How did China A-share factors perform during China’s annual legislative NPC meetings? - AP Institutional | Invesco

We examined China A-share factor performance during China’s annual legislative meetings from 1999 to 2020 to see if investors react systematically to major policy events. Here’s what we found.

China’s parliament, the National People’s Congress (NPC), concluded its latest annual legislative meeting in late May with the unveiling of new fiscal and monetary policies aimed at restarting a post-pandemic economy. Historically, investors in stocks of mainland-listed Chinese companies, or A shares, have paid close attention to these announcements in order to gauge the impact of these policies on both short- and long- term market movement.

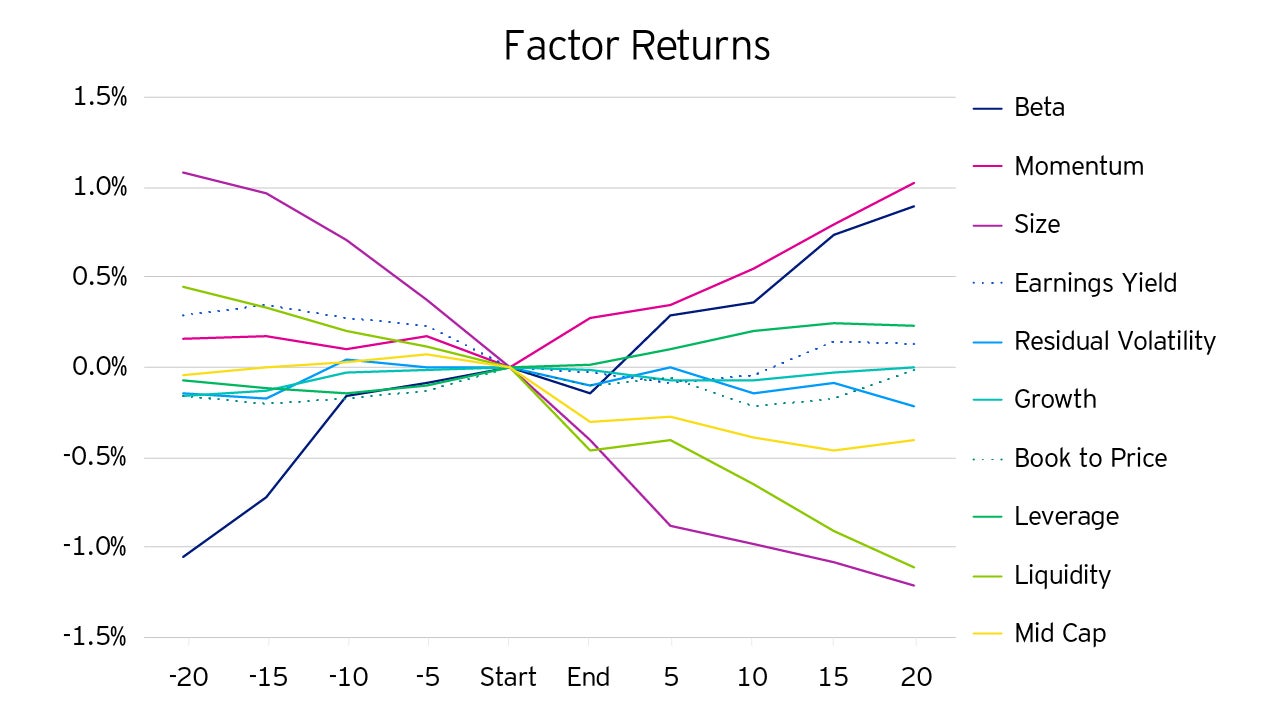

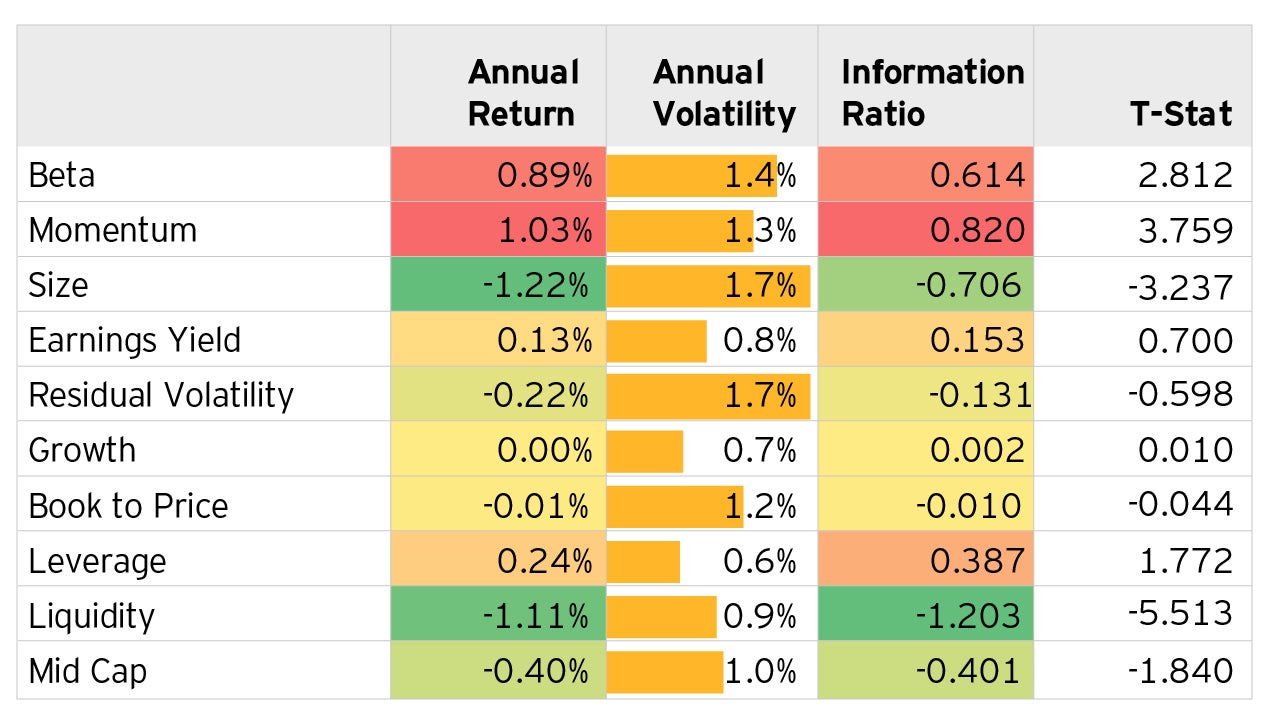

