Applied philosophy: Sector in focus: Media

The media sector has been the strongest performer in the last 12 months. This has pushed both absolute and relative valuations to uncomfortably high levels. Total returns may be more modest in the next 12 months if earnings growth becomes the main driving force. This implies that outperformance may be more difficult to achieve if multiple expansion fades or reverses, in my view.

The sector in focus section normally appears as part of our quarterly Strategic Sector Selector document, but it has been a while since the last time I published a standalone report about sectors. Media is also a highly visible sector with well-known brands among its largest constituents that punches above its weight as it is usually vying for the title of the smallest global sector with chemicals (it is the smallest based on market capitalisations in US dollars, as of 28 July 2025). The sector has had its ups and downs around the pandemic with streaming providers surging during lockdowns, and subsequently slumping after the world reopened. Nevertheless, despite underperforming quarter-to-date, the sector has been the best performer in the last 12 months.

Perhaps this should not be a surprise considering the sector’s minimal exposure to tariffs (even the idea of 100% tariffs on foreign-made films seems to have faded into the background). Streaming providers are still the most dominant stocks within the sector, which may also explain why it seems to have weathered concerns about an economic slowdown relatively well.

In any case, a reacceleration of growth would not hurt the sector, although it would probably raise the hurdle for outperformance against more cyclical sectors. Importantly the resumption of rate cuts by the US Federal Reserve could boost valuations for such a long duration sector.

This may be particularly important for media as it is dominated by US names – the US accounts for 76% of market capitalisation, followed by Europe at 16%, Japan at 4% and Emerging Markets at 2%. Unsurprisingly, the dominant subsector (out of four in total) is entertainment, which includes the two dominant streaming providers, accounting for 63% of market capitalisation. This is followed by radio and TV broadcasters at 22%, media agencies at 10% and publishing at 4%. Another aspect of high concentration is that the top four stocks account for 66% of market capitalisation (as of 28 July 2025).

As ever, there are multiple moving parts when trying to determine how media will fare in the next 12 months. Even though exposure to streaming services may have reduced the cyclicality of the sector somewhat, the path of global economic growth could still be an important factor to consider. Although trailing earnings growth has been strong in the last 12 months, trailing dividend growth has been deteriorating since Q3 2024.

At the same time, after being the best performer in the last 12 months, sector valuations look rich. This may be a risk even if global economic growth reaccelerates.

