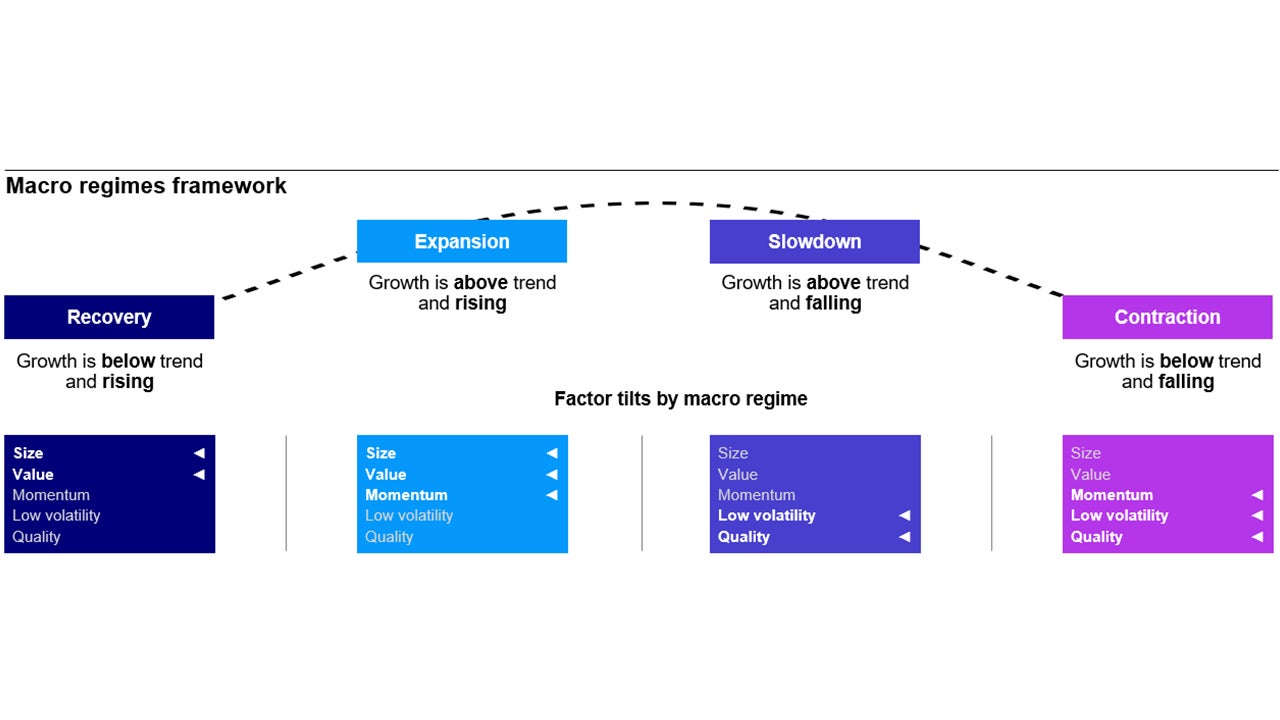

By understanding whether the economy is in a growth, contraction or recovery phase, investors can tilt their portfolios toward factors that are most likely to perform well in that specific regime.

For example, during periods of economic contraction, defensive factors like quality and low volatility may outperform, while during growth periods, cyclical factors like value and momentum may be more effective.

This dynamic multi-factor framework allows for a more nuanced and responsive approach to factor investing and provides a framework to increase or decrease portfolio risk depending on market outlook.

Source: Invesco Solutions. For illustrative purposes only.

Challenges in factor investing

While factor investing has the potential to improve portfolio outcomes, challenges still exist. One primary difficulty is identifying the correct market regime and aligning factor exposures accordingly. Robust historical data and research can guide decisions about which factors are likely to perform well in each phase of the business cycle but misidentifying the regime can lead to suboptimal factor tilts, resulting in underperformance.

Another common challenge is factor timing, which refers to the attempt to exploit short-term fluctuations in factor performance. We believe investors should be cautious of any over-reliance on short-term factor timing as it can introduce additional complexity and transaction costs, ultimately detracting from long-term returns.

Transaction costs and liquidity concerns are also potential pitfalls when implementing factor strategies. Investors must be mindful of the additional costs associated with frequent trading, especially in strategies that require tactical adjustments. Efficiently managing these costs is crucial to maintaining the integrity of factor-based strategies.

Investors may otherwise prefer to outsource their factor mandates to external investment managers that can implement these multi-factor strategies via low cost and transparent ETFs.

Conclusion

Factor investing has become a cornerstone of modern portfolio management, offering investors a powerful tool to enhance returns and manage risk. By identifying and blending factors such as value, quality, and momentum, investors can build diversified portfolios that are better equipped to weather market volatility and capitalize on long-term opportunities.

Dynamic multi-factor frameworks can provide additional layers of sophistication, allowing investors to adjust their factor exposures in response to changing economic conditions.

While challenges such as factor timing and transaction costs must be carefully managed, the benefits of factor investing, particularly using a well-diversified, systematic approach, are clear. We also think that both strategic and dynamic factor exposure can work in tandem, demonstrating efficacy in both enhancing portfolio returns and reducing risk. Ultimately, we believe leveraging both approaches simultaneously can yield the strongest results.

Investors can easily harness single factors via ETFs and blend them to achieve multi-factor portfolios. Additionally, investors can outsource multi-factor mandates to investment managers via ETFs to complement their own strategies and potentially take a more deliberate approach to factor construction.

Investment Risks:

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations), and investors may not get back the full amount invested.