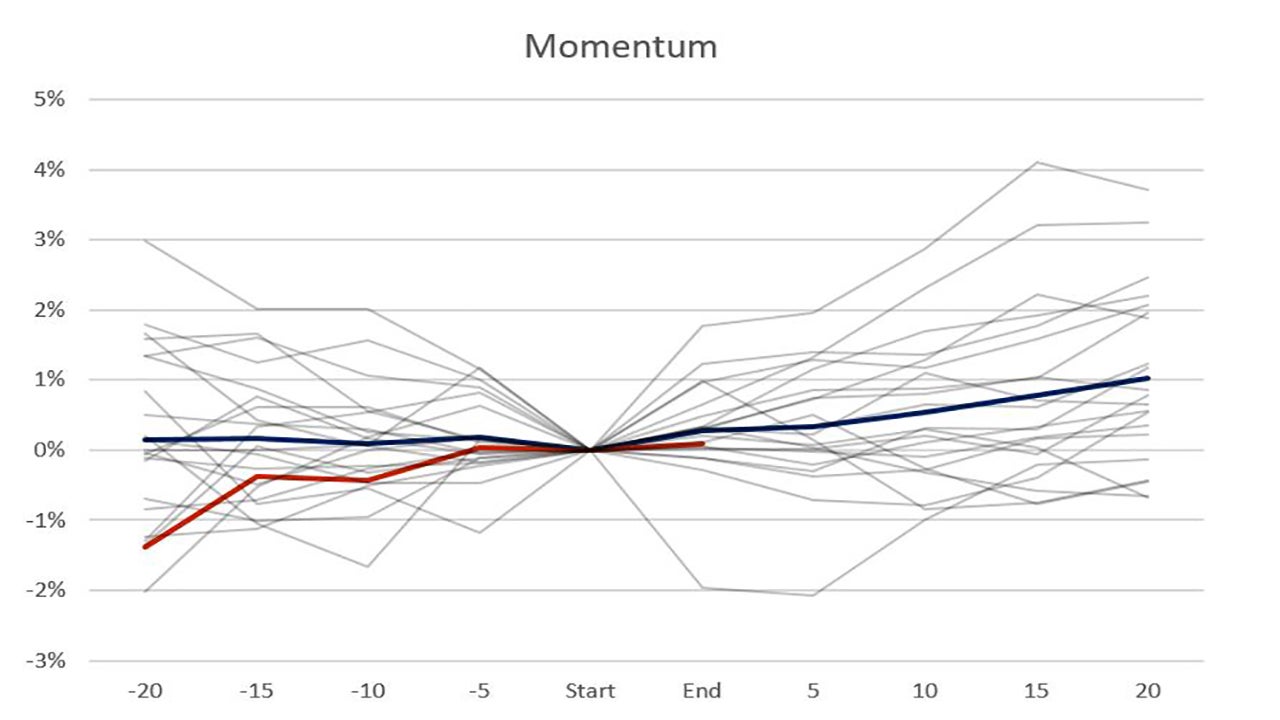

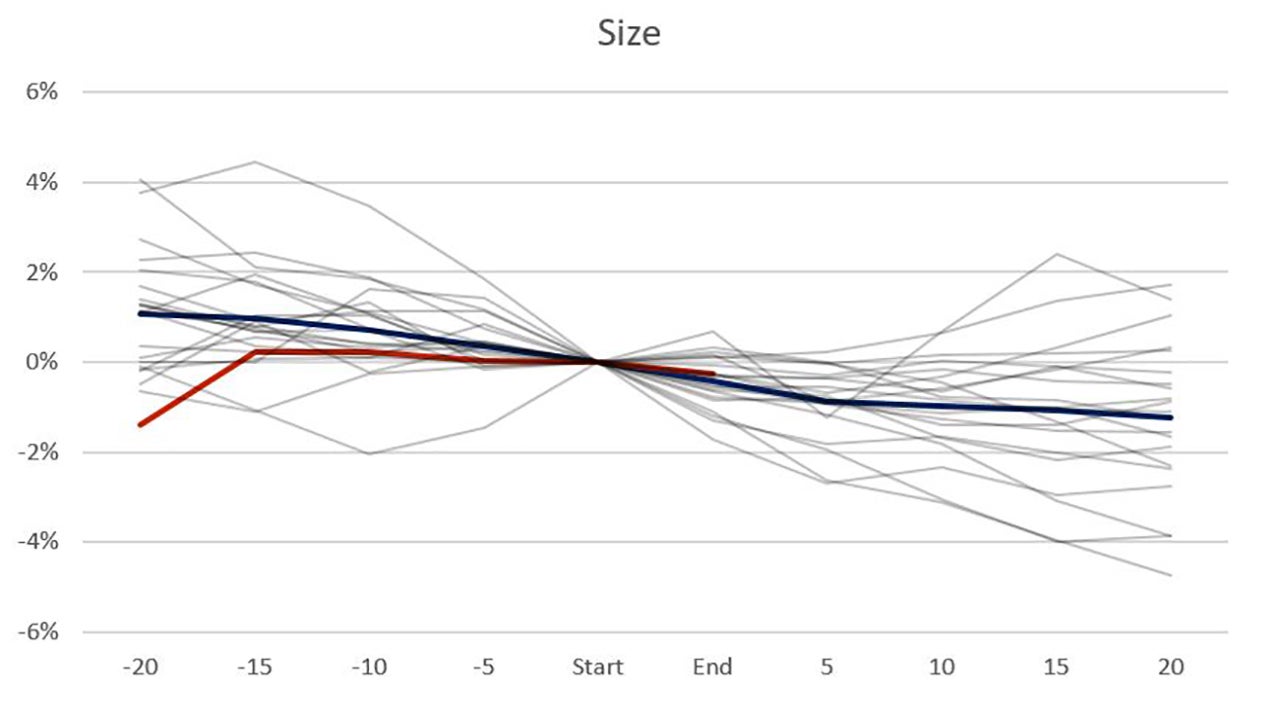

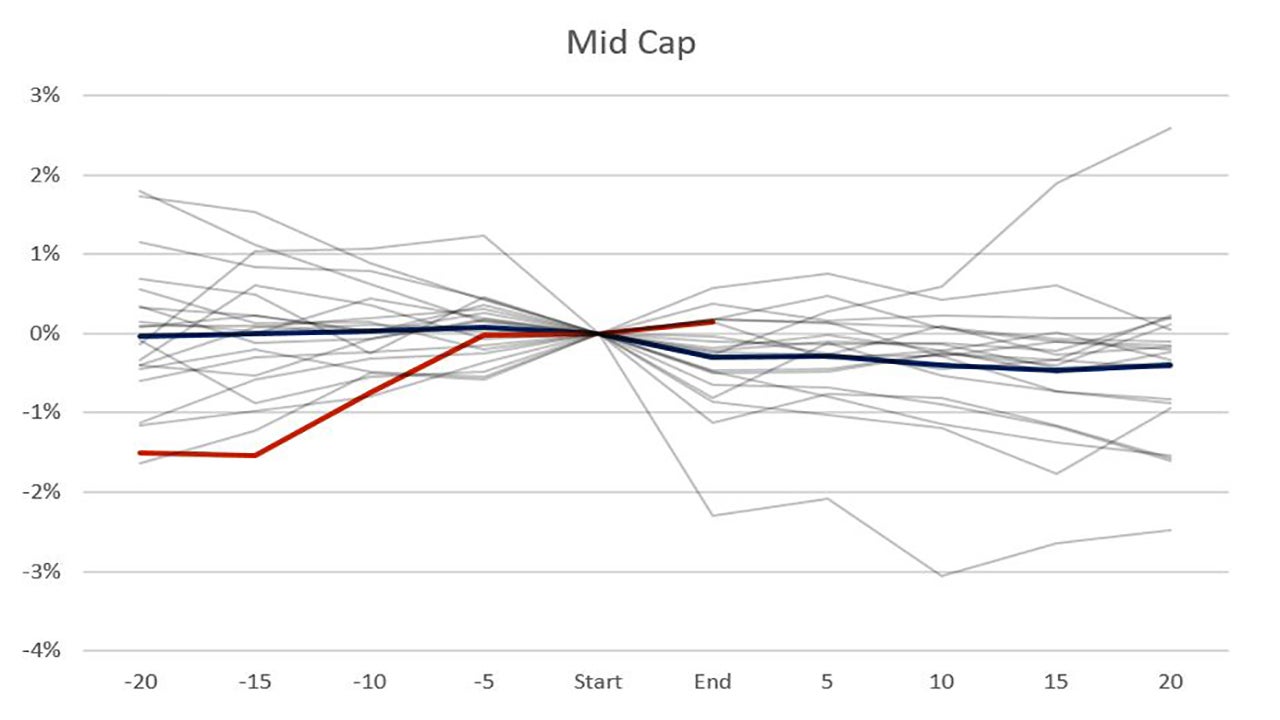

We examined the performance of ten classic China A factors around the NPC meetings from 1999 to 2020 to gauge any systematic behavior of investors’ reaction to these major policy events. We found that Momentum and Beta had been the most positive drivers post NPC meetings, while Size and Liquidity underperformed the most.