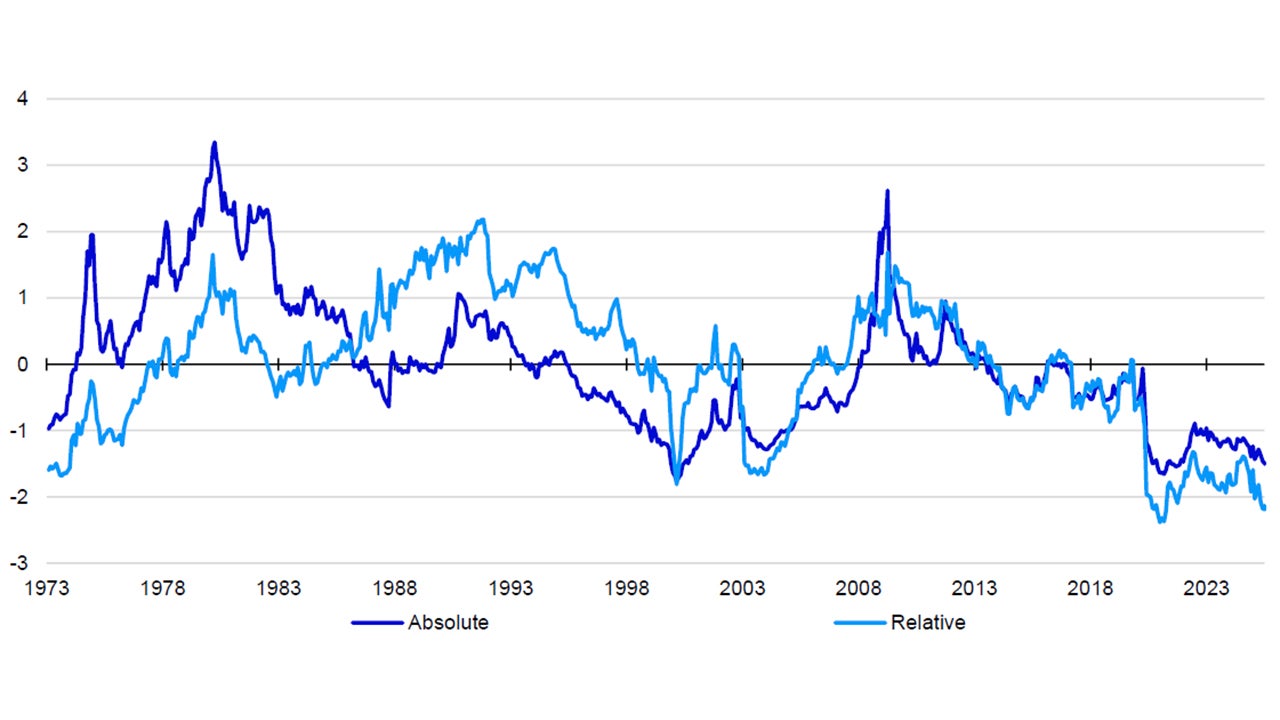

Notes: Data as of 28 July 2025. Past performance is no guarantee of future results. We use monthly data based on the 12-month trailing dividend yield on the Datastream World Media Index and the Datastream World Total Market Index with 28 July 2025 the last data point. Relative dividend yields are calculated by dividing the yield on the media index by the yield on the total market index. Z-scores are calculated by dividing the difference from the long-term average since 2 January 1973 by the standard deviation of respective dividend yields.

Source: LSEG Datastream and Invesco Global Market Strategy Office.

A lot of good news may have been priced in including the four Fed rate cuts currently implied by rate futures for the next 12 months (as of 28 July 2025).

