Insurance Insights Q3 2025: Enhancing Fixed Income Portfolios

Introduction

In previous editions of our 2025 Insurance Insights newsletter, we focused on a top-down approach – looking for enhancements at a strategic asset allocation level through regular reviews and a selective addition of asset classes that complement existing portfolios. We also assessed the viability of a multi-alternatives strategy to build carefully curated exposures to these asset classes. All of this is aimed at making insurance portfolios more efficient and resilient.

In this edition of the newsletter, we take a slightly different perspective by adopting more of a bottom-up approach – particularly for broad fixed income portfolios. We highlight how, even at the security level, there are still opportunities to uncover efficiencies.

To support this analysis, we leverage our powerful in-house portfolio analytics system, Invesco Vision. As part of a case study, we define an appropriate universe of securities, apply a series of screens, including setting generic portfolio constraints, and then determine portfolio parameters. The process is illustrated through a series of snapshots to help convey the types of analysis that can be performed. An interactive demo remains the most effective way to really understand the process, the system, and its outputs – and we would be delighted to arrange such a session with you.

We hope that this topic and observations shared will help your discussions on portfolio assessment, construction, and management in today’s constantly evolving environment. As always, we welcome the opportunity to discuss these areas in greater detail with you.

Enhancing fixed income buy-and-maintain portfolios - Security level analysis

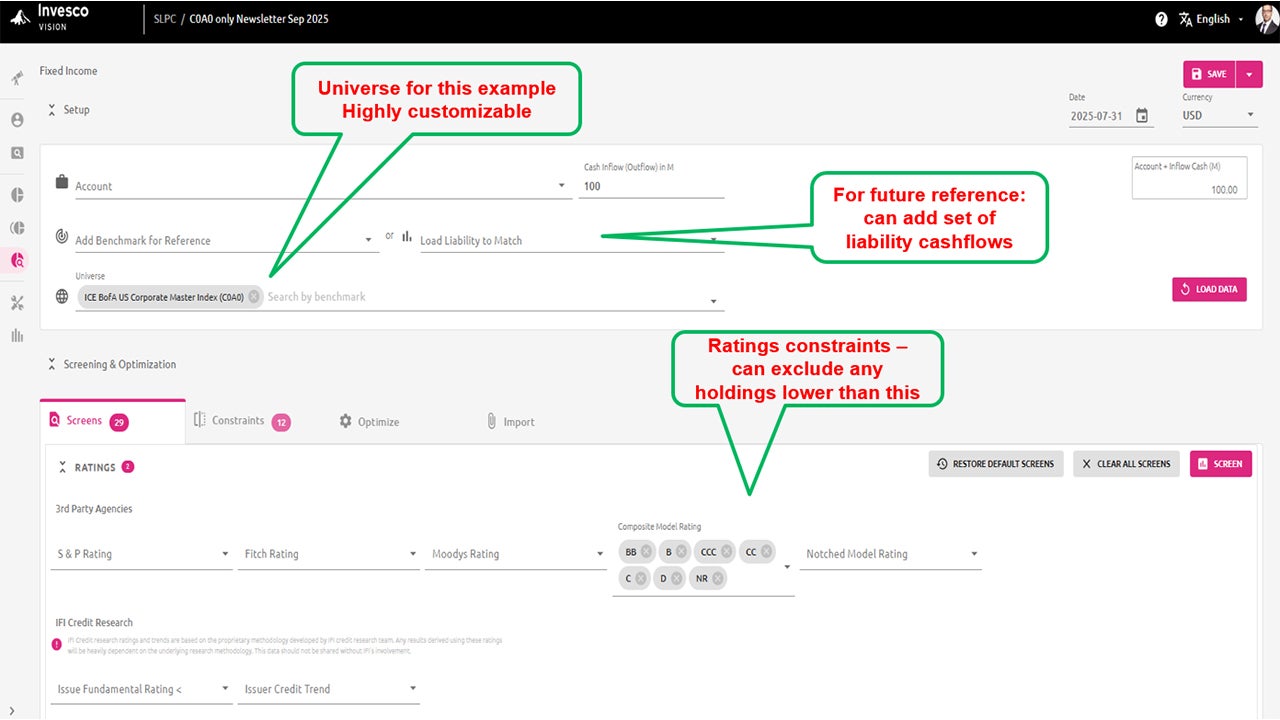

In the following example, we start with an initial exposure to broad investment-grade US debt as the asset class under assessment. For the first part of the analysis, we have selected the ICE BofAML US Corporate Master Index (ticker: C0A0) as the investable universe.

Once an insurer decides to invest in this asset class, the next step typically involves implementation decision. One option is to invest in public vehicles such as funds, unit trusts, or ETFs; another way is to invest via segregated or separate accounts managed under a mandate by an investment manager. The latter approach is often preferred as it allows for greater customization - such as setting guidelines and constraints around average or minimum credit ratings, duration, and other parameters - - and can be managed as part of a core exposure with more flexibility in accounting treatment.

