Thinking thematically: Flows and Woes: 2023 in Review

Overview

2023 was a more challenged flow year for thematics as market conditions dominated

There were still categories of strength, however, especially related to AI

Next year could see a better environment for growth as the market bottoms, though recession risks remain

As our first year of Thinking Thematically draws to a close, we wanted to take a moment to look back at everything we saw in the market during 2023. But first, a sincere thanks to you, our audience. You joined us as we explored the ever-changing landscape of thematics, diving deep on nuclear, India, real estate and more. Your support – and your curiosity about new ways of investing – means a lot to us.

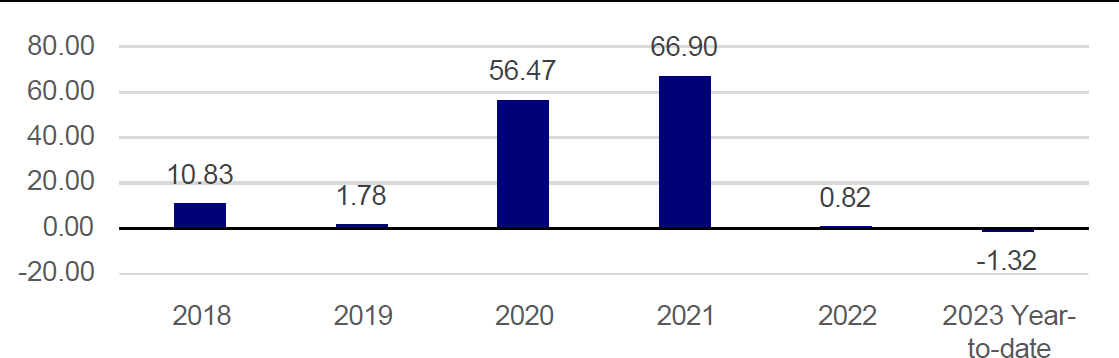

There’s no question 2023 was a challenging year for thematic investing. Through November 15, we saw -$1.3B of outflows from the thematic universe1. The struggle is clearly driven at least in part by macro conditions – with focus on the Federal Reserve and recession fears driving markets. After all, many themes target smaller-cap growth equities in the early innings of development, and the largest seven companies in the S&P 500 contributed nearly 70% of this year’s index return1. While that’s an unusual environment, this year’s results are also a large departure from the $66.9B thematics took in during 2021, when stay-at-home orders and retail investors flush with cash flocked to the space1.

Still, thematic investing is far from a monolith. Even as some funds struggled, 62 new ones came to market this year (growing the number of funds by 13%), and 36% of funds were in in-flows, working to offset the more challenged areas1. Part of this speaks to the dynamism within thematic investing, with a variety of industry and sector exposures. Below we’ll explore factors that drove some of those winners and losers and what we expect in 2024.

How we think about thematics

To better understand the thematic universe, we maintain tags on more than 500 funds by their thematic style and the specific themes they target. We’ll use those distinctions below to explore what trends we’re seeing this year.

One of the first lenses we use to divide the thematic universe is between what we call “NextGen” themes and more traditional “Thematic Industries.” Thematic investing is ultimately about investor choice, going beneath and between traditional sectors to target a more specific global or macro trend that interests the end investors. On the NextGen side, you have familiar futuristic spaces like Robotics, artificial intelligence (AI), Sustainability and more. On the Thematic Industry side, you have investments options in areas like defense, banking, or packaging. We think this distinction is useful, because while most thematic fund providers focus only on NextGen technologies, investors could also care deeply about issues like rising geopolitical tensions or how a rise in e-commerce during the pandemic might change the demand for cardboard boxes.

This year, the preference was clearly for NextGen, a reversal of 2022’s results when value investing was in vogue. Through November 15, we saw +$1.9B for NextGen themes vs. -$3.2B for Thematic Industries. This also reflects market conditions, of course, with an average year-to-date return on net asset value through November 15 of 10.7% for all market NextGen funds vs 4.6% for all market Thematic Industries1. Next, we’ll explore which individual themes were working and not working within those categories.

What worked in 2023?

With all of the market attention on artificial intelligence and the launch of Chat-GPT, it will likely come as no surprise that semiconductors were the top flow-gathering theme in 2023 with $2.6B of inflows for all market funds in the space1. The overall story around AI also showed up in the 5th, 6th, and 7th ranked slots with Digital Future (a term we apply to AI, robotics, and things like internet/networking), Software, and Industrial Revolution (which also has some robotics as well as infrastructure and reshoring) taking in a combined $2.18B of flows1.

We also saw two slots in the top ten go to Thematic Industries. Defense and banking took third and fourth with $1.4B and $943M of inflows, respectively1. The number two slot went to Sustainability, but that was driven primarily by outliers as DWS and iShares were both able to place new funds directly with large European pension clients, sourcing demand in what was otherwise a challenging environment for sustainability focused funds.

On the side of outflows, the largest struggles were in biotechnology (-$2.7B), oil and gas (-$1.7B), and other healthcare industries – non-biotechnology healthcare industries that include things like healthcare devices and services (-$894m)1.

Where do we go from here?

After a rocky October, markets in November have so far seen more sustained gains as investors hoped improvement on inflation and other macroeconomic figures pointed to a near-term end for the Federal Reserve’s hiking cycle. We also saw heavy short covering in some of the most beaten-up segments of the market. Of course, part of what’s slowing inflation is lower economic growth, so we still have some recessionary risk to contend with in 2024. Still, investors may soon begin to look for the start of the next cycle, and that will likely mean widening the breadth of market performance away from mega-cap tech names and toward more diversified growth opportunities. No matter what happens, we think 2024 could be an interesting year, and we hope you’ll join us as we navigate the world of thematic investing.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

The risks of investing in securities of foreign issuers can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues. The performance of an investment concentrated in issuers of a certain region or country is expected to be closely tied to conditions within that region and to be more volatile than more geographically diversified investments.

Investments focused in a particular industry or sector are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.

Footnotes

-

1

Source: Bloomberg L.P. as of November 15, 2023. Theme type determined by US tagged thematic fund list.

Rankings based on YTD flows per the universe of tagged funds described above