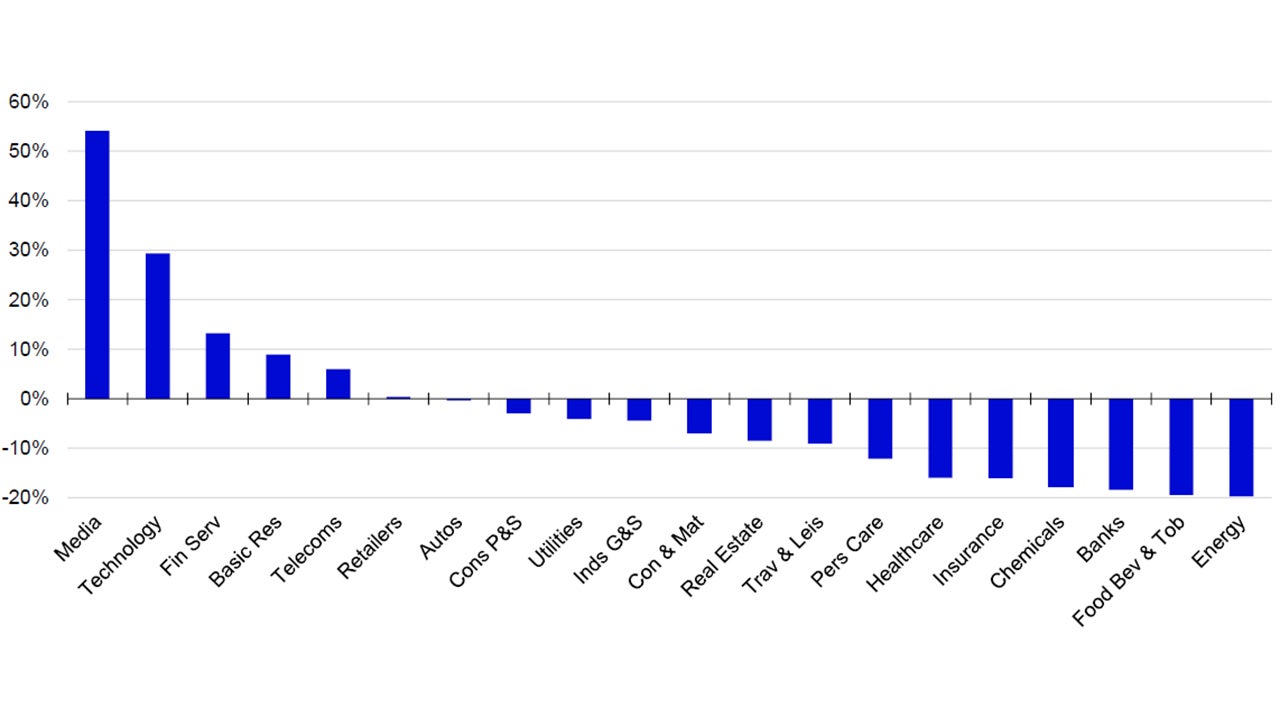

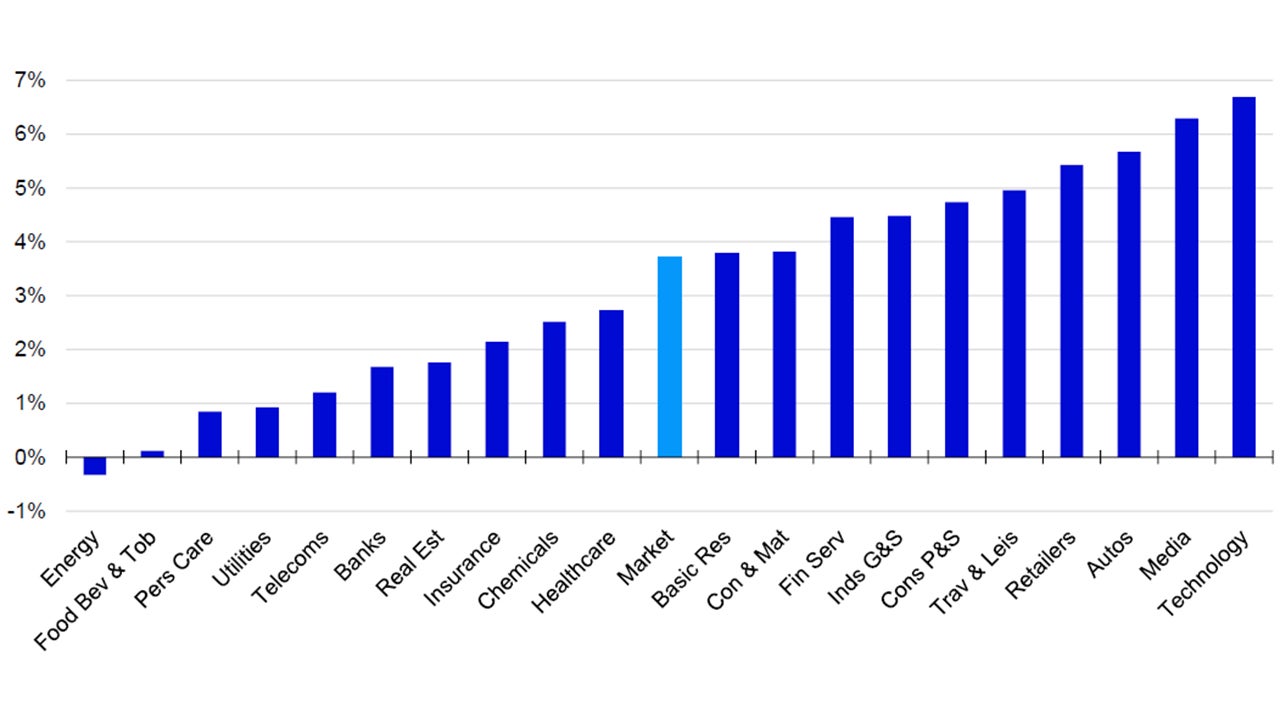

When it comes to sector allocations, we start by comparing the relative dividend yield implied by our multiple regression model to what the sector trades at. This suggests that the sector is the most overvalued versus what our model implies (Figure 3). We then cross-check that using our perpetual dividend growth model, which shows that dividends would have to grow by a real 6.3% per year into perpetuity for the sector to generate the hurdle rate of return, significantly higher than that of the market at 3.7% and suggesting it is expensive (Figure 4).

Comparing other valuation metrics to their own respective historical averages paints the same picture. The sector looks overvalued in absolute terms on all four valuations metrics (price/earnings, dividend yield, price/cash flow and price/book value – see Figure 5 in PDF below). Relative valuations also look stretched with, for example, the relative dividend yield looking overvalued at 2.1 standard deviations below the historical average, not far from the extremes reached in March 2021 (Figure 1). The relative price/earnings ratio also shows the sector as overvalued at 0.7 standard deviations above historical norms.

However, before the introduction of streaming services, the sector consisted of stocks that depended on advertising revenues or were providers of advertising services. As streaming services have begun to replace traditional media, business models shifted to subscriptions providing more stable income flows. Admittedly, this also meant high levels of initial investment including marketing spend. These factors may have lowered both the level and volatility of sector dividend yields. Having said that, the absolute dividend yield of the sector at 0.8% is close to the all-time low of 0.6% reached during the “dot-com bubble” (as of 28 July 2025). Although there may not be any imminent threats to the sector, such high valuations tend to carry high levels of risk, especially with only a handful of dominant stocks determining the bulk of returns.