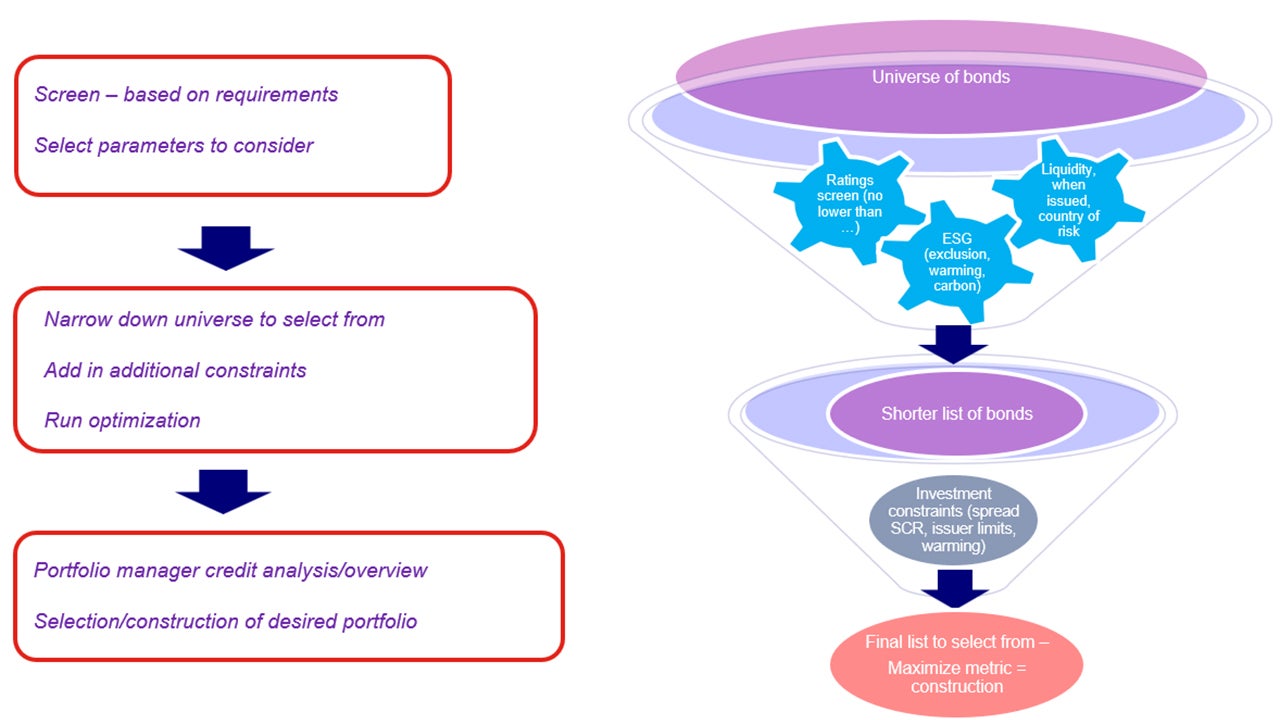

The next step involves screening the thousands of bonds in the selected universe to narrow them down to construct an appropriate portfolio. This process is illustrated below:

For illustrative purposes only.

Security-level analysis using Invesco Vision – Initial screening

The following steps demonstrate how Invesco Vision can help narrow a broad bonds universe into a focused list for constructing an efficient portfolio.

The process begins with a series of screens, followed by defining constraints and optimization objectives. Screening criteria can include: credit quality and liquidity, countries or regions exclusions (depending on an insurers’ internal guidelines and requirements), more granular requirements across maturity, issuer limits, ratings– or a combination of these factors.

As indicated earlier, in the example below, we start with the ICE BofAML US Corporate Master Index, which represents a comprehensive universe of high-grade US corporate bonds.

Step 1: Ratings-based screen

We start by reaffirming that only investment grade securities are included in the screening universe:

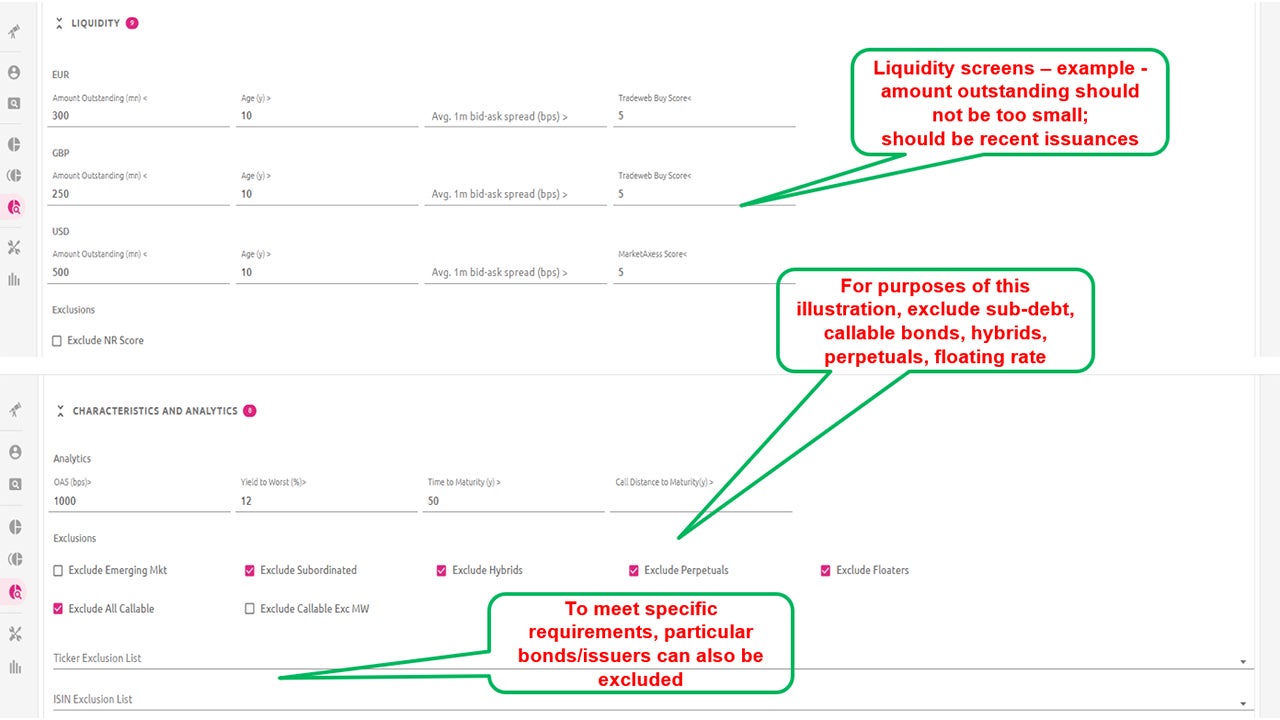

Step 2: Liquidity and structural filters

We refine the universe by applying liquidity and structural screens. For example, we may exclude bonds issued more than 10 years ago and remove instruments with optionality such as callable bonds, as well as subordinate, hybrids, perpetuals securities. These measures aim to construct a stable and predictable portfolio:

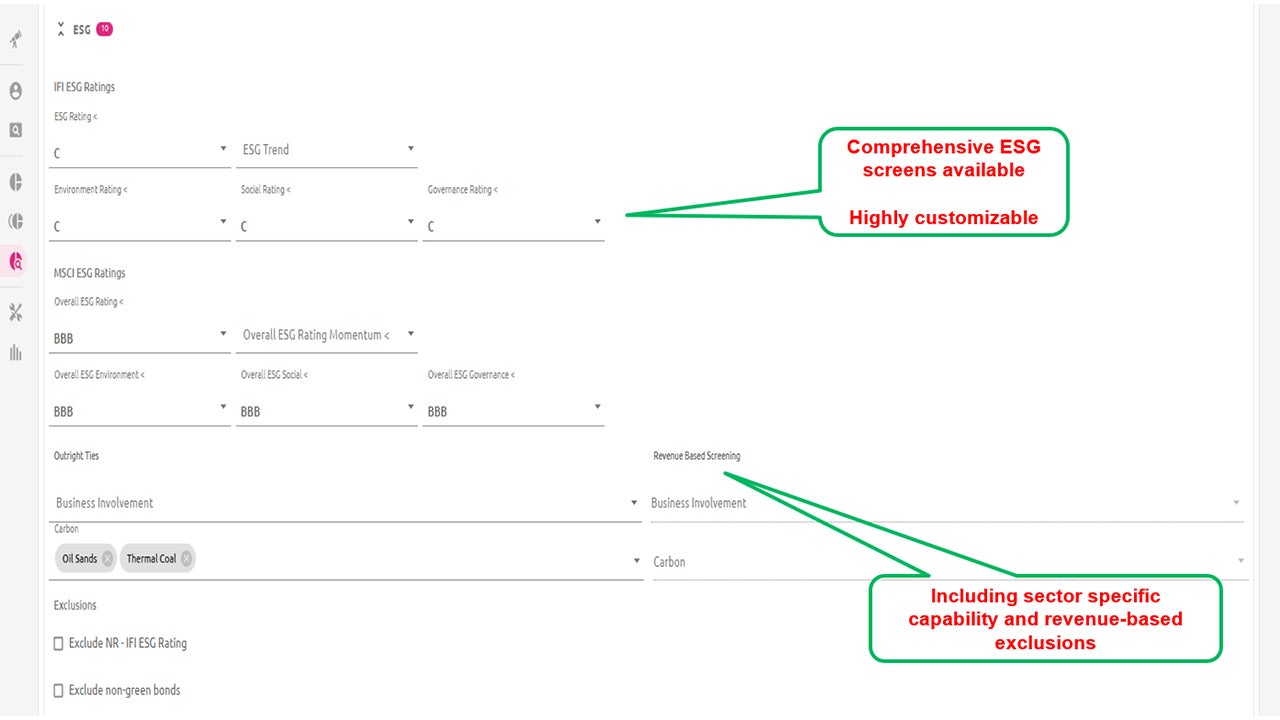

Step 3: ESG Screening

Invesco Vision offers highly customizable ESG filters, including overall ESG ratings, business involvements, direct carbon intensity measures and revenue-based screens across a wide subset of industries as shown below:

In this example, we exclude certain carbon-related industries and set minimum ESG rating requirements.

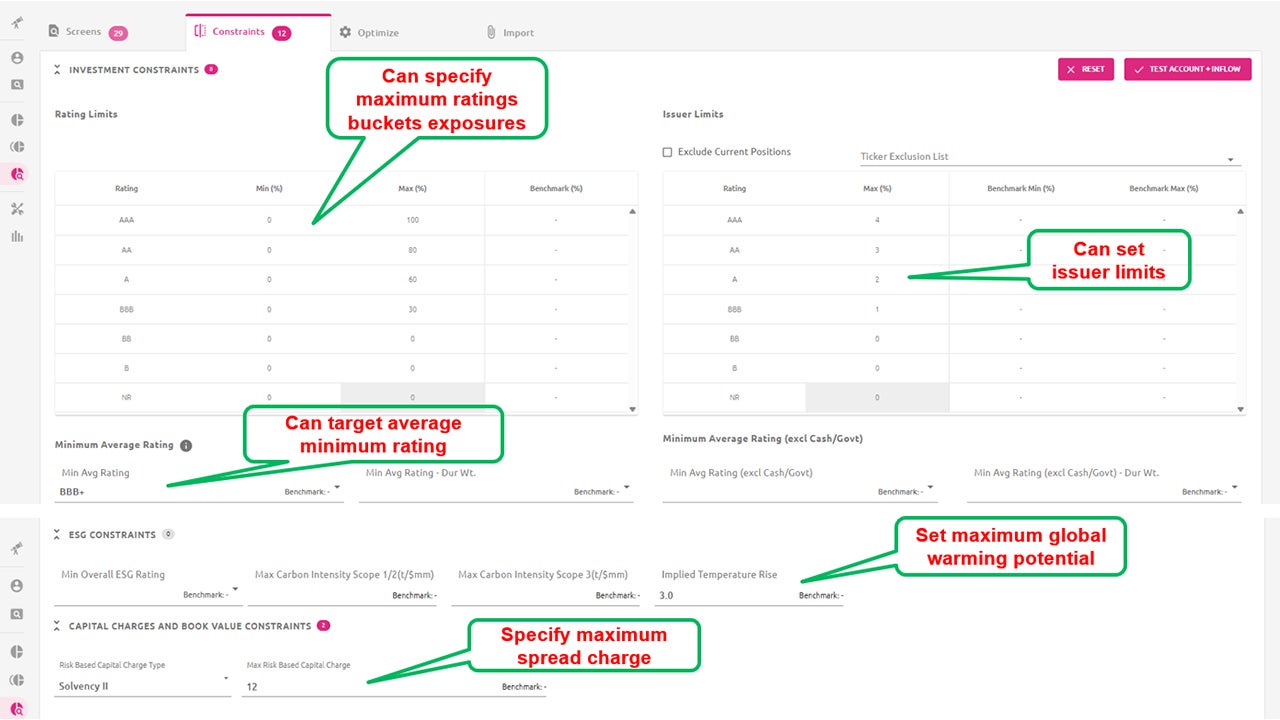

Security-level analysis using Invesco Vision – Applying constraints

After initial screening, the next step is to introduce portfolio constraints to align with investment objectives and regulatory requirements. Examples include:

- Credit quality: Set a minimum average rating (e.g., BBB+)

- Issuer and sector limits: Introduce limits across single issuers, at both aggregate and individual levels, as well as across asset sub-types and sectors.

