Fixed Income A proven approach

The Invesco Global Total Return (EUR) Bond fund embodies our philosophy of only investing when the compensation for doing so is sufficient.

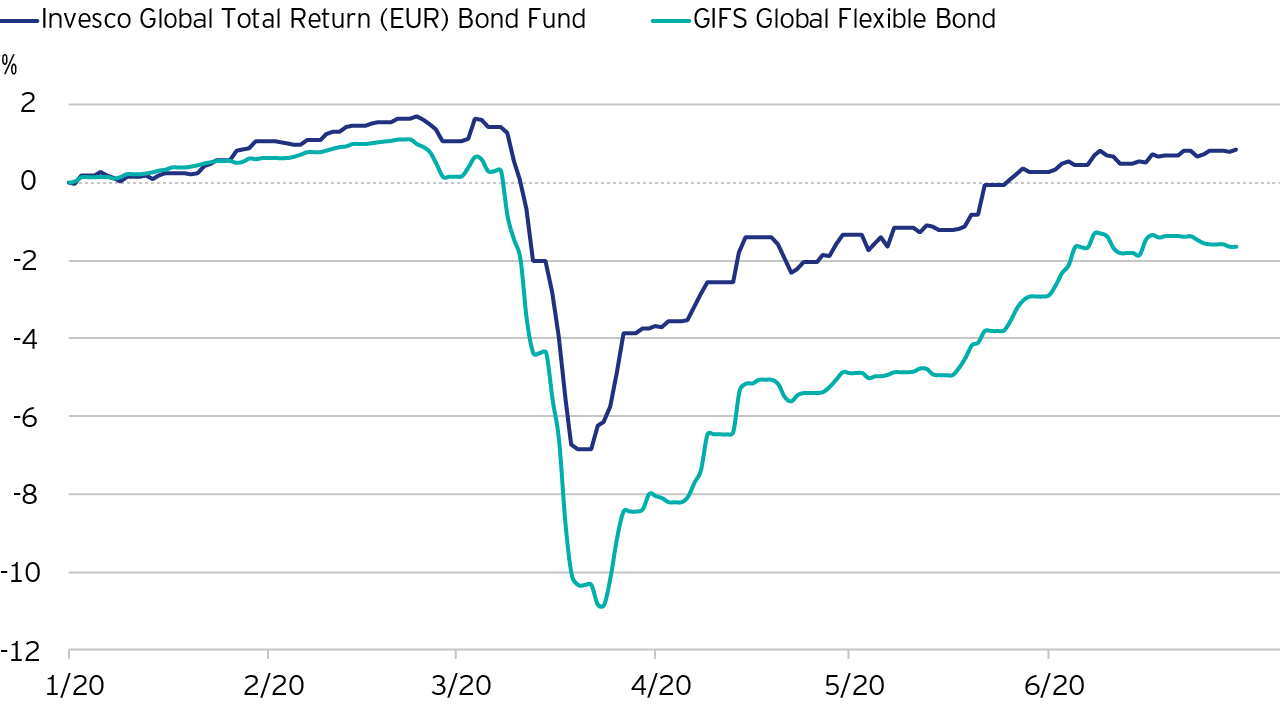

The Invesco Global Total Return (EUR) Bond Fund performed well in its peer group during the Covid-19 led market sell-off, it having only modest amounts of credit risk and sufficient duration. As illustrated in figure 1, the fund’s drawdown was much shallower than many of its peers and much of the loss has now been recovered with year to date returns to the end of June positive for the fund.

At the start of the period, two-thirds of the fund was allocated to cash, core government bonds and bonds maturing within 1-year). 28% was held in credit risk with the two largest exposures, subordinated financials and emerging market bonds. Currency exposure included some emerging markets as well as oil producers such as Norway.

| 30-06-15 30-06-16 |

30-06-16 30-06-17 |

30-06-17 30-06-18 |

30-06-18 30-06-19 |

30-06-19 30-06-20 |

|

| Invesco Global Total Return (EUR) Bond | -0.71 | 4.15 | -1.63 | 4.98 | 2.52 |

| GIFS Global Flexible Bond | -0.20 | 3.34 | -1.99 | 2.68 | -0.33 |

Past performance is not a guide to future returns. Data as at 30 June 2020. Fund performance figures are shown in euros, inclusive of reinvested income and net of the ongoing charges and portfolio transaction costs. The figures do not reflect the entry charge paid by individual investors. Sector average performance is calculated on an equivalent basis. Source: Invesco, © Morningstar 2020. All rights reserved. Use of this content requires expert knowledge. It is to be used by specialist institutions only. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied, adapted or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information, except where such damages or losses cannot be limited or excluded by law in your jurisdiction. Past financial performance is no guarantee of future results. The performance data shown does not take account of the commissions and costs incurred on the issue and redemption of units. Any reference to a ranking, a rating or an award provides no guarantee for future performance results and is not constant over time.

The Invesco Global Total Return (EUR) Bond fund embodies our philosophy of only investing when the compensation for doing so is sufficient.

The flexibility of the Invesco Global Total Return (EUR) Bond’s mandate, and the fund managers’ willingness to use it, can be seen in the historical asset allocation and duration positioning.