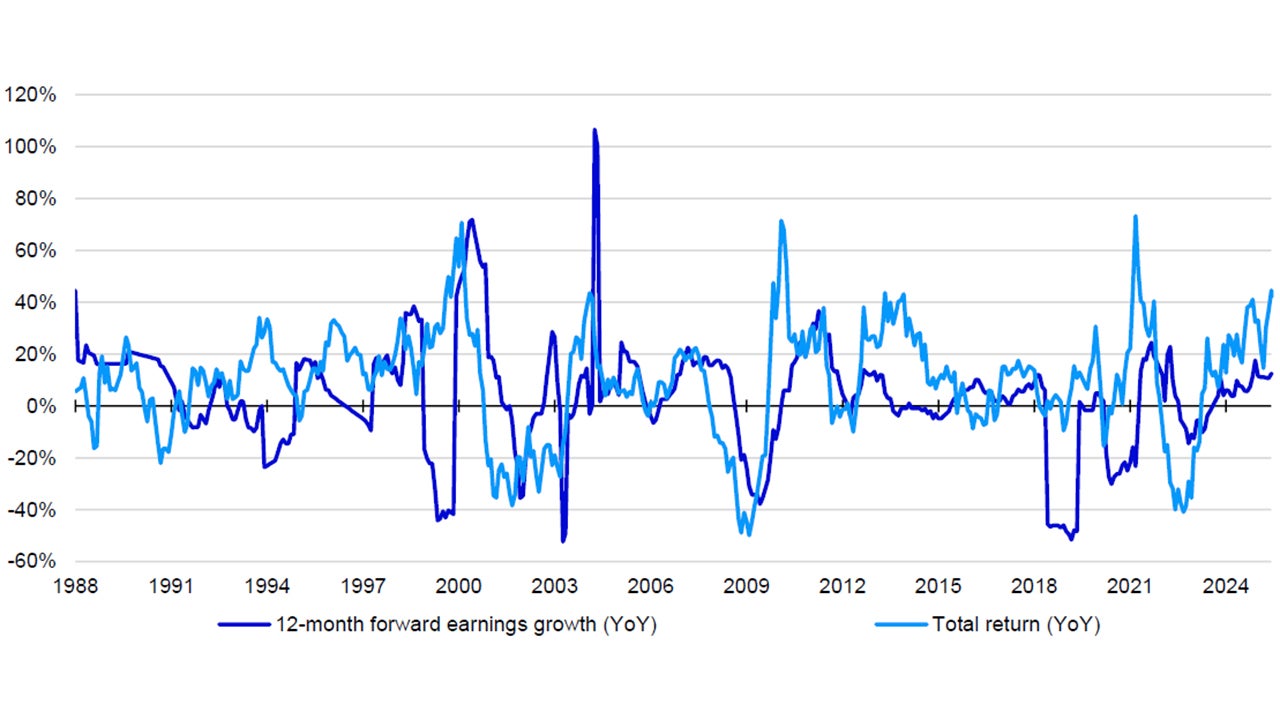

I think the decoupling of valuations from the underlying change in earnings expectations is concerning (see Figure 2). Even if there is no significant pull-back in absolute sector returns, it may become harder for media to outperform in the next 12 months, in my view. Also, I would not be surprised if there was a period of consolidation after recent outperformance. The sector may have to rely on volume growth and pricing to drive earnings as it could become more challenging to achieve margin expansion from historically high levels. With countries in developed markets close to saturation for streaming providers, most volume growth will have to come from emerging markets where they would struggle to charge the same prices as in the US, for example. In my view, further outperformance is less likely than in January when we upgraded the sector to Overweight, therefore I reduced the allocation to media to Underweight in the latest Strategic Sector Selector (see here).

Notes: Data as of 28 July 2025. Past performance is not a guarantee of future results. The data shown in the chart is monthly starting in February 1988 with 28 July 2025 the last data point. The index used to represent global media is the Datastream Media World index in US dollars. We use IBES consensus 12-month forward EPS and calculate year-on-year change in those earnings.

Source: LSEG Datastream and Invesco Global Market Strategy Office.

Notes: Data as of 30 June 2025. *% above/below using relative dividend yield. We run a multiple regression analysis to examine how macroeconomic factors influence sector valuations using dividend yields relative to market as the dependent variable. We then compare how current relative dividend yields compare to the model-predicted ratio to calculate how overvalued or undervalued sectors look. Fin Serv = financial services. Basic Res = basic resources. Telecoms = telecommunications. Autos = automobiles & parts. Cons P&S = consumer products & services. Inds G&S = industrial goods & services. Con & Mat = construction & materials. Trav & Leis = travel & leisure. Pers Care = personal care, drug & grocery stores. Food Bev & Tob = food, beverage & tobacco.

Source: LSEG Datastream and Invesco Global Market Strategy Office.

Notes: Data as of 30 June 2025. We use a simple perpetual growth model to calculate implied growth in real terms to eliminate the distorting influence of inflation, the output being growth in real terms. The risk-free rate used is an equity market capitalisation weighted average of US, UK, Eurozone, Japanese and Chinese 10-year real yields. Sector betas are calculated using five years of weekly price movements relative to the global market index. The risk premium is derived from US equity and treasury market returns since 1871. The dividend yield for each sector is the 12-month trailing yield calculated by Datastream. Fin Serv = financial services. Basic Res = basic resources. Telecoms = telecommunications. Autos = automobiles & parts. Cons P&S = consumer products & services. Inds G&S = industrial goods & services. Con & Mat = construction & materials. Trav & Leis = travel & leisure. Pers Care = personal care, drug & grocery stores. Food Bev & Tob = food, beverage & tobacco.

Source: LSEG Datastream and Invesco Global Market Strategy Office.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.