- ESG Parameters: Define maximum carbon intensity levels (scope1/2/3) as well as set a global warming potential threshold (e.g., 3.0°C)

- Regulatory metrics: Specify limits for Solvency II credit spread SCR (Solvency Capital Requirement) to manage spread risk charges

- Duration buckets: Apply duration constraints for better liability matching ability

- Liability Alignment: Optionally, construct the portfolio relative to a set of defined or best-estimate liabilities

Invesco Vision also supports custom constraints, allowing users to define logical conditions and setting tailored limits.

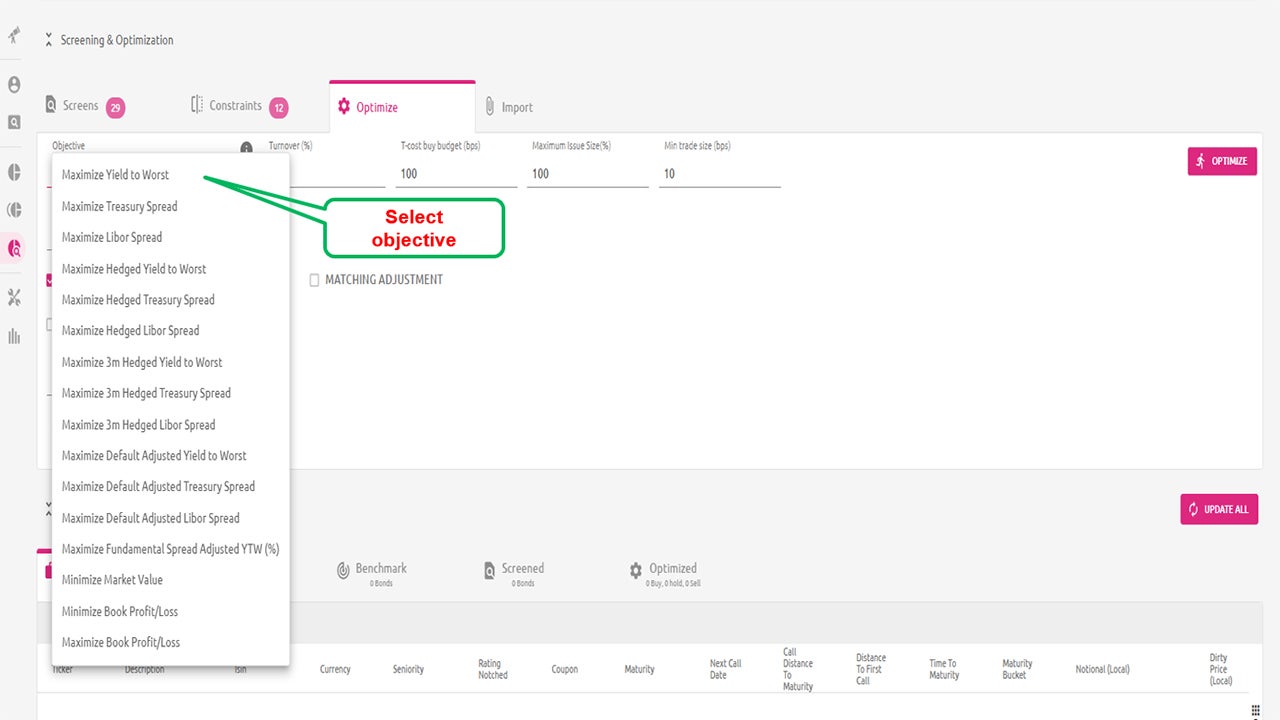

Once the desired constraints are parameterized, the final step is optimization – selecting the portfolio metric to optimize. In our example, we select the objective of maximizing the yield to worst:

With all parameters in place, the system runs the optimization and generates the results for review.

