Insurance Insights Q2 2025: Certainty over US policy direction is key

The global economic and political landscape is shifting rapidly, marked by a broad reordering of trade relations and political alliances around the globe. In response, uncertainty measures across global markets soared in the first half of 2025. We acknowledge that there are plenty of things we do not know today – precise estimates of where tariff rates will settle, the timing of interest rate changes, and detailed inflation and growth forecasts. These estimates, among others, are heavily dependent on a more consistent sense of US policy direction.

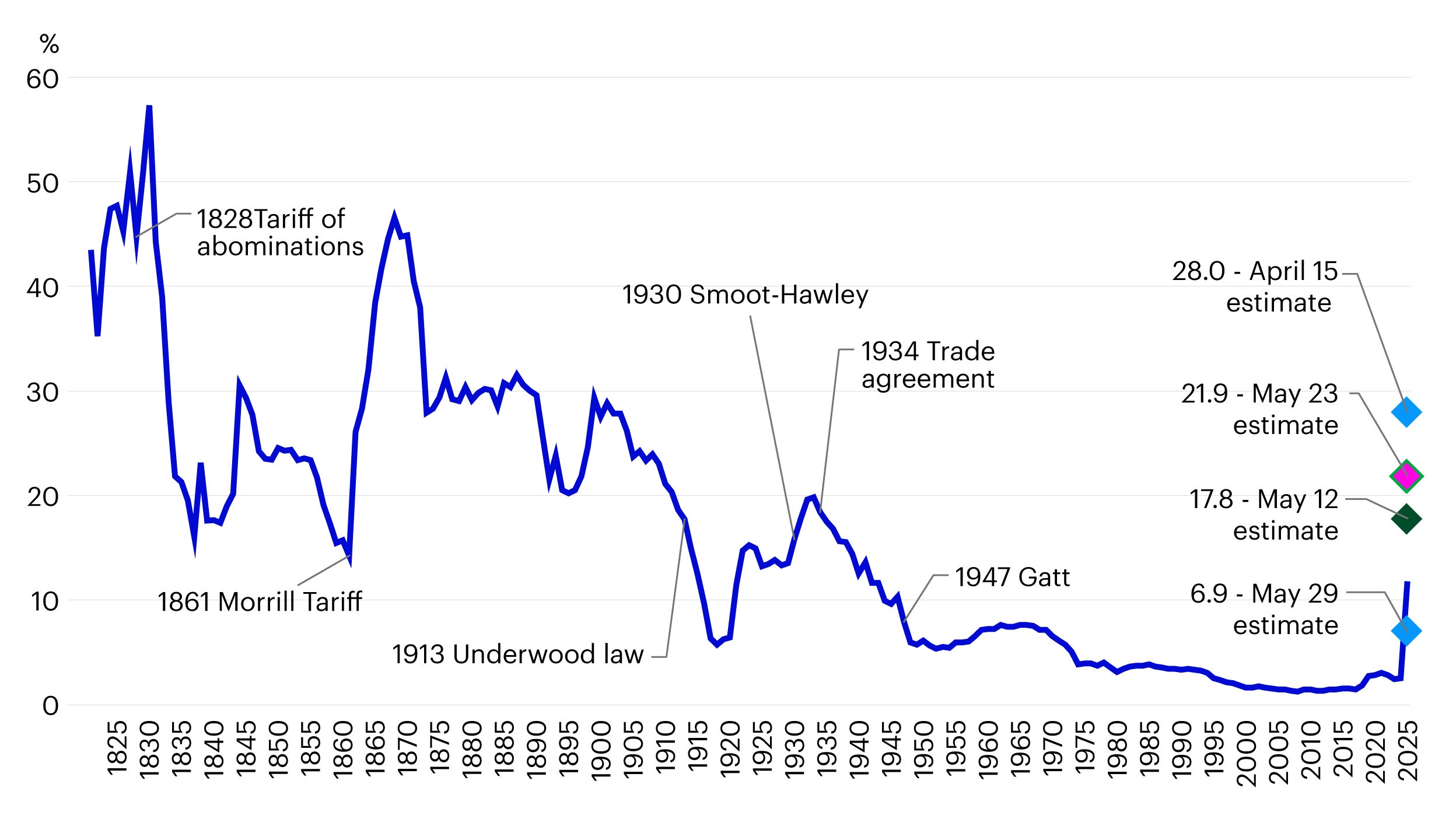

Chart source: Invesco, Macrobond, Yale Budget Lab as of 29 May 2025 Estimates provided by Yale Budget Lab.

That said, we expect tariffs to be higher than in previous decades and US immigration to be lower. Businesses have been faced with difficult hiring and investment decisions while consumer sentiment has struggled. The result is likely to be slower growth and higher inflation in the US in 2025 than was expected at the start of the year, although the better-than-expected resolution of tariff disputes and the positive impact of anticipated deregulation may continue to lead US markets to rally.

While US politics dominated the news flow in the first half of 2025, it is important to note that there have been developments elsewhere in the world that would have been the “story of the year” in more normal times. In March, German Chancellor Friedrich Merz pledged to do “whatever it takes” to ensure the defense of Europe, releasing Germany’s debt brake and freeing the country to engage in greater infrastructure and defense spending. We believe this bold move should provide a positive tailwind for European growth over the next decade.

China, too, is engaging in greater fiscal spending and there are signs of improvement in the property and consumer sectors. These green shoots are a further signal that while US tariffs will remain a drag on global growth, other factors are becoming more supportive of better growth outside of the US.

We view this as an opportunity for investors to diversify their portfolios across regions and asset classes, as well as to reduce concentrations. Private markets can help to reduce overall volatility with lower short-term correlations to other assets. This may help in weathering bouts of uncertainty while also allowing investors to benefit from potential upside surprises.

Read more about our expectations for 2H 2025 and which asset classes we find attractive in our 2025 Midyear Investment Outlook.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.