Factor performance

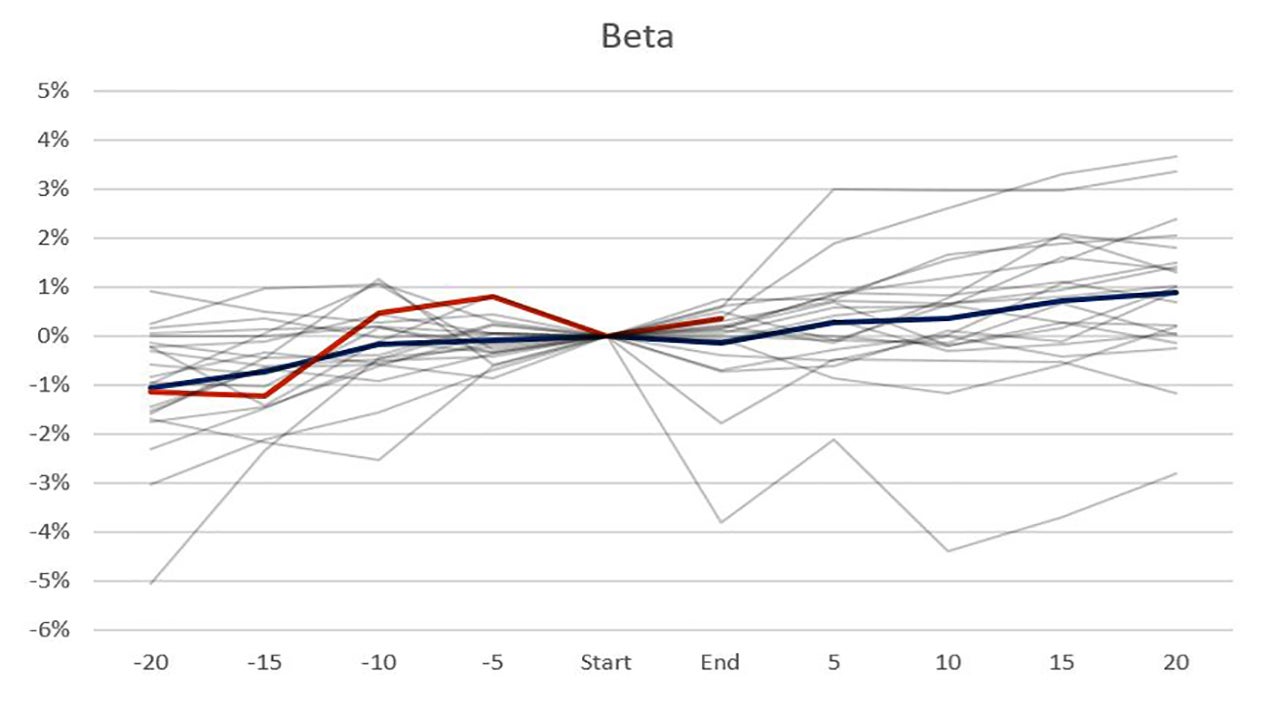

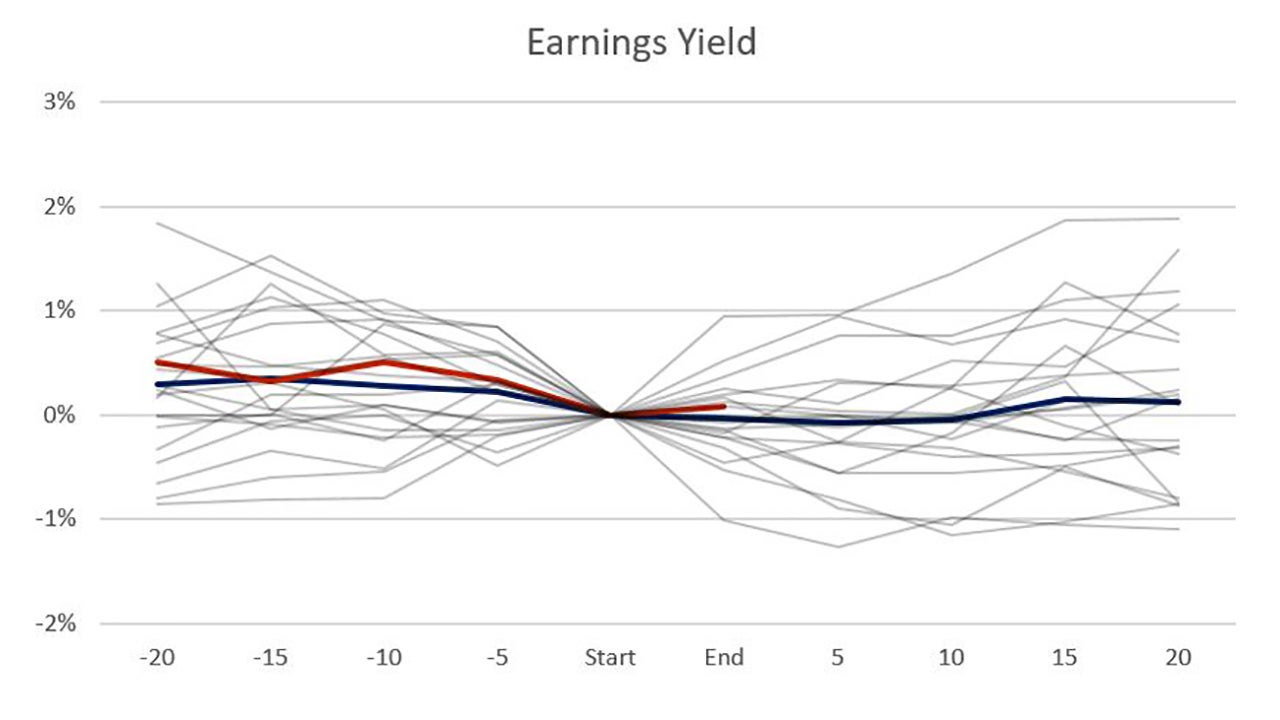

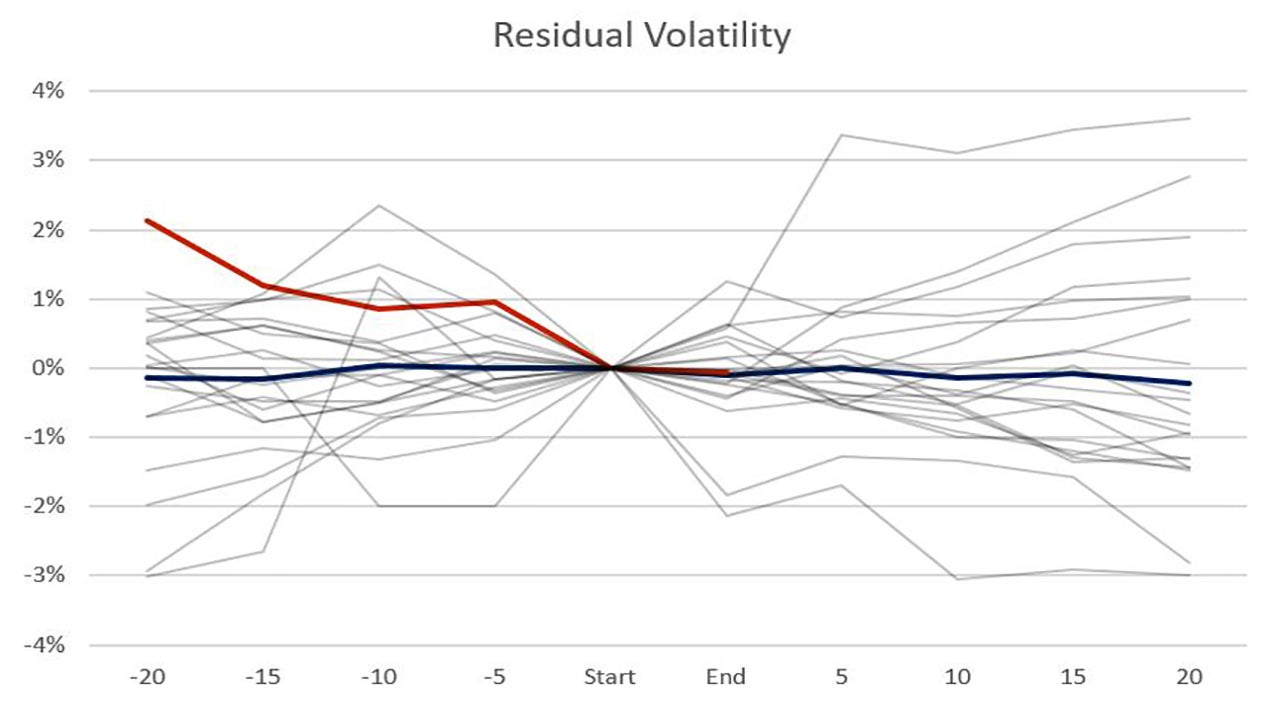

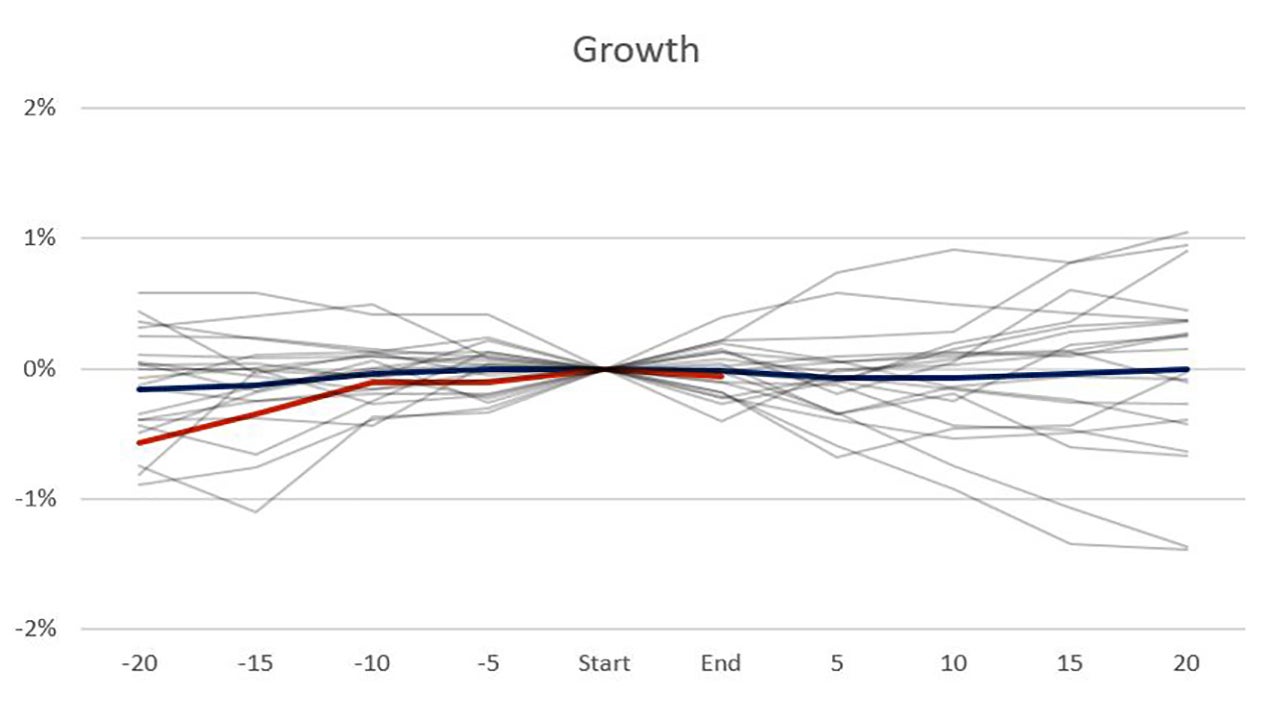

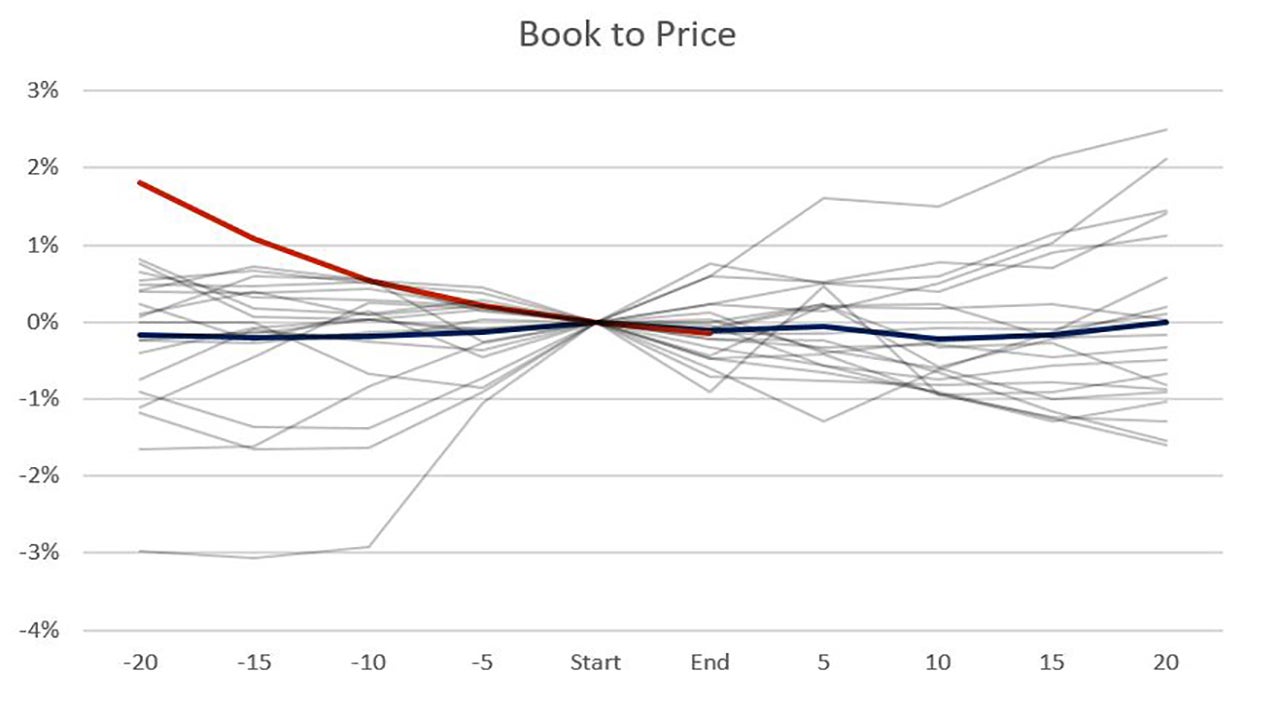

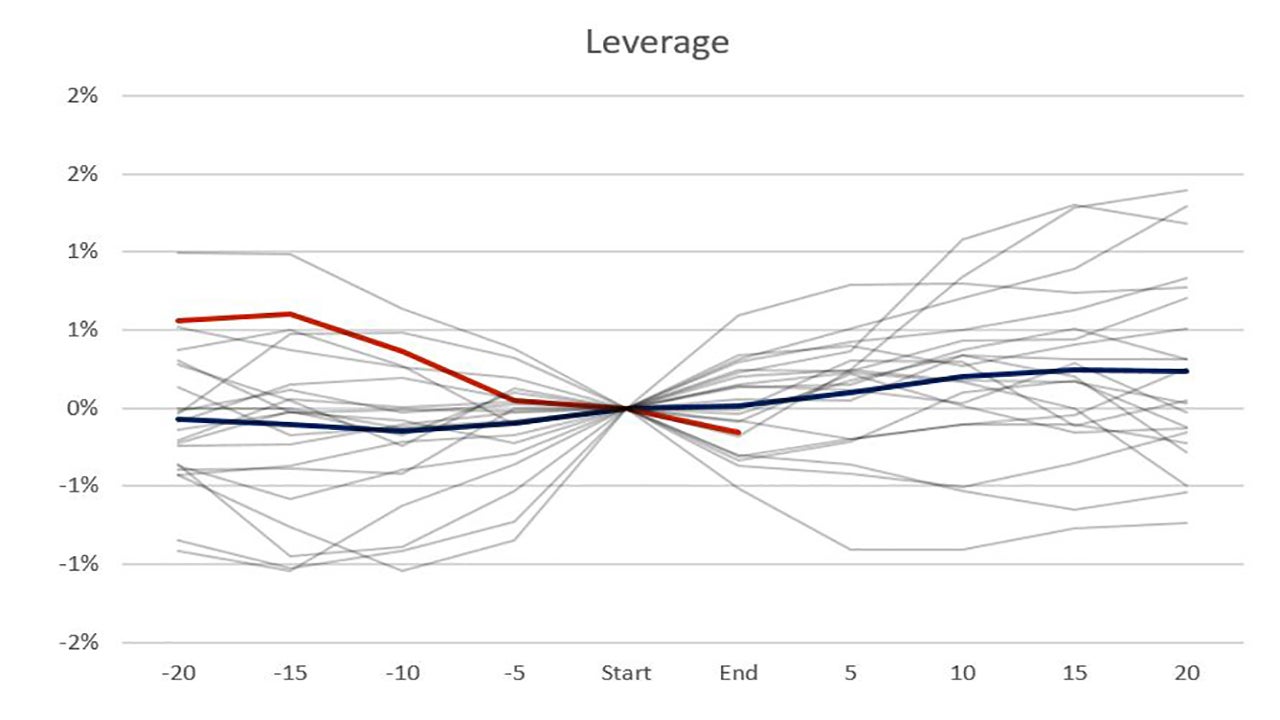

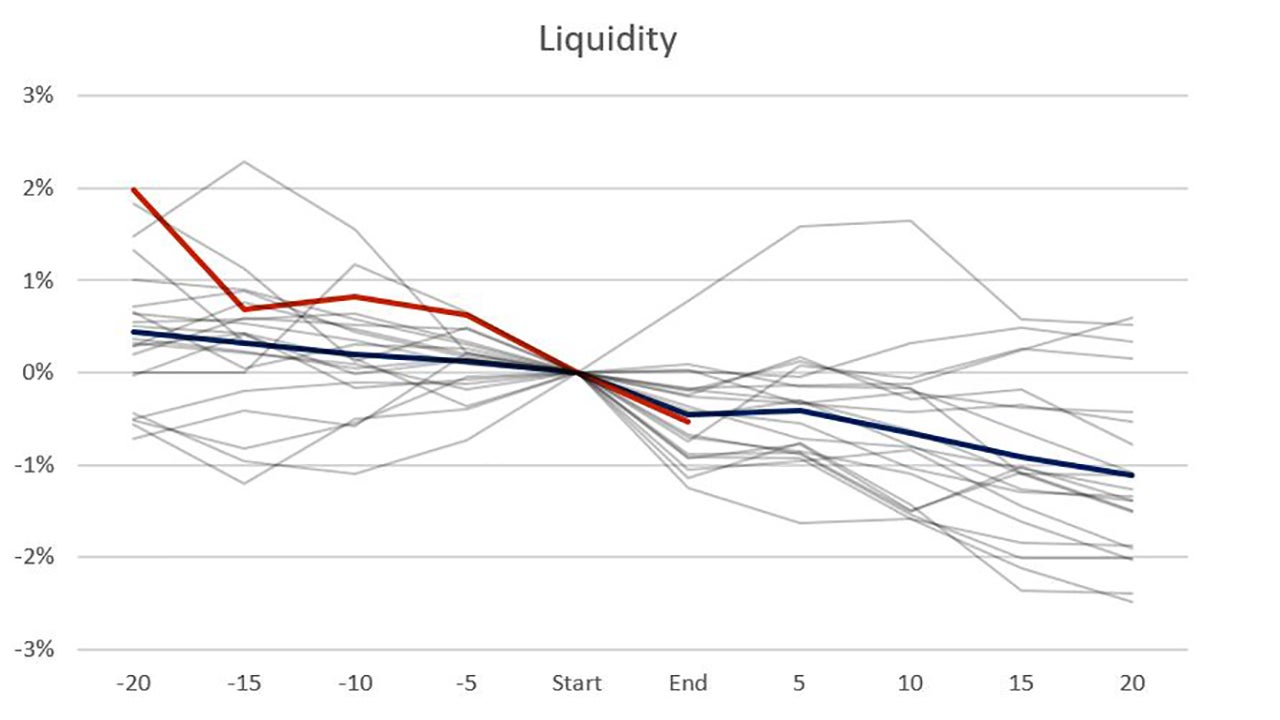

We first computed the daily cumulative pure factor returns of the ten style factors during the period that the NPC meeting was held in each year since 1999. To study the full scale of investor reaction, we extended the cumulative factor return for another 20 days from the end date of the NPC meeting. For comparison, we also computed the factor return from 20 days prior to the beginning of the NPC meetings. The average annual performance of the factors over the last 22 years is presented below.

We should also point out that the annual NPC meetings have begun on March 5 of every year during our study period from 1999 to 2020 and averaged over 11 days long, except this year when it was postponed to May 22 and lasted only 7 days due to the COVID-19 disruption. A generic seasonality factor that examines historical returns based purely on rolling calendar windows only will have to deal with not just the pandemic induced market swings but also the change in NPC meeting dates.

On a relative performance basis, we found that Size had the strongest reaction among style factors with a -1.22% annualized return relative to the market. Unsurprisingly, this indicated a strong outperformance for small cap as government policy announcements over the past two decades have focused on GDP growth which supports the development of small and medium enterprises. In fact, small caps have historically seen a positive return even before the NPC meetings which normally take place in March. Although for this year, due to the postponement of the meeting and following a strong start for small caps this year, their performance was relatively flat in May. However, with Beijing replacing its usual numeric GDP growth target this year with various high level economic and social objectives, small caps performance should continue to be supported.

On a risk-adjusted basis, Momentum had the highest annualized information ratio (IR) of 0.8. Its strong return indicated the persistence of mid- to long- term stock price behavior tied to a stable policy continuation in most periods. While Momentum has generally lacked a clear direction leading up to the NPC meetings, it had a strong run up prior to the NPC meeting this year.

Liquidity had the most persistent negative returns (IR=-1.2 and T-Stat=-5.513) during the study period which is consistent with its long-term behavior. This behavior was especially visible during the NPC meeting period when it was down in 19 of the 22 years we examined. The liquidity exposure has been considered a negative return predictor at the firm level and this was supported by empirical evidence of behavioral bias among the retail dominated investors in China1. Stocks with lower Liquidity exposures are currently most likely to also have higher Beta exposures and lower Book-to-Price and Earnings Yield exposures.

Fundamental factors like Earnings Yield, Book to Price and Growth showed relatively insignificant results during the NPC meetings. This may be due to the market’s focus on macro outlook overshadowing fundamentals considerations or the relative inefficacy of these factors just before the earnings reporting seasons around the month April.

Leverage had a somewhat significant positive return during NPC meetings in the past but had declined during this year’s meeting despite a strong government stance in boosting credit growth and lowering rates. The factor had underperformed during the past few years of deleveraging cycle and will be a good indicator to how the market is responding to the monetary policy.

Past performance is not a guide to future returns.

Factor returns based on Barra CNE5 model. Years covered from 1999 to 2020. Data for 2020 ends on May 29, a day after the meeting ended. Factor returns for 20-day and 15-day prior to NPC meeting in 1999 was excluded. Source: Invesco, MSCI Inc., Wikipedia. Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent.

^1 M. Frömmela, X. Han, X.F. Ruan, “The Price of Liquidity Beta in China: A Sentiment-based Explanation”, Jan 2017.