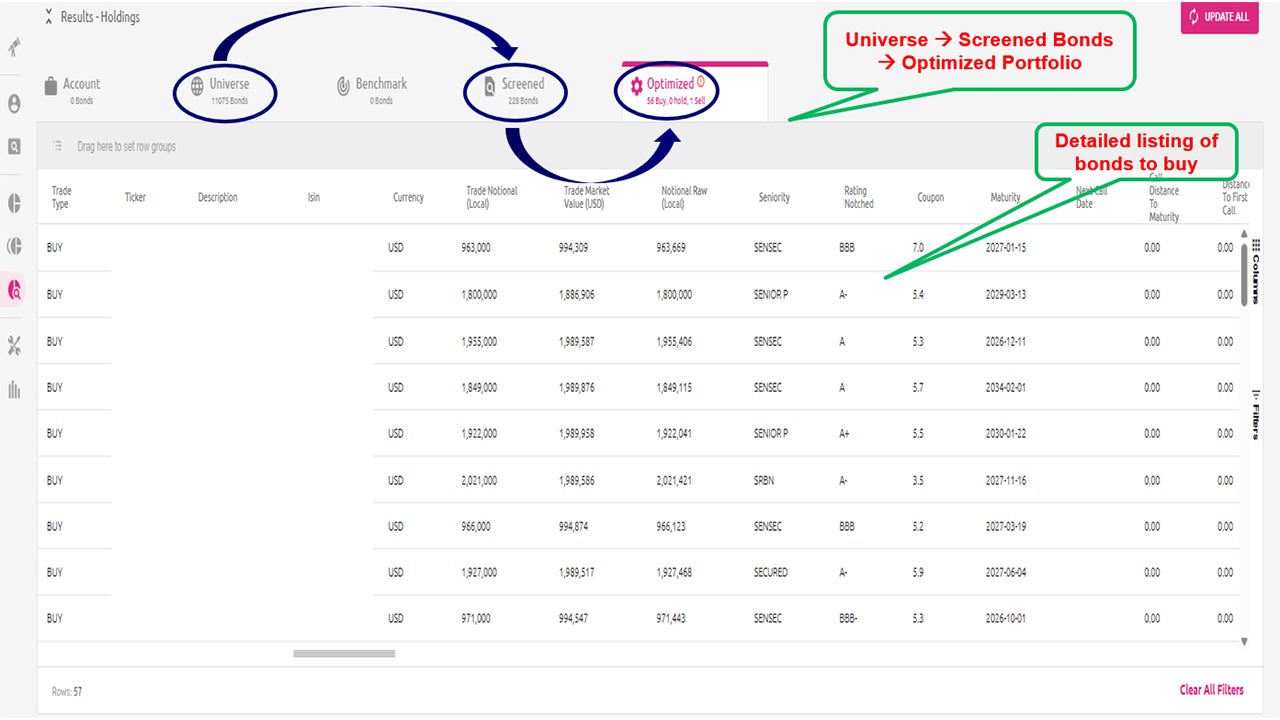

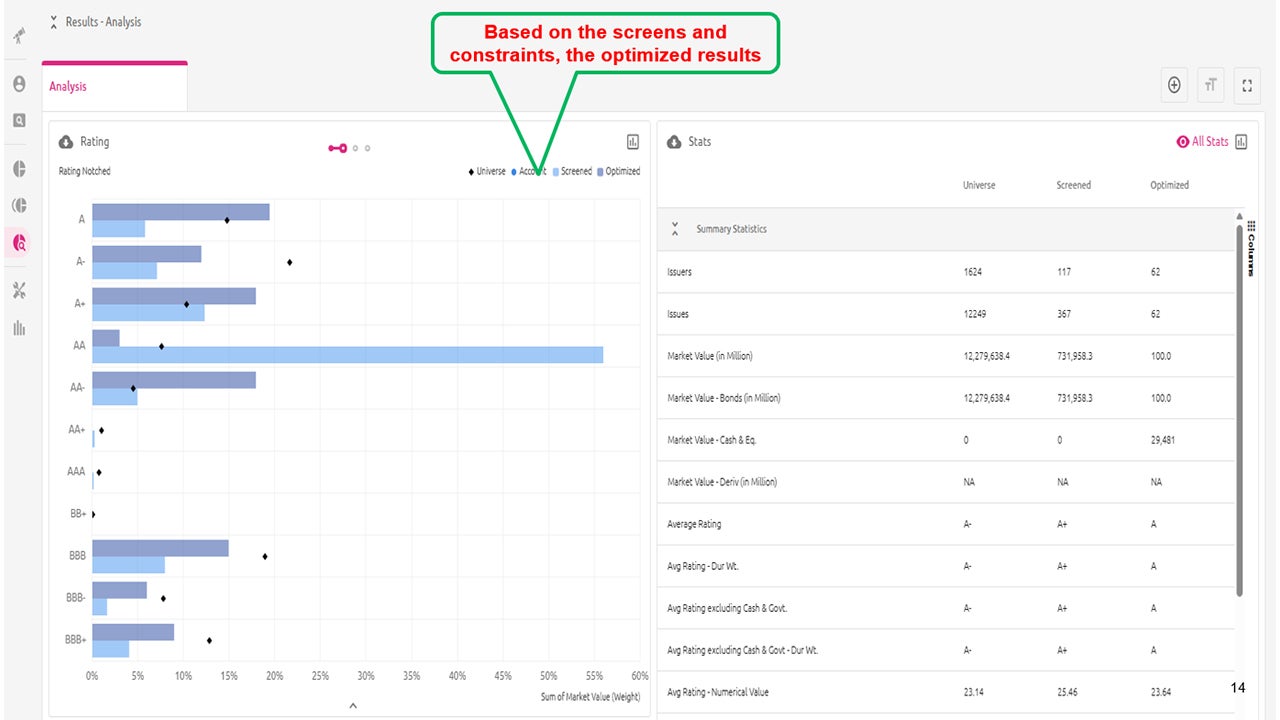

Analysis of results

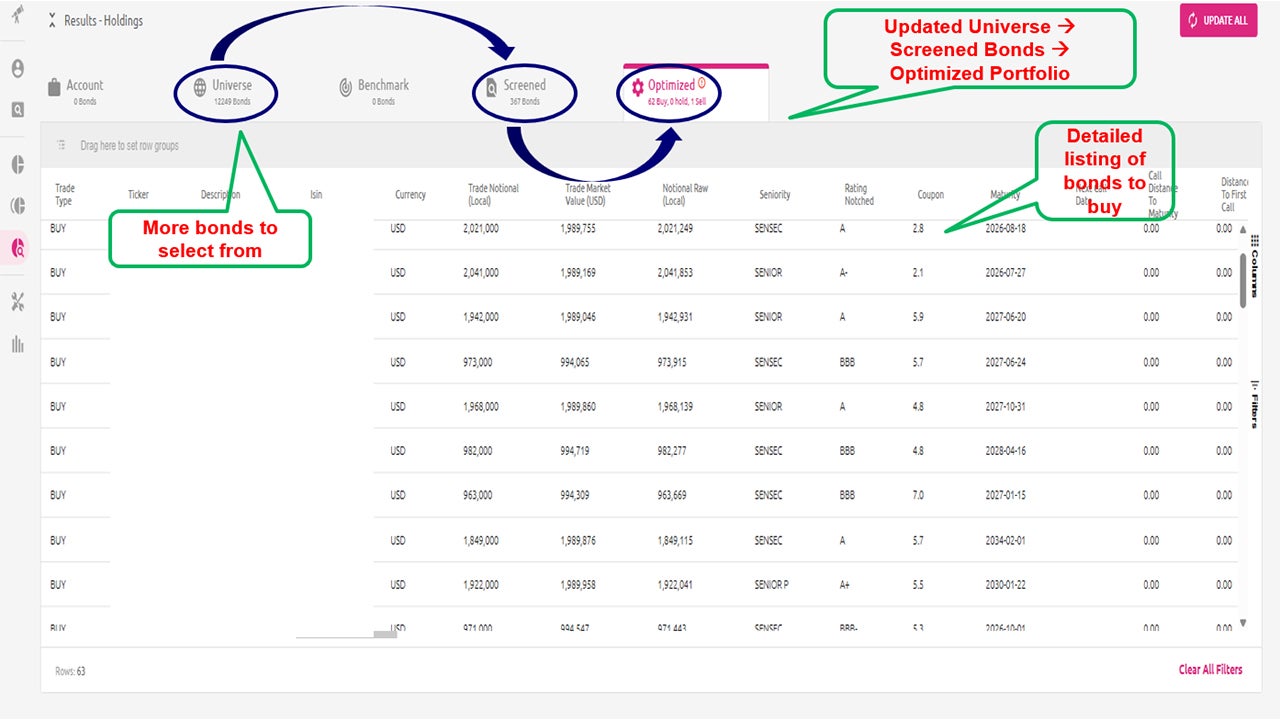

The optimized portfolio reflects the screens and constraints we specified earlier. From an initial universe of more than 10,000 bonds, the process narrows the selection based on the screening criteria to a focused list of bonds that achieves the desired parameters. A final list of the suggested bonds can serve as the basis for constructing an appropriate portfolio:

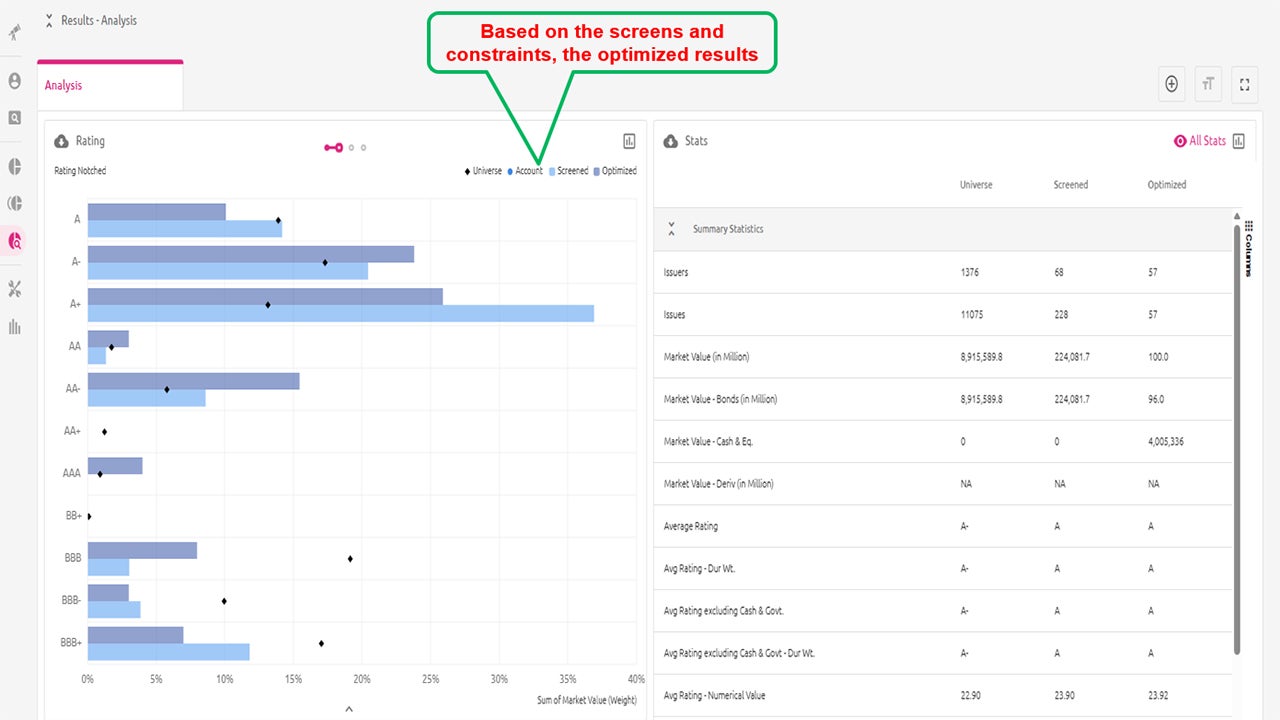

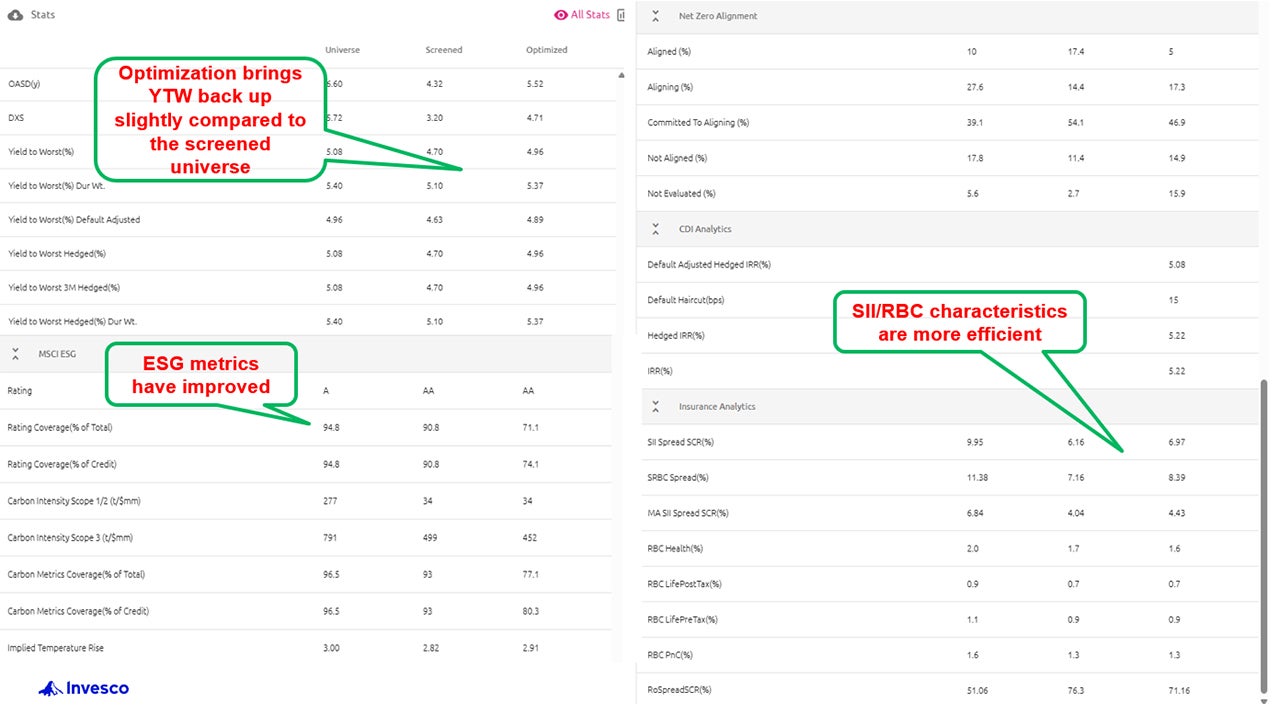

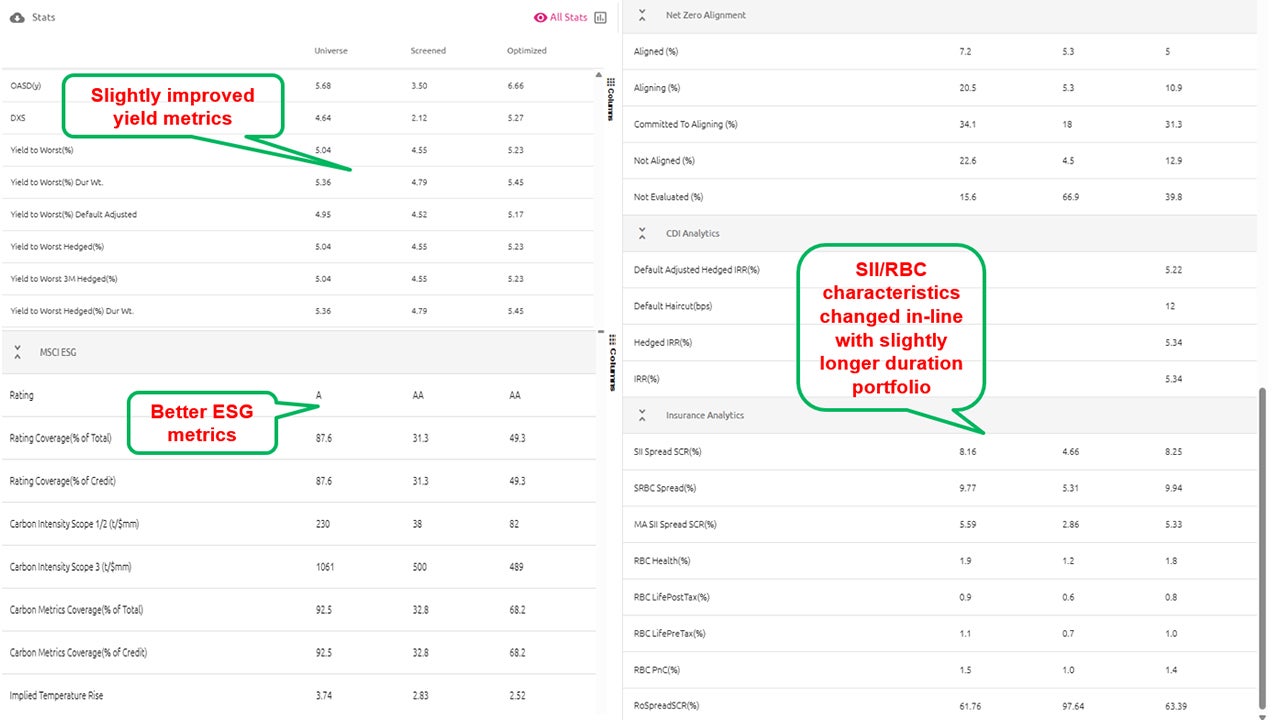

Using Invesco Vision, we can compare and assess the characteristics of the optimized portfolio against the original universe and screened bonds:

Detailed statistics allow a fuller comparison across various metrics such as credit rating, duration, yield, spread risk charge, and ESG scores to assess improvements and enhancements:

Through an iterative process, the portfolio can be fine-tuned by adjusting screening criteria or constraints) to achieve the desired characteristics.

Additionally, basic matching adjustment considerations can also be incorporated during portfolio construction and optimization by integrating liability cashflows as part of the security selection process and applying constraints to manage asset-liability gaps.

Security-level analysis using Invesco Vision – Enhancing the universe

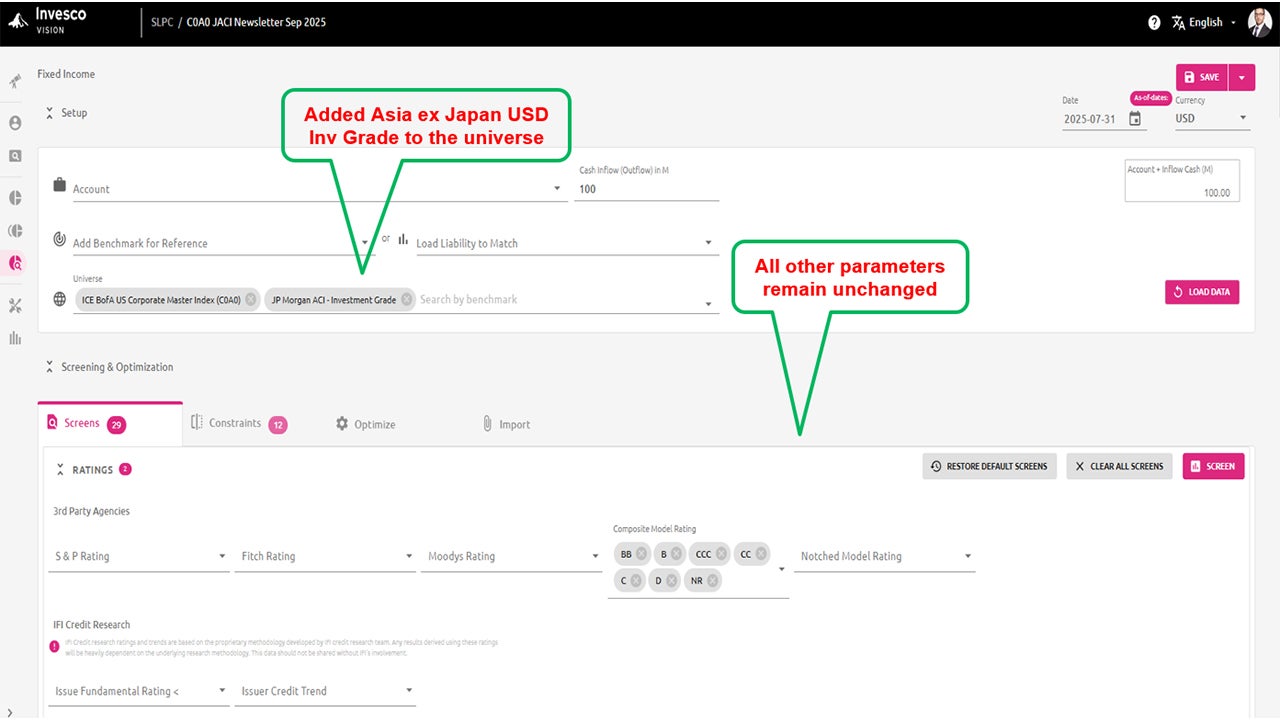

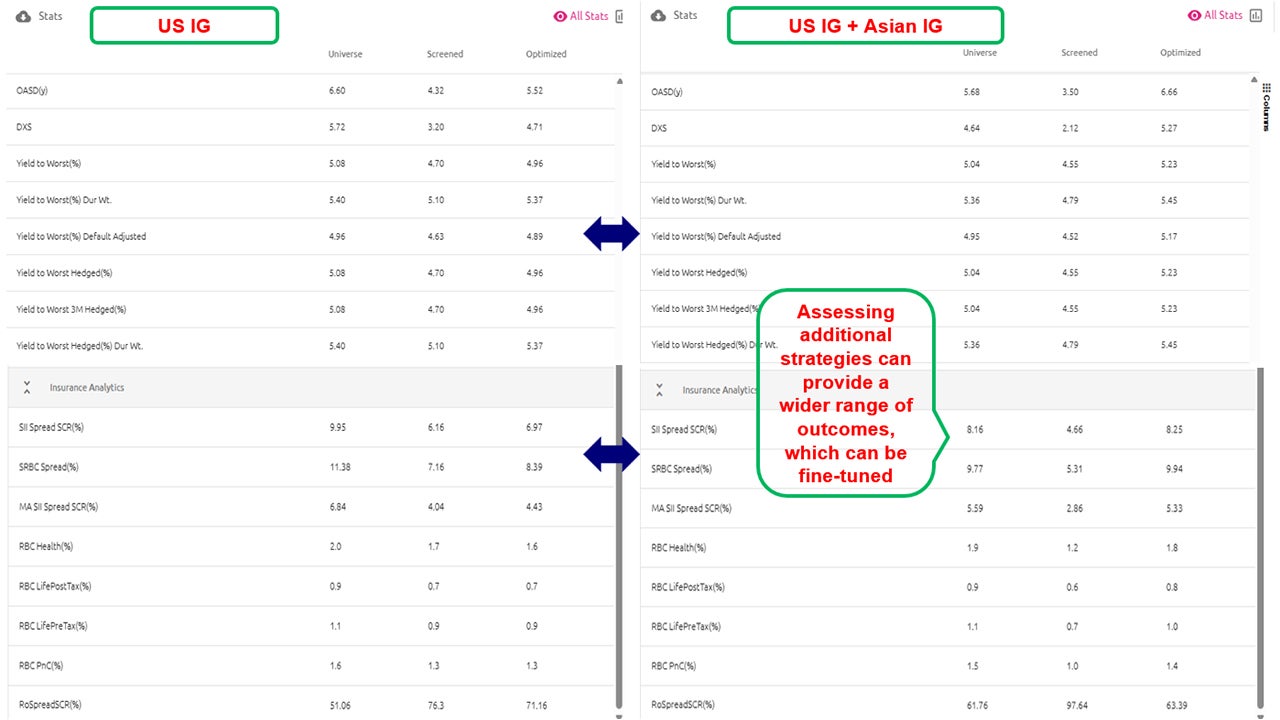

In this stage, we assess the viability of expanding the investment universe by adding Asia ex Japan USD-denominated high-grade bonds. to provide diversification within the existing credit exposure and to potentially enhance yield in a controlled manner.

We can assess the implications of adding a representative index to our initial universe of our optimized portfolio above for a new universe and let Invesco Vision do all the hard work!

We keep the same screens, constraints and optimization objective. The system then recalculates and produces an updated bond list which can serve as the basis for portfolio construction:

A snapshot of some of the revised portfolio characteristics:

The revised portfolio shows a modest improvement in the portfolio yield while maintaining the same average credit rating, while the risk-based parameters are in-line with a portfolio that is of slightly longer duration.

We can compare key metrics across the original and expanded portfolios and use these insights to adjust criteria as needed, ensuring to construct a portfolio aligns with requirements and achieves the desired balance of risk, return and diversification. As noted, this is an iterative process.

Summary and key takeaways

The process outlined above demonstrates the viability of analyzing a portfolio on a granular level to optimize key parameters. By systemically narrowing a universe of thousands of bonds into a manageable subset, investors can conduct a deeper analysis to form the basis of effective portfolio construction. This approach also highlights the benefits of selectively expanding the universe to design portfolios that are robust and aligned with specific objectives – provided this is done in a careful and calibrated manner.

This process can be applied when constructing portfolios for new products, deploying new funds into existing products, or conducting periodic reviews (on a semi-annual or annual basis). It serves as a tool to assess how the portfolio metrics are trending and identify any significant deviations, and take corrective actions to realign the portfolio with its desired characteristics.

We encourage you to view this series of Insurance Insights as a cohesive whole, which demonstrates the benefit of a stepwise and disciplined approach to constructing optimal insurance portfolios.

We trust you will find this approach practical and the information actionable through the case study format. Our methodology combines the top-down and bottom-up approaches to construct resilient portfolios, while stressing the importance of regular portfolio analysis to continuously enhance efficiencies.1

We hope you find these insights valuable and invite you to reach out to us for a more interactive and